Current Report Filing (8-k)

June 24 2019 - 1:32PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of

1934

Date

of report (date of earliest event reported):

April

8, 2019

Blockchain Industries, Inc.

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

000-51126

|

|

88-0355407

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer ID No.)

|

|

1632 First Ave #325

New York, NY

|

|

10028

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant's telephone number, including area code:

866-995-7521

(Former name or former address, if changed since last

report.)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2.

below):

|

☐

|

Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule

14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule

13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

None

|

|

None

|

|

None

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this

chapter).

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period

for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange

Act.

☐

Item

4.02

Non-Reliance on Previously Issued Financial Statements or a Related

Audit Report or Completed Interim Report.

On

April 8, 2019, the board of directors (the “Board”) of

Blockchain Industries, Inc. (the “Company”), following

discussion by the board of directors (the “Board”) with

the Company’s independent registered public accounting firm,

BF Borgers CPA PC (“Borgers”), concluded that the

following previously filed financial statements of the Company

should not be relied upon:

●

The Company’s

unaudited financial statements for the quarterly period ended

January 31, 2018, contained in the Company’s Quarterly

Reports on Form 10-Q, originally filed with the Securities and

Exchange Commission (“SEC”) on March 19, 2018 (the

“Q3 Report”), as amended by Amendment No. 1 to the Q3

Report on June 22, 2018 (“Amendment No. 1”) and as

amended by Amendment No. 2 to the Q3 Report on November 2, 2018

(“Amendment No. 2”).

The conclusion to prevent future reliance on the aforementioned

financial statements resulted from the determination that the Q3

Report, Amendment No. 1 and Amendment No. 2 failed to properly

account for the Company’s 2-for-1 forward stock split,

stock-based compensation expense and a note receivable as part of

the previously disclosed AutoLotto Agreement. Specifically, the

Company has determined that:

i.

Certain

components of the Company’s shareholders’ equity

(deficit) had not been adjusted for the Company’s 2-for-1

forward stock split effected on January 16, 2018. As a result, both

Additional Paid in Capital and Common Stock as reported on the

Company’s Balance Sheets as of January 31, 2018 and April 30,

2017 were adjusted to reflect outstanding shares at the appropriate

par value per share;

The

Company adopted ASU 2014-09 Revenue From Contracts With Customers

(Topic 606) and, as such, we analyze obligations on contracts with

customers, assessing the transaction price and recording revenue

accordingly. During the nine months ended January 31, 2018, we had

one contract with a customer to provide services;

The

Company had incorrectly accounted for stock-based compensation

expense and recorded a total of approximately $18.8 million. The

Company corrected the stock-based compensation expense to

accurately reflect $166,603 in the statement of operations and cash

flows in Amendment No. 1. However, the Company failed to update the

disclosure in Item 2. Management’s Discussion and Analysis of

Financial Condition and Results of Operations of Amendment No. 1 to

reflect the change.

iv.

As

previously disclosed on January 17, 2018, the Company entered into

a Promissory Note Agreement (the “AutoLotto Agreement”)

with AutoLotto, Inc. Under the terms of the AutoLotto Agreement the

Company funded AutoLotto $250,000 during the period ended January

31, 2018. The Company incorrectly classified $250,000 funded to

AutoLotto, Inc. as part of the AutoLotto Agreement as an in

investment in available-for-sale securities on the Company’s

balance sheet. This amount should have been recorded as a Note

receivable from AutoLotto at January 31, 2018.

The

conclusion to prevent future reliance on the aforementioned

financial statements resulted from conversation stemming from a

comment letter received by the Company from the United States

Securities and Exchange Commission regarding the Q3 Report,

Amendment No.1 and Amendment No. 2.

The

Company continues to review certain other historical transactions

which could result in additional adjustments to the Q3 Report,

Amendment No.1 and Amendment No. 2 and which also could result in

additional prior period financial statements that can no longer be

relied upon. The Company will, as soon as is practicable, make

adjustments as appropriate to those periods.

The

Board discussed the matters described in this Item 4.02 with

representatives of Borgers.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

Blockchain Industries, Inc.

|

|

|

|

|

|

Date:

June 24, 2019

|

By:

|

/s/

Robert

Kalkstein

|

|

|

|

Robert

Kalkstein

|

|

|

|

Principal

Financial Officer

|

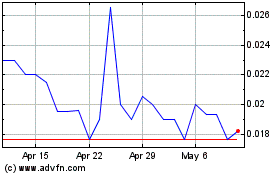

BCII Enterprises (PK) (USOTC:BCII)

Historical Stock Chart

From Mar 2024 to Apr 2024

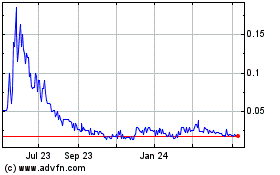

BCII Enterprises (PK) (USOTC:BCII)

Historical Stock Chart

From Apr 2023 to Apr 2024