BAE Systems 2020 Profit Fell

February 25 2021 - 3:06AM

Dow Jones News

By Anthony O. Goriainoff

BAE Systems PLC said Thursday that 2020 pretax profit fell after

it booked higher costs and that it was well placed to deliver

profitable top-line growth with increasing cash conversion in the

coming years.

The U.K. defense-and-aerospace group said this was due to its

large order backlog, incumbent program positions and its evolving

pipeline of opportunities.

BAE Systems made a pretax profit of 1.6 billion pounds ($2.26

billion), compared with GBP1.63 billion for 2019.

Sales rose to GBP20.86 billion from GBP20.11 billion a year

earlier. Analysts at FactSet had forecast sales of GBP20.29

billion.

Net profit was GBP1.3 billion compared with GBP1.48 billion in

2019 and consensus of GBP1.24 billion, taken from FactSet and based

on eight analysts' forecasts.

Revenue rose to GBP19.28 billion from GBP18.31 billion the year

before.

The arms company said that it expects sales for 2021 to grow in

the 3% to 5% range over 2020. It added that sales growth is

expected in Air and Electronic Systems partially offset by

continued weakness in commercial aerospace revenues. It added that

around 80% of expected sales are already in order backlog.

The board declared a dividend of 14.3 pence a share.

Write to Anthony O. Goriainoff at

anthony.orunagoriainoff@dowjones.com

(END) Dow Jones Newswires

February 25, 2021 02:51 ET (07:51 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

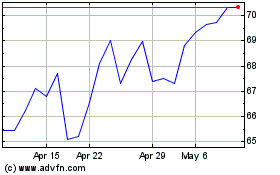

Bae Systems (PK) (USOTC:BAESY)

Historical Stock Chart

From Mar 2024 to Apr 2024

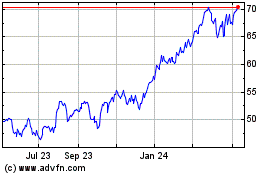

Bae Systems (PK) (USOTC:BAESY)

Historical Stock Chart

From Apr 2023 to Apr 2024