UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 6-K

_____________________

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of October, 2022

Commission File Number: 001-40816

_____________________

Argo Blockchain plc

(Translation of registrant’s name into English)

_____________________

9th Floor

16 Great Queen Street

London WC2B 5DG

England

(Address of principal executive office)

_____________________

Indicate

by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒

Form

40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper

as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper

as permitted by Regulation S-T Rule 101(b)(7): ☐

EXHIBIT INDEX

|

Exhibit No.

1

|

Description

Strategic

Actions to Strengthen the Balance Sheet dated 07 October

2022

|

Press Release

7 October 2022

Argo Blockchain plc

("Argo" or "the Company")

Announcement of Strategic Actions to Strengthen the Company's

Balance Sheet

●

Argo signs LOI to amend existing equipment financing

agreement

●

Argo plans to sell 3,400 mining machines for cash proceeds of

£6.0 million ($6.8m)

●

Argo intends to raise approximately £24 million ($27m) via

Proposed Subscription with a strategic investor

Argo Blockchain plc, a global leader in cryptocurrency mining (LSE:

ARB; NASDAQ: ARBK), is pleased to announce several strategic

actions that are intended to bring in additional capital to the

business and ensure that the Company has the working capital

necessary to execute its current strategy and meet its obligations

over the next twelve months.

As previously reported on 9 September 2022, the

Company has

seen headwinds from the price of both natural gas and electricity

caused by the geopolitical situation in Europe and low levels of

natural gas storage in the United States. These factors, coupled

with the decline in the price of Bitcoin since March 2022 and the

increased mining difficulty, have reduced the Company's

profitability and free cash flow generation.

The Company has been proactive in curtailing operations at its

flagship Helios facility in Dickens County, Texas, during periods

of high power prices and securing a more favourable short term

power purchase agreement ("PPA") with a new electricity provider.

The Company remains optimistic about securing a long term,

low-collateral, fixed price PPA and is continually reviewing its

other expenditures to identify and take additional steps to manage

the Company's costs.

In addition to the Company's measures to reduce costs and preserve

capital, Argo's Board of Directors ("Board") has made the

decision to pursue a combination of financing opportunities to

strengthen the Company's balance sheet. Based on its cost

reductions and the assumed completions of the transactions

described below on the terms set forth in the letters of intent and

presently anticipated timing, the Company believes its working

capital will be sufficient for its present requirements, that is

for at least the next twelve months from the date of this

announcement. The Company and the Board remain of the view that

following these strategic steps, Argo will be both well positioned

and capitalised to endure the current period of market dislocation.

The Board and the Company will continue to closely monitor the

Company's cash needs and available sources of capital.

A.

Amendment to Existing Equipment Financing

Agreement

The

Company has executed a non-binding letter of intent ("NYDIG LOI")

to amend its existing equipment financing agreement with an

affiliate of New York Digital Investment Group LLC ("NYDIG"). This

amendment releases approximately £5.0 million ($5.7 million)

of restricted cash and modifies the amortisation schedule for the

Company's existing loans. The transaction significantly reduces the

Company's debt service payments and links future payments for NYDIG

loans used to finance purchases of digital asset mining equipment

to network mining profitability. In exchange, the Company will

provide NYDIG with an expanded collateral package. The amended

equipment financing agreement is expected to contain customary

covenants for an agreement of its type. The Company and NYDIG

expect to close the amendment within the next few weeks, and a

further announcement will be made in due course.

B.

Sale of Mining Machines

In

addition, the Company has signed an agreement to sell to a third

party 3,400 new in box Bitmain S19J Pro machines, representing ~340

PH/s of total hashrate capacity, for cash proceeds of £6.0

million ($6.8 million). Argo will host these machines for the third

party at Helios pursuant to a hosting services agreement that

includes a profit sharing arrangement.

After accounting for this sale, the Company

expects to achieve a total hashrate capacity of 2.9 EH/s by the end

of October 2022.

C.

Conditional Subscription for Ordinary Shares

The

Company has entered into a non-binding letter of intent with a

strategic investor ("Investor") under which, subject to contract,

due diligence and other customary conditions, the Investor has

agreed to subscribe for approximately 87 million Ordinary Shares at

GBP £0.276 per Ordinary Share for gross proceeds of

approximately GBP £24 million ($27 million) (the

"Subscription").

Assuming

completion of the Subscription, the net proceeds of the

Subscription will be used by the Company for working capital and

general corporate purposes, including capital expenditures in

connection with the continued build out of its flagship Helios

facility in Dickens County, Texas.

Assuming

completion of the Subscription, the Investor will hold 15.46% of

the Company's enlarged issued share capital.

The

Investor will have the right to nominate two new non-executive

directors to the Board, subject to the Company's approval. One of

these new non-executive directors will replace an existing

non-executive director. Following these appointments, the Board

will consist of seven directors.

The

Subscription is limited to the Investor, and this announcement

should not be considered an offer or solicitation to purchase or

subscribe for securities in the United States.

The

Company and Investor expect to complete the Subscription within the

next 30 days, and a further announcement will be made in due

course.

Management Commentary

Peter Wall, Chief Executive at Argo Blockchain, said, "We have

worked relentlessly to create and execute on a strategy that will

support our objective of sustainable growth for the Company," Wall

continued. "We also understand the importance of maintaining

flexibility in our approach in order to respond swiftly to external

factors. We are glad to have a strong relationship with our lender

NYDIG, who has been working with us to provide flexibility and to

help ensure the long term success of the Company."

"Additionally, the sale of the 3,400 Bitmain machines generates

cash in the near term, and the Subscription with a major strategic

investor strengthens the balance sheet while adding significant

expertise in Bitcoin mining and digital asset management to the

Board. After careful consideration, we are convinced that taking

these steps will better position the Company to navigate the

current market conditions and preserve shareholder

value."

Operational Update

The Company's next regular monthly operational update will be

released on Tuesday 11 October 2022.

Consummation of Transactions Under Letters of Intent Subject to

Entry into Definitive Agreements

Argo and the respective parties to the letters of intent described

above intend to negotiate and execute definitive agreements in the

near term. There can, however, be no assurance that any definitive

agreements will be signed or that any transaction will be

consummated. In that circumstance, the Board would review

other financing options, of which there are a number currently

available. Should Argo be unsuccessful in completing any further

financing, Argo would become cash flow negative in the near term

and would need to curtail or cease operations. The Board of

Directors remains confident that the Company will be able to

complete the transactions described in this announcement or failing

that, other financing transactions to provide the Company with

working capital sufficient for its present requirements, that is

for at least the next twelve months from the date of this

announcement.

Inside Information and Forward-Looking Statements

This announcement contains inside information and includes

forward-looking statements which reflect the Company's or, as

appropriate, the Directors' current views, interpretations, beliefs

or expectations with respect to the Company's financial

performance, business strategy and plans and objectives of

management for future operations. These statements include

forward-looking statements both with respect to the Company and the

sector and industry in which the Company operates. Statements which

include the words "remains confident", "expects", "intends",

"plans", "believes", "projects", "anticipates", "will", "targets",

"aims", "may", "would", "could", "continue", "estimate", "future",

"opportunity", "potential" or, in each case, their negatives, and

similar statements of a future or forward-looking nature identify

forward-looking statements. All forward-looking statements address

matters that involve risks and uncertainties because they relate to

events that may or may not occur in the future, including the risk

that the Company may be unable to secure sufficient additional

financing to meet its operating needs. Forward-looking statements

are not guarantees of future performance. Accordingly, there are or

will be important factors that could cause the Company's actual

results, prospects and performance to differ materially from those

indicated in these statements. In addition, even if the Company's

actual results, prospects and performance are consistent with the

forward-looking statements contained in this document, those

results may not be indicative of results in subsequent periods.

These forward-looking statements speak only as of the date of this

announcement. Subject to any obligations under the Prospectus

Regulation Rules, the Market Abuse Regulation, the Listing Rules

and the Disclosure and Transparency Rules and except as required by

the FCA, the London Stock Exchange, the City Code or applicable law

and regulations, the Company undertakes no obligation publicly to

update or review any forward-looking statement, whether as a result

of new information, future developments or otherwise. For a more

complete discussion of factors that could cause our actual results

to differ from those described in this announcement, please refer

to the filings that Company makes from time to time with the United

States Securities and Exchange Commission and the United Kingdom

Financial Conduct Authority, including the section entitled "Risk

Factors" in the Company's Registration Statement on Form

F-1.

For further information please contact:

|

Argo Blockchain

|

|

|

Peter Wall

Chief

Executive

|

via Tancredi +44 203 434 2334

|

|

finnCap Ltd

|

|

|

Corporate

Finance

Jonny Franklin-Adams

Seamus Fricker

Joint

Corporate Broker

Sunila de Silva

|

+44 207 220 0500

|

|

Tennyson Securities

|

|

|

Joint

Corporate Broker

Peter Krens

|

+44 207 186 9030

|

|

OTC Markets

|

|

|

Jonathan Dickson

jonathan@otcmarkets.com

|

+44 204 526 4581

+44 7731 815 896

|

|

Tancredi Intelligent Communication

UK

& Europe Media Relations

|

|

|

Salamander Davoudi

Fabio Galloni-Roversi Monaco

Nasser Al-Sayed

argoblock@tancredigroup.com

|

+44 7957 549 906

+44 7888 672 701

+44 7915 033 739

|

About Argo:

Argo Blockchain plc is a dual-listed (LSE: ARB; NASDAQ: ARBK)

blockchain technology company focused on large-scale cryptocurrency

mining. With its flagship mining facility in Texas, and offices in

the US, Canada, and the UK, Argo's global, sustainable operations

are predominantly powered by renewable energy. In 2021, Argo became

the first climate positive cryptocurrency mining company, and a

signatory to the Crypto Climate Accord. Argo also participates in

several Web 3.0, DeFi and GameFi projects through its Argo Labs

division, further contributing to its business operations, as well

as the development of the cryptocurrency markets. For more

information, visit www.argoblockchain.com.

SIGNATURES

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant

has duly caused this report to be signed on its behalf by the

undersigned, thereunto duly authorized.

|

Date:

07 October, 2022

|

ARGO BLOCKCHAIN PLC

By:

Name:

Peter Wall

Title:

Chief Executive Officer

Name:

David Zapffe

Title:

General Counsel

|

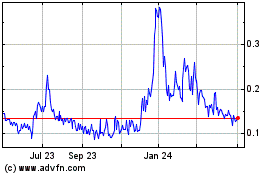

Argo Blockchain (PK) (USOTC:ARBKF)

Historical Stock Chart

From Mar 2024 to Apr 2024

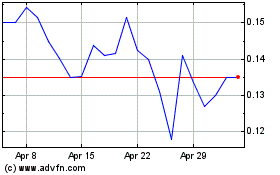

Argo Blockchain (PK) (USOTC:ARBKF)

Historical Stock Chart

From Apr 2023 to Apr 2024