If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ☒

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

BioLargo, Inc. (the “Company,” “we,” or “us”) filed a Registration Statement on Form S-1 with the Securities and Exchange Commission (“SEC”) on June 9, 2017 (the “Registration Statement”), and paid the registration fee. The Registration Statement was declared effective on June 15, 2017. The Company filed post-effective Amendment No. 1 to the Registration Statement on August 28, 2018, and it was declared effective on September 6, 2018, post-effective Amendment No. 2 to the Registration Statement on August 30, 2019, and it was declared effective on September 11, 2019, post-effective Amendment No. 3 to the Registration Statement on April 27, 2020, and it was declared effective on April 28, 2020, and post-effective Amendment No. 4 to the Registration Statement on April 7, 2021, and it was declared effective on April 8, 2021.

The Company is submitting this Post-Effective Amendment No. 5 (“Amendment”) to its Registration Statement for the purpose of providing information from its Annual Report on Form 10-K for the period ended December 31, 2021, filed with the SEC March 31, 2022.

The warrants to purchase 20,159,062 shares of common stock as described in the Registration Statement expired on their terms, unexercised, on June 1, 2020. Therefore, no additional shares will be sold by the Company to the Selling Stockholders pursuant to those warrants.

The contents of the Registration Statement as previously filed which are not modified and revised by this Amendment are hereby incorporated by reference.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

This prospectus relates to the sale of up to 36,090,857 shares of our common stock by persons who have purchased shares in a series of private placements. The aforementioned persons are sometimes referred to in this prospectus as the selling stockholders. The shares offered under this prospectus by the selling stockholders may be sold on the public market, in negotiated transactions with a broker-dealer or market maker as principal or agent, or in privately negotiated transactions not involving a broker dealer. The prices at which the selling stockholder may sell the shares may be determined by the prevailing market price of the shares at the time of sale, may be different than such prevailing market prices or may be determined through negotiated transactions with third parties. We will not receive proceeds from the sale of our shares by the selling stockholders.

As of the date of this prospectus, the selling stockholders have not exercised any of the warrants to purchase shares registered hereby. The selling shareholders have sold approximately 6,000,000 shares registered for sale in the registration statement of which this prospectus is part.

Each selling stockholder may be considered an “underwriter” within the meaning of the Securities Act of 1933, as amended.

Since January 23, 2008, our common stock has been quoted on the OTC Markets “OTCQB” marketplace (formerly known as the “OTC Bulletin Board”) under the trading symbol “BLGO.” The selling stockholders will sell up the shares at prices established on the OTC Bulletin Board during the term of this offering, at prices different than prevailing market prices or at privately negotiated prices. On March 30, 2022, the last reported sale price of our common stock on the OTC Markets was $0.234.

TABLE OF CONTENTS

Unless otherwise specified, the information in this prospectus is set forth as of April 13, 2022, and we anticipate that changes in our affairs will occur after such date. We have not authorized any person to give any information or to make any representations, other than as contained in this prospectus, in connection with the offer contained in this prospectus. If any person gives you any information or makes representations in connection with this offer, do not rely on it as information we have authorized. This prospectus is not an offer to sell our common stock in any state or other jurisdiction to any person to whom it is unlawful to make such offer.

PROSPECTUS SUMMARY

The following summary highlights selected information from this prospectus and may not contain all the information that is important to you. To understand our business and this registration statement fully, you should read this entire prospectus carefully, including the financial statements and the related notes beginning on page F-1. When we refer in this prospectus to “BioLargo,” the “Company,” “our company,” “we,” “us” and “our,” we mean BioLargo, Inc., a Delaware corporation, and its subsidiaries, BioLargo Life Technologies, Inc., a California corporation, ONM Environmental, Inc., a California corporation, BioLargo Water Investment Group, Inc., a California corporation (and its subsidiary, BioLargo Water, Inc., a Canadian corporation), BioLargo Development Corp., a California corporation, BioLargo Engineering, Science & Technologies, LLC, a Tennessee limited liability company, and partially owned Clyra Medical Technologies, Inc., a California corporation. This prospectus contains forward-looking statements and information relating to BioLargo. See “Cautionary Note Regarding Forward Looking Statements” on page 14.

Our Company

BioLargo, Inc. is a Delaware corporation.

Our principal executive offices are located at 14921 Chestnut St., Westminster, California 92683. Our telephone number is (888) 400-2863.

The Registration Statement

This prospectus covers 36,090,857 shares of stock, all of which are offered for sale by the selling stockholders.

ABOUT THIS REGISTRATION

|

|

|

|

Securities Being Registered

|

This Prospectus covers the following shares, all of which are being sold by the selling stockholders: 20,159,062 shares of common stock of BioLargo issuable upon the exercise of warrants to purchase common stock which have expired since the filing of the initial Registration Statement, and 15,931,795 outstanding shares held by the Selling Stockholders. As of the date hereof, the Selling Stockholders have not exercised any of the warrants and lost their rights to do so, but have sold approximately 6,000,000 shares held by them and offered for sale by this prospectus.

|

|

|

|

|

Initial Offering Price

|

The selling stockholders will sell up to 36,090,857 shares at prices established on the OTC Electronic Bulletin Board during the term of this offering, at prices different than prevailing market prices or at privately negotiated prices.

|

|

|

|

|

Termination of the Offering

|

The offering will conclude when all the 36,090,857 shares of common stock registered hereby have been sold by the selling stockholders.

|

|

|

|

|

Risk Factors

|

An investment in our common stock is highly speculative and involves a high degree of risk. See “Risk Factors” beginning on page 3.

|

RISK FACTORS

An investment in our common stock is highly speculative, involves a high degree of risk and should be made only by investors who can afford a complete loss. You should carefully consider the following risk factors, together with the other information in this prospectus, including our financial statements and the related notes, before you decide to buy our common stock. If any of the following risks actually occurs, then our business, financial condition or results of operations could be materially adversely affected, the trading of our common stock could decline, and you may lose all or part of your investment therein.

Risks Relating to our Business

COVID-19

The Covid-19 crisis creates an environment in which no person can be certain about what is next. It continues to evolve even two years after it began. The global reach and impact are far reaching and place extreme pressure on financing, sales, accounts receivable collection cycles, and any growth plan. We believe the Covid-19 virus crisis may have a delaying effect on our plans for growth and expansion. We urge the reader to consider our forward-looking statements in light of the extraordinary circumstances of today’s business, social and economic climate. While our company is mobilizing to be a solutions provider to help inhibit the spread of Covid-19, these business plans are not mature and may be more difficult that we expect. While it may be reasonable to assume that the crisis will subside, we cannot be certain about the timing and a host of impacts that cannot be easily predicted to occur.

Supply Chain Challenges

As we emerge with new products like our AEC and AOS, that find adoption in the commercial markets, we will likely face supply chain challenges, including supply and pricing volatility, that will be beyond our control that might include steel, electrodes, membranes, electronic components (like chips), raw chemicals. We predict that at some level we may face delays and or extended delivery times for systems sold to clients and that could lead to delays in our anticipated growth.

We have a history of losses, and cannot assure you that we will ever become or remain profitable.

We have not yet generated enough revenue or gross profit from operations to fund our expenses, and, accordingly, we have incurred net losses every year since our inception. We have funded the majority of our activities through the issuance of convertible debt or equity securities. Although we are devoting more energy and money to our sales and marketing activities, we continue to anticipate net losses and negative cash flow for the foreseeable future. Our ability to reach positive cash flow depends on many factors, including our ability to fund sales and marketing activities, and the rate of client adoption. There can be no assurance that our revenues will be sufficient for us to become profitable in 2022 or future years, or thereafter maintain profitability. We may also face unforeseen problems, difficulties, expenses or delays in implementing our business plan, including regulatory hurdles.

Our cash requirements are significant. We will continue to require additional financing to sustain our operations and without it we may not be able to continue operations.

Our cash requirements and expenses continue to be significant. Our net cash used in continuing operations for the year ended December 31, 2021, was $3,937,000, approximately $328,000 monthly average. During 2021, we generated $2,531,000 in consolidated gross revenues, approximately $211,000 monthly average. Thus, in order to become profitable, we must significantly increase our revenues. Although our revenues are increasing through sales of our products and from our engineering division, we expect to continue to use cash in 2022 as it becomes available and to continue to sell our securities to fund operations.

At December 31, 2021, we had working capital of $427,000. Our auditor’s report for the year ended December 31, 2021, includes an explanatory paragraph to their audit opinion stating that our recurring losses from operations, negative cash flow from operations, and limited capital resources raise substantial doubt about our ability to continue as a going concern. We do not currently have sufficient financial resources to fund our operations or those of our subsidiaries. Therefore, we need additional financing to continue these operations.

We have relied on private securities offerings, as well as Lincoln Park Capital (see below), to provide cash needed to close the gap between operational revenue and expenses. Our ability to rely on private financing may change if the United States enters a recession, if the Dow Industrial Average or Nasdaq composite decline significantly, if interest rates rise, if real estate values decline, if international events affect the global economy, or many other factors that impact private investors’ willingness to invest in high-risk companies. Thus, while we have been able to rely on private investments in the past, we may not be able to do so in the near future.

In the year ended December 31, 2021, we relied on our financing agreement with Lincoln Park Capital to sell shares and raise capital, as well as other private investors. In total, we received almost $5 million from stock sales, and issued approximately 30 million shares of stock to these investors. These issuances are dilutive to our existing stockholders. We intend to continue these financing activities, and thus intend to continue to dilute the existing stockholders.

These issuances are dilutive to our existing stockholders. We intend to continue these financing activities, and thus intend to continue to dilute the existing stockholders.

We regularly issue stock, or stock options, instead of cash, to pay some of our operating expenses. These issuances are dilutive to our existing stockholders.

We are party to agreements that provide for the payment of, or permit us to pay at our option, securities rather than cash in consideration for services provided to us. We include these provisions in agreements to allow us to preserve cash. We anticipate that we will continue to do so in the future. All such issuances preserve our cash reserves, but are also dilutive to our stockholders because they increase (and will increase in the future) the total number of shares of our common stock issued and outstanding, even though such arrangements assist us with managing our cash flow. These issuances also increase the expense amount recorded.

Our stockholders face further potential dilution in any new financing.

In the year ended December 31, 2021, we issued almost 30 million shares of our common stock in financing activities. Our private securities offerings typically offer convertible securities, including notes and warrants. Those warrants often include provisions that require investors to pay for the underlying shares with cash, which if executed would generate working capital for the company. Any additional capital that we raise would dilute the interest of the current stockholders and any persons who may become stockholders before such financing. Given the price of our common stock, such dilution in any financing of a significant amount could be substantial.

We may be required to seek stockholder approval to amend our charter to increase our authorized number of shares.

We have approximately 262 million common shares outstanding. We have reserved for further issuance approximately 104 million shares: 6 million to Lincoln Park, 42 million in our 2018 Equity Plan, 19 million to “non-plan” option holders, and 37 million to warrant holders. As our Certificate of Incorporation authorizes us to issue 400 million shares, we currently have approximately 34 million shares available for future issuances. In order to continue financing our operations through the sale of our common stock or convertible securities, we will be required to seek stockholder approval to amend our charter to increase the number of shares authorized. If our stockholders do not agree to increase the number of shares our Certificate of Incorporation authorizes us to issue, we may have to cease further financing activities. If we were forced to do so, we would run out of cash and may be forced to significantly curtail our operations.

Our stockholders face further potential adverse effects from the terms of any preferred stock that may be issued in the future.

Our certificate of incorporation authorizes 50 million shares of preferred stock. None are outstanding as of the date hereof. In order to raise capital to meet expenses or to acquire a business, our board of directors may issue additional stock, including preferred stock. Any preferred stock that we may issue may have voting rights, liquidation preferences, redemption rights and other rights, preferences and privileges. The rights of the holders of our common stock will be subject to, and in many respects subordinate to, the rights of the holders of any such preferred stock. Furthermore, such preferred stock may have other rights, including economic rights, senior to our common stock that could have a material adverse effect on the value of our common stock. Preferred stock, while providing desirable flexibility in connection with possible acquisitions and other corporate purposes, can also have the effect of making it more difficult for a third party to acquire a majority of our outstanding voting stock, thereby delaying, deferring or preventing a change in control of our company.

Our revenue growth rate may not be indicative of future performance and may slow over time.

Although our revenues have grown over the last several years, our revenue growth rate may slow over time for a number of reasons, including increasing competition, market saturation, slowing demand for our products and services, increasing regulatory costs and challenges, the impact of COVID-19, and failure to capitalize on growth opportunities.

We do not have contracts with customers that require the purchase of a minimum amount of our products.

None of our customers provide us with firm, long-term or short-term volume purchase commitments. As a result, we could have periods during which we have no or limited orders for our products but will continue to have fixed costs. We may not be able to find new customers in a timely manner if we experience no or limited purchase orders. Periods of no or limited purchase orders for our products, particularly from one or more of our four largest customers, could adversely affect our business, financial condition and results of operations.

There are several specific business opportunities we are considering in further development of our business. None of these opportunities is yet the subject of a definitive agreement, and many of these opportunities will require additional funding obligations on our part, for which funding is not currently in place.

In furtherance of our business plan, we are presently considering a number of opportunities to promote our business, to further develop and broaden, and to license, our technology with third parties. While discussions are underway with respect to such opportunities, there are no definitive agreements in place with respect to any of such opportunities at this time. There can be no assurance that any of such opportunities being discussed will result in definitive agreements or, if definitive agreements are entered into, that they will be on terms that are favorable to us.

Moreover, should any of these opportunities result in definitive agreements being executed or consummated, we may be required to expend additional monies above and beyond our current operating budget to promote such endeavors. No such financing is in place at this time for such endeavors, and we cannot assure you that any such financing will be available, or if it is available, whether it will be on terms that are favorable to our company.

We expect to incur future losses and may not be able to achieve profitability.

Although we are generating revenue from the sale of our products and from providing services, and we expect to generate revenue from new products we are introducing, and eventually from other license or supply agreements, we anticipate net losses and negative cash flow to continue for the foreseeable future until our products are expanded in the marketplace and they gain broader acceptance by resellers and customers. Our current level of sales is not sufficient to support the financial needs of our business. We cannot predict when or if sales volumes will be sufficiently large to cover our operating expenses. We intend to expand our marketing efforts of our products as financial resources are available, and we intend to continue to expand our research and development efforts. Consequently, we will need to generate significant additional revenue or seek additional financings to fund our operations. This has put a proportionate corresponding demand on capital. Our ability to achieve profitability is dependent upon our efforts to deliver a viable product and our ability to successfully bring it to market, which we are currently pursuing. Although our management is optimistic that we will succeed in licensing our technology, we cannot be certain as to timing or whether we will generate sufficient revenue to be able to operate profitably. If we cannot achieve or sustain profitability, then we may not be able to fund our expected cash needs or continue our operations. If we are not able to devote adequate resources to promote commercialization of our technology, then our business plans will suffer and may fail.

Because we have limited resources to devote to sales, marketing and licensing efforts with respect to our technology, any delay in such efforts may jeopardize future research and development of technologies and commercialization of our technology. Although our management believes that it can finance commercialization efforts through sales of our securities and possibly other capital sources, if we do not successfully bring our technology to market, our ability to generate revenues will be adversely affected.

Our internal controls are not effective.

We have determined that our disclosure controls and procedures and our internal control over financial reporting are currently not effective. The lack of effective internal controls, has not yet, but could in the future, materially adversely affect our financial condition and ability to carry out our business plan. As more financial resources come available, we need to invest in additional personnel to better manage the financial reporting processes.

If we are not able to manage our anticipated growth effectively, we may not become profitable.

We anticipate that expansion will continue to be required to address potential market opportunities for our technologies and our products. Our existing infrastructure is limited. While we believe our current manufacturing processes as well as our office and warehousing provide the basic resources to expand to sales of more than $2 million per month, our infrastructure will need more staffing to support manufacturing, customer service, administration as well as sales/account executive functions. There can be no assurance that we will have the financial resources to create new infrastructure, or that any such infrastructure will be sufficiently scalable to manage future growth, if any. There also can be no assurance that, if we invest in additional infrastructure, we will be effective in expanding our operations or that our systems, procedures or controls will be adequate to support such expansion. In addition, we will need to provide additional sales and support services to our partners if we achieve our anticipated growth with respect to the sale of our technology for various applications. Failure to properly manage an increase in customer demands could result in a material adverse effect on customer satisfaction, our ability to meet our contractual obligations, and our operating results.

Some of the products incorporating our technology will require regulatory approval.

The products in which our technology may be incorporated have both regulated and non-regulated applications. The regulatory approvals for certain applications may be difficult, impossible, time consuming and/or expensive to obtain. While our management believes such approvals can be obtained for the applications contemplated, until those approvals from the FDA or the EPA or other regulatory bodies, at the federal and state levels, as may be required are obtained, we may not be able to generate commercial revenues for regulated products. Certain specific regulated applications and their use require highly technical analysis and additional third-party validation and will require regulatory approvals from organizations like the FDA. Certain applications may also be subject to additional state and local agency regulations, increasing the cost and time associated with commercial strategies. Additionally, most products incorporating our technology that may be sold in the European Union (“EU”) will require EU and possibly also individual country regulatory approval. All such approvals, including additional testing, are time-consuming, expensive and do not have assured outcomes of ultimate regulatory approval.

We need to outsource and rely on third parties for the manufacture of the chemicals, material components or delivery apparatus used in our technology, and part of our future success will be dependent on the timeliness and effectiveness of the efforts of these third parties.

We do not have the required financial and human resources or capability to manufacture the chemicals necessary to make our odor control products. Our business model calls for the outsourcing of the manufacture of these chemicals in order to reduce our capital and infrastructure costs as a means of potentially improving our financial position and the profitability of our business. Accordingly, we must enter into agreements with other companies that can assist us and provide certain capabilities, including sourcing and manufacturing, which we do not possess. We may not be successful in entering into such alliances on favorable terms or at all. Even if we do succeed in securing such agreements, we may not be able to maintain them. Furthermore, any delay in entering into agreements could delay the development and commercialization of our technology or reduce its competitiveness even if it reaches the market. Any such delay related to such future agreements could adversely affect our business. While we have been able to secure materials and supplies like plastic containers through the COVID-19 crisis, we have not assurances that our ability to purchase in large quantities on a continual basis.

If any party to which we have outsourced certain functions fails to perform its obligations under agreements with us, the commercialization of our technology could be delayed or curtailed.

To the extent that we rely on other companies to manufacture the chemicals used in our technology, or sell or market products incorporating our technology, we will be dependent on the timeliness and effectiveness of their efforts. If any of these parties does not perform its obligations in a timely and effective manner, the commercialization of our technology could be delayed or curtailed because we may not have sufficient financial resources or capabilities to continue such efforts on our own.

We rely on a small number of key supply ingredients in order to manufacture CupriDyne Clean.

The raw ingredients used to manufacture CupriDyne Clean are readily available from multiple suppliers. However, commodity prices for these ingredients can vary significantly, and the margins that we are able to generate could decline if prices rise. If our manufacturing costs rise significantly, we may be forced to raise the prices for our products, which may reduce their acceptance in the marketplace. Given the current delays in supply chain delivery on a global scale, we are anticipating and developing strategies to manage the expected increases in our cost of raw goods and potential supply limitations which could impact our business and results of operations.

If our technology or products incorporating our technology do not gain market acceptance, it is unlikely that we will become profitable.

The potential markets for products into which our technology can be incorporated are rapidly evolving, and we have many successful competitors including some of the largest and most well-established companies in the world. The commercial success of products incorporating our technology will depend on the adoption of our technology by commercial and consumer end users in various fields.

Market acceptance may depend on many factors, including:

| |

●

|

the willingness and ability of consumers and industry partners to adopt new technologies from a company with little or no history in the industry;

|

| |

●

|

our ability to convince potential industry partners and consumers that our technology is an attractive alternative to other competing technologies;

|

| |

●

|

our ability to license our technology in a commercially effective manner;

|

| |

●

|

our ability to continue to fund operations while our products move through the process of gaining acceptance, before the time in which we are able to scale up production to obtain economies of scale; and

|

| |

●

|

our ability to overcome brand loyalties.

|

If products incorporating our technology do not achieve a significant level of market acceptance, then demand for our technology itself may not develop as expected, and, in such event, it is unlikely that we will become profitable.

Any revenues that we may earn in the future are unpredictable, and our operating results are likely to fluctuate from quarter to quarter.

We believe that our future operating results will fluctuate due to a variety of factors, including:

| |

●

|

delays in product development by us or third parties;

|

| |

●

|

market acceptance of products incorporating our technology;

|

| |

●

|

changes in the demand for, and pricing of, products incorporating our technology;

|

| |

●

|

competition and pricing pressure from competitive products; and

|

| |

●

|

expenses related to, and the results of, proceedings relating to our intellectual property.

|

We expect our operating expenses will continue to fluctuate significantly in 2021 and beyond, as we continue our research and development and increase our marketing and licensing activities. Although we expect to generate revenues from licensing our technology in the future, revenues may decline or not grow as anticipated, and our operating results could be substantially harmed for a particular fiscal period. Moreover, our operating results in some quarters may not meet the expectations of stock market analysts and investors. In that case, our stock price most likely would decline.

Some of our revenue may be dependent on the award of new contracts from the U.S. government, which we do not directly control.

Some of our revenue has been generated from sales to the U.S. Defense Logistics Agency through a bid process in response to request for bids. The timing and size of requests for bids is unpredictable and outside of our control. The number of other companies competing for these bids is also unpredictable and outside of our control. In the event of more competition for these awards, we may have to reduce our margins. These variables make it difficult to predict when or if we will sell more products to the U.S. government, which in turns makes it difficult to stock inventory and purchase raw materials.

We have limited product distribution experience, and we rely in part on third parties who may not successfully sell our products.

We have limited product distribution experience and rely in part on product distribution arrangements with third parties. In our future product offerings, we may rely solely on third parties for product sales and distribution. We also plan to license our technology to certain third parties for commercialization of certain applications. We expect to enter into additional distribution agreements and licensing agreements in the future, and we may not be able to enter into these additional agreements on terms that are favorable to us, if at all. In addition, we may have limited or no control over the distribution activities of these third parties. These third parties could sell competing products and may devote insufficient sales efforts to our products. As a result, our future revenues from sales of our products, if any, will depend on the success of the efforts of these third parties.

We may not be able to attract or retain qualified senior personnel.

We believe we are currently able to manage our current business with our existing management team. However, as we expand the scope of our operations, we will need to obtain the full-time services of additional senior management and other personnel. Competition for highly-skilled personnel is intense, and there can be no assurance that we will be able to attract or retain qualified senior personnel. Our failure to do so could have an adverse effect on our ability to implement our business plan. As we add full-time senior personnel, our overhead expenses for salaries and related items will increase from current levels and, depending upon the number of personnel we hire and their compensation packages, these increases could be substantial.

If we lose our key personnel or are unable to attract and retain additional personnel, we may be unable to achieve profitability.

Our future success is substantially dependent on the efforts of our senior management, particularly Dennis P. Calvert, our president and chief executive officer. The loss of the services of Mr. Calvert or other members of our senior management may significantly delay or prevent the achievement of product development and other business objectives. Because of the scientific nature of our business, we depend substantially on our ability to attract and retain qualified marketing, scientific and technical personnel. There is intense competition among specialized and technologically-oriented companies for qualified personnel in the areas of our activities. If we lose the services of, or do not successfully recruit, key marketing, scientific and technical personnel, then the growth of our business could be substantially impaired. At present, we do not maintain key man insurance for any of our senior management, although management is evaluating the potential of securing this type of insurance in the future as may be available.

Nondisclosure agreements with employees and others may not adequately prevent disclosure of trade secrets and other proprietary information.

In order to protect our proprietary technology and processes, we rely in part on nondisclosure agreements with our employees, potential licensing partners, potential manufacturing partners, testing facilities, universities, consultants, agents and other organizations to which we disclose our proprietary information. These agreements may not effectively prevent disclosure of confidential information and may not provide an adequate remedy in the event of unauthorized disclosure of confidential information. In addition, others may independently discover trade secrets and proprietary information, and in such cases we could not assert any trade secret rights against such parties. Costly and time-consuming litigation could be necessary to enforce and determine the scope of our proprietary rights, and failure to obtain or maintain trade secret protection could adversely affect our competitive business position. Since we rely on trade secrets and nondisclosure agreements, in addition to patents, to protect some of our intellectual property, there is a risk that third parties may obtain and improperly utilize our proprietary information to our competitive disadvantage. We may not be able to detect unauthorized use or take appropriate and timely steps to enforce our intellectual property rights.

We may become subject to product liability claims.

As a business that manufactures and markets products for use by consumers and institutions, we may become liable for any damage caused by our products, whether used in the manner intended or not. Any such claim of liability, whether meritorious or not, could be time-consuming and/or result in costly litigation. Although we maintain general liability insurance, our insurance may not cover potential claims of the types described above and may not be adequate to indemnify for all liabilities that may be imposed. Any imposition of liability that is not covered by insurance or is in excess of insurance coverage could harm our business and operating results, and you may lose some or all of any investment you have made, or may make, in our company.

Litigation or the actions of regulatory authorities may harm our business or otherwise distract our management.

Substantial, complex or extended litigation could cause us to incur major expenditures and distract our management. For example, lawsuits by employees, former employees, investors, stockholders, partners, customers or others, or actions taken by regulatory authorities, could be very costly and substantially disrupt our business. As a result of our financing activities over time, and by virtue of the number of people that have invested in our company, we face increased risk of lawsuits from investors. Such lawsuits or actions could from time to time be filed against our company and/or our executive officers and directors. Such lawsuits and actions are not uncommon, and we cannot assure you that we will always be able to resolve such disputes or actions on terms favorable to our company.

If we suffer negative publicity concerning the safety or efficacy of our products, our sales may be harmed.

If concerns should arise about the safety or efficacy of any of our products that are marketed, regardless of whether or not such concerns have a basis in generally accepted science or peer-reviewed scientific research, such concerns could adversely affect the market for those products. Similarly, negative publicity could result in an increased number of product liability claims, whether or not those claims are supported by applicable law.

The licensing of our technology or the manufacture, use or sale of products incorporating our technology may infringe on the patent rights of others, and we may be forced to litigate if an intellectual property dispute arises.

If we infringe or are alleged to have infringed another party’s patent rights, we may be required to seek a license, defend an infringement action or challenge the validity of the patents in court. Patent litigation is costly and time consuming. We may not have sufficient resources to bring these actions to a successful conclusion. In addition, if we do not obtain a license, do not successfully defend an infringement action or are unable to have infringed patents declared invalid, we may:

| |

●

|

incur substantial monetary damages;

|

| |

●

|

encounter significant delays in marketing our current and proposed product candidates;

|

| |

●

|

be unable to conduct or participate in the manufacture, use or sale of product candidates or methods of treatment requiring licenses;

|

| |

●

|

lose patent protection for our inventions and products; or

|

| |

●

|

find our patents are unenforceable, invalid or have a reduced scope of protection

|

Parties making such claims may be able to obtain injunctive relief that could effectively block our company’s ability to further develop or commercialize our current and proposed product candidates in the United States and abroad and could result in the award of substantial damages. Defense of any lawsuit or failure to obtain any such license could substantially harm our company. Litigation, regardless of outcome, could result in substantial cost to, and a diversion of efforts by, our company.

Our patents are expensive to maintain, our patent applications are expensive to prosecute, and thus we are unable to file for patent protection in many countries.

Our ability to compete effectively will depend in part on our ability to develop and maintain proprietary aspects of our technology and either to operate without infringing the proprietary rights of others or to obtain rights to technology owned by third parties. Pending patent applications relating to our technology may not result in the issuance of any patents or any issued patents that will offer protection against competitors with similar technology. We must employ patent attorneys to prosecute our patent applications both in the United States and internationally. International patent protection requires the retention of patent counsel and the payment of patent application fees in each foreign country in which we desire patent protection, on or before filing deadlines set forth by the International Patent Cooperation Treaty (“PCT”). We therefore choose to file patent applications only in foreign countries where we believe the commercial opportunities require it, considering our available financial resources and the needs for our technology. This has resulted, and will continue to result, in the irrevocable loss of patent rights in all but a few foreign jurisdictions.

Patents we receive may be challenged, invalidated or circumvented in the future, or the rights created by those patents may not provide a competitive advantage. We also rely on trade secrets, technical know-how and continuing invention to develop and maintain our competitive position. Others may independently develop substantially equivalent proprietary information and techniques or otherwise gain access to our trade secrets.

We are subject to risks related to future business outside of the United States.

Over time, we may develop business relationships outside of North America, and as those efforts are pursued, we will face risks related to those relationships such as:

| |

●

|

foreign currency fluctuations;

|

| |

●

|

unstable political, economic, financial and market conditions;

|

| |

●

|

import and export license requirements;

|

| |

●

|

increases in tariffs and taxes;

|

| |

●

|

high levels of inflation;

|

| |

●

|

restrictions on repatriating foreign profits back to the United States;

|

| |

●

|

greater difficulty collecting accounts receivable and longer payment cycles;

|

| |

●

|

less favorable intellectual property laws, and the lack of intellectual property legal protection;

|

| |

●

|

regulatory requirements;

|

| |

●

|

unfamiliarity with foreign laws and regulations; and

|

| |

●

|

changes in labor conditions and difficulties in staffing and managing international operations.

|

The volatility of certain raw material costs may adversely affect operations and competitive price advantages for products that incorporate our technology.

Most of the chemicals and other key materials that we use in our business, such as minerals, fiber materials and packaging materials, are neither generally scarce nor price sensitive, but prices for such chemicals and materials can be cyclical. Supply and demand factors, which are beyond our control, generally affect the price of our raw materials. We try to minimize the effect of price increases through production efficiency and the use of alternative suppliers, but these efforts are limited by the size of our operations. If we are unable to minimize the effects of increased raw material costs, our business, financial condition, results of operations and cash flows may be materially adversely affected.

Certain of our products sales historically have been highly impacted by fluctuations in seasons and weather.

Industrial odor control products have proven highly effective in controlling volatile organic compounds that are released as vapors produced by decomposing waste material. Such vapors are produced with the highest degree of intensity in temperatures between 40 degrees Fahrenheit (5 degrees Celsius) and 140 degrees Fahrenheit (60 degrees Celsius). When weather patterns are cold or in times of precipitation, our clients are less prone to use our odor control products, presumably because such vapors are less noticeable or, in the case of precipitation, can be washed away or altered. This leads to unpredictability in use and sales patterns for, especially, our CupriDyne Clean product line which accounts for over one-half our total sales.

The cost of maintaining our public company reporting obligations is high.

We are obligated to maintain our periodic public filings and public reporting requirements, on a timely basis, under the rules and regulations of the SEC. In order to meet these obligations, we will need to continue to raise capital. If adequate funds are not available, we will be unable to comply with those requirements and could cease to be qualified to have our stock traded in the public market. As a public company, we incur significant legal, accounting and other expenses. In addition, the Sarbanes-Oxley Act of 2002, as well as related rules adopted by the SEC, has imposed substantial requirements on public companies, including certain corporate governance practices and requirements relating to internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act.

Business disruptions could seriously harm our future revenue and financial condition and increase our costs and expenses.

Our operations, and those of our contractors and consultants, could be subject to pandemics, earthquakes, power shortages, telecommunications failures, water shortages, floods, hurricanes, typhoons, fires, extreme weather conditions, medical epidemics, acts of terrorism, acts of war and other natural or man-made disasters or business interruptions, for which we are predominantly self-insured. The occurrence of any of these business disruptions could seriously harm our operations and financial condition and increase our costs and expenses. We rely in part on third-party manufacturers to produce and process our products or the raw materials used to make our products. Our ability to obtain supplies of our products or raw materials could be disrupted if the operations of these suppliers are affected by a man-made or natural disaster, pandemics, epidemics, or other business interruption, including the recent novel strain of coronavirus (SARS‑CoV‑2 aka COVID-19) that originally surfaced in Wuhan, China in December 2019. The extent to which COVID‑19 impacts our business will depend on future developments, which are highly uncertain and cannot be predicted, including new information which may emerge concerning the severity of COVID‑19 and the actions to contain 2 or treat its impact, among others. Our corporate headquarters and offices of ONM are in Southern California near major earthquake faults and fire zones. Our operations and financial condition could suffer in the event of a major earthquake, fire or other natural disaster.

The COVID-19 coronavirus pandemic is ongoing and may result in significant disruptions to our clients and/or supply chain which could have a material adverse effect on our business and revenues.

The COVID-19 pandemic is still ongoing as of the date of this report, is still evolving and much of its impact remains unknown. It is impossible to predict the impact it may have on the development of our business and on our revenues in 2022.

Our corporate headquarters and offices of our ONM Environmental division are in Southern California. On March 19, 2020, California’s Governor issued an executive order that all residents of the State must stay at home indefinitely except as needed to maintain “essential critical infrastructure”. Although some of these emergency provisions were eliminated or modified in 2021, COVID cases are increasing in certain European and Asian countries, and that may foretell an additional surge of cases in the United States or in California in the next months or longer. The restrictions put in place in March 2020 and thereafter to mitigate the pandemic have affected our clients’ willingness to purchase our products and services. Their continuing affect is impossible for us to predict.

The severity of the coronavirus pandemic could also make access to our existing supply chain difficult or impossible by delaying the delivery of key raw materials used in our product candidates and therefore delay the delivery of our products. Any of these results could materially impact our business and have an adverse effect on our business.

A recession in the United States may affect our business.

If the U.S. economy were to contract into a recession or depression, our existing clients, and potential future clients, may divert their resources to other goods and services, and our business may suffer.

Risks Relating to our Common Stock

The sale or issuance of our common stock to Lincoln Park may cause dilution, and the sale of the shares of common stock acquired by Lincoln Park, or the perception that such sales may occur, could cause the price of our common stock to fall.

On March 30, 2020, we entered into a Purchase Agreement with Lincoln Park, pursuant to which Lincoln Park agreed to purchase from us at our request up to an aggregate of $10,250,000 of our common stock (subject to certain limitations) from time to time over a period of three years, noted above in our Risks Related to our Business. We generally have the right to control the timing and amount of any sales of our shares to Lincoln Park. Sales of our common stock, if any, to Lincoln Park will depend on market conditions and other factors to be determined by us. We may ultimately decide to sell to Lincoln Park all, some or none of the shares of our common stock that may be available for us to sell pursuant to the LPC Agreement. If and when we do sell shares to Lincoln Park, after Lincoln Park has acquired the shares, Lincoln Park may resell all, some or none of those shares at any time or from time to time in its discretion. Therefore, sales to Lincoln Park by us could result in substantial dilution to the interests of other holders of our common stock, as well as sales of our stock by Lincoln Park into the open market causing reductions in the price of our common stock. Additionally, the sale of a substantial number of shares of our common stock to Lincoln Park, or the anticipation of such sales, could make it more difficult for us to sell equity or equity-related securities in the future at a time and at a price that we might otherwise desire to effect sales.

Our common stock is thinly traded and largely illiquid.

Our stock is currently quoted on the OTC Markets (OTCQB). Being quoted on the OTCQB has made it more difficult to buy or sell our stock and from time to time has led to a significant decline in the frequency of trades and trading volume. Continued trading on the OTCQB will also likely adversely affect our ability to obtain financing in the future due to the decreased liquidity of our shares and other restrictions that certain investors have for investing in OTCQB traded securities. While we intend to seek listing on the Nasdaq Stock Market (“Nasdaq”) or another national stock exchange when our company is eligible, there can be no assurance when or if our common stock will be listed on Nasdaq or another national stock exchange.

The market price of our stock is subject to volatility.

Our stock price has been and is likely to continue to be volatile. As a result of this volatility, investors may not be able to sell their common stock at or above their purchase price. The market price of our common stock and warrants may fluctuate significantly in response to numerous factors, many of which are beyond our control, including:

| |

●

|

Because our stock is thinly traded, its price can change dramatically over short periods, even in a single day. An investment in our stock is subject to such volatility and, consequently, is subject to significant risk. The market price of our common stock could fluctuate widely in response to many factors, including:

|

| |

●

|

developments with respect to patents or proprietary rights;

|

| |

●

|

announcements of technological innovations by us or our competitors;

|

| |

●

|

announcements of new products or new contracts by us or our competitors;

|

| |

●

|

actual or anticipated variations in our operating results due to the level of development expenses and other factors;

|

| |

●

|

changes in financial estimates by securities analysts and whether any future earnings of ours meet or exceed such estimates;

|

| |

●

|

conditions and trends in our industry;

|

| |

●

|

new accounting standards;

|

| |

●

|

the size of our public float;

|

| |

●

|

short sales, hedging, and other derivative transactions involving our common stock;

|

| |

●

|

sales of large blocks of our common stock including sales by our executive officers, directors, and significant stockholders, including Lincoln Park;

|

| |

●

|

general economic, political and market conditions and other factors; and

|

| |

●

|

the occurrence of any of the risks described herein.

|

You may have difficulty selling our shares because they are deemed a “penny stock”.

Because our common stock is not quoted or listed on a national securities exchange, if the trading price of our common stock remains below $5.00 per share, which we expect for the foreseeable future, trading in our common stock will be subject to the requirements of certain rules promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which require additional disclosure by broker-dealers in connection with any trades involving a stock defined as a penny stock (generally, any non-Nasdaq equity security that has a market price of less than $5.00 per share, subject to certain exceptions). Such rules require the delivery, before any penny stock transaction, of a disclosure schedule explaining the penny stock market and the risks associated therewith and impose various sales practice requirements on broker-dealers who sell penny stocks to persons other than established customers and accredited investors (generally defined as an investor with a net worth in excess of $1,000,000 or annual income exceeding $200,000 individually or $300,000 together with a spouse). For these types of transactions, the broker-dealer must make a special suitability determination for the purchaser and have received the purchaser’s written consent to the transaction before the sale. The broker-dealer also must disclose the commissions payable to the broker-dealer and current bid and offer quotations for the penny stock and, if the broker-dealer is the sole market-maker, the broker-dealer must disclose this fact and the broker-dealer’s presumed control over the market. Such information must be provided to the customer orally or in writing before or with the written confirmation of trade sent to the customer. Monthly statements must be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks. The additional burdens imposed on broker-dealers by such requirements could discourage broker-dealers from effecting transactions in our common stock, which could severely limit the market liquidity of our common stock and the ability of holders of our common stock to sell their shares.

Because our shares are deemed a “penny stock,” rules enacted by FINRA make it difficult to sell previously restricted stock.

Rules put in place by the Financial Industry Regulatory Authority (FINRA) require broker-dealers to perform due diligence before depositing unrestricted common shares of penny stocks, and as such, some broker-dealers, including many large national firms (such as eTrade and Charles Schwab), are refusing to deposit previously restricted common shares of penny stocks. We routinely issued non-registered restricted common shares to investors, vendors and consultants. The issuance of such shares is subjected to the FINRA-enacted rules. As such, it can be difficult for holders of restricted stock, including those issued in our private securities offerings, to deposit the shares with broker-dealers and sell those shares on the open market.

Because we will not pay dividends in the foreseeable future, stockholders will only benefit from owning common stock if it appreciates.

We have never declared or paid a cash dividend to stockholders. We intend to retain any earnings that may be generated in the future to finance operations. Accordingly, any potential investor who anticipates the need for current dividends from his investment should not purchase our common stock, and must rely on the benefit of owning shares, and presumably a rise in share price. We cannot predict the future price of our stock, and due to the factors enumerated herein, can make no assurance of a future increase in the price of our common stock.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

All statements, other than statements of historical fact, included in this prospectus regarding our strategy, future operations, future financial position, future revenues, projected costs, prospects and plans and objectives of management are forward-looking statements. The words “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “will,” “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words.

We have based these forward-looking statements on our current expectations and projections about future events. Although we believe that the expectations underlying our forward-looking statements are reasonable, these expectations may prove to be incorrect, and all of these statements are subject to risks and uncertainties. Therefore, you should not place undue reliance on our forward-looking statements. We have included important risks and uncertainties in the cautionary statements included in this prospectus, particularly the section titled “Risk Factors” incorporated by reference herein. We believe these risks and uncertainties could cause actual results or events to differ materially from the forward-looking statements that we make. Should one or more of these risks and uncertainties materialize, or should underlying assumptions, projections or expectations prove incorrect, actual results, performance or financial condition may vary materially and adversely from those anticipated, estimated or expected. Our forward-looking statements do not reflect the potential impact of future acquisitions, mergers, dispositions, joint ventures or investments that we may make. We do not assume any obligation to update any of the forward-looking statements contained herein, whether as a result of new information, future events or otherwise, except as required by law. In the light of these risks and uncertainties, the forward-looking events and circumstances discussed in this prospectus may not occur, and actual results could differ materially from those anticipated or implied in the forward-looking statements. Any forward-looking statement made by us in this prospectus is based only on information currently available to us and speaks only as of the date on which it is made.

USE OF PROCEEDS

This prospectus relates to shares of our common stock that may be offered and sold from time to time by the selling stockholders upon exercise of outstanding warrants to purchase common stock. We will receive no proceeds from the sale of shares of common stock by the selling stockholders in this offering. See “Plan of Distribution” elsewhere in this prospectus for more information.

DIVIDEND POLICY

We have never declared or paid a cash dividend to stockholders. We intend to retain any earnings that may be generated in the future to finance operations.

CAPITALIZATION

The following table sets forth our actual cash and cash equivalents and our capitalization as of December 31, 2021 (unaudited), and as adjusted to give effect to the sale of the shares offered hereby and the use of proceeds, as described in the section titled “Use of Proceeds” above.

You should read this information in conjunction with “Managements’ Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes appearing in our Annual Report on Form 10-K for the year ended December 31, 2021.

| |

|

As of December 31, 2021

(in thousands)

|

|

| |

|

Actual

|

|

|

As Adjusted(1)

|

|

|

CASH AND CASH EQUIVALENTS

|

|

$ |

962 |

|

|

$ |

962 |

|

| |

|

|

|

|

|

|

|

|

|

STOCKHOLDERS’ DEFICIT:

|

|

|

|

|

|

|

|

|

|

Convertible Preferred Series A, $.00067 Par Value, 50,000,000 Shares Authorized, -0- Shares Issued and Outstanding at December 31, 2021.

|

|

|

— |

|

|

|

— |

|

|

Common stock, $.00067 Par Value, 400,000,000 Shares Authorized, 255,893,726 Shares Issued at December 31, 2021, and 255,893,726 Shares Issued, as adjusted.

|

|

|

171 |

|

|

|

171 |

|

|

Additional paid-in capital

|

|

|

143,718 |

|

|

|

143,718 |

|

|

Accumulated other comprehensive loss

|

|

|

(115 |

) |

|

|

(115 |

) |

|

Accumulated deficit

|

|

|

(139,121 |

) |

|

|

(139,121 |

) |

| |

|

|

|

|

|

|

|

|

|

Total Biolargo and subsidiaries stockholders’ equity

|

|

|

4,653 |

|

|

|

4,653 |

|

|

Non-controlling interest

|

|

|

(3,720 |

) |

|

|

(3,720 |

) |

|

Total stockholders’ equity

|

|

|

933 |

|

|

|

933 |

|

|

Total liabilities and stockholders’ equity

|

|

|

3,023 |

|

|

|

3,023 |

|

| |

(1)

|

The warrants available to the selling stockholders expired unexercised on June 1, 2020. As such, no cash will be received from the Selling Stockholders, and no additional shares will be issued to the Selling Stockholders.

|

DILUTION

The net tangible book value of the Company as of December 31, 2021, was $480,000, or approximately $0.002 per share of common stock. Net tangible book value per share is determined by dividing the net tangible book value of the Company (total tangible assets less total liabilities) by the number of outstanding shares of our common stock.

No additional shares will be issued to the Selling Stockholders, and no proceeds will be received from the Selling Stockholders. As such, we do not expect a change in the net tangible book value from this offering.

MARKET PRICE OF AND DIVIDENDS ON COMMON EQUITY

AND RELATED STOCKHOLDER MATTERS

Market Information

Since January 23, 2008, our common stock has been quoted on the OTC Markets “OTCQB” marketplace (formerly known as the “OTC Bulletin Board”) under the trading symbol “BLGO”.

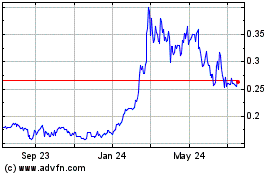

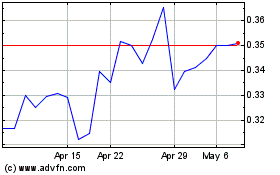

The table below represents the quarterly high and low closing prices of our common stock for the last three fiscal years as reported by www.otcmarkets.com.

| |

|

|

|

|

2019

|

|

|

2020

|

|

|

2021

|

|

| |

|

High

|

|

|

|

|

|

High

|

|

|

High

|

|

|

|

|

|

Low

|

|

|

High

|

|

|

Low

|

|

|

First Quarter

|

|

|

|

|

|

$ |

0.27 |

|

|

|

|

|

|

$ |

0.16 |

|

|

$ |

0.29 |

|

|

$ |

0.12 |

|

|

$ |

0.25 |

|

|

$ |

0.13 |

|

|

Second Quarter

|

|

|

|

|

|

$ |

0.31 |

|

|

|

|

|

|

$ |

0.16 |

|

|

$ |

0.20 |

|

|

$ |

0.14 |

|

|

$ |

0.24 |

|

|

$ |

0.16 |

|

|

Third Quarter

|

|

|

|

|

|

$ |

0.38 |

|

|

|

|

|

|

$ |

0.22 |

|

|

$ |

0.22 |

|

|

$ |

0.15 |

|

|

$ |

0.22 |

|

|

$ |

0.17 |

|

|

Fourth Quarter

|

|

|

|

|

|

$ |

0.36 |

|

|

|

|

|

|

$ |

0.22 |

|

|

$ |

0.16 |

|

|

$ |

0.12 |

|

|

$ |

0.23 |

|

|

$ |

0.17 |

|

The closing price for our common stock on March 30, 2022, was $0.234 per share.

Holders of our Common Stock

As of March 30, 2022, 262,722,515 shares of our common stock were outstanding and held of record by approximately 650 stockholders of record, and approximately 5,200 beneficial owners.

Dividends

We have never declared or paid a cash dividend to stockholders. We intend to retain any earnings that may be generated in the future to finance operations.

Securities Authorized for Issuance Under Equity Compensation Plans

Equity compensation plan information as of December 31, 2021.

|

(1) Plan Category

|

|

Number of securities to be

issued upon exercise of

outstanding options,

warrants and rights

(a)

|

|

|

Weighted average

exercise price of

outstanding options,

warrants and rights

(b)

|

|

|

Number of securities

remaining available

for future issuance

(c)

|

|

|

Equity compensation plans approved by security holders

|

|

|

26,065,388(1) |

|

|

|

$0.29 |

|

|

|

25,134,475 |

|

|

Equity compensation plans not approved by security holders(2)

|

|

|

20,119,207 |

|

|

|

$0.40 |

|

|

|

n/a |

|

|

Total

|

|

|

45,304,471 |

|

|

|

$0.34 |

|

|

|

25,134,475 |

|

| |

(1)

|

Includes 5,689,363 shares issuable under the 2007 Equity Plan. The 2007 Equity Plan expired September 6, 2017, and 18,865,525 shares issuable under the 2018 Equity Incentive Plan adopted by the Board on March 7, 2018 and subsequently approved by stockholders on May 23, 2018.

|

| |

(2)

|

This includes various issuances to specific individuals either as a conversion of un-paid obligations pursuant to a plan adopted by our board of directors, or as part of their agreement for services

|

2018 Equity Incentive Plan

On June 22, 2018, our stockholders adopted the BioLargo 2018 Equity Incentive Plan (“2018 Plan”) as a means of providing our directors, key employees and consultants additional incentive to provide services. Both stock options and stock grants may be made under this plan for a period of 10 years. It is set to expire on its terms on June 22, 2028. Our Board of Director’s Compensation Committee administers this plan. As plan administrator, the Compensation Committee has sole discretion to set the price of the options. The plan authorizes the following types of awards: (i) incentive and non-qualified stock options, (ii) restricted stock awards, (iii) stock bonus awards, (iv) stock appreciation rights, (v) restricted stock units, and (vi) performance awards. The total number of shares reserved and available for awards pursuant to this Plan as of the date of adoption of this 2018 Plan by the Board is 40 million shares. The number of shares available to be issued under the 2018 Plan increases automatically each January 1st by the lesser of (a) 2 million shares, or (b) such number of shares determined by our Board. As of December 31, 2021, 46,000,000 shares are authorized under the plan.

2007 Equity Incentive Plan

On September 7, 2007, and as amended April 29, 2011, the BioLargo, Inc. 2007 Equity Incentive Plan (“2007 Plan”) was adopted as a means of providing our directors, key employees and consultants additional incentive to provide services. Both stock options and stock grants may be made under this plan for a period of 10 years, which expired on September 7, 2017. The Board’s Compensation Committee administers this plan. As plan administrator, the Compensation Committee has sole discretion to set the price of the options. As of September 2017, the Plan was closed to further stock option grants.

Equity Compensation Plans not approved by stockholders

In addition to the 2018 and 2007 Equity Plans, our board of directors has approved a plan for employees, consultants and vendors by which outstanding amounts owed to them by our company may be converted to common stock or options to purchase common stock. The conversion and exercise price is based on the closing price of our common stock on the date of agreement. If an option is issued, the number of shares purchasable by the option is calculated by dividing the amount owed by the exercise price, times one and one-half.

DESCRIPTION OF BUSINESS

Our Business - Innovator and Solution Provider

BioLargo, Inc. invents, develops, and commercializes innovative platform technologies to solve challenging environmental problems like PFAS contamination, advanced water and wastewater treatment, industrial odor and VOC control, air quality control, infection control, and myriad environmental remediation challenges. Having conducted continual and extensive research and development, BioLargo holds a wide array of issued patents, maintains a robust pipeline of products, and provides full-service environmental engineering. We invent or acquire novel technologies and develop them to maturity through our operating subsidiaries using cutting-edge scientific and engineering methodologies. With a keen emphasis on partnerships with academic, government, and commercial organizations and associations, BioLargo has proven itself by executing on challenging environmental engineering projects, demonstrating its powerful technologies through pilots, trials, and early commercial adoption, publishing high-impact academic and industry publications, and winning over 80 grants. We monetize our innovations through direct sales, recurring service contracts, licensing agreements, strategic joint venture formation and/or the sale of the IP.

The past year held a shift in focus at BioLargo toward the development and commercial execution of several key business initiatives with the potential to generate significant organizational and revenue growth for the company. Three of these projects in particular represent the dominant catalysts for near-term monetization of our core technologies and engineering services. Those are: 1) the advancement of our PFAS removal system, the Aqueous Electrostatic Concentrator (AEC), toward commercial trials with leading customers in the industry (including the federal government) most notably by the in-house piloting of the technology with client-provided water sources in preparation for commercial field trials which are organizing now, 2) the design, manufacture, pre-trial testing, and preparation for field trials with first customers of a novel “minimal liquid discharge” wastewater treatment system in partnership with Garratt-Callahan, the largest privately held water treatment company in America with more than 100 years history, and 3) the manufacture and successful launch of a new pet odor control product based on BioLargo’s intellectual properly launched by our partners at Ikigai Marketing Works, LLC, a venture aimed at building a nationally-branded disruptive new pet odor control brand for ultimate distribution into big-box retailers and sale to a national consumer products company.

Three main factors differentiate 2021 from the years that preceded it for BioLargo. First, we have built our credibility as cleantech technology innovators and environmental engineering service providers to the point where industry stakeholders, clients, and prospective partners rightfully view us as an effective and reliable means to solve their challenges. This has resulted in partners like Garratt-Callahan, Ikigai, and more approaching BioLargo for high-value projects. This “critical mass” of credibility as a cleantech solutions provider is a result of our investments in our talented team of engineers and scientists, our history of developing creative and powerful new technologies, and our track record of executing complex engineering projects. Secondly, in 2021 our core patented water treatment technologies, the BioLargo Advanced Oxidation System (AOS) and Aqueous Electrostatic Concentrator (AEC), were demonstrated in successful pilot projects, either on-site at a prospective client’s facility, or in-house with client-provided contaminated waters. Both of these technologies are now primed for commercialization and monetization. Third, our balance sheet continued to improve throughout 2021, with the near-elimination of debt to the point where only one $50,000 convertible note due in 2023 and $464,000 of covid-related low-interest U.S. Small Business Administration loans are owed, in addition to the elimination of debt owed by our partially owned subsidiary Clyra Medical Technologies.

Formula for Success: Technology, Talent and Purpose

Technology

BioLargo has continually advanced its robust portfolio of technologies since the first acquisition of early iterations of the BioLargo technology in the spring of 2007. Our innovations have primarily been developed through our internal resources, and some through acquisition. These include patents, patents pending, and trade secrets that include solutions for:

| |

●

|

Water decontamination, including:

|

| |

o

|

Removal of per- and poly-fluoroalkyl substances (PFAS) from drinking and ground water

|

| |

o

|

Micropollutant destruction and removal

|

| |

o

|

Legionella detection and water treatment solutions

|

| |

●

|

Air quality controls and systems including odor and VOC control

|

Talent

We have steadily grown our team to 27 team members and numerous other part-time consultants, including highly qualified PhDs, engineers, MDs and medical professionals, construction professionals, field service technicians, innovators, sales marketing specialists, entrepreneurial and executive leadership.

Purpose

Our mission to make life better drives us to serve others with integrity, knowledge, technology, and solutions that protect the environment, improve quality of life, and protect lives. All our technologies were developed from the ground-up to be sustainable, practical solutions to significant global challenges. We are unique in our ability to tailor our offerings to serve our customers with proven expertise, proven technology and, if needed, we often have the ability to develop new technical solutions to meet our customer’s needs.

Combating the PFAS Crisis – the AEC