AXA 9-Month Revenue Fell; Confirms Impact Estimates From Coronavirus-Related Claims

November 03 2020 - 12:18PM

Dow Jones News

By Mauro Orru

AXA SA said Tuesday that revenue for the first nine months of

the year fell and confirmed its estimates for the impact on 2020

underlying earnings from coronavirus-related property and casualty

claims and solidarity measures.

The French insurance giant said revenue for the period fell to

73.39 billion euros ($85.41 billion) compared with EUR79.68 billion

in the first nine months of 2019.

Annual premium equivalent, known as APE, rose 1% to EUR3.92

billion. APE measures new business growth by combining the value of

payments on new regular premium policies, and 10% of the value of

payments made on one-time, single-premium products.

AXA's solvency II ratio--a key measure of financial strength for

insurance companies--was 180% at Sept. 30, remaining stable from

the end of June.

"AXA expects only a limited impact on claims from the current

second wave of lockdowns and has reaffirmed today its current best

estimate of EUR1.5 billion Covid-19 claims for 2020," said Chief

Executive Thomas Buberl.

The company said the estimated impact of EUR1.5 billion on 2020

underlying earnings from coronavirus-related property and casualty

claims and solidarity measures is after-tax and net of

reinsurance.

Write to Mauro Orru at mauro.orru@wsj.com; @MauroOrru94

(END) Dow Jones Newswires

November 03, 2020 12:03 ET (17:03 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

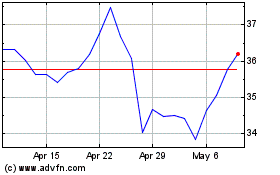

AXA (QX) (USOTC:AXAHY)

Historical Stock Chart

From Mar 2024 to Apr 2024

AXA (QX) (USOTC:AXAHY)

Historical Stock Chart

From Apr 2023 to Apr 2024