UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

_____________________

FORM 6-K

_____________________

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE

13a-16 OR 15d-16

UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of April, 2022

Commission File Number: 001-40816

_____________________

Argo Blockchain plc

(Translation of

registrant’s name into English)

_____________________

9th Floor

16

Great Queen Street

London WC2B

5DG

England

(Address of

principal executive

office)

_____________________

Indicate

by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒

Form

40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper

as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper

as permitted by Regulation S-T Rule 101(b)(7): ☐

EXHIBIT INDEX

|

Exhibit

No.

1

|

Description

March

2022 Operational Update dated 08 April 2022

|

Press Release

8 April 2022

Argo Blockchain PLC

("Argo" or "the Company")

March 2022 Operational Update

Operational

Update

Argo Blockchain plc, a global leader in cryptocurrency mining (LSE:

ARB; NASDAQ: ARBK), is pleased to provide the following operational

update for March 2022.

During the month of March, Argo mined 163 Bitcoin or Bitcoin

Equivalent (together, BTC) compared to 135 BTC in February

2022.

Based on daily foreign exchange rates and cryptocurrency prices

during the month, mining revenue in March amounted to £5.22

million [$6.92 million*] (February 2022: £4.15 million [$5.58

million*]).

Argo generated this income at a Bitcoin and Bitcoin Equivalent

Mining Margin of approximately 74% for the month of March (February

2022: 71%).

At the end of March, the Company owned 2,700 Bitcoin, of which 259

were BTC equivalents.

Appointment of Chief Operating Officer

Argo is also pleased to announce the appointment of Seif El-Bakly

as Chief Operating Officer. Seif has over 16 years' experience in

the capital markets and trading sectors. Prior to joining Argo,

Seif founded a fintech startup and worked for TMX Group, where his

responsibilities included leading the strategy and business

management efforts for the entire Markets Business. Fluent in three

languages, Seif graduated from Concordia University's John Molson

School of Business and is a CFA Charterholder.

Update on Helios Facility

The Company is also pleased to provide the following update on the

construction of its 200MW flagship cryptocurrency mining facility,

Helios, in Dickens County, Texas. The Company has continued to make

significant progress on this stage of construction and expects

mining operations to commence at Helios in Q2 2022. Argo has

successfully installed critical equipment, including immersion

pumps, air coolers, transformers, power distribution units, and

pallet racks. Additionally, the fiber internet connection to Helios

has now been completed.

Participation in April Conferences

The Company is also pleased to announce that Chief Executive, Peter

Wall, participated in a panel discussion entitled "Mining the

Public Markets" at the Bitcoin 2022 conference in Miami on 7 April.

He will also be participating in a panel discussion entitled

"Sustainability & Energy Efficiency of Bitcoin Mining" at the

virtual Cowen Bitcoin Mining Summit on 12-13 April.

Peter Wall, Chief Executive and interim Chairman, said: "We are

delighted to welcome Seif as our Chief Operating Officer. He will

play a critical role in bolstering Argo's senior leadership team

and brings a wealth of experience in the trading and capital

markets sectors to Argo. As we approach the opening of our Helios

facility and significantly scale up our owned and operated mining

operations, Seif will be integral in driving the operational

performance of Argo."

Non-IFRS Measures

Bitcoin and Bitcoin Equivalent Mining Margin is a financial measure

not defined by IFRS. We believe Bitcoin and Bitcoin Equivalent

Mining Margin has limitations as an analytical tool. In particular,

Bitcoin and Bitcoin Equivalent Mining Margin excludes the

depreciation of mining equipment and so does not reflect the full

cost of our mining operations, and it also excludes the effects of

fluctuations in the value of digital currencies and realized losses

on the sale of digital assets, which affect our IFRS gross profit.

This measure should not be considered as an alternative to gross

margin determined in accordance with IFRS, or other IFRS measures.

This measure is not necessarily comparable to similarly titled

measures used by other companies. As a result, you should not

consider this measure in isolation from, or as a substitute

analysis for, our gross margin as determined in accordance with

IFRS.

The following table shows a reconciliation of gross margin to

Bitcoin and Bitcoin Equivalent Mining Margin, the most directly

comparable IFRS measure, for the months of February 2022 and March

2022.

|

|

Month

Ended 28 February 2022

|

Month

Ended 31 March 2022

|

|

|

£

|

$

|

£

|

$

|

|

Gross (loss)/profit¹

|

11,383,225

|

15,372,973

|

2,453,564

|

3,313,522

|

|

Gross

Margin

|

276%

|

276%

|

48%

|

48%

|

|

Depreciation

of mining equipment

|

1,287,252

|

1,738,426

|

1,313,598

|

1,774,006

|

|

Charge

in fair value of digital currencies

|

(9,380,856)

|

(12,668,786)

|

40,937

|

55,285

|

|

Realised

loss/(gain) on sale of digital currencies

|

(377,028)

|

(509,174)

|

3,628

|

4,900

|

|

|

|

|

|

|

|

Mining Profit

|

2,912,593

|

3,933,439

|

3,811,727

|

5,147,713

|

|

Bitcoin

and Bitcoin Equivalent Mining Margin

|

71%

|

71%

|

74%

|

74%

|

(1) Due to favourable changes in the fair value of Bitcoin and

Bitcoin Equivalents in February 2022 there was a gain on change in

fair value of digital currencies. March 2022 resulted in a loss due

to unfavourable changes in the fair value of digital

currencies.

* Dollar values translated from pound sterling into U.S. dollars

using the noon buying rate of the Federal Reserve Bank of New York

as at the applicable dates.

Inside Information and Forward-Looking Statements

This announcement contains inside information and includes

forward-looking statements which reflect the Company's or, as

appropriate, the Directors' current views, interpretations, beliefs

or expectations with respect to the Company's financial

performance, business strategy and plans and objectives of

management for future operations. These statements include

forward-looking statements both with respect to the Company and the

sector and industry in which the Company operates. Statements which

include the words "expects", "intends", "plans", "believes",

"projects", "anticipates", "will", "targets", "aims", "may",

"would", "could", "continue", "estimate", "future", "opportunity",

"potential" or, in each case, their negatives, and similar

statements of a future or forward-looking nature identify

forward-looking statements. All forward-looking statements address

matters that involve risks and uncertainties because they relate to

events that may or may not occur in the future. Forward-looking

statements are not guarantees of future performance. Accordingly,

there are or will be important factors that could cause the

Company's actual results, prospects and performance to differ

materially from those indicated in these statements. In addition,

even if the Company's actual results, prospects and performance are

consistent with the forward-looking statements contained in this

document, those results may not be indicative of results in

subsequent periods. These forward-looking statements speak only as

of the date of this announcement. Subject to any obligations under

the Prospectus Regulation Rules, the Market Abuse Regulation, the

Listing Rules and the Disclosure and Transparency Rules and except

as required by the FCA, the London Stock Exchange, the City Code or

applicable law and regulations, the Company undertakes no

obligation publicly to update or review any forward-looking

statement, whether as a result of new information, future

developments or otherwise. For a more complete discussion of

factors that could cause our actual results to differ from those

described in this announcement, please refer to the filings that

Company makes from time to time with the United States Securities

and Exchange Commission and the United Kingdom Financial Conduct

Authority, including the section entitled "Risk Factors" in the

Company's Registration Statement on Form F-1.

For further information please contact:

|

Argo

Blockchain

|

|

|

Peter

Wall

Chief

Executive

|

via Tancredi +44 203 434 2334

|

|

finnCap Ltd

|

|

|

Corporate

Finance

Jonny Franklin-Adams

Tim Harper

Joint

Corporate Broker

Sunila

de Silva

|

+44

207 220 0500

|

|

Tennyson Securities

|

|

|

Joint

Corporate Broker

Peter Krens

|

+44

207 186 9030

|

|

OTC Markets

|

|

|

Jonathan

Dickson

jonathan@otcmarkets.com

|

+44

204 526 4581

+44

7731 815 896

|

|

Tancredi Intelligent Communication

UK

& Europe Media Relations

|

|

|

Emma Valgimigli

Emma Hodges

Fabio Galloni-Roversi Monaco

Nasser Al-Sayed

argoblock@tancredigroup.com

|

+44 7727 180 873

+44 7861 995 628

+44 7888 672 701

+44 7915 033 739

|

About Argo:

Argo Blockchain plc is a global leader in cryptocurrency mining

with one of the largest and most efficient operations powered by

clean energy. The Company is headquartered in London, UK and its

shares are listed on the Main Market of the London Stock Exchange

under the ticker: ARB and on the Nasdaq Global Select Market in the

United States under the ticker: ARBK.

SIGNATURES

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant

has duly caused this report to be signed on its behalf by the

undersigned, thereunto duly authorized.

|

Date:

08 April, 2022

|

ARGO BLOCKCHAIN PLC

By:

Name:

Peter

Wall

Title:

Chief

Executive Officer

Name:

Davis

Zaffe

Title:

General

Counsel

|

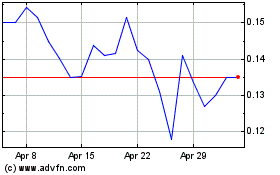

Argo Blockchain (PK) (USOTC:ARBKF)

Historical Stock Chart

From Mar 2024 to Apr 2024

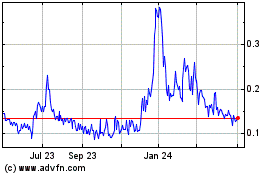

Argo Blockchain (PK) (USOTC:ARBKF)

Historical Stock Chart

From Apr 2023 to Apr 2024