UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

SCHEDULE 14F-1

INFORMATION STATEMENT

Pursuant to Section 14(F) of the Securities

Exchange Act of 1934

and Rule 14f-1 thereunder

BESPOKE EXTRACTS, INC.

(Exact name of registrant as specified in its

charter)

000-52759

(Commission File Number)

|

Nevada

|

|

20-4743354

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

323 Sunny Isles Blvd., Suite 700

Sunny Isles, Florida, 33160

(Address of principal executive offices)

(855) 633-3738

(Registrant’s telephone number)

BESPOKE EXTRACTS, INC.

323 Sunny Isles Blvd., Suite 700

Sunny Isles, Florida, 33160

INFORMATION STATEMENT PURSUANT TO

SECTION 14(f) OF

THE SECURITIES EXCHANGE ACT OF 1934

AND RULE 14f-1 THEREUNDER

NOTICE OF CHANGE IN MAJORITY OF THE BOARD

OF DIRECTORS

May 1, 2020

INTRODUCTION

This Information Statement

is being mailed to shareholders of record as of May 1, 2020 of the shares of common stock of Bespoke Extracts, Inc., a Nevada corporation

(the “Company”), in accordance with the requirements of Section 14(f) of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), and Rule 14f-1 promulgated thereunder. Section 14(f) of the Exchange Act and Rule 14f-1 require

the mailing to our shareholders of record of the information set forth in this Information Statement at least 10 days prior to

the date a change in a majority of our directors occurs (otherwise than at a meeting of our shareholders). Accordingly, the

change in a majority of our directors described herein will not occur until at least 10 days following the mailing of this Information

Statement.

As used in this Information

Statement, unless the context otherwise requires or where otherwise indicated, “we”, “our”, “us”,

the “Company” and similar expressions refer to Bespoke Extracts, Inc.

THIS INFORMATION STATEMENT

IS BEING PROVIDED SOLELY FOR INFORMATIONAL PURPOSES AND NOT IN CONNECTION WITH ANY VOTE OF THE SHAREHOLDERS OF BESPOKE EXTRACTS,

INC.

NO PROXIES ARE BEING

SOLICITED AND YOU ARE NOT REQUESTED TO SEND A PROXY OR TAKE ANY OTHER ACTION.

CHANGE IN DIRECTORS

On April 21, 2020, Niquana

Noel resigned as the Company’s president, chief executive officer and chief financial officer and Danil Pollack was appointed

as the Company’s president, chief executive officer and chief financial officer. Ms. Noel will resign as the Company’s

director, and Mr. Pollack will be appointed as the Company’s director, 10 days following the mailing of this Information

Statement. In connection with Ms. Noel’s resignation and Mr. Pollack’s appointment, Ms. Noel sold 1 share of Series

C Preferred Stock of the Company (which provides the holder with 51% of the voting power of the Company’s stockholders) to

Mr. Pollack for $24,000, and the Company entered into an employment agreement with Mr. Pollack, pursuant to which he was granted

the right, for a period of six months, to purchase up to 100,000,000 shares of common stock with an exercise price of $0.001 per

share.

VOTING SECURITIES

As of the date of this

Information Statement, the Company is authorized to issue 800,000,000 shares of common stock, $0.001 par value per share and 50,000,000

shares of preferred stock, par value $0.001 per share. As of May 1, 2020, 110,389,621 shares of common stock and 1 share of Series

C Preferred Stock were issued and outstanding, respectively. Each share of Company common stock entitles the holder thereof to

one vote. The Series C Preferred Stock entitles the holder to 51% of the voting power of the Company’s stockholders.

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

As of May 1, 2020 we had

110,389,621 shares of common stock issued and outstanding. The following table sets forth information known to us relating to the

beneficial ownership of such shares as of such date by:

|

|

●

|

each person who is known by us to be the beneficial owner of more than 5% of our outstanding voting stock;

|

|

|

●

|

each named executive officer; and

|

|

|

●

|

all named officers and directors as a group.

|

Unless otherwise indicated,

the business address of each person listed is care of Bespoke Extracts, Inc., at 323 Sunny Isles Blvd., Suite 700, Sunny Isles,

Florida 33160. The percentages in the table have been calculated on the basis of treating as outstanding for a particular

person, all shares of our common stock outstanding on that date and all shares of our common stock issuable to that holder in the

event of exercise of outstanding options, warrants, rights or conversion privileges owned by that person at that date which are

exercisable within 60 days of May 1, 2020. Except as otherwise indicated, the persons listed below have sole voting and investment

power with respect to all shares of our common stock owned by them.

|

Name of Beneficial Owner

|

|

Amount of Beneficial Ownership

|

|

|

Percent of Class

|

|

|

Executive Officers and Directors:

|

|

|

|

|

|

|

|

|

|

Danil Pollack

|

|

|

100,000,000

|

(1)

|

|

|

47.5

|

%

|

|

Niquana Noel

|

|

|

20,000,000

|

|

|

|

18.1

|

%

|

|

Officers and Directors as a group (2 persons):

|

|

|

120,000,000

|

|

|

|

57.0

|

%

|

|

5% Holders:

|

|

|

|

|

|

|

|

|

|

McGlothlin Holdings, Ltd. (2)

|

|

|

14,562,667

|

|

|

|

6.9

|

%

|

|

Ronald Smith (3)

|

|

|

20,833,333

|

|

|

|

18.9

|

%

|

(1) Represents shares issuable upon exercise of right to purchase.

Mr. Pollack also owns 1 outstanding share of Series C Preferred Stock.

(2) McGlothlin Holdings, Ltd.’s address is PO Box 590, Luling,

Texas, 78649, and its control person is Stan McGlothlin.

(3) Mr. Smith’s address is 9239 Carpenter Rd., Eden, NY 14057.

DIRECTORS AND EXECUTIVE OFFICERS

Current Officers and Directors of the Company

The following discussion

sets forth information regarding our current executive officers and directors.

|

Name

|

|

Age

|

|

Title

|

|

Niquana Noel

|

|

39

|

|

Director

|

|

Danil Pollack

|

|

32

|

|

President, Chief Executive Officer, Chief Financial Officer

|

Niquana Noel. Ms.

Noel served as the Company’s president, chief executive officer and chief financial officer from October 2018 until April

2020, and has served as a director since October 2018. Ms. Noel previously served as operations manager at the Company. Ms. Noel

has served as chief operating officer of Coro Global Inc. (“Coro”) since May 18, 2018 and as a director of Coro since

August 2013. She served as Coro’s chief executive officer and president from January 2014 to May 2018. Prior to serving in

that capacity, Ms. Noel served as Coro’s operations manager from 2008. Prior to joining Coro, Ms. Noel was the Executive

Assistant to a Florida-based serial entrepreneur who had business interests ranging from the ownership and operation of cemeteries

in Maryland, Virginia and Florida to the ownership and operation of exotic, high performance car dealerships and auto accessory

businesses. Ms. Noel’s operational experience qualifies her to serve on the Company’s board of directors.

Danil Pollack. Mr.

Pollack was appointed president, chief executive officer and chief financial officer of the Company on April 21, 2020. Prior to

the joining the Company, Mr. Pollack oversaw sales and marketing at 2Marketing as Project Manager, a PPC (pay per click), SEO and

social media and inbound marketing firm in Toronto, from 2017. In addition, he worked as a lead videographer and editor at YP Media

Productions, a creative film production agency which he co-founded in 2010. Between 2010 and 2013, Mr. Pollack also served as Vice

President of Operations at Auto Ad, Inc., a full service infomercial production agency specializing in the auto dealership market.

Fluent in three languages, Mr. Pollack attended the Toronto Film School, as well as Senaca College - York, where he studied computer

system technology.

Officers and Directors Following the Company

Meeting its Information Requirements under the Exchange Act

Danil Pollack will serve

as the Company’s director, president, chief executive officer, and chief financial officer, following the Company meeting

its information obligations under the Exchange Act.

Background information

with respect to Mr. Pollack is in the “Current Officers and Directors of the Company” section above.

Terms of Office

Our directors are appointed

for one year terms in accordance with our charter documents and hold office until the earlier of (i) the next annual meeting of

our shareholders, (ii) until they are removed from the board or (iii) until they resign.

Family

Relationships

None.

Legal Proceedings

Involvement in Certain Legal Proceedings

During the past ten years,

none of our current directors or executive officers has been:

|

|

●

|

the subject of any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time;

|

|

|

●

|

convicted in a criminal proceeding or is subject to a pending criminal proceeding (excluding traffic violations and other minor offenses);

|

|

|

●

|

subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction or any Federal or State authority, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities;

|

|

|

●

|

found by a court of competent jurisdiction (in a civil action), the Commission or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law.

|

|

|

●

|

the subject of, or a party to, any Federal or State judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated, relating to an alleged violation of (a) any Federal or State securities or commodities law or regulation; (b) any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order; or (c) any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or

|

|

|

●

|

the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act (15 U.S.C. 78c(a)(26))), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act (7 U.S.C. 1(a)(29))), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member.

|

Change of Control Arrangements

We have no pension or compensatory

plans or other arrangements which provide for compensation to our directors or officers in the event of a change in our control.

There are no arrangements known to us the operation of which may at a later date result in a change in control of our company.

TRANSACTIONS WITH RELATED PERSONS

On September 18, 2017,

the Company issued a $180,000 convertible debenture with an original issue discount of $60,000 to Alneil Associates (“Alneil”),

which was then a greater than 5% stockholder. The note had a 0% interest rate and a term of two years. In connection with the note,

the Company issued to Alneil an aggregate of 900,000 shares of common stock and 300,000 warrants to purchase common stock. The

debenture and warrants were subsequently exchanged for common stock of the Company, as described below.

On December 13, 2017, the

Company issued a $120,000 convertible debenture to McGlothlin Holdings, Ltd. (“McGlothlin), a greater than 5% stockholder,

with an original issue discount of $20,000. The debenture had a 0% interest rate and a term of one year. The conversion price of

the outstanding balance was the lesser of $3.00 or 40% of the volume weighted average price of the last 30 days at date of conversion;

not to be less than $1.00. In connection with the debenture, the Company issued to McGlothlin an aggregate of 200,000 shares of

common stock and 100,000 warrants to purchase common stock. The debenture and warrants were subsequently exchanged for common stock

of the Company, as described below.

During the year ended August

31, 2018, the Company had sales of $3,975 to the spouse of Stan McGlothin, who is the owner of McGlothlin.

On April 22, 2019, the

Company entered into an exchange agreement with McGlothlin. Pursuant to the exchange agreement, McGlothlin exchanged convertible

debentures of the Company, in the original principal amounts of $540,000 and $120,000, respectively, and 1,000,000 warrants to

purchase shares of common stock of the Company, for an aggregate of 11,000,000 newly issued shares of common stock of the Company.

On April 22, 2019, the

Company entered into an exchange agreement with Alneil. Pursuant to the exchange agreement, Alneil exchanged a convertible debenture

of the Company, in the original principal amount of $180,000, and 300,000 warrants to purchase shares of common stock of the Company,

for an aggregate of 3,000,000 newly issued shares of common stock of the Company.

On October 3, 2019, the

Company entered into a letter agreement with Niquana Noel, the Company’s chief executive officer. Pursuant to the agreement,

Ms. Noel exchanged $24,000 in accrued but unpaid compensation owed to her by the Company for one share of newly created Series

B Preferred Stock of the Company.

On March 25, 2020, the

Company entered into a letter agreement with Niquana Noel. Pursuant to the agreement, Ms. Noel exchanged one share of Series B

Preferred Stock of the Company for one share of newly created Series C Preferred Stock of the Company.

On April 20, 2020, the

Company entered into a letter agreement with Niquana Noel. Pursuant to the letter agreement, Ms. Noel waived any and all accrued

but unpaid compensation owed to her in exchange for the right to retain all 20,000,000 shares of common stock of the Company Ms.

Noel had acquired upon exercise of warrants, notwithstanding provisions of the warrant agreement that would have required her to

return certain shares to the Company in the event of her resignation.

Delinquent Section 16(a) Reports

Section 16(a) of the Securities

Exchange Act of 1934, as amended, requires the Company’s officers and directors, and certain persons who own more than 10%

of a registered class of the Company’s equity securities (collectively, “Reporting Persons”), to file reports

of ownership and changes in ownership (“Section 16 Reports”) with the Securities and Exchange Commission (the “SEC”).

Based solely on its review of the copies of such Section 16 Reports received by the Company, all Section 16(a) filing requirements

applicable to the Company’s Reporting Persons during and with respect to the fiscal year ended August 31, 2019 have been

complied with on a timely basis, except that a Form 3 was not filed by McGlothlin Holdings, Ltd.

CORPORATE GOVERNANCE

Director Independence

We do not have any independent

directors.

Board of Directors’ Meetings

During the fiscal year

ended August 31, 2019, our Board did not hold any meetings but adopted resolutions pursuant to written consents. We encourage,

but do not require, our Board members to attend the annual meeting of shareholders.

Board Committees

We have not established

any committees of the board of directors due to the small size of the Company and the board. We do not have an audit committee

financial expert because we do not have the resources to retain one.

Board Leadership Structure and Role on Risk

Oversight

Ms. Noel is presently the

only board member.

Our board is primarily

responsible for overseeing our risk management processes. The board receives and reviews periodic reports from management, auditors,

legal counsel, and others, as considered appropriate regarding the Company’s assessment of risks. The board focuses on the

most significant risks facing the Company and the Company’s general risk management strategy, and also ensures that risks

undertaken by the Company are consistent with the board’s appetite for risk. While the board oversees the Company’s

risk management, management is responsible for day-to-day risk management processes. We believe this division of responsibilities

is the most effective approach for addressing the risks facing the Company and that our board leadership structure supports this

approach.

Stockholder Communication with the Board

of Directors

Stockholders may send communications

to our Board of Directors by writing to Bespoke Extracts, Inc., 323 Sunny Isles Blvd., Suite 700, Sunny Isles, Florida, 33160,

Attention: Corporate Secretary.

COMPENSATION OF DIRECTORS AND EXECUTIVE OFFICERS

The following table summarizes all compensation

to our chief executive officer during the years ended August 31, 2019 and August 31, 2018. No other officer received compensation

of more than $100,000 during such periods.

|

Name and Principal Position

|

|

Year

|

|

|

Salary

|

|

|

Bonus

|

|

|

Stock

Awards

|

|

|

Option

Awards

|

|

|

Non-Equity

Incentive

Plan

Compensation

|

|

|

Nonqualified

Deferred

Compensation

Earnings

|

|

|

All Other

Compensation

|

|

|

Total

|

|

|

(a)

|

|

(b)

|

|

|

(c)

|

|

|

(d)

|

|

|

(e)

|

|

|

(f)

|

|

|

(g)

|

|

|

(h)

|

|

|

(i)

|

|

|

(j)

|

|

|

Marc Yahr

|

|

|

2019

|

|

|

|

|

|

|

|

--

|

|

|

|

--

|

|

|

$

|

0

|

|

|

|

--

|

|

|

|

--

|

|

|

|

--

|

|

|

$

|

0

|

|

|

Former CEO, President (1)

|

|

|

2018

|

|

|

$

|

19,000

|

|

|

|

--

|

|

|

|

--

|

|

|

$

|

3,633,532

|

(3)

|

|

|

|

|

|

|

--

|

|

|

|

--

|

|

|

$

|

3,652,532

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Niquana Noel

|

|

|

2019

|

|

|

$

|

80,000

|

|

|

|

|

|

|

|

|

|

|

$

|

542,390

|

(4)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

622,390

|

|

|

Former CEO and President (2)

|

|

|

2018

|

|

|

|

|

|

|

|

--

|

|

|

|

--

|

|

|

|

--

|

|

|

|

--

|

|

|

|

--

|

|

|

|

--

|

|

|

|

--

|

|

|

(1)

|

Mr. Yahr resigned as president and chief executive officer of the Company on October 30, 2018.

|

|

(2)

|

Ms. Noel was appointed as president and chief executive officer of the Company on October 30, 2018.

|

|

(3)

|

Represents warrants issued to Marc Yahr under

his employment agreement. See Note 5 to the financial statements included in the Company’s annual report for the year ended

August 31, 2019. The value attributable to any option awards is computed in accordance with FASB ASC Topic 718. The assumptions

made in the valuations of the option awards are included in Note 5 of the notes to the financial statements included in the Company’

annual report for the year ended August 31, 2019.

|

|

(4)

|

Represents warrants issued to Niquana Noel under her employment agreement. See Note 5 to the financial statements included in the Company’s annual report for the year ended August 31, 2019. The value attributable to any option awards is computed in accordance with FASB ASC Topic 718. The assumptions made in the valuations of the option awards are included in Note 5 of the notes to the financial statements included in the Company’s annual report for the year ended August 31, 2019.

|

Employment Agreements

Effective October 30, 2018,

the Company entered into an employment agreement with Ms. Noel pursuant to which Ms. Noel served as the Company’s chief executive

officer and president. Pursuant to the terms of the employment agreement, Ms. Noel’s salary was $96,000 per year and she

received warrants to purchase up to 20,000,000 shares of the Company’s common stock at an exercise price of $0.0001 per share.

Ms. Noel exercised the warrants and was issued the shares. On April 20, 2020, the Company entered into a letter agreement with

Ms. Noel. Pursuant to the letter agreement, Ms. Noel waived any and all accrued but unpaid compensation owed to her in exchange

for the right to retain all 20,000,000 shares of common stock of the Company Ms. Noel had acquired upon exercise of warrants, notwithstanding

provisions of the warrant agreement that would have required her to return certain shares to the Company in the event of her resignation.

On April 21, 2020, the

Company entered into an employment agreement with Danil Pollack. Pursuant to the employment agreement, Mr. Pollack will serve as

the Company’s chief executive officer and president for a period of one year, which term will renew automatically for successive

one year terms, subject to the right of either party to terminate the agreement at any time upon written notice. Mr. Pollack was

granted the right, for a period of six months, to purchase up to 100,000,000 shares of common stock of the Company for a purchase

price of $0.001 per share.

Outstanding Equity Awards at Fiscal Year-End

None.

Compensation of Directors

No director of the Company

received any compensation for serving as director of the Company during the year ended August 31, 2019.

WHERE YOU CAN FIND ADDITIONAL

INFORMATION

We are required to file

periodic reports, proxy statements and other information with the SEC. You may read and copy this information by accessing the

SEC’s website at http://www.sec.gov. You may also send communications to our Board of Directors at Bespoke Extracts, Inc.,

323 Sunny Isles Blvd., Suite 700, Sunny Isles, Florida, 33160, Attention: Corporate Secretary.

NO STOCKHOLDER ACTION

REQUIRED

This Information Statement

is being provided for informational purposes only, and does not relate to any meeting of stockholders. Neither applicable securities

laws, nor the corporate laws of the State of Nevada require approval of the any transaction referred to herein. No vote or other

action is being requested of the Company’s stockholders. This Information Statement is provided for informational purposes

only. This Information Statement has been filed with the Securities and Exchange Commission and is available electronically on

EDGAR at www.sec.gov.

SIGNATURES

Pursuant to the requirements

of the Securities and Exchange Act of 1934, the Company has duly caused this Information Statement to be signed on its behalf by

the undersigned hereunto duly authorized.

Date: May 1, 2020

|

|

BESPOKE EXTRACTS, INC.

|

|

|

|

|

|

|

By:

|

/s/ Danil Pollack

|

|

|

|

Danil Pollack

|

|

|

|

Chief Executive Officer

|

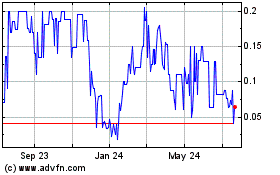

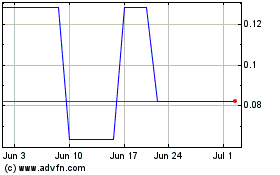

Bespoke Extracts (QB) (USOTC:BSPK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bespoke Extracts (QB) (USOTC:BSPK)

Historical Stock Chart

From Apr 2023 to Apr 2024