UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

SCHEDULE

14C

INFORMATION

STATEMENT PURSUANT TO SECTION 14(c)

OF

THE SECURITIES EXCHANGE ACT OF 1934

Check

the appropriate box:

|

[ ]

|

Preliminary

Information Statement

|

|

|

|

|

[ ]

|

Confidential,

for Use of the Commission only (as permitted by Rule 14c-5(d)(2))

|

|

|

|

|

[X]

|

Definitive

Information Statement

|

CANBIOLA,

INC.

(Name

of Registrant As Specified In Its Charter)

Payment

of Filing Fee (Check the Appropriate Box):

[X]

No fee required

[ ]

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11

|

|

(1)

|

Title

of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate

number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which

the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed

maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total

fee paid:

|

[ ]

Check box if any party of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the

offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and

the date of its filing.

|

(1)

|

Amount

Previously Paid:

|

|

|

|

|

(2)

|

Form,

Schedule or Registration Statement No.:

|

|

|

|

|

(3)

|

Filing

Party:

|

|

|

|

|

(4)

|

Date

Filed:

|

CANBIOLA,

INC.

960

SOUTH BROADWAY, SUITE 120, HICKSVILLE, NY 11801

IMPORTANT

NOTICE REGARDING INTERNET AVAILABILITY OF INFORMATION STATEMENT FOR CANBIOLA, INC.

To

the Shareholders of Canbiola, Inc.:

NOTICE

IS HEREBY GIVEN to you as a stockholder of Canbiola, Inc., a Florida corporation (the “Company,” “we,”

“us” or “our”), that you are receiving this notice regarding the internet availability of an information

statement (the “Information Statement”) relating to the matters described below. This notice presents only an overview

of the more complete Information Statement that is available to you on the internet or, upon request, by mail. We encourage you

to access and review all the important information contained in the Information Statement. As described below, the Information

Statement is for informational purposes only and, as a stockholder of the Company, you need not take any action.

By

sending you this notice, we are notifying you that we are making the Information Statement available to you via the internet in

lieu of mailing you a paper copy. You may print and view the full Information Statement on our website at http://www.canbiola.com.

To view and print the Information Statement, click on the link of the appropriate information statement in order to open the document.

You may request a paper copy or PDF via email of the Information Statement, free of charge, by contacting us in writing at Canbiola,

Inc. c/o Marco Alfonsi, 960 South Broadway, Suite 120, Hicksville, NY 11801 or by calling 516-595-9544. If you do not request

a paper copy or PDF via email by July 14, 2019, you will not otherwise receive a paper or email copy. The Company’s most

recent annual report and quarterly reports are available upon request, without charge, by contacting the Company at the address

above. If you want to receive a paper copy of the Information Statement, you must request one. There is no charge to you for requesting

a copy.

The

materials available to shareholders on the Company’s website and by sending a request as described above include: (i) the

Information Statement; and (ii) the Company’s Annual Report for the fiscal year 2018, as amended; and (iii) the Company’s

Quarterly Report for the period ending March 31, 2019, as amended.

We

are furnishing this notice and Information Statement to our shareholders as of April 12, 2019, in connection with the approval

by written consent of the Company’s Board of Directors and holders of a majority of the issued and outstanding voting stock

of the appointment of Marco Alfonsi and Stanley Teeple to the Company’s Board of Directors (the “Director Appointment”).

In accordance with Rule 14c-2 promulgated under the Exchange Act, the above actions will become effective no sooner than 40 days

from the date the definitive Information Statement is available to shareholders. This notice is first being sent to our stockholders

on or about June 14, 2019.

The

written consent that we received constitutes the only stockholder approval required to approve the foregoing actions under the

FBCA and, as a result, no further action by any other stockholder is required to approve the foregoing and we have not and will

not be soliciting your approval of the same. This notice and the Information Statement shall constitute notice to you of the action

by written consent in accordance with the FBCA and Rule 14c-2 promulgated under the Exchange Act.

WE

ARE NOT ASKING FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

On

behalf of the Board of Directors,

|

|

/s/

Marco Alfonsi

|

|

|

Name

|

Marco Alfonsi

|

|

|

|

Chief

Executive Officer and Director

|

|

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

INFORMATION

STATEMENT PURSUANT TO SECTION 14(c)

OF

THE SECURITIES EXCHANGE ACT OF 1934

AND

RULE 14C PROMULGATED THERETO

CANBIOLA,

INC.

960

South Broadway, Suite 120, Hicksville, NY 11801

INFORMATION

STATEMENT

(DEFINITIVE)

JUNE

14, 2019

THIS

INFORMATION STATEMENT IS FOR INFORMATION PURPOSES ONLY AND NO VOTE OR OTHER ACTION OF THE COMPANY’S STOCKHOLDERS IS REQUIRED

IN CONNECTION WITH THIS INFORMATION STATEMENT.

A

NOTICE OF THE INTERNET AVAILABILITY OF THIS INFORMATION STATEMENT IS BEING MAILED ON OR ABOUT JUNE 14, 2019 TO STOCKHOLDERS OF

RECORD AS OF APRIL 12, 2019.

This

information statement (“Information Statement”) is being made available to the shareholders of record Canbiola, Inc.,

a Florida corporation (“Company,” “CANB,” “we,” “us,” or “our”) as

of the close of business on April 12, 2019 (“Record Date”). This Information Statement is being sent to you for information

purposes only. No action is requested or required on your part.

WE

ARE NOT ASKING YOU FOR A PROXY AND

YOU

ARE REQUESTED NOT TO SEND US A PROXY.

GENERAL

OVERVIEW OF ACTIONS

The

Board of Directors has recommended, and the holders of a majority of the voting stock of CANB have adopted resolutions, to effect

the actions listed in this Information Statement. This Information Statement is being filed with the Securities and Exchange Commission

and is provided to CANB’s shareholders pursuant to Section 14(c) of the Securities Exchange Act of 1934, as amended (“Exchange

Act”).

Through

the written consent of its Board of Directors and stockholders holding a majority of the Company’s voting stock, the Company

has approved the appointment of Marco Alfonsi and Stanley Teeple to the Company’s Board of Directors (the “Director

Appointment”).

Holders

of 159,287,477 of the 535,858,645 common shares issued and outstanding as of the Voting Record Date, and 16 out of the 17 Series

A Preferred Shares (representing 320,000,000 votes out of 340,000,000) outstanding as of the Voting Record Date, approved the

Share Increase. Thus, from the 875,858,645 votes eligible to be cast in this matter, 479,287,477 of the votes, or approximately

54.72%, approved the Share Increase by written consent.

The

Director Appointment will become effective no sooner than 40 days after we mail the Notice of Stockholder Action Taken by Written

Consent to our stockholders. This notice is first being mailed to our stockholders on or about June 14, 2019.

In

order to obtain the approval of our stockholders for the Director Appointment, we could have convened a special meeting of the

stockholders for the specific purpose of voting on such matter. However, Section 607.0704 of the Florida Business Corporations

Act (the “FBCA”) provides that any action required or permitted to be taken at a shareholders’ meeting may be

taken without a meeting. In order to eliminate the costs and management time involved in holding a meeting and obtaining proxies

and in order to effect the Director Appointment as early as possible in order to accomplish the purposes hereafter described,

we elected to utilize the written consent of a majority of the holders our Common Stock and Preferred Stock. Under the FBCA and

our bylaws, the affirmative vote of the holders of at least a majority of the outstanding stock entitled to vote thereon is required

to approve the Director Appointment.

This

Information Statement is intended to provide such notice as required by the FBCA to provide after the taking of the corporate

action without a meeting to the holders of record of our stock who have not consented in writing to such action.

Directors,

Executive Officers, Corporate Governance

Our

board of directors is elected annually by our shareholders. The board of directors elects our executive officers annually. Our

directors and executive officers as of April 12, 2019 are as follows:

|

Name

|

|

Age

|

|

Position

|

|

Marco

Alfonsi

|

|

57

|

|

CEO,

Director, Chairman

|

|

Stanley

L. Teeple

|

|

70

|

|

CFO,

Secretary, Director

|

|

Andrew

Holtmeyer

|

|

57

|

|

VP

of Business Development

|

Marco

Alfonsi,

CEO and Chairman Director has been a financial service professional for the past 20 years. Mr. Alfonsi was appointed

director and CEO of the Company in or around January 2015. Immediately prior to that, he spent eight years serving as the CEO

of Prosperity Systems, Inc. Throughout his career, Mr. Alfonsi was directly and indirectly involved in raising over $100 million

dollars for small and medium sized business. Prior to his involvement in the financial services industry, Mr. Alfonsi has owned,

operated, financed and sold several businesses. Mr. Alfonsi successfully started and managed two companies (ExecuteDirect.com,

and Bakers Express of New York, Inc.), and held senior management positions with a number of financial institutions, including:

Global American Investments, Clark Street Capital and Basic Investors.

Stanley

L. Teeple

–Mr. Teeple was engaged from 2017-2018 with Solis Tek, Inc. (OTCQB:SLTK) a California based publicly traded

corporation as Senior Vice President, Corporate Secretary, and Chief Compliance Officer. Solis Tek, Inc. a NV Corporation, is

a developer of lighting and nutrient products, and most recently in cultivation and processing for the cannabis industry. Previously,

from 2015-2016 Mr. Teeple was Chief Financial Officer and Secretary for Zonzia Media, Inc. (OTC:ZONX), a provider of streaming

video and content to cable subscribers and hotel networks throughout the eastern US. From 2008 to 2014 Mr. Teeple was Chief Financial

Officer and Secretary of Indigo-Energy, Inc. (OTC:IDGG) a publicly traded company in the oil and gas exploration business. Over

the prior three plus decades Mr. Teeple through his turnaround consulting business, Stan Teeple, Inc., has held numerous senior

management positions in several public and private companies across a broad spectrum of industries. Additionally, he has operated

and worked for various court appointed trustees and principals as CEO, COO, and CFO in the entertainment, pharmaceuticals, food,

travel, and tech industries. He operated his consulting business on a project-to-project basis and holds various other directorships.

His businesses operational strengths include knowing how to manage and maximize the resources and preserve the integrity of a

company from start-up through to maturity and corporate compliance in a regulatory environment.

Andrew

Holtmeyer –

Mr. Holtmeyer started his business career in the financial services sector. During his 20 year career on

Wall Street, Mr. Holtmeyer worked at and built several investment firms that employed hundreds of salesmen. During the last 5

years of his career, he concentrated mostly on investment banking. After leaving the financial sector, Mr. Holtmeyer started a

highly successful consulting firm, which concentrated on raising capital for small to mid-sized companies that were both private

and public. After selling his consulting business, Mr. Holtmeyer started a very successful real estate business which is now run

by his family.

Carl

Dilley, 63, served on our Board of Directors until he resigned for personal reasons on February 21, 2019.

David

Posel, 39, served as the Company’s COO during 2018, when the Company’s operations were limited to its contractual

arrangement with Pure Health Products (PHP). After acquiring PHP directly, Mr. Posel was transitioned to COO of PHP.

We

currently have two serving directors on our Board of Directors: Marco Alfonsi and Stanley Teeple. Mr. Alfonsi, our Chairman of

the Board, also serves as our Chief Executive Officer. Mr. Teeple is also our Chief Financial Officer and secretary. There currently

is no independent director.

We

have not yet established an audit committee, compensation committee, or nominating committee. During 2018, the functions ordinarily

handled by these committees were handled by our entire Board. The Company is not currently listed on any national securities exchange

that has a requirement that the board of directors be independent. None of the Company’s directors are independent. Additional

information regarding the Board of Directors’ control and procedures from Item 9A of the Company’s Annual Report for

fiscal year 2018, as amended, is incorporated herein by reference

Our

current directors and executive officers have not been involved in any legal proceedings as described in Item 401(f) of Regulation

S-K in the past ten years. There are no familial relationships between any of our officers and directors.

Except

as described herein, none of the following parties (each a “Related Party”) has, in our fiscal years ended 2017 and

2018, had any material interest, direct or indirect, in any transaction with us or in any presently proposed transaction that

has or will materially affect us:

|

●

|

any

of our directors or officers;

|

|

●

|

any

person who beneficially owns, directly or indirectly, shares carrying more than 10% of the voting rights attached to our outstanding

shares of common stock; or

|

|

●

|

any

member of the immediate family (including spouse, parents, children, siblings and in- laws) of any of the above persons.

|

ProAdvanced

Group, Inc. (“PAG”), an entity controlled by the Company’s chief executive officer, is a customer of CANB. At

December 31, 2018, CANB had an account receivable from PAG of $7,240. For the year ended December 31, 2018, CANB had revenues

from PAG of $5,000.

Island

Stock Transfer (“IST”), an entity controlled by Carl Dilley, a past Company director, is both a customer and vendor

of CANB. At December 31, 2018, CANB had an account receivable from IST of $7,035 and an account payable to IST of $1,454. For

the year ended December 31, 2018, CANB had revenues from IST of $4,000.

Stock

Market Manager, Inc. is also an entity controlled by Mr. Dilley. For the year ended December 31, 2018, CANB had an account payable

to Stock Market Manager Inc. of $1,676.

In

order to facilitate its operations, the Company has entered into a Production Agreement with Pure Health Products, LLC (“PHP”),

a New York limited liability company. Pursuant to the Production Agreement, PHP will manufacture, package, and sell the Company’s

CBD infused products on an exclusive basis. PHP will not produce or manufacture any product containing any cannabis or hemp derivative

for any person or entity other than the Company, and the Company controls the ingredients, recipe, manufacturing processes and

procedures and quality and taste parameters for all Products produced at the PHP facility. PHP may also white label / rebrand

or relabel the products on the Company’s behalf pursuant to “white label agreements” entered into between the

Company and third-party customers. Credit card sales are processed through PHP as well. Through its contractual relationship with

PHP, the Company is able to control the manufacturing process of its products while reducing its production costs. In addition,

the Company has the option to acquire certain assets of PHP should it elect to take over direct manufacture of its Products. For

the year ended December 31, 2018, purchase of CBD infused products from PHP totaled $274,556.50. Effective December 28, 2018,

the Company acquired Pure Health Products, LLC.

During

the year ended December 31, 2018, we had products and service sales to related parties totaling $5,000.

The

Company does not have a formal written process to review, approve or ratify related party transactions; however, if the related

party is a board member, such party is excluded from the vote approving the transaction.

Section

16(a) Beneficial Ownership Reporting Compliance

Section16(a)

of the Exchange Act requires our directors and executive officers, and persons who own more than 10% of a registered class of

our equity securities, to file reports of ownership and changes in ownership with the SEC. Officers, directors and greater than

10% shareholders are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file. Based

on our review of the reports filed by Reporting Persons, we believe that, during the year ended December 31, 2018, the following

Reporting Persons did not meet all applicable Section 16(a) filing requirements: (i) Stanley Teeple, (ii) David Posel, and (iii)Carl

Dilley. Otherwise, we believe that the Reporting Persons met such filing requirements.

Executive

Compensation

The

table below summarizes all compensation awarded to, earned by, or paid to our executive officers and directors for all services

rendered in all capacities to us during the previous two fiscal years, as of December 31, 2018.

Name

and

principal

position

|

|

Year

|

|

|

Salary

|

|

|

Bonus

|

|

|

Stock

awards

|

|

|

Option

awards

|

|

|

Non-

equity incentive plan compensation

|

|

|

Non-

qualified deferred compensation earnings

|

|

|

All

other compensation

|

|

|

Total

|

|

|

Marco Alfonsi(1)

|

|

|

2017

|

|

|

$

|

84,000

|

|

|

$

|

0

|

|

|

$

|

63,902

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

147,902

|

|

|

CEO and Director

|

|

|

2018

|

|

|

$

|

104,500

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

104,500

|

|

|

Stanley L. Teeple(2)

|

|

|

2018

|

|

|

$

|

45,000

|

|

|

$

|

0

|

|

|

$

|

144,500

|

|

|

$

|

118,200

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

307,700

|

|

|

Andrew Holtmeyer(3)

|

|

|

2018

|

|

|

$

|

118,400

|

|

|

$

|

0

|

|

|

$

|

1,169,658

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

1,288,058

|

|

|

David Posel (4)

|

|

|

2018

|

|

|

$

|

60,000

|

|

|

$

|

0

|

|

|

$

|

58,720

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

118,720

|

|

(1)

Pursuant to an employment agreement entered on or around May 14, 2015, Marco Alfonsi was entitled to receive compensation of $6,000

per month through September 31, 2017 when the contract expired. On or around October 3, 2017, the Company entered into a new employment

agreement with Mr. Alfonsi whereby he was entitled to receive $10,000 per month for a period of three years. Mr. Alfonsi also

received one share of Class A Preferred Stock upon his execution of the new agreement. In addition, on or around October 4, 2017,

the Company authorized the issuance of an additional two shares of Class A Preferred Stock to Mr. Alfonsi in consideration for

cancellation of approximately $120,000 of deferred income owed to Mr. Alfonsi. The Company entered into a new employment agreement

dated October 21, 2018 Mr. Alfonsi, pursuant to which Mr. Alfonsi agreed to continue to serve as the Company’s Chief Executive

Officer (“CEO”) and accept appointment as Chairman of the Board of Directors (“Chairman”) for an initial

term of four (4) years. He is entitled to receive $15,000 per month and other compensation under the new agreement.

(2)

Pursuant to an employment agreement entered on or around October 15, 2018, Mr. Teeple services as the Company’s Chief Financial

Officer and Secretary for a term of 4 years. The Agreement also provides for compensation to Mr. Teeple of $15,000 cash per month

and the issuance of 1 share of Series A Preferred Stock upon execution of the Agreement. The fair value of the Series A preferred

Stock is $578,000 and has a vesting period of four years. In 2018, the amortized portion of Series A preferred Stock is $144,500.

(3)

On February 16, 2018, the Company executed an Executive Service Agreement (“Agreement”) with Andrew W Holtmeyer. The

Agreement provides that Mr. Holtmeyer services as the Company’s Executive Vice President Business for a term of 3 years.

The Agreement also provides for compensation to Mr. Holtmeyer of $10,000 cash per month and the issuance of 3, 2 and 1 share of

Series A Preferred Stock at the beginning of each year. On December 29, 2018, this Agreement was terminated due to the execution

of a new Employment Agreement with Andrew W Holtmeyer. The Agreement provides that Mr. Holtmeyer services as the Company’s

Executive Vice President Business for a term of 4 years. The Agreement also provides for compensation to Mr. Holtmeyer of $15,000

cash per month and the issuance of 245,789 shares of common stock upon signing of the agreement. In 2018, the Company issued 5

shares of Series A preferred shares valued at $3,910,000 and the amortization in 2018 is $1,169,658.

(4)

On February 12, 2018, the Company executed an Executive Service Agreement (“Agreement”) with David Posel. The Agreement

provides that Mr. Posel services as the Company’s Chief Operating Officer for a term of 4 years. The Agreement also provides

for compensation to Mr. Posel of $5,000 cash per month and the issuance of 1 share of Series A Preferred Stock at the inception

of the Agreement. In the fourth quarter, this Agreement was terminated due to the execution of a new Employment Agreement between

Pure Health Products, LLC and David Posel. The fair value of the Series A preferred Stock is $373,000 and has a vesting period

of four years. In 2018, the amortized portion of Series A preferred Stock related to Mr. Posel’s service as an executive

is $58,720.

We

do not have an equity incentive plan and no named executive officer has unexercised outstanding equity awards.

The

table below summarizes all compensation awarded to, earned by, or paid to our non-interested directors for all services rendered

in all capacities to us during the previous two fiscal years, as of December 31, 2018.

Name

and

principal

position

|

|

Year

|

|

|

Fees

Earned

or Paid

in Cash

|

|

|

Stock

awards

|

|

|

Option

awards

|

|

|

Non-equity

incentive plan compensation

|

|

|

Non-qualified

deferred compensation earnings

|

|

|

All

other compensation

|

|

|

Total

|

|

|

Carl Dilley(1)

|

|

|

2017

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

Director

|

|

|

2018

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

84,000

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

84,000

|

|

|

|

(1)

|

Mr.

Dilley resigned from the Company on February 21, 2019.

|

No

director has received cash compensation for their directorship. We do not have a compensation committee and compensation for our

directors and officers is determined by our board of directors.

We

reimburse Non-Employee Directors for actual out-of-pocket costs incurred to attend board meetings. No additional compensation

is paid for attendance in person or by telephone at board meetings.

Compensation

Committee Interlocks and Insider Participation

We

have not yet established a compensation committee. During 2018, the functions ordinarily handled by these committees were handled

by our entire Board.

Compensation

Committee Report:

The

entire Board of Directors has reviewed and discussed the Compensation Discussion and Analysis required by §229.402(b) with

management and, based on the review and discussions thereof, the Board of Directors elected that the Compensation Discussion and

Analysis not be included in our information statement on Schedule 14C.

Marco

Alfonsi and Stanley L. Teeple are the only current members of our Board of Directors. Carl Dilley was a director for all of fiscal

year 2018 and the beginning of 2019.

Legal

Proceedings

We

are not aware of any pending or threatened legal proceedings in which we are involved, except as disclosed herein.

Purpose

The

Director Appointment was to elect the Company’s directors for the upcoming year.

Effect

on Authorized and Outstanding Shares

The

rights and preferences of shares of our Common Stock subsequent to the Director Appointment will remain the same. The Director

Appointment will affect all of our stockholders uniformly.

Federal

Income Tax Consequences

The

following description of federal income tax consequences of the Director Appointment is based on the Internal Revenue Code of

1986, as amended, the applicable Treasury Regulations promulgated thereunder, judicial authority, and current administrative rulings

and practices as in effect on the date of this information statement. We have not sought and will not seek an opinion of counsel

or a ruling from the Internal Revenue Service regarding the federal income tax consequences of the Director Appointment.

We

believe that the Director Appointment will not have federal income tax effects. The Company should not recognize gain or loss

as a result of the Director Appointment.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

following tables set forth the ownership, as of the Record Date, of our common stock by each person known by us to be the beneficial

owner of more than 5% of our outstanding voting stock, our directors, and our executive officers and directors as a group. To

the best of our knowledge, the persons named have sole voting and investment power with respect to such shares, except as otherwise

noted. There are not any pending or anticipated arrangements that may cause a change in control.

The

information presented below regarding beneficial ownership of our voting securities has been presented in accordance with the

rules of the Securities and Exchange Commission and is not necessarily indicative of ownership for any other purpose. Under these

rules, a person is deemed to be a “beneficial owner” of a security if that person has or shares the power to vote

or direct the voting of the security or the power to dispose or direct the disposition of the security. A person is deemed to

own beneficially any security as to which such person has the right to acquire sole or shared voting or investment power within

60 days through the conversion or exercise of any convertible security, warrant, option or other right. More than one person may

be deemed to be a beneficial owner of the same securities.

|

Name

|

|

Title

|

|

Number

of Common Shares [6]

|

|

|

%

of Common Shares

|

|

|

Number

of Series

A

Preferred Shares [7]

|

|

|

%

of Series A Preferred Shares

|

|

|

%

of Eligible Votes

|

|

|

Number

of Warrants currently exercisable or exercisable in the next 60 days

|

|

|

Marco Alfonsi [1]

|

|

CEO, Director

|

|

|

59,398,915

|

|

|

|

10.83

|

%

|

|

|

5

|

|

|

|

29.41

|

%

|

|

|

17.94

|

%

|

|

|

0

|

|

|

Stanley Teeple

[2]

|

|

CFO, Secretary,

Director

|

|

|

980,752

|

|

|

|

0.18

|

%

|

|

|

1

|

|

|

|

5.88

|

%

|

|

|

2.36

|

%

|

|

|

0

|

|

|

Andrew Holtmeyer[3]

|

|

Vice President

|

|

|

1,107,769

|

|

|

|

0.20

|

%

|

|

|

5

|

|

|

|

29.41

|

%

|

|

|

11.38

|

%

|

|

|

0

|

|

|

All officers and directors as a group

[3 persons]

|

|

|

|

|

61,487,436

|

|

|

|

11.21

|

%

|

|

|

11

|

|

|

|

64.70

|

%

|

|

|

31.68

|

%

|

|

|

0

|

|

|

McKenzie Webster

Limited [4]

|

|

Shareholder

|

|

|

64,879,916

|

|

|

|

11.83

|

%

|

|

|

0

|

|

|

|

0

|

%

|

|

|

7.30

|

%

|

|

|

0

|

|

|

Pasquale Ferro

[5]

|

|

Shareholder

|

|

|

22,172,159

|

|

|

|

4.04

|

%

|

|

|

5

|

|

|

|

29.41

|

%

|

|

|

13.75

|

%

|

|

|

0

|

|

(1)

As of the Record Date, Marco Alfonsi owned approximately 59,398,915 shares of common stock and 5 shares of Series A Preferred

stock, which are convertible into 50,000,000 common shares and equal 100,000,000 votes. In addition to the listed shares, four

members of Mr. Alfonsi’s family hold an aggregate of 10,000,000 shares of common stock, which shares have not been included

in the above calculations.

(2)

As of the Record Date, Stanley Teeple owned approximately 980,752 shares of common stock and 1 share of Series A Preferred stock,

which is convertible into 10,000,000 common shares and equal 20,000,000 votes.

(3)

As of the Record Date, Andrew Holtmeyer owned approximately 1,107,769 and 5 shares of Series A Preferred stock, which are convertible

into 50,000,000 common shares and equal 100,000,000 votes.

(4)

McKenzie Webster Limited is controlled by the Company’s former director and CFO, Rolv Heggenhougen. The business address

for this shareholder is 445 NE 12th Ave., Fort Lauderdale, Florida 33301.

(5)

Pasquale Ferro is the President of Pure Health Products, LLC, a wholly owned subsidiary of the Company. Mr. Ferro holds 5 shares

of Series A Preferred stock, which are convertible into 50,000,000 common shares and equal 100,000,000 votes.

(6)

There were 548,487,714 shares of common stock and 17 shares of Series A Preferred stock outstanding as of April 12, 2019, for

a total of 888,487,714 votes currently eligible to be cast on the Record Date.

(7)

The Company’s preferred stock is classified as Series A Preferred shares and Series B Preferred Shares. Series B Preferred

shares have no voting rights. Series B Preferred shares are convertible into shares of common stock; however, all Series B Preferred

shares issued and outstanding as of the Record Date are held by a single shareholder and each Series B Preferred shareholder is

limited to converting no more than 20,000 Series B Preferred shares at any given time (the “Series B Conversion Limit”).

Even assuming the Series B Conversion Limit were waived, the 342,853 Series B Preferred shares issued and outstanding as of the

Record Date would convert into less than 5% of the Company’s voting stock.

The

following tables set forth the ownership of our common stock by each person known by us to be the beneficial owner of more than

5% of our outstanding voting stock, our directors, and our executive officers and directors as a group,

assuming

all preferred shares were converted to common shares as of the Record Date (which they were not).

|

Name

|

|

Title

|

|

Number

of Common Shares [1]

|

|

|

%

of Common Shares

|

|

|

Number

of Preferred Shares

|

|

|

%

of Preferred Share

|

|

|

%

of Eligible Votes

|

|

|

Number

of Warrants currently exercisable

or

exercisable

in the next 60 days

|

|

|

Marco

Alfonsi

|

|

CEO, Director

|

|

|

109,398,915

|

|

|

|

14.35

|

%

|

|

|

0

|

|

|

|

0

|

%

|

|

|

14.35

|

%

|

|

|

0

|

|

|

Stanley Teeple

|

|

CFO, Secretary, Director

|

|

|

10,980,752

|

|

|

|

1.44

|

%

|

|

|

0

|

|

|

|

0

|

%

|

|

|

1.44

|

%

|

|

|

0

|

|

|

Andrew Holtmeyer

|

|

Vice President

|

|

|

51,107,769

|

|

|

|

6.70

|

%

|

|

|

0

|

|

|

|

0

|

%

|

|

|

6.70

|

%

|

|

|

0

|

|

|

All officers and

directors as a group [3 persons]

|

|

|

|

|

171,487,436

|

|

|

|

22.49

|

%

|

|

|

0

|

|

|

|

0

|

%

|

|

|

22.49

|

%

|

|

|

0

|

|

|

McKenzie Webster

Limited

|

|

Shareholder

|

|

|

64,879,916

|

|

|

|

8.51

|

%

|

|

|

0

|

|

|

|

0

|

%

|

|

|

8.51

|

%

|

|

|

0

|

|

|

Pasquale Ferro

|

|

Shareholder

|

|

|

72,172,159

|

|

|

|

9.46

|

%

|

|

|

0

|

|

|

|

0

|

%

|

|

|

9.46

|

%

|

|

|

0

|

|

|

|

(1)

|

Had

all 17 issued and outstanding Series A Preferred Shares and 342,853 issued and outstanding

Series B Preferred shares been converted to common shares, there would have been 762,617,308

shares of common stock outstanding as of the Record Date.

|

The

above tables are based upon information derived from our stock records. Except as otherwise indicated below and under applicable

community property laws, we believe that the beneficial owners of our common stock listed below have sole voting and investment

power with respect to the shares shown. Unless stated otherwise, the business address for these shareholders is 960 South Broadway,

Suite 120, Hicksville, NY 11801.

DISSENTERS’

RIGHTS

Under

the FBCA and our Articles of Incorporation and bylaws, no stockholder has any right to dissent to the Director Appointment, nor

is any stockholder entitled to appraisal of or payment for their shares of our stock.

INTEREST

OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

Excepting

their election as directors, none of our officers or directors, and no person associated with any of them, have any interest in

the Director Appointment that is different from every other stockholder.

WHERE

YOU CAN FIND MORE INFORMATION

Information

is available by request or can be accessed on the internet. Reports, proxy statements and other information filed with the SEC

by the Company can be accessed electronically by means of the Securities and Exchange Commission’s home page on the Internet

at http://www.sec.gov or at other Internet sites such as http://www.freeedgar.com or http://www.otcmarkets.com.

You

may read and copy any materials that we file with the Securities and Exchange Commission at the commission’s Public Reference

Room at 100 F Street, N.E., Washington D.C. 20549. A copy of any public filing is also available to any shareholder at no charge

upon written request to the Company by providing an e-mail or facsimile number.

PROPOSALS

BY SECURITY HOLDERS

No

security holder has asked the Company to include any proposal in this Information Statement.

MULTIPLE

STOCKHOLDERS SHARING ONE ADDRESS

Only

one information statement to security holders is being delivered to multiple security holders sharing an address unless the Company

has received contrary instructions from one or more of the security holders. Upon written or oral request, a separate copy of

an information statement can be provided to security holders at a shared address. For an oral request, please contact the Company

at 516-595-9544. For a written request, mail request to 960 South Broadway, Suite 120, Hicksville, NY 11801.

EXPENSE

OF THIS INFORMATION STATEMENT

The

expenses of this Information Statement will be borne by us, including expenses in connection with the preparation and sending

of this Information Statement and all related materials. It is contemplated that brokerage houses, custodians, nominees, and fiduciaries

will be requested to forward this Information Statement to the beneficial owners of our Common Stock held of record by such person

and that we will reimburse them for their reasonable expenses incurred in connection therewith.

FORWARD-LOOKING

STATEMENTS

This

Information Statement contains forward-looking statements regarding our intentions to effectuate the Director Appointment. Forward-looking

statements are not guarantees, and they involve risks, uncertainties and assumptions. Although we make such statements based on

assumptions that we believe to be reasonable, there can be no assurance that actual results will not differ materially from those

expressed in the forward-looking statements. We caution investors not to rely unduly on any forward-looking statements. We expressly

disclaim any obligation to update any forward-looking statement in the event it later turns out to be inaccurate, whether as a

result of new information, future events or otherwise.

INCORPORATION

BY REFERENCE

The

Company’s financial statements, supplementary financial information, changes and disagreements with accountants, manager

discussion and analysis, and quantitative and qualitative disclosures about market risk from its Annual Report filed on Form 10-K/A

on April 17, 2019 are incorporated herein by reference. The Company’s financial statements, supplementary financial information,

manager discussion and analysis, and quantitative and qualitative disclosures about market risk from its Quarterly Reports filed

on Form 10-Q on May 23, 2019 are also incorporated herein by reference. No representative from the Company’s accountant

is expected to make a statement or be available for questions regarding the actions herein detailed.

By

the Order of the Board of Directors.

Dated:

June 14, 2019

|

|

CANBIOLA,

INC.

|

|

|

|

|

|

|

|

/s/

Marco Alfonsi

|

|

|

Name:

|

Marco

Alfonsi

|

|

|

|

Chief

Executive Officer

|

|

|

DIRECTORS:

|

|

|

|

|

|

|

By:

|

/s/

Marco Alfonsi

|

|

|

Name:

|

Marco

Alfonsi

|

|

|

Title:

|

Director

|

|

|

|

|

|

|

By:

|

/s/

Stanley Teeple

|

|

|

Name:

|

Stanley

Teeple

|

|

|

Title:

|

Director

|

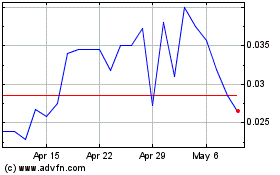

CAN B (QB) (USOTC:CANB)

Historical Stock Chart

From Mar 2024 to Apr 2024

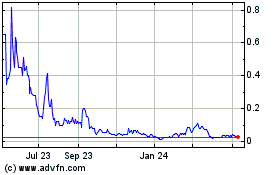

CAN B (QB) (USOTC:CANB)

Historical Stock Chart

From Apr 2023 to Apr 2024