UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

Filed by the Registrant

o

|

|

|

|

Filed by a Party other than the Registrant

x

|

|

|

|

Check the appropriate box:

|

|

o

|

Preliminary Proxy Statement

|

|

o

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

x

|

Definitive Proxy Statement

|

|

o

|

Definitive Additional Materials

|

|

o

|

Soliciting Material under §240.14a-12

|

|

|

|

Aura Systems, Inc.

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

Zvi Kurtzman

Elimelech Lowy

David Mann

Cipora Lavut

Robert Lempert

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

x

|

No fee required.

|

|

o

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

o

|

Fee paid previously with preliminary materials.

|

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

|

|

|

|

|

|

CONSENT STATEMENT

June 7, 2019

Dear Fellow Stockholder:

This Consent Statement and the accompanying

WHITE

consent card are being furnished to you as a stockholder of Aura Systems, Inc., a Delaware corporation (“Aura” or the “Company”), by Zvi Kurtzman, Elimelech Lowy, Cipora Lavut,

David Mann and Robert Lempert (collectively, the “Participants”, “us”, “our” or “we”) in connection with our solicitation of written consents to remove three of the five members of the current Board of Directors of the Company (the “Board”), and replace them with our three director nominees and to repeal any amendments to the Company’s Bylaws adopted after January 1, 2019 that were not adopted or approved by the Company’s stockholders (this “Consent Solicitation”).

As a group of significant stockholders of the Company, with aggregate ownership of

21,571,195 shares of the Company’s Common Stock, par value $0.0001 per share (the “Common Stock”), constituting approximately 40.35% of the outstanding shares, we believe that the Board must be significantly and immediately reconstituted to ensure that the best interests of the Company and its stockholders, the true owners of Aura, are appropriately represented in the boardroom. The interests of the three directors that we are proposing to remove are poorly aligned with those of the Company’s stockholders because, based on the Company’s public filings, they own almost no stock of your company. The Participants believe that they have support for the Proposals by other stockholders who own an additional approximately 4.3 million shares of Common Stock, representing an additional 8% of the outstanding Common Stock. One of these stockholders is Hebiao Song, who owns 1,428,571 shares of Common Stock and is the CEO of Jiangsu AoLunTe Electrical Machinery Industrial Co., Ltd., a company which has a joint venture with Aura to exploit Aura’s axial flux induction technology in the Chinese market. Accordingly, counting the aggregate share ownership of the Participants and the share ownership of other stockholders supporting the Proposals, the Participants believe that there will be votes in favor of the Proposals aggregating approximately 48.35% of the Company’s outstanding Common Stock, plus any additional favorable votes obtained through this Consent Solicitation.

The address of the principal executive offices of the Company is 10541 Ashdale Street, Stanton California 90680. This Consent Solicitation is not being made by the Company. This Consent Statement and

WHITE

consent card are first being sent or given to the stockholders of Aura on or about June 7, 2019.

A solicitation of written consents is a process that allows a company’s stockholders to act by submitting written consents to any proposed stockholder actions in lieu of voting in person or by proxy at an annual or special meeting of stockholders.

Each of the Participants, including the Nominees (as defined below) are deemed to be participants in this Consent Solicitation. See the section titled “INFORMATION REGARDING THE PARTICIPANTS” for more information.

We are soliciting written consents from the holders of shares of the Common Stock to take the following actions (each, as more fully described in this Consent Statement, a “Proposal” and

1

together, the “Proposals”), in the following order, without a stockholders’ meeting, as authorized by Delaware law:

PROPOSAL NO. 1

: To remove Ronald Buschur, Si Ryong Yu and William Anderson as directors of the Company (the “Director Removal Proposal”);

PROPOSAL NO. 2:

To elect David Mann, Cipora Lavut and Robert Lempert (each a “Nominee” and collectively, the “Nominees”) as directors of the Company to serve until their respective successors are duly elected and qualified (the “Director Election Proposal”); and

PROPOSAL NO. 3:

To repeal any amendments to the Company’s Bylaws adopted after January 1, 2019 that were not adopted or approved by the Company’s stockholders.

We are soliciting your written consent in favor of the adoption of the Proposals. We believe that neither Aura’s current management nor the current Board is representing the long-term interests of the Company’s stockholders, as a result of which Aura’s stockholders will be better served by a change to leadership that is aligned with the Company’s stockholders and is committed to creating stockholder value

and a positive corporate culture.

If we are successful in this Consent Solicitation, then the Board will be composed of the three Nominees, together with current directors Gary Douglas and Salvador Diaz-Versón, Jr. You should refer to the Company’s Current Reports on Form 8-K filed on April 5, 2018 and July 10, 2018, respectively, for the background, qualifications and other information concerning the incumbent directors.

Section 228 of the General Corporation Law of the State of Delaware (the “DGCL”) governs the circumstances under which the Proposals will become legally effective, and Section 213(b) of the DGCL governs the record dates for determination of the stockholders entitled to cast their votes by executing written consents. See the sections entitled “RECORD DATES” and “CONSENT PROCEDURES” for additional information.

WE URGE YOU TO ACT TODAY TO ENSURE THAT YOUR CONSENT WILL COUNT.

2

As of the date of this filing, the participants, are beneficial owners of an aggregate of 21,571,195 shares of the Company’s Common Stock, constituting approximately 40.35% of the currently outstanding shares of the Company’s Common Stock. The shares of Common Stock are held for the following accounts:

|

Name

|

|

Stockholder of

Record

|

|

Beneficially

Owned but

Not Held of

Record

|

|

Total

|

|

|

Zvi Kurtzman

|

|

7,764,276

|

|

39,022

|

|

7,803,298

|

|

|

Elimelech Lowy

|

|

3,519,768

|

|

8,217,595

|

(1)

|

11,737,363

|

|

|

David Mann

|

|

557,264

|

|

785,851

|

(2)

|

1,343,115

|

|

|

Cipora Lavut

|

|

287,846

|

|

207,610

|

|

495,456

|

|

|

Robert Lempert

|

|

53,963

|

|

138,000

|

|

191,963

|

|

|

TOTAL

|

|

|

|

|

|

21,571,195

|

|

The percentages used herein are calculated based upon the 53,453,661 shares of Common Stock outstanding as of March 26, 2019, each entitled to one vote per share. Information regarding the outstanding shares of Common Stock is based on a report (the “Transfer Online Report”) from Transfer Online, the Company’s transfer agent. The Transfer Online Report was provided to the Participants by counsel to the Company on April 12, 2019 and such counsel represented to the Participants that the Transfer Online Report represents the Company’s stockholder list as of March 26, 2019.

We urge you to consent to the Proposals by signing, dating and returning the enclosed

WHITE

consent card.

If you take no action, you will in effect be rejecting the Proposals

. The failure to execute and return a

WHITE

consent card and “withheld consents” will have the same effect as a “no” vote. Please note that in addition to signing the enclosed

WHITE

consent card, you must also date it to ensure its validity.

IMPORTANT

PLEASE READ THIS CAREFULLY

Shares Registered in Your Own Name.

If your shares of Common Stock are registered in your own name, please submit your written consent today by signing, dating and returning the enclosed

WHITE

consent card by e-mail, in PDF form, to harry@kurtzman.name or drrtl@comcast.net.

Shares Held in “Street Name.”

The current Board has taken the position that only stockholders owning shares in their own name can exercise the right to consent by signing a

(1) Includes 7,547,693 shares for which Mr. Lowy has the power to vote under powers of attorney.

(2) Includes 451,911 shares for which Mr. Mann has the power to vote under powers of attorney.

3

consent card, regardless of who is the beneficial owner. To avoid unnecessary disputes, if you hold your shares in “street” name with a bank, brokerage firm, dealer, trust company or other nominee, that nominee should exercise the right to consent with respect to the shares of Common Stock that you beneficially own through such nominee upon receipt of your specific instructions. Accordingly, it is critical that you promptly give instructions to your bank, brokerage firm, dealer, trust company or other nominee to execute a consent in writing in favor of the Proposals. Please follow the consent instructions provided on the enclosed

WHITE

consent card. We urge you to confirm in writing your instructions to the person responsible for your account and provide a copy of those instructions to Zvi Kurtzman or Robert Lempert at the e-mail addresses provided below, so that we will be aware of all instructions given and can seek to ensure that such instructions are followed.

Execution and delivery of a

WHITE

consent card by a record holder of shares of Common Stock will be presumed and treated to be a written consent with respect to all shares held by such record holder unless specified otherwise. If you are a stockholder of record as of the close of business on the Record Dates, you will retain your right to consent in writing to the Proposals even if you sell your shares of Common Stock after the Record Dates.

WITHHELD CONSENTS AND FAILURES TO CONSENT WILL HAVE THE SAME EFFECT AS REJECTING THE PROPOSALS.

If you have any questions regarding your

WHITE

consent card or need assistance in executing your consent, please contact Zvi Kurtzman or Robert Lempert.

RECORD DATES

Section 213(b) of the DGCL governs the record date for stockholder action by written consent. Section 213(b) states as follows:

(b) In order that the corporation may determine the stockholders entitled to consent to corporate action in writing without a meeting, the board of directors may fix a record date, which record date shall not precede the date upon which the resolution fixing the record date is adopted by the board of directors, and which date shall not be more than 10 days after the date upon which the resolution fixing the record date is adopted by the board of directors. If no record date has been fixed by the board of directors, the record date for determining stockholders entitled to consent to corporate action in writing without a meeting, when no prior action by the board of directors is required by [the DGCL], shall be the first date on which a signed written consent setting forth the action taken or proposed to be taken is delivered to the corporation by delivery to its registered office in this State, its principal place of business or an officer or agent of the corporation having custody of the book in which proceedings of meetings of stockholders are recorded. Delivery made to a corporation’s registered office shall be by hand or by certified or registered mail, return receipt requested. If no record date has been fixed by the board of directors and prior action by the board of directors is required by [the DGCL], the record date for determining stockholders entitled to consent to corporate action in writing without a meeting shall be at the close of business on the day on which the board of directors adopts the resolution taking such prior action.

4

The following information is qualified in its entirety by the quoted language of Section 213(b) of the DGCL set forth above.

For the three Proposals for which written consents are being requested, no prior action by the board of directors is required by the DGCL. Further, to the knowledge of the Participants, no resolution fixing a record date has been adopted by Aura’s Board of Directors.

The Participants delivered a signed written consent to the Company on March 26, 2019 removing Ronald Buschur as a member of the Company’s Board and electing Cipora Lavut as a director of the Company. The Participants delivered a further signed written consent to the Company on March 27, 2019 removing William Anderson and Si Ryong Yu as members of the Company’s Board and electing Robert Lempert and David Mann as directors of the Company. Accordingly, the Participants believe that the Record Date for the proposed removal Ronald Buschur as a member of the Company’s Board and electing Cipora Lavut as a director of the Company is March 26, 2019 and the Record Date for the proposed removal of William Anderson and Si Ryong Yu as members of the Company’s Board and the election of Robert Lempert and David Mann as directors of the Company March 27, 2019 (together, the “Record Dates”).

CONSENT PROCEDURES

Consent Procedures for corporations having stockholders are governed by Section 228(a), (c), (d) and (e) of the DGCL, which provide as follows:

(a) Unless otherwise provided in the certificate of incorporation, any action required by this chapter to be taken at any annual or special meeting of stockholders of a corporation, or any action which may be taken at any annual or special meeting of such stockholders, may be taken without a meeting, without prior notice and without a vote, if a consent or consents in writing, setting forth the action so taken, shall be signed by the holders of outstanding stock having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted and shall be delivered to the corporation by delivery to its registered office in this State, its principal place of business or an officer or agent of the corporation having custody of the book in which proceedings of meetings of stockholders are recorded. Delivery made to a corporation’s registered office shall be by hand or by certified or registered mail, return receipt requested.

* * * *

(c) No written consent shall be effective to take the corporate action referred to therein unless written consents signed by a sufficient number of holders or members to take action are delivered to the corporation in the manner required by this section within 60 days of the first date on which a written consent is so delivered to the corporation. Any person executing a consent may provide, whether through instruction to an agent or otherwise, that such a consent will be effective at a future time (including a time determined upon the happening of an event), no later than 60 days after such instruction is given or such provision is made, if evidence of such instruction or provision is provided to the corporation. Unless otherwise provided, any such consent shall be revocable prior to its becoming effective.

5

(d)(1) A telegram, cablegram or other electronic transmission consenting to an action to be taken and transmitted by a stockholder, member or proxyholder, or by a person or persons authorized to act for a stockholder, member or proxyholder, shall be deemed to be written and signed for the purposes of this section, provided that any such telegram, cablegram or other electronic transmission sets forth or is delivered with information from which the corporation can determine (A) that the telegram, cablegram or other electronic transmission was transmitted by the stockholder, member or proxyholder or by a person or persons authorized to act for the stockholder, member or proxyholder and (B) the date on which such stockholder, member or proxyholder or authorized person or persons transmitted such telegram, cablegram or electronic transmission. No consent given by telegram, cablegram or other electronic transmission shall be deemed to have been delivered until such consent is reproduced in paper form and until such paper form shall be delivered to the corporation by delivery to its registered office in this State, its principal place of business or an officer or agent of the corporation having custody of the book in which proceedings of meetings of stockholders or members are recorded. Delivery made to a corporation’s registered office shall be made by hand or by certified or registered mail, return receipt requested. Notwithstanding the foregoing limitations on delivery, consents given by telegram, cablegram or other electronic transmission, may be otherwise delivered to the principal place of business of the corporation or to an officer or agent of the corporation having custody of the book in which proceedings of meetings of stockholders or members are recorded if, to the extent and in the manner provided by resolution of the board of directors or governing body of the corporation.

(2) Any copy, facsimile or other reliable reproduction of a consent in writing may be substituted or used in lieu of the original writing for any and all purposes for which the original writing could be used, provided that such copy, facsimile or other reproduction shall be a complete reproduction of the entire original writing.

(e) Prompt notice of the taking of the corporate action without a meeting by less than unanimous written consent shall be given to those stockholders or members who have not consented in writing and who, if the action had been taken at a meeting, would have been entitled to notice of the meeting if the record date for notice of such meeting had been the date that written consents signed by a sufficient number of holders or members to take the action were delivered to the corporation as provided in this section. In the event that the action which is consented to is such as would have required the filing of a certificate under any other section of this title, if such action had been voted on by stockholders or by members at a meeting thereof, the certificate filed under such other section shall state, in lieu of any statement required by such section concerning any vote of stockholders or members, that written consent has been given in accordance with this section.

The Company’s Certificate of Incorporation does not prohibit or otherwise restrict the ability of stockholders of the Company from taking any action by written consent.

The following information and instructions are qualified in their entirety by the quoted language of Sections 228(a), (c), (d) and (e) set forth above.

As of March 26, 2019, based on the Transfer Online Report, there were 53,453,661 shares of the Company’s Common Stock outstanding, each entitled to one vote per share. The Participants are not aware of any changes in the number of shares of outstanding common stock of the Company between March 26 and March

6

27. As a result, Participants believe that, based upon this number of outstanding shares of Common Stock, the Proposals will become effective upon proper delivery of properly completed unrevoked written consents representing at least 26,726,831 shares of Common Stock.

A stockholder may consent to the removal of less than all of the incumbent directors by designating the names of one or more directors who are not to be removed. Similarly, a stockholder may consent to the election of less than all of the Nominees by designating the names of one or more Nominees who are not to be elected.

If your shares of Common Stock are registered in your own name, please submit your consent to us today by signing, dating and returning the enclosed

WHITE

consent card by e-mail, in PDF form, to harry@kurtzman.name or drrtl@comcast.net.

If you hold your shares in “street” name with a bank, brokerage firm, dealer, trust company or other nominee, only that nominee can exercise the right to provide consent with respect to the shares of Common Stock you beneficially own through such nominee and only upon receipt of your specific instructions. Accordingly, it is critical that you promptly give instructions to consent in writing to the Proposals to your bank, brokerage firm, dealer, trust company or other nominee. Please follow the consent instructions provided on the enclosed

WHITE

consent card. We urge you to confirm in writing your instructions to the person responsible for your account and provide a copy of those instructions to Zvi Kurtzman or David Mann so that we will be aware of all instructions given and can seek to ensure that such instructions are followed.

Execution and delivery of a

WHITE

consent card by a record holder of shares of Common Stock will be presumed and treated to be a written consent with respect to all shares held by such record holder unless specified otherwise. An executed consent card may be revoked by marking, dating, signing and delivering a written revocation before the time that the action authorized by the executed consent becomes effective. A revocation may be in any written form validly signed by the record holder as long as it clearly states that the consent previously given is no longer effective. The delivery of a subsequently dated consent card that is properly completed will constitute a revocation of any earlier consent. The revocation may be delivered either to the Company or to Zvi Kurtzman or David Mann. Although a revocation is effective if delivered to the Company, we request that either the original or photostatic copies of all revocations of consents be mailed or delivered to Zvi Kurtzman or David Mann, at the address set forth above, so that we will be aware of all revocations and can more accurately determine if and when consents to the Proposals have been received from the holders of record of a majority of the shares of Common Stock outstanding on the Record Dates.

IF YOU TAKE NO ACTION, YOU WILL IN EFFECT BE REJECTING THE PROPOSALS. WITHHELD CONSENTS AND FAILURES TO CONSENT WILL HAVE THE SAME EFFECT AS REJECTING THE PROPOSALS.

If you have any questions regarding your

WHITE

consent card or need assistance in executing your consent, please contact Zvi Kurtzman or Robert Lempert.

If the Proposals become effective as a result of this Consent Solicitation, prompt notice of the action taken will be given under Section 228(e) of the DGCL to stockholders who have not

7

consented in writing to the Proposals and who, if the action had been taken at a meeting, would have been entitled to notice of the meeting if the record date for notice of such meeting had been the date that written consents signed by a sufficient number of holders to take the action were delivered to the Company in accordance with Section 228 of the DGCL.

REASONS FOR THE CONSENT SOLICITATION

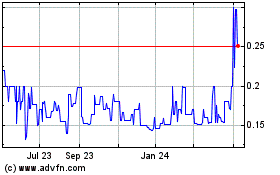

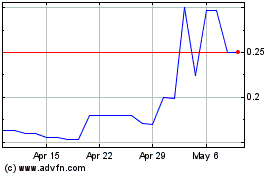

The objective of the Consent Solicitation is to cause the election of directors who will be better aligned with Aura’s stockholders and place a greater emphasis on the enhancement of stockholder value for all stockholders of the Company. The Participants believe that the Company’s stock performance, market valuation and future prospects have been unduly impaired by the actions of Messrs. Buschur, Anderson and Yu. The Company’s last annual meeting was held on January 11, 2018. Prior to that, the Company had not held an annual meeting since October 27, 2011.

On May 15, 2019, three of the Participants brought an action in the Delaware Court of Chancery under Section 211 of the DGCL seeking to compel the Company to hold a meeting of its stockholders for the purpose of electing directors and transacting such other business as may properly come before the meeting. On June 4, 2019, Aura filed a Current Report on Form 8-K disclosing that Aura has purportedly scheduled an annual meeting of stockholders for August 26, 2019. On June 3, 2019, counsel to the Participants filed a letter with the Court requesting a scheduling conference for purposes of setting an annual meeting prior to the August 26, 2019 date. While opposing counsel has filed its own letter, the Court has not responded or scheduled a conference.

Accordingly, due to such remaining uncertainty, we believe that it is in the best interests of the Company and its stockholders for the stockholders of Aura to act now by written consent to replace Messrs. Buschur, Anderson and Yu with the Nominees who will enable the Board to change course and vigorously pursue enhanced stockholder value.

BACKGROUND OF THE CONSENT SOLICITATION

The following is a chronology of the events and circumstances that preceded the solicitation from the stockholders of the Company written consents to (1) remove Ronald Buschur, Si Ryong Yu, and William Anderson as members of the Company’s five-member Board and (2) to elect Cipora Lavut, Robert Lempert and David Mann to fill the vacancies created by such removals.

·

On March 26, 2019, each of the Participants in this solicitation, as well as Hebiao Song, Donald Kendall and Peter Dalrymple delivered a written consent to the Company to effect the removal of Ronald Buschur as a director of the Company and the election of Cipora Lavut to fill the vacancy created thereby on the Board. On March 27, 2019, the same stockholders delivered written consents to the Company to effect the removal of Si Ryong Yu, and William Anderson as directors of the Company and the election of Robert Lempert and David Mann to fill the vacancies created by their removal. These written consents (the “Original Consents”) represented a majority of the outstanding shares of the Company’s common stock as of March 26, 2019 and March 27, 2019, respectively.

·

In a March 27, 2019, letter to Mr. Mann, Mr. Gagerman, Aura’s interim chief executive officer, wrote that the Original Consents were ineffective, claiming such consenting stockholders were not the record owners of more than 50% of the voting stock. According to Mr. Gagerman, such consenting Stockholders were record owners of a total of 15,873,597 shares — 8,527,288 less than the amount needed. Mr. Gagerman’s vote count was repeated in an April 5, 2019, letter from a law firm purporting to represent the Company, which asserted that stockholder written consents are only valid as to the shares held of record by the signatories.

8

·

Because of Aura’s refusal to recognize the legal effectiveness of the Original Consents, on April 8, 2019, Participants Cipora Lavut, Robert Lempert, David Mann and Zvi Kurtzman, as well as Peter Dalrymple, filed a suit against Aura in the Court of Chancery of the State of Delaware pursuant to Section 225 of the DGCL, seeking an order confirming the validity of the Original Consents and declaring that Aura’s Board consists of Ms. Lavut, Mr. Mann, Mr. Lempert, Mr. Douglas and Mr. Diaz-Versón, Jr.

See Lavut, et al., v. Aura Systems, Inc.

, Case No. 2019-0263-JRS. A copy of the Verified Complaint filed in that suit, which is currently pending, is attached hereto as Annex III.

·

On April 16, 2019, Peter Dalrymple delivered a revocation of his consents to Aura, and on April 18, Donald Kendall delivered a revocation of his consents to Aura. On April 24, 2019, Peter Dalrymple’s notice and proposed order to withdraw from the Delaware litigation was approved by the Court of Chancery.

·

On April 29, 2019, Aura filed its Answer and Verified Counterclaim in the Delaware Court of Chancery suit, a copy of which is attached hereto as Annex IV.

·

May 15, 2019, three of the Participants brought an action in the Delaware Court of Chancery under Section 211 of the DGCL seeking to compel the Company to hold a meeting of its stockholders for the purpose of electing directors and transacting such other business as may properly come before the meeting. On June 4, 2019, Aura filed a Current Report on Form 8-K disclosing that Aura has purportedly scheduled an annual meeting of stockholders for August 26, 2019. On June 3, 2019, counsel to the Participants filed a letter with the Court requesting a scheduling conference for purposes of setting an annual meeting prior to the August 26, 2019 date. While opposing counsel has filed its own letter, the Court has not responded or scheduled a conference.

Although the remaining plaintiffs in the Delaware Court of Chancery litigation (Participants Cipora Lavut, Robert Lempert, David Mann and Zvi Kurtzman) may challenge the legal effectiveness of the revocations delivered by Messrs. Dalrymple and Kendall, there can be no assurance of how the court will rule on the issue. Similarly, there can be no assurance as to when the Company will hold a meeting of its stockholder for the purpose of electing directors. To avoid further delay and unnecessary complications and disputes, the Participants seek to obtain additional consents that will moot the issues and ensure the accomplishment of the objectives of removing Messrs. Buschur, Yu and Anderson as directors of the Company and electing Ms. Lavut, Mr. Mann and Mr. Lempert in their place.

THE PROPOSALS

The Participants are seeking written consents from the Company’s stockholders to remove three of Aura’s five current directors and to elect the three Nominees without a stockholders meeting, as permitted by the DGCL and to repeal any amendments to the Company’s Bylaws adopted after January 1, 2019 that were not adopted or approved by the Company’s stockholders. The effectiveness of each of the Proposals is subject to, and conditioned upon, the adoption by the holders of record, as of the close of business on the Record Dates, of a majority of the shares of Aura’s Common Stock entitled to vote thereon and then outstanding.

PROPOSAL NO. 1:

DIRECTOR REMOVAL PROPOSAL

The Company’s Board is currently composed of five directors. This proposal would remove Messrs. Buschur, Anderson and Yu as directors of the Company. If the Director Removal Proposal is successful and the three Nominees are elected pursuant to the Director Election Proposal (described below), Aura’s Board would consist of the three Nominees together with current directors Messrs. Douglas and Diaz-Versón, Jr.

Section 141(k) of the DGCL governs removal of directors. It provides as follows:

(k) Any director or the entire board of directors may be removed, with or without cause, by the holders of a majority of the shares then entitled to vote at an election of directors, except as follows:

9

(1) Unless the certificate of incorporation otherwise provides, in the case of a corporation whose board is classified as provided in subsection (d) of this section, stockholders may effect such removal only for cause; or

(2) In the case of a corporation having cumulative voting, if less than the entire board is to be removed, no director may be removed without cause if the votes cast against such director’s removal would be sufficient to elect such director if then cumulatively voted at an election of the entire board of directors, or, if there be classes of directors, at an election of the class of directors of which such director is a part.

Whenever the holders of any class or series are entitled to elect 1 or more directors by the certificate of incorporation, this subsection shall apply, in respect to the removal without cause of a director or directors so elected, to the vote of the holders of the outstanding shares of that class or series and not to the vote of the outstanding shares as a whole.

The following information is qualified in its entirety by the language of Section 141(k) of the DGCL as set forth above.

The Company does not have a classified board or cumulative voting in the election of its directors. Consequently, Section 141(k) of the DGCL permits the stockholders of the Company to remove any director or the entire Board without cause. Article III, Section 3.12 of the Bylaws provides that, unless otherwise provided in the certificate of incorporation, any director or the entire board of directors may be removed with or without cause by the holders of a majority of the shares then entitled to vote at an election of directors. You should refer to Exhibit 3(II) of the Company’s Annual Report on Form 10-K filed on June 15, 2009 for a full copy of the Bylaws. Aura’s Certificate of Incorporation does not provide otherwise.

If a stockholder wishes to consent in writing to the removal of certain of the members of the Board, but not to the removal of all three current directors recommended for removal by the Participants, such stockholder may do so by checking the appropriate “consent” box on the enclosed

WHITE

consent card and writing the name of each such person that the stockholder does not wish to be removed. If fewer than three directors are removed pursuant to the Director Removal Proposal and there are more Nominees receiving the requisite number of consents to fill vacancies pursuant to the Director Election Proposal than the number of such resulting vacancies, then the Participants intends to fill the vacancies in the following order: Cipora Lavut, David Mann and Robert Lempert.

As of March 26, 2019, based on the Transfer Online Report, there were 53,453,661 shares of Common Stock outstanding, each entitled to one consent per share. Accordingly, the written consent of the holders of at least 26,726,831 shares of outstanding Common Stock and entitled to vote would be necessary to effect the Director Removal Proposal and remove Messrs. Buschur, Anderson and Yu from Aura’s Board. Therefore, to avoid disputes arising from the withdrawal of consents by Mr. Darymple and Mr. Kendall, written consents representing shares of Common Stock in addition to the shares of Common Stock entitled to consent held by the Participants and their supporters are being sought to effect the Director Removal Proposal and remove the three members of the Board. In the event that holders of less than 26,726,831 shares of Common Stock consent to the removal of any existing director, then such director will not be removed pursuant to the Director Removal Proposal.

10

The text of the Director Removal Proposal resolution is as follows:

RESOLVED, that pursuant to and in accordance with Section 141(k) of the DGCL and Article III, Section 3.12 of the Bylaws, each of Ronald Buschur, Si Ryong Yu and William Anderson be, and each hereby is, removed without cause, effective immediately, as directors of the Company.

WE URGE YOU TO CONSENT TO THE DIRECTOR REMOVAL PROPOSAL.

PROPOSAL NO. 2: DIRECTOR ELECTION PROPOSAL

The Board of Directors is currently comprised of five directors, three of whom would be removed if Proposal No. 1 is approved. This Director Election Proposal would elect Cipora Lavut, David Mann and Robert Lempert as directors of the Company to fill the vacancies that would be created by the adoption of Proposal No. 1. In such event, Aura’s Board would be comprised of the three Nominees together with Messrs. Douglas and Diaz-Versón, Jr. If the number of Nominees elected pursuant to the Director Election Proposal is less than the number of Board vacancies, then such unfilled vacancies, pursuant to Section 3.4 of the Company’s Bylaws, may be filled at the discretion of the newly constituted Board. Section 3.4 of the Company’s Bylaws states:

Vacancies and newly created directorships resulting from any increase in the authorized number of directors elected by all of the stockholders having the right to vote as a single class

may be filled by a majority of the directors then in office, although less than a quorum, or by a sole remaining director

.

You should refer to Exhibit 3(II) of the Company’s Annual Report on Form 10-K filed on June 15, 2009 for a full copy of the Bylaws. All of the Nominees, if elected, would hold office until such person’s successor has been elected or until such person’s death, resignation, retirement or removal. Each of the Nominees has consented to serve as a director of the Company if elected. See “Information Regarding the Nominees” for more information about the Nominees.

As of March 26, 2019, based on the Transfer Online Report, there were 53,453,661 shares of Common Stock outstanding, each entitled to one consent per share. Accordingly, the written consent of the holders of at least 26,726,831 shares of outstanding Common Stock and entitled to vote would be necessary to effect the Director Election Proposal and elect Mr. Mann, Ms. Lavut and Mr. Lempert to Aura’s Board. Therefore, to avoid disputes arising from the withdrawal of consents by Mr. Darymple and Mr. Kendall, and avoid further delay, written consents representing shares of Common Stock in addition to the shares of Common Stock entitled to consent held by the Participants and their supporters are being sought to effect the Director Election Proposal and elect the three Nominees to the Board. In the event that holders of less than 26,726,831 shares of Common Stock consent to the election of any Nominee, then such Nominee will not be elected pursuant to the Director Election Proposal.

The text of the Director Election Proposal resolution is as follows:

RESOVED, that each of Cipora Lavut, David Mann and Robert Lempert be, and each hereby is, elected pursuant to and in accordance with Section 223 of the DGCL as directors of the Company and fill the vacancies created by the foregoing director removals, to serve until the next annual meeting of the Company or until their respective successors has been duly elected and qualified.

WE URGE YOU TO CONSENT TO THE DIRECTOR ELECTION PROPOSAL.

PROPOSAL NO. 3: REPEAL OF BYLAW AMENDMENTS PROPOSAL

Article IX of the Company’s Bylaws provides as follows: “The bylaws of the corporation may be adopted, amended or repealed by a majority of the voting power of the stockholders entitled to vote; provided, however, that the corporation may, in its certificate of incorporation, also confer the power to adopt, amend or repeal bylaws upon the board of directors. The fact that such power has been so conferred upon the board of directors shall not divest the stockholders of the power, nor limit their power to adopt, amend or repeal bylaws. Notwithstanding the foregoing, the amendment or repeal of all or any portion of Section 3.13 or this Article IX shall require the approval of the holders of a majority of the stock having voting power at a meeting of the stockholders.”

Article Seventh of the Company’s Amended and Restated Certificate of Incorporation provides as follows: “In furtherance and not in limitation of the powers conferred by the laws of the State of Delaware, the board of directors is expressly authorized to adopt, amend or repeal the bylaws, except as otherwise provided therein.”

The Participants do not believe the Company’s Board should be adopting amendments to the Bylaws that are detrimental to the Company’s stockholders in this period of uncertainty at Aura. Any such amendments might impede this Consent Solicitation. The Participants are not aware of any change to the Company’s Bylaws since January 1, 2019, which would have been required to be disclosed by the Company in a Current Report on Form 8-K. While the Participants are unaware of any circumstances that would indicate that this is the case, it is possible that a repeal of an undisclosed Bylaw amendment which has not been adopted or approved by the stockholders might be detrimental to the Company’s stockholders. The Participants recommend that you consent to repeal any amendments to the Company’s Bylaws adopted after January 1, 2019 that were not adopted or approved by the Company’s stockholders.

The text of the Repeal of Bylaw Amendments Proposal is as follows:

RESOLVED, that any provision of the Bylaws that was not included in the Bylaws as in effect on January 1, 2019, other than any amendment to the Bylaws adopted or approved by the stockholders of the Corporation, be, and hereby is, repealed.

WE URGE YOU TO CONSENT TO THE REPEAL OF BYLAW AMENDMENTS PROPOSAL.

11

INFORMATION REGARDING THE NOMINEES

Set forth below is the name, age, present principal occupation and employment history of each of the Nominees for at least the past five years. The information regarding each Nominee has been furnished to the Participants by each Nominee.

|

Name and Business Address

|

|

Age

|

|

Background

|

|

David Mann

5565 Chemin De La cote De Liesse

Montreal, Quebec, Canada H40 1A1

|

|

48

|

|

Mr. Mann has been Vice President of Marketing for Mann Marketing, a manufacturing and import company, since 1990 and the Vice President of Sales of that company since 2007. From 2000 until 2007, Mr. Mann also served as Vice President of Operations. Mr. Mann has extensive experience dealing with all aspects of marketing and sales, as well as suppliers in both North America and China. His marketing and sales experience, particularly in China, would provide the Board with important knowledge and insight in a key target market of the Company.

Mr. Mann has been an investor in the Aura since 2007. Mr. Mann is presently the record holder of 557,264 shares of Aura Common Stock, the beneficial holder of an additional 785,851 shares of Aura Common Stock, and holds warrants to purchase approximately 400,000 shares of the Company’s Common Stock at an exercise price of $1.40 per share. Mr. Mann’s warrants are exercisable through 2020.

Mr. Mann previously served as a director of the Company from November 28, 2017 (when he was appointed by the then-Board to fill one of the two existing vacancies) until January 11, 2018. Mr. Mann holds a degree in Business Administration from College St. Laurent, Montreal, Canada.

|

|

|

|

|

|

|

|

Cipora Lavut

227 Sandy Springs Place

Suite D56

Sandy Springs, GA 30328

|

|

63

|

|

Ms. Lavut was one of Aura’s original founding members. From 1987 to 2002 Ms. Lavut served on Aura’s Board and as a Senior Vice President. During this period, Ms. Lavut was instrumental to Aura receiving large contracts from The Boeing Company, Litton Industries and the United States Air Force. Ms. Lavut also provided critical investor relations and marketing support during this time. Ms. Lavut left Aura in 2002. At the request of Aura’s then Board of Directors and management, in 2006 Ms. Lavut returned to Aura as Vice President in charge of investors relations and

|

12

|

Name and Business Address

|

|

Age

|

|

Background

|

|

|

|

|

|

corporate communication. In January 2016, Ms. Lavut left the Company to pursue other business ventures. Ms. Lavut presently provides marketing and business consulting to a variety of retail and service-oriented businesses. She earned a degree in marketing from California State University, Northridge, in 1987.

Ms. Lavut is presently the record holder of 287,846 shares and beneficial holder of additional 207,610 shares.

|

|

|

|

|

|

|

|

Captain (ret.) Robert Lempert

1209 Chapel Avenue

West Cherry Hill, NJ 08002

|

|

76

|

|

Dr. Lempert is a retired dentist with many years of experience investing in numerous high technology companies and running his own business. Dr. Lempert also served as a Captain in the U.S. Army for two years and served on the Company’s Board from 2017 to 2018.

He graduated from University of Pennsylvania and had a one year residency at the Albert Einstein Medical Center in Philadelphia. He was a member of the American Dental Association and the Academy of General Dentistry.

Dr. Lempert has been a significant investor, shareholder and an active advocate of Aura’s technology for more than 20 years and, as such, his interests are significantly aligned with this Consent Solicitation purpose to install leadership that is committed to enhancing long-term shareholder value.

Dr. Lempert is the record holder of 53,963 shares of Aura Common Stock and is the beneficial holder of an additional 138,000 shares of Aura Common Stock. Dr. Lempert also holds warrants to purchase 100,000 shares of the Company’s Common Stock at an exercise price of $1.40 per share. Dr. Lempert’s warrants are exercisable through 2022.

|

None of the corporations or organizations in which each of the Nominees has conducted his or her principal occupation or employment during the past five years was a parent, subsidiary or other affiliate of the Company. No Nominee holds any current position or office with the Company or has any family relationship with any current executive officer or director of the Company. No Nominee or any associate of any Nominee has any arrangement or understanding with any person with respect to any future employment of the Company or with respect to any future transactions to which the registrant or any of its affiliates will or may be a party. I

f elected, we believe that

13

each of the Nominees will be considered an independent director of the Company under Item 407(a) of Regulation S-K.

INFORMATION REGARDING THE PARTICIPANTS

This Consent Solicitation is being made by Zvi Kurtzman, Elimelech Lowy and each of the three Nominees.

|

Zvi Kurtzman

|

|

Mr. Kurtzman is a physicist (M.S. Physics from the University of California, Riverside) and one of the founders of Aura. He served as Aura’s CEO from 1987-2002. During this period, he spearheaded the growth of the Company from a five employee start-up to an international presence with more than 1000 employees worldwide. Under Mr. Kurtzman’s leadership, the Company entered into numerous agreements and contracts related to electromagnetic and electro-optical technologies developed by Aura with Daewoo Electronics of South Korea, BMW of Germany, Fujitsu of Japan, IAI of Israel, Jet Propulsion laboratory, to name a few, the Company also received more than 80 patents related to electromagnetic and electro-optical technologies.

Mr. Kurtzman left Aura in March 2002. In June of 2002, in connection with an investigation of Aura and its majority-owned subsidiary Newcom, Inc., Mr. Kurtzman, without admitting or denying any of the allegations filed by the SEC, consented to a bar against serving as an officer or director of any public company and paid a $75,000 fine. At the request of Aura’s then Board of Directors and management, from 2006-2015 Mr. Kurtzman returned to Aura as an employee in order to provide the Company with technical assistance regarding Aura’s staple product, the AuraGen. In 2015, Aura entered into an agreement with BetterSea, LLC, a consulting firm owned by Mr. Kurtzman, pursuant to which Mr. Kurtzman continued to provide services to Aura as an outside consultant. The consulting contract was terminated after February 28, 2019, and was not renewed. Aura paid Better Sea approximately $370,000 in 2018 for services and expenses. Aura owes BetterSea approximately $500,000 past due for work performed from 2016 through February 2019. In addition, Aura owes Mr. Kurtzman past due wages for work performed while he was an employee of the Company during 2006 through 2015 of approximately $300,000.

As of the date of this filing, Mr. Kurtzman was the record owner of 7,764,276 shares of Common Stock and the beneficial owner of an additional 39,022 shares of Common Stock. Mr. Kurtzman’s principal business address is 419 Oakmont Place, Atlanta, GA 30327.

|

14

|

Elimelech Lowy

|

|

Elimelech Lowy, known as the Tosher Rebbe, is the Grand Rabbi of the Tosh Hasidic dynasty, founded in Hungary in the seventeenth century. Following the Holocaust, the movement relocated to North America and is presently centered in Quebec and New York State. As of the date of this filing, Rabbi Lowy was the record owner of 3,519,768 shares of Common Stock and the beneficial owner of an additional 8,217,595 shares of Common Stock. Rabbi Lowy’s principal business address is 36 Beth Halevy Boisbriand, Quebec, Canada J7E 4H4.

|

The principal business and principal business address of each Nominee is disclosed in the section titled “INFORMATION REGARDING THE NOMINEES” above.

Please see Annex I for all transactions in the Common Stock effectuated by each of the Participants during the past two years.

Except as set forth in this Consent Statement (including the Annexes hereto): (i) during the past ten years, no Participant has been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors); (ii) no Participant in this Consent Solicitation directly or indirectly beneficially owns any securities of the Company; (iii) no Participant owns any securities of the Company which are owned of record but not beneficially; (iv) no Participant has purchased or sold any securities of the Issuer during the past two years; (v) no part of the purchase price or market value of the securities of the Company owned by any Participant is represented by funds borrowed or otherwise obtained for the purpose of acquiring or holding such securities; (vi) no Participant is, or within the past year was, a party to any contract, arrangements or understandings with any person with respect to any securities of the Company, including, but not limited to, joint ventures, loan or option arrangements, puts or calls, guarantees against loss or guarantees of profit, division of losses or profits, or the giving or withholding of proxies; (vii) no associate (as that term is defined in Rule 14a-1 of the Exchange Act) of any Participant owns beneficially, directly or indirectly, any securities of the Company; (viii) no Participant owns beneficially, directly or indirectly, any securities of any parent or subsidiary of the Company; (ix) no Participant or any of his, her or its associates was a party to any transaction, or series of similar transactions, since the beginning of the Company’s last fiscal year, or is a party to any currently proposed transaction, or series of similar transactions, to which the Company or any of its subsidiaries was or is to be a party, in which the amount involved exceeds $120,000; (x) no Participant or any of his, her or its associates has any arrangement or understanding with any person with respect to any future employment by the Company or its affiliates, or with respect to any future transactions to which the Company or any of its affiliates will or may be a party; and (xi) no person, including any of the Participants, who is a party to an arrangement or understanding pursuant to which the Nominees are proposed to be elected, has a substantial interest, direct or indirect, by security holdings or otherwise in any matter to be acted on as set forth in this Consent Statement.

Except as disclosed in this Consent Statement, there are no material proceedings to which any Participant or any of his, her or its associates is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries. With respect to each of the Nominees, none of the events enumerated in Item 401(f)(1)-(8) of Regulation S-K of the Exchange Act occurred during the past ten years.

15

SOLICITATION OF CONSENTS

The solicitation of consents pursuant to this Consent Solicitation is being made by the Participants. Consents may be solicited by mail, facsimile, telephone, Internet, in person and by advertisements. The Participants will solicit consents from individuals, brokers, banks, bank nominees and other institutional holders. The Participants have requested banks, brokerage houses and other custodians, nominees and fiduciaries to forward all solicitation materials to the beneficial owners of the shares of Common Stock they hold of record. The Participants have not retained any proxy advisors to provide solicitation or advisory services in connection with this Consent Soliciation.

Our estimate of the total maximum cost to be incurred in connection with this Consent Solicitation (excluding litigation costs, if any) is $200,000. To date, approximately $120,000 of expenses have been incurred in connection with this Consent Solicitation.

The Participants will bear the costs of this Consent Solicitation. To the extent legally permissible, if successful in the adoption of the Proposals in whole or in part, we currently intend to seek reimbursement from the Company for our costs and expenses in connection of this Consent Solicitation. We do not currently intend to submit the question of such reimbursement to a vote of the stockholders of the Company.

APPRAISAL RIGHTS

Stockholders are not entitled to appraisal rights under Delaware law in connection with the Proposals or this Consent Solicitation.

SPECIAL INSTRUCTION:

If you were a record holder of shares of Common Stock as of the close of business on

the Record Dates for this Consent Solicitation, you may elect to consent to, withhold consent or abstain with respect to the Proposals by marking the “CONSENT”, “WITHHOLD CONSENT” or “ABSTAIN” box, as applicable, underneath each Proposal on the accompanying WHITE consent card and signing, dating and returning it promptly in the enclosed post-paid envelope.

IF A STOCKHOLDER EXECUTES AND DELIVERS A

WHITE

CONSENT CARD, BUT FAILS TO CHECK A BOX MARKED “CONSENT,” “WITHHOLD CONSENT” OR “ABSTAIN” FOR THE PROPOSALS THAT STOCKHOLDER WILL BE DEEMED TO HAVE CONSENTED TO ALL PROPOSALS, EXCEPT THAT THE STOCKHOLDER WILL NOT BE DEEMED TO CONSENT TO THE REMOVAL OF ANY DIRECTOR WHOSE NAME IS WRITTEN IN THE APPLICABLE SPACE PROVIDED IN ACCORDANCE WITH THE INSTRUCTION TO PROPOSAL 1 ON THE CONSENT CARD. IF A STOCKHOLDER EXECUTES AND DELIVERS A

WHITE

CONSENT CARD, BUT FAILS TO CHECK A BOX MARKED “CONSENT” OR “WITHHOLD CONSENT” FOR PROPOSAL 2 THAT THE STOCKHOLDER WILL NOT BE DEEMED TO CONSENT TO THE ELECTION OF ANY DIRECTOR WHOSE NAME IS WRITTEN IN THE APPLICABLE SPACE PROVIDED IN ACCORDANCE WITH THE INSTRUCTION TO PROPOSAL 2 ON THE CONSENT CARD.

YOUR CONSENT IS IMPORTANT. PLEASE SIGN AND DATE THE ENCLOSED

WHITE

CONSENT CARD AND RETURN IT BY E-MAIL IN PDF FORM TO HARRY@KURTZMAN.NAME OR TO DRRTL@COMCAST.NET PROMPTLY. YOU MUST DATE YOUR CONSENT IN ORDER FOR IT TO BE VALID. FAILURE TO SIGN, DATE AND RETURN YOUR CONSENT WILL HAVE THE SAME EFFECT AS REJECTING THE PROPOSALS.

16

If your shares are held in the name of a bank, brokerage firm, dealer, trust company or other nominee, only it can execute a consent with respect to those shares of Common Stock and only on receipt of specific instructions from you. Thus, you should contact the person responsible for your account and give instructions for the

WHITE

consent card to be signed representing your shares. You should confirm in writing your instructions to the person responsible for your account and provide a copy of those instructions to Zvi Kurtzman or Robert Lempert, so that we will be aware of all instructions given and can seek to ensure that those instructions are followed.

If you have any questions, require assistance in voting your

WHITE

consent card, or need additional copies of this Consent Statement, please contact

Zvi Kurtzman or Robert Lempert at the phone number or email listed below.

|

Zvi Kurtzman

|

|

Robert Lempert

|

|

Telephone: 310-801-5019

|

|

Telephone: 856-912-4139

|

|

E-mail: harry@kurtzman.name

|

|

E-mail: drrtl@comcast.net

|

Important Notice Regarding the Availability of this Consent Statement

This Consent Statement and all other solicitation materials in connection with this Consent Solicitation are available on the Internet, free of charge, at the SEC’s website at www.sec.gov.

Information Concerning the Issuer

Stockholders are referred to the Company’s public filings with respect to certain disclosure relating to the Company that this Consent Statement has omitted.

The Participants expect that the Company will furnish the stockholders with t

his information, in the Company’s consent revocation statement or proxy statement for the Company’s annual meeting. Such disclosure include, among other things, information regarding securities of the Company beneficially owned by the Company’s directors, nominees and management; certain stockholders’ beneficial ownership of more than 5% of the Company’s voting securities; information concerning executive compensation; and information concerning the procedures for submitting stockholder proposals and director nominations intended for consideration at the next Annual Meeting and for consideration for inclusion in the proxy materials for that meeting. If the Company does not distribute its consent revocation statement or proxy statement for the Company’s annual meeting, we will distribute to the stockholders a supplement to this Consent Statement containing those required disclosures that have been omitted herein.

Except as otherwise noted herein, the information in this Consent Statement concerning the Company has been taken from or is based upon documents and records on file with the SEC and other publicly available information. The Company’s SEC filings available to the public at the SEC’s website at www.sec.gov. We do not take responsibility, except to the extent imposed by law, for the accuracy or completeness of statements in public documents and records that were not prepared by or on behalf of the Participants, or for any failure of the Company to disclose in its public documents and records any events that may affect the significance or accuracy of the information contained herein. For information regarding the security ownership of certain beneficial owners and management of the Company, see Annex II.

17

Conclusion

We urge you to carefully consider the information contained in the attached Consent Statement and then support our efforts by signing, dating and returning the enclosed

WHITE

consent card today.

Thank you for your support.

18

ANNEX I

TRANSACTIONS BY THE PARTICIPANTS IN THE SECURITIES OF AURA SYSTEMS, INC. DURING THE PAST TWO YEARS

This Annex I sets forth information with respect to each purchase and sale of shares of Common Stock that was effectuated by a Participant, or affiliates of a Participant, during the past two years. Unless otherwise indicated, all transactions were effectuated in the open market through a broker.

Zvi Kurtzman

|

DATE

|

|

DESCRIPTION

|

|

12/04/2017

|

|

Redemption 127,500 AUSI shares

|

|

12/07/2017

|

|

Redemption 25,000 AUSI shares

|

|

12/08/2017

|

|

Bought 2000 AUSI @ 0.1155

|

|

12/13/2017

|

|

Bought 5000 AUSI @ 0.1177

|

|

12/27/2017

|

|

Bought 1000 AUSI @ 0.1301

|

|

01/18/2018

|

|

Bought 5000 AUSI @ 0.18

|

|

01/24/2018

|

|

Bought 5000 AUSI @ 0.165

|

|

01/31/2018

|

|

Bought 5000 AUSI @ 0.15

|

|

02/15/2018

|

|

Redemption 128,639 AUSID shares

|

|

02/16/2018

|

|

Bought 100 AUSID @ 1

|

|

02/16/2018

|

|

Bought 50 AUSID @ 0.99

|

|

02/16/2018

|

|

Bought 100 AUSID @ 0.96

|

|

02/21/2018

|

|

Bought 100 AUSID @ 0.91

|

|

02/22/2018

|

|

Bought 100 AUSID @ 0.7997

|

|

02/26/2018

|

|

Sold 1000 AUSID @ 0.7

|

|

02/28/2018

|

|

Sold 1000 AUSID @ 0.6803

|

|

02/28/2018

|

|

Sold 2000 AUSID @ 0.68

|

|

03/01/2018

|

|

Bought 100 AUSID @ 0.7

|

|

03/02/2018

|

|

Bought 100 AUSID @ 0.7

|

|

03/05/2018

|

|

Bought 100 AUSID @ 0.73

|

|

03/06/2018

|

|

Bought 2000 AUSID @ 0.61

|

|

03/07/2018

|

|

Sold 500 AUSID @ 0.69

|

|

03/09/2018

|

|

Sold 3353 AUSID @ 0.72

|

I-

1

|

DATE

|

|

DESCRIPTION

|

|

03/14/2018

|

|

Bought 100 AUSI @ 0.73

|

|

03/16/2018

|

|

Bought 100 AUSI @ 0.74

|

|

04/04/2018

|

|

Sold 5000 AUSI @ 0.61

|

|

04/05/2018

|

|

Bought 10000 AUSI @ 0.32

|

|

04/06/2018

|

|

Bought 500 AUSI @ 0.518

|

|

04/06/2018

|

|

Bought 2500 AUSI @ 0.45

|

|

04/18/2018

|

|

Bought 2000 AUSI @ 0.375

|

|

04/20/2018

|

|

Bought 2500 AUSI @ 0.27

|

|

05/03/2018

|

|

Bought 3000 AUSI @ 0.156

|

|

05/03/2018

|

|

Bought 1000 AUSI @ 0.1562

|

|

05/14/2018

|

|

Bought 400 AUSI @ 0.248

|

|

05/22/2018

|

|

Bought 5000 AUSI @ 0.25

|

|

05/24/2018

|

|

Bought 5000 AUSI @ 0.25

|

|

05/24/2018

|

|

Bought 200 AUSI @ 0.295

|

|

05/25/2018

|

|

Bought 500 AUSI @ 0.223

|

|

05/30/2018

|

|

Bought 1000 AUSI @ 0.1999

|

|

06/29/2018

|

|

Sold 2350 AUSI @ 0.49

|

|

07/24/2018

|

|

Bought 2000 AUSI @ 0.3

|

|

07/26/2018

|

|

Bought 100 AUSI @ 0.25

|

|

07/26/2018

|

|

Bought 200 AUSI @ 0.35

|

|

08/03/2018

|

|

Sold 5000 AUSI @ 0.3

|

|

08/03/2018

|

|

Sold 2500 AUSI @ 0.36

|

|

08/07/2018

|

|

Sold 5000 AUSI @ 0.2201

|

|

08/10/2018

|

|

Sold 1000 AUSI @ 0.3

|

|

08/15/2018

|

|

Bought 2500 AUSI @ 0.36

|

|

08/15/2018

|

|

Bought 500 AUSI @ 0.36

|

|

08/16/2018

|

|

Bought 500 AUSI @ 0.36

|

|

08/16/2018

|

|

Bought 500 AUSI @ 0.39

|

|

08/21/2018

|

|

Bought 500 AUSI @ 0.35

|

|

08/23/2018

|

|

Bought 500 AUSI @ 0.32

|

I-

2

|

DATE

|

|

DESCRIPTION

|

|

08/27/2018

|

|

Bought 500 AUSI @ 0.32

|

|

08/29/2018

|

|

Bought 500 AUSI @ 0.35

|

|

08/29/2018

|

|

Bought 500 AUSI @ 0.35

|

|

08/31/2018

|

|

Bought 476 AUSI @ 0.35

|

|

10/12/2018

|

|

Bought 500 AUSI @ 0.325

|

|

10/17/2018

|

|

Bought 1000 AUSI @ 0.325

|

|

10/19/2018

|

|

Bought 500 AUSI @ 0.32

|

|

10/22/2018

|

|

Bought 200 AUSI @ 0.32

|

|

10/24/2018

|

|

Bought 300 AUSI @ 0.31

|

|

10/25/2018

|

|

Bought 200 AUSI @ 0.31

|

|

11/01/2018

|

|

Bought 800 AUSI @ 0.31

|

|

11/05/2018

|

|

Bought 250 AUSI @ 0.31

|

|

11/06/2018

|

|

Bought 100 AUSI @ 0.3

|

|

11/07/2018

|

|

Bought 100 AUSI @ 0.31

|

|

11/13/2018

|

|

Bought 100 AUSI @ 0.3

|

|

11/15/2018

|

|

Bought 100 AUSI @ 0.3

|

|

11/19/2018

|

|

Bought 100 AUSI @ 0.29

|

|

11/20/2018

|

|

Bought 100 AUSI @ 0.29

|

|

11/21/2018

|

|

Bought 100 AUSI @ 0.27

|

|

11/30/2018

|

|

Bought 500 AUSI @ 0.2

|

|

11/30/2018

|

|

Bought 500 AUSI @ 0.2

|

|

12/07/2018

|

|

Bought 500 AUSI @ 0.1975

|

|

12/07/2018

|

|

Bought 500 AUSI @ 0.2

|

|

12/11/2018

|

|

Bought 5000 AUSI @ 0.175

|

|

12/11/2018

|

|

Bought 500 AUSI @ 0.2

|

|

12/12/2018

|

|

Bought 5000 AUSI @ 0.15

|

|

12/12/2018

|

|

Bought 100 AUSI @ 0.2

|

|

12/14/2018

|

|

Bought 5000 AUSI @ 0.17

|

|

12/18/2018

|

|

Bought 100 AUSI @ 0.18

|

|

12/18/2018

|

|

Bought 1857 AUSI @ 0.135

|

I-

3

|

DATE

|

|

DESCRIPTION

|

|

12/18/2018

|

|

Bought 100 AUSI @ 0.2

|

|

12/19/2018

|

|

Bought 100 AUSI @ 0.2

|

|

12/20/2018

|

|

Bought 5000 AUSI @ 0.15

|

|

12/20/2018

|

|

Bought 300 AUSI @ 0.2

|

|

12/21/2018

|

|

Bought 100 AUSI @ 0.188

|

|

12/21/2018

|

|

Bought 100 AUSI @ 0.1596

|

|

12/21/2018

|

|

Bought 500 AUSI @ 0.1445

|

|

12/27/2018

|

|

Bought 500 AUSI @ 0.1573

|

|

12/27/2018

|

|

Bought 1412 AUSI @ 0.1122

|

|

12/28/2018

|

|

Bought 250 AUSI @ 0.1978

|

|

12/28/2018

|

|

Bought 250 AUSI @ 0.1584

|

|

12/28/2018

|

|

Bought 250 AUSI @ 0.1584

|

|

12/31/2018

|

|

Bought 200 AUSI @ 0.249

|

|

01/07/2019

|

|

Sold 500 AUSI @ 0.29

|

|

01/08/2019

|

|

Bought 100 AUSI @ 0.3324

|

|

01/10/2019

|

|

Bought 100 AUSI @ 0.31

|

|

01/11/2019

|

|

Bought 100 AUSI @ 0.338

|

|

01/14/2019

|

|

Bought 100 AUSI @ 0.328

|

|

01/16/2019

|

|

Sold 1000 AUSI @ 0.31

|

|

01/17/2019

|

|

Bought 100 AUSI @ 0.338

|

|

01/22/2019

|

|

Bought 100 AUSI @ 0.2945

|

|

02/07/2019

|

|

Sold 2000 AUSI @ 0.4

|

|

02/07/2019

|

|

Sold 500 AUSI @ 0.4

|

|

02/19/2019

|

|

Bought 100 AUSI @ 0.49

|

|

02/19/2019

|

|

Sold 1000 AUSI @ 0.45

|

|

02/19/2019

|

|

Sold 269 AUSI @ 0.45

|

|

02/26/2019

|

|

Sold 2000 AUSI @ 0.4001

|

|

02/26/2019

|

|

Sold 2000 AUSI @ 0.4

|

|

02/26/2019

|

|

Sold 2000 AUSI @ 0.4

|

|

02/28/2019

|

|

Sold 3000 AUSI @ 0.42

|

I-

4

|

DATE

|

|

DESCRIPTION

|

|

02/28/2019

|

|

Sold 1000 AUSI @ 0.41

|

|

03/01/2019

|

|

Sold 1000 AUSI @ 0.4101

|

|

03/05/2019

|

|

Bought 100 AUSI @ 0.46

|

|

03/07/2019

|

|

Sold 2000 AUSI @ 0.4102

|

|

03/07/2019

|

|

Sold 1100 AUSI @ 0.4101

|

|

03/12/2019

|

|

Bought 100 AUSI @ 0.5

|

|

03/14/2019

|

|

Sold 2000 AUSI @ 0.44

|

|

03/15/2019

|

|

Sold 471 AUSI @ 0.4301

|

|

03/15/2019

|

|

Sold 1529 AUSI @ 0.4201

|

|

03/22/2019

|

|

Sold 5000 AUSI @ 0.35

|

|

03/22/2019

|

|

Sold 2000 AUSI @ 0.35

|

|

04/05/2019

|

|

Sold 2000 AUSI @ 0.3621

|

|

04/05/2019

|

|

Bought 100 AUSI @ 0.45

|

David Mann

|

DATE

|

|

DESCRIPTION

|

|

04/25/2017

|

|

Bought 14600 AUSI @ 0.12

|

|

04/27/2017

|

|

Bought 100 AUSI @ 0.13

|

|

05/01/2017

|

|

Bought 5000 AUSI @ 0.142

|

|

05/02/2017

|

|

Bought 5000 AUSI @ 0.148

|

|

05/04/2017

|

|

Sold 25000 AUSI @ 0.16

|

|

05/05/2017

|

|

Bought 10000 AUSI @ 0.17

|

|

05/05/2017

|

|

Bought 5000 AUSI @ 0.165

|

|

05/08/2017

|

|

Bought 8000 AUSI @ 0.182

|

|

05/09/2017

|

|

Bought 100 AUSI @ 0.189

|

I-

5

|

05/19/2017

|

|

Sold 13100 AUSI @ 0.177

|

|

05/19/2017

|

|

Sold 20000 AUSI @ 0.177

|

|

05/25/2017

|

|

Bought 7000 AUSI @ 0.17

|

|

05/30/2017

|

|

Bought 4000 AUSI @ 0.152

|

|

05/30/2017

|

|

Bought 6000 AUSI @ 0.151

|

|

05/31/2017

|

|

Bought 2387 AUSI @ 0.145

|

|

05/31/2017

|

|

Bought 2613 AUSI @ 0.138

|

|

06/01/2017

|

|

Bought 5000 AUSI @ 0.15

|

|

06/01/2017

|

|

Bought 3000 AUSI @ 0.19

|

|

06/09/2017

|

|

Sold 10000 AUSI @ 0.16

|

|

06/12/2017

|

|

Bought 5000 AUSI @ 0.134

|

|

06/12/2017

|

|

Bought 7000 AUSI @ 0.134

|

|

06/12/2017

|

|

Bought 100 AUSI @ 0.15

|

|

06/21/2017

|

|

Sold 12100 AUSI @ 0.17

|

|

06/23/2017

|

|

Sold 20000 AUSI @ 0.16

|

|

06/23/2017

|

|

Sold 18100 AUSI @ 0.12

|

|

06/23/2017

|

|

Sold 17000 AUSI @ 0.12

|

|

06/23/2017

|

|

Sold 44758 AUSI @ 0.12

|

|

06/28/2017

|

|

Bought 148 AUSI @ 0.159

|

|

06/30/2017

|

|

Bought 5000 AUSI @ 0.137

|

|

07/03/2017

|

|

Bought 10110 AUSI @ 0.134

|

|

07/03/2017

|

|

Bought 6600 AUSI @ 0.134

|

|

07/03/2017

|

|

Bought 100 AUSI @ 0.15

|

|

07/06/2017

|

|

Bought 2 AUSI @ 0.10

|

I-

6

|

07/06/2017

|

|

Bought 5000 AUSI @ 0.10

|

|

07/07/2017

|

|

Bought 100 AUSI @ 0.114

|

|

07/10/2017

|

|

Bought 25000 AUSI @ 0.08

|

|

07/10/2017

|

|

Bought 15000 AUSI @ 0.07

|

|

07/10/2017

|

|

Bought 100 AUSI @ 0.099

|

|

07/10/2017

|

|

Bought 100 AUSI @ 0.109

|

|

07/11/2017

|

|

Bought 100 AUSI @ 0.097

|

|

07/11/2017

|

|

Bought 100 AUSI @ 0.109

|

|

07/11/2017

|

|

Bought 100 AUSI @ 0.105

|

|

07/11/2017

|

|

Bought 100 AUSI @ 0.105

|

|

07/13/2017

|

|

Sold 20802 AUSI @ 0.09

|

|

07/14/2017

|

|

Bought 100 AUSI @ 0.10

|

|

07/17/2017

|

|

Bought 100 AUSI @ 0.108

|

|

07/18/2017

|

|

Bought 100 AUSI @ 0.119

|

|

07/19/2017

|

|

Bought 100 AUSI @ 0.119

|

|

07/24/2017

|

|

Bought 4164 AUSI @ 0.101

|

|

07/25/2017

|

|

Bought 779 AUSI @ 0.119

|

|

07/25/2017

|

|

Bought 9221 AUSI @ 0.119

|

|

07/25/2017

|

|

Bought 300 AUSI @ 0.11

|

|

07/26/2017

|

|

Bought 2536 AUSI @ 0.122

|

|

07/26/2017

|

|

Bought 5000 AUSI @ 0.119

|

|

07/26/2017

|

|

Bought 7600 AUSI @ 0.11

|

|

07/28/2017

|

|

Bought 100 AUSI @ 0.123

|

|

07/28/2017

|

|

Bought 12000 AUSI @ 0.09

|

I-

7

|

07/28/2017

|

|

Bought 1472 AUSI @ 0.089

|

|

07/28/2017

|

|

Bought 100 AUSI @ 0.089

|

|

08/08/2017

|

|

Bought 10000 AUSI @ 0.072

|

|

08/08/2017

|

|

Bought 17800 AUSI @ 0.072

|

|

08/09/2017

|

|

Bought 18428 AUSI @ 0.075

|

|

08/09/2017

|

|

Bought 4000 AUSI @ 0.075

|

|

08/11/2017

|

|

Bought 572 AUSI @ 0.073

|

|

08/11/2017

|

|

Bought 100 AUSI @ 0.073

|

|

08/16/2017

|

|

Bought 100 AUSI @ 0.069

|

|

08/22/2017

|

|

Sold 13772 AUSI @ 0.064

|

|

08/23/2017

|

|

Bought 100 AUSI @ 0.069

|

|

08/23/2017

|

|

Bought 100 AUSI @ 0.085

|

|

08/24/2017

|

|

Bought 11300 AUSI @ 0.075

|

|

08/29/2017

|

|

Bought 9277 AUSI @ 0.07

|

|

08/29/2017

|

|

Bought 296 AUSI @ 0.066

|

|

08/30/2017

|

|

Bought 18000 AUSI @ 0.071

|

|

08/30/2017

|

|

Sold 12000 AUSI @ 0.071

|

|

08/30/2017

|

|

Bought 100 AUSI @ 0.084

|

|

08/30/2017

|

|

Bought 1404 AUSI @ 0.085

|

|

08/30/2017

|

|

Bought 12200 AUSI @ 0.084

|

|

08/30/2017