This prospectus relates to

the resale of up to an aggregate of 41,133,333 outstanding shares of common stock, par value $0.001 per share, of Applied Energetics,

Inc. to be sold by selling stockholders named herein (whom we refer to as the “Selling Stockholders”). Each of the Selling

Stockholders purchased the shares in a private transaction as described herein.

The Selling Stockholders are

offering their shares at varying prices, at different times and in different ways. Information on the Selling Stockholders and the times

and manner in which they may offer and sell shares of our common stock under this prospectus is provided under “Selling Stockholders”

and “Plan of Distribution.” We are not offering any shares under this Prospectus, nor will Applied Energetics receive any

of the proceeds from this offering. We expect to pay for expenses associated with the registration and offering of the shares under this

Prospectus

Shares of our common stock

trade on the OTCQB Market under the symbol “AERG”. On April 15, 2021, the closing price of our common stock was $.75 per share.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and

current reports, proxy statements, and other information with the SEC. Such reports, proxy statements, and other information concerning

us can be read and copied at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549 or on the Internet at

http://www.sec.gov. Please call the SEC at 1-800-SEC-0330 for further information on the Public Reference Room. The

SEC also maintains a web site at http://www.sec.gov that contains reports, proxy statements and other information about issuers, such

as us, who file electronically with the SEC.

We have filed with the SEC

a registration statement on Form S-3 under the Securities Act of 1933, as amended (the “Securities Act”) with respect to the

securities covered by this prospectus. This prospectus, which is a part of the registration statement, does not contain all of the information

set forth in the registration statement or the exhibits and schedules filed therewith. For further information with respect to us and

the securities covered by this prospectus, please see the registration statement and the exhibits filed with the registration statement.

A copy of the registration statement and the exhibits filed with the registration statement may be inspected without charge from

the SEC as indicated above, or from us as indicated under “Incorporation by Reference.”

INCORPORATION BY REFERENCE

The SEC allows us to “incorporate

by reference” into this prospectus the information that we file with the SEC. This permits us to disclose important information

to you by referring to these filed documents. Any information referred to in this way is considered part of this prospectus, and any information

filed with the SEC by us after the date of this prospectus will automatically be deemed to update and supersede this information. We incorporate

by reference the following documents that have been filed with the SEC (other than, in each case, documents or information deemed furnished

and not filed in accordance with SEC rules, including pursuant to Item 2.02 or Item 7.01 or any related exhibit furnished under Item 9.01(d)

of Form 8-K, and no such information shall be deemed specifically incorporated by reference hereby):

|

|

●

|

Annual Report on Form 10-K for the fiscal year ended December 31, 2020;

|

|

|

●

|

Current Reports on Form 8-K filed with the SEC on July 16, 18 and 19, October 31, and November 8, 2019, January 6, March 10, June 4 and 15, August 5, September 2, 3, 10 and 29, October 6 and November 12, 2020 and January 7 and February 3 and 9, 2021.

|

We also incorporate by reference

any future filings (other than information in such documents that is not deemed to be filed) made with the SEC pursuant to Sections 13(a),

13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) until we file a post-effective

amendment which indicates the termination of the offering of the securities made by this prospectus.

Any statement contained in

a document incorporated or deemed to be incorporated by reference in this prospectus will be deemed to be modified or superseded to the

extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by

reference in this prospectus modifies or supersedes that statement. Any statement so modified or superseded will not be deemed, except

as so modified or supersede, to constitute a part of this prospectus.

Upon written or oral request,

we will provide, without charge, each person to whom a copy of this prospectus is delivered, a copy of any document incorporated by reference

in this prospectus (other than exhibits, unless such exhibits are specifically incorporated by reference in such documents). Requests

should be directed to Applied Energetics Inc. 2480 W Ruthrauff Road, Suite 140Q, Tucson, AZ 85705 Attn. Stephen McCommon, Finance Manager.

USE OF MARKET AND INDUSTRY DATA

This prospectus includes market

and industry data that has been obtained from third party sources, including industry publications, as well as industry data prepared

by our management on the basis of its knowledge of and experience in the industries in which we operate (including our management’s

estimates and assumptions relating to such industries based on that knowledge). Management’s knowledge of such industries has been

developed through its experience and participation in these industries. While our management believes the third-party sources referred

to in this prospectus are reliable, neither we nor our management have independently verified any of the data from such sources referred

to in this prospectus or ascertained the underlying economic assumptions relied upon by such sources. Internally prepared and third-party

market forecasts, in particular, are estimates only and may be inaccurate, especially over long periods of time. In addition, we have

not independently verified any of the industry data prepared by management or ascertained the underlying estimates and assumptions relied

upon by management. Furthermore, references in this prospectus to any publications, reports, surveys or articles prepared by third parties

should not be construed as depicting the complete findings of the entire publication, report, survey or article. The information in any

such publication, report, survey or article is not incorporated by reference in this prospectus.

CAUTIONARY STATEMENT ON FORWARD-LOOKING INFORMATION

This prospectus contains certain

statements relating to our future results that are considered “forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995. Some of these statements can be identified by use of forward-looking words such as “believes,”

“expects,” “anticipates,” “may,” “should,” “seeks,” “approximately,”

“intends,” “plans” or “estimates,” or the negative of these words, or other comparable terminology.

The discussion of financial trends, strategy, plans or intentions may also include forward-looking statements. Actual results may differ

materially from those expressed or implied as a result of certain risks and uncertainties, including, but not limited to, changes in political

and economic conditions; interest rate fluctuation; competitive pricing pressures within our market; equity and fixed income market fluctuation;

technological change; changes in law; changes in fiscal, monetary regulatory and tax policies as well as other risks and uncertainties

detailed elsewhere in this prospectus or from time-to-time in our filings with the Securities and Exchange Commission. Such forward-looking

statements speak only as of the date on which such statements are made, and we undertake no obligation to update any forward-looking statement

to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events.

You should not consider the

above list to be a complete statement of all risks and uncertainties. You are cautioned not to place undue reliance on any such forward-looking

statements, which speak only as of the date such statements were first made. Except to the extent required by federal securities laws,

we undertake no obligation to publicly release the result of any revisions to these forward-looking statements to reflect events or circumstances

after the date hereof or to reflect the occurrence of unanticipated events.

RISK FACTORS

Investing in our securities

involves a high degree of risk. Before making a decision to invest in our securities, in addition to the other information contained in

this prospectus, any accompanying prospectus supplement or any related free writing prospectus, or incorporated by reference herein or

therein, you should carefully consider the risks discussed under “Risk Factors” in

our most recent Annual Report on Form 10-K, in our Quarterly Reports on Form 10-Q, in any prospectus supplement related hereto, and in

other information contained in our publicly available SEC filings and press releases. See “Where You Can Find Additional Information.”

USE OF PROCEEDS

The sale of the shares of our

common stock offered by this Prospectus are for the account of the Selling Stockholders, and therefore, we will not receive any of the

proceeds from the sale of these shares.

APPLIED ENERGETICS, INC.

Applied

Energetics, Inc. is a corporation organized and existing under the laws of the State of Delaware. Our executive office is located at 2480

W Ruthrauff Road, Suite 140 Q, Tucson, Arizona, 85705 and our telephone number is (520) 628-7415.

Applied

Energetics specializes in the development and manufacture of advanced high-performance lasers, high voltage electronics, advanced optical

systems, and integrated guided energy systems for defense, aerospace, industrial, and scientific customers worldwide.

AERG

has developed, successfully demonstrated and holds all crucial ownership rights to a dynamic Directed Energy technology called Laser Guided

Energy (“LGE”) and its companion, Laser Induced Plasma Channel (“LIPC”). LGE and LIPC are technologies that can

be used in a new generation of high-tech weapons. Currently, there are two key types of Directed Energy Weapon (“DEW”) technologies,

High Energy Lasers (“HEL”), and High-Power Microwave (“HPM”). Neither HEL nor HPM is owned by a single entity.

Now, there is a third DEW technology, LGE. Applied Energetics’ LGE and LIPC technologies are owned by Applied Energetics and patent

protected with 25 current patents and an additional 11 Government Sensitive Patent Applications (“GSPA”). The GSPA’s

are held under secrecy orders of the US government and allow AERG greatly extended protection rights.

Applied

Energetics’ technology is significantly different from conventional directed energy weapons, i.e. HEL, and HPM. LGE uses Ultra-Short

Pulse (USP) technology to combine the speed and precision of lasers with the overwhelming punch of high-voltage electricity. This advanced

technology allows extremely high peak power and energy, with target and effects tenability, and is effective against a wide variety of

potential targets. A key element of LGE is its novel ability to offer selectable and tunable properties that can help protect non-combatants

and combat zone infrastructure.

As

Applied Energetics moves toward the future, our business strategy reflects upon the significant value of the company’s key intellectual

properties, including LGE and LIPC, and technologies involving Advanced Ultra Short-Pulse (“AUSP”).

We

will pay for the expenses of this offering, except that the selling stockholders will pay any broker discounts or commissions or equivalent

expenses and expenses of selling stockholder legal counsel applicable to any sale of the shares.

SELLING STOCKHOLDERS

The following table sets forth

the information as to the ownership of our securities by the Selling Stockholders on April 11, 2021, at which time 199,375,149 shares

of our common stock were outstanding. Unless otherwise indicated, it is assumed that each Selling Stockholder listed below

possesses sole voting and investment power with respect to the shares owned as of such date by the Selling Stockholder,

|

Selling Stockholder (2)

|

|

Shares of

Common

Stock

Owned

Before the

Offering

|

|

|

Total Number

of Shares of

Common

Stock to be

Offered (1) (2)

|

|

|

Shares of

Common

Stock to be

Beneficially

Owned

After the

Offering (2)

|

|

|

Percentage

of Common

Stock

Beneficially

Owned

After the

Offering

|

|

|

Dan W. Baer

|

|

|

8,227,733

|

|

|

|

4,333,333

|

|

|

|

3,894,400

|

|

|

|

2

|

|

|

Jonathan Barcklow (3)

|

|

|

6,000,000

|

(3)

|

|

|

1,000,000

|

|

|

|

5,000,000

|

|

|

|

2.1

|

|

|

Thomas R. Brown

|

|

|

500,000

|

|

|

|

500,000

|

|

|

|

-0-

|

|

|

|

—

|

|

|

Rene R. Carlis

|

|

|

300,000

|

|

|

|

300,000

|

|

|

|

-0-

|

|

|

|

—

|

|

|

Christopher H. Daly

|

|

|

1,265,846

|

|

|

|

500,000

|

|

|

|

765,846

|

|

|

|

*

|

|

|

S. Preston Dillard

|

|

|

1,000,000

|

|

|

|

1,000,000

|

|

|

|

-0-

|

|

|

|

—

|

|

|

Elizabeth P. Vaughan - CPVTrust

|

|

|

2,000,000

|

(4)

|

|

|

2,000,000

|

|

|

|

-0-

|

|

|

|

—

|

|

|

Douglas M Faris

|

|

|

7,425,000

|

|

|

|

2,500,000

|

|

|

|

4,925,000

|

|

|

|

1.8

|

|

|

Scott Preston Harrison

|

|

|

1,000,000

|

|

|

|

1,000,000

|

|

|

|

-0-

|

|

|

|

—

|

|

|

Charles M. Johnson

|

|

|

3,584,977

|

|

|

|

3,333,333

|

|

|

|

251,644

|

|

|

|

—

|

|

|

Robert V. Katherman

|

|

|

7,282,131

|

|

|

|

1,500,000

|

|

|

|

5,782,131

|

|

|

|

1.7

|

|

|

Ryan Keelin

|

|

|

3,572,577

|

|

|

|

1,666,667

|

|

|

|

1,905,910

|

|

|

|

*

|

|

|

Alexander C. McAree

|

|

|

2,666,667

|

|

|

|

1,000,000

|

|

|

|

1,666,667

|

|

|

|

—

|

|

|

Kevin T. McFadden

|

|

|

12,100,000

|

|

|

|

12,000,000

|

|

|

|

100,000

|

|

|

|

—

|

|

|

Moriah Stone Global LP (5)

|

|

|

1,563,599

|

(5)

|

|

|

1,000,000

|

|

|

|

563,599

|

|

|

|

—

|

|

|

Robert Harris

|

|

|

3,600,000

|

|

|

|

1,000,000

|

|

|

|

2,600,000

|

|

|

|

1.2

|

|

|

E. Lee Pinney, Jr.

|

|

|

5,028,160

|

|

|

|

3,500,000

|

|

|

|

1,528,160

|

|

|

|

*

|

|

|

Michael Kevin Rowe

|

|

|

701,125

|

|

|

|

500,000

|

|

|

|

201,125

|

|

|

|

*

|

|

|

Khang Ting

|

|

|

500,000

|

|

|

|

500,000

|

|

|

|

-0-

|

|

|

|

|

|

|

Alan Porter Vaughan

|

|

|

1,762,500

|

(6)

|

|

|

1,500,000

|

|

|

|

262,500

|

|

|

|

*

|

|

|

Watson Howell Wright

|

|

|

1,254,987

|

|

|

|

500,000

|

|

|

|

754,987

|

|

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL

|

|

|

71,335,302

|

|

|

|

41,133,333

|

|

|

|

30,201,969

|

|

|

|

|

|

|

|

(1)

|

Represents the shares held

by the selling stockholders which we have agreed to include in this Prospectus.

|

|

|

(2)

|

Assumes all of the shares being

offered under this Prospectus will be sold by the Selling Stockholders. However, we are unable to determine the exact number of shares

that will actually be sold hereunder.

|

|

|

(3)

|

Includes 5,000,000 share underlying

employee options. Mr. Barcklow is Vice President, Secretary and a director of the Company.

|

|

|

(4)

|

Shares not included in those

owned by Alan Vaughan who is the beneficiary of a 25% interest in the Elizabeth P. Vaughan - CPVTrust. See note 6.

|

|

|

(5)

|

Moriah Stone Global LP is beneficially

owned by Bradford T. Adamczyk, our Chairman and a director. As such, Mr. Adamczyk is deemed to beneficially own shares held by Moriah

Stone Global LP. Mr. Adamczyk also holds in his own name 671,486 shares of common stock and 5,000,000 share underlying employee options.

|

|

|

(6)

|

Includes 1,750,000 shares held

directly by Mr. Vaughan, 12,500 shares underlying warrants but does not include 2 million shares held by Elizabeth P. Vaughan CPV Trust,

of which Mr. Vaughan is one of four beneficiaries. Also does not include 171,096 shares held by ProspectBlue Ventures LLC, of which Mr.

Vaughan is the Managing Partner.

|

The information set forth above

is based upon information obtained from the selling stockholders and upon information in our possession regarding the issuance of shares

of common stock and warrants to the selling stockholders in connection with private placement transactions. None of the selling stockholders

has within the past three years had any position, office or other material relationship with us or any of our subsidiaries other than

as a holder of shares of our common stock or warrants.

PLAN OF DISTRIBUTION

Each Selling Stockholder (the

“Selling Stockholders”) of the securities and any of their pledgees, assignees and successors-in-interest may, from

time to time, sell any or all of their securities covered hereby on the OTCQB or any other stock exchange, market or trading facility

on which the securities are traded or in private transactions. These sales may be at fixed or negotiated prices. A Selling Stockholder

may use any one or more of the following methods when selling securities:

|

|

●

|

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

|

|

●

|

block trades in which the broker-dealer will attempt to sell the securities as agent but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

●

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

|

●

|

an exchange distribution in accordance with the rules of the applicable exchange;

|

|

|

●

|

privately negotiated transactions;

|

|

|

●

|

settlement of short sales entered into after the effective date of the registration statement of which this prospectus is a part;

|

|

|

●

|

in transactions through broker-dealers that agree with the Selling Stockholders to sell a specified number of such securities at a stipulated price per security;

|

|

|

●

|

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

|

|

|

●

|

a combination of any such methods of sale; or

|

|

|

●

|

any other method permitted pursuant to applicable law.

|

The Selling Stockholders may

also sell securities under Rule 144 under the Securities Act of 1933, as amended (the “Securities Act”), if available,

rather than under this prospectus.

Broker-dealers engaged by the

Selling Stockholders may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts

from the Selling Stockholders (or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser) in amounts

to be negotiated, but, except as set forth in a supplement to this Prospectus, in the case of an agency transaction, not in excess of

a customary brokerage commission in compliance with FINRA Rule 2440; and in the case of a principal transaction a markup or markdown in

compliance with FINRA IM-2440.

In connection with the sale

of the securities or interests therein, the Selling Stockholders may enter into hedging transactions with broker-dealers or other financial

institutions, which may in turn engage in short sales of the securities in the course of hedging the positions they assume. The Selling

Stockholders may also sell securities short and deliver these securities to close out their short positions, or loan or pledge the securities

to broker-dealers that in turn may sell these securities. The Selling Stockholders may also enter into option or other transactions with

broker-dealers or other financial institutions or create one or more derivative securities which require the delivery to such broker-dealer

or other financial institution of securities offered by this prospectus, which securities such broker-dealer or other financial institution

may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

We will pay all of the expenses

incident to the registration, offering, and sale of the shares to the public other than commissions or discounts of underwriters, broker-dealers,

or agents. Any commissions, discounts or other fees payable to brokers-dealers in connection with any sale of the shares of common stock

will be borne by the selling stockholders, the purchasers participating in such transaction, or both.

The Selling Stockholders and

any broker-dealers or agents that are involved in selling the securities may be deemed to be “underwriters” within the meaning

of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any

profit on the resale of the securities purchased by them may be deemed to be underwriting commissions or discounts under the Securities

Act. We know of no existing arrangements between the selling stockholders, any other shareholder, broker, dealer, underwriter, or agent

relating to the sale or distribution of the shares offered by this prospectus. In no event shall any broker-dealer receive fees, commissions

and markups which, in the aggregate, would exceed eight percent (8%).

Because Selling Stockholders

may be deemed to be “underwriters” within the meaning of the Securities Act, they will be subject to the prospectus delivery

requirements of the Securities Act including Rule 172 thereunder. In addition, any securities covered by this Prospectus which qualify

for sale pursuant to Rule 144 under the Securities Act may be sold under Rule 144 rather than under this Prospectus.

We agreed to keep this Prospectus

effective until the earlier of (i) the date on which the securities may be resold by the Selling Stockholders without registration and

without regard to any volume or manner-of-sale limitations by reason of Rule 144, without the requirement for the Company to be in compliance

with the current public information under Rule 144 under the Securities Act or any other rule of similar effect or (ii) all of the securities

have been sold pursuant to this prospectus or Rule 144 under the Securities Act or any other rule of similar effect. The resale securities

will be sold only through registered or licensed brokers or dealers if required under applicable state securities laws. In addition, in

certain states, the resale securities covered hereby may not be sold unless they have been registered or qualified for sale in the applicable

state or an exemption from the registration or qualification requirement is available and is complied with.

Under applicable rules and regulations under

the Exchange Act, any person engaged in the distribution of the resale shares may not simultaneously engage in market making activities

with respect to the common stock for the applicable restricted period, as defined in Regulation M, prior to the commencement of the distribution.

In addition, the Selling Stockholders will be subject to applicable provisions of the Exchange Act and the rules and regulations thereunder,

including Regulation M, which may limit the timing of purchases and sales of shares of the common stock by the Selling Stockholders or

any other person. We will make copies of this Prospectus available to the Selling Stockholders and have informed them of the need to deliver

a copy of this Prospectus to each purchaser at or prior to the time of the sale (including by compliance with Rule 172 under the Securities

Act).

Penny Stock Rules

Our shares of common stock

are subject to the “penny stock” rules of the Exchange Act. In general terms, “penny stock” is defined as any

equity security that has a market price less than $5.00 per share, subject to certain exceptions. The rules provide that any equity security

is considered to be a penny stock unless that security is registered and traded on a national securities exchange meeting specified criteria

set by the SEC, authorized for quotation from the NASDAQ stock market, issued by a registered investment company, and excluded from the

definition on the basis of price (at least $5.00 per share), or based on the issuer’s net tangible assets or revenues. In the last

case, the issuer’s net tangible assets must exceed $3,000,000 if in continuous operation for at least three years or $5,000,000

if in operation for less than three years, or the issuer’s average revenues for each of the past three years must exceed $6,000,000.

Trading in shares of penny

stock is subject to additional sales practice requirements for broker-dealers who sell penny stocks to persons other than established

customers and accredited investors. Accredited investors, in general, include individuals with assets in excess of $1,000,000 or annual

income exceeding $200,000 (or $300,000 together with their spouse), and certain institutional investors. For transactions covered by these

rules, broker-dealers must make a special suitability determination for the purchase of the security and must have received the purchaser’s

written consent to the transaction prior to the purchase. Additionally, for any transaction involving a penny stock, the rules require

the delivery, prior to the first transaction, of a risk disclosure document relating to the penny stock. A broker-dealer also must disclose

the commissions payable to both the broker-dealer and the registered representative, and current quotations for the security. Finally,

monthly statements must be sent disclosing recent price information for the penny stocks. These rules may restrict the ability of broker-dealers

to trade or maintain a market in our common stock, to the extent it is penny stock, and may affect the ability of stockholders to sell

their shares.

DESCRIPTION OF SECURITIES

The following description of

our capital stock being registered herein is a summary only and is qualified in its entirety by reference to our Articles of Incorporation,

as amended, and Amended and Restated Bylaws, which are included as Exhibits 3.1 through 3.7 of the Company’s Annual Report on Form

10-K (incorporating such documents by reference to prior reports on file with the SEC by the Company).

Common Stock

We are authorized to issue

up to 500,000,000 shares of common stock, $0.001 par value per share. Holders of our common stock are entitled to receive dividends when

and as declared by our board of directors out of funds legally available. Holders of our common stock are entitled to one vote for each

share on all matters voted on by stockholders, including the election of directors. Holders of our common stock do not have any conversion,

redemption or preemptive rights. In the event of our dissolution, liquidation or winding up, holders of our common stock are entitled

to share ratably in any assets remaining after the satisfaction in full of the prior rights of creditors and the aggregate liquidation

preference of any preferred stock then outstanding. The rights, preferences and privileges of the holders of our common stock are subject

to, and may be adversely affected by, the rights of the holders of shares of any series of preferred stock that we may designate and issue

in the future.

Preferred Stock

As of December 31, 2020 and

2019, there were 13,602 shares of Series A Redeemable Convertible Preferred Stock (the “Series A Preferred Stock”) outstanding.

The company has not paid the dividends commencing with the quarterly dividend due August 1, 2013. Dividend arrearages as of December 31,

2020 and April 8, 2021 were approximately $261,000 and $270,000, respectively. Our Board of Directors suspended the declaration of the

dividend, commencing with the dividend payable as of February 1, 2015 since we did not have a surplus (as such term is defined in the

Delaware general corporation Law) as of December 31, 2014, until such time as we have a surplus or net profits for a fiscal year.

Our Series A Preferred Stock

has a liquidation preference of $25.00 per Share. The Series A Preferred Stock bears dividends at the rate of 6.5% of the liquidation

preference per share per annum, which accrues from the date of issuance, and is payable quarterly. Dividends may be paid in: (i) cash,

(ii) shares of our common stock (valued for such purpose at 95% of the weighted average of the last sales prices of our common stock for

each of the trading days in the ten trading day period ending on the third trading day prior to the applicable dividend payment date),

provided that the issuance and/or resale of all such shares of our common stock are then covered by an effective registration statement

and the company’s common stock is listed on a U.S. national securities exchange or the Nasdaq Stock Market at the time of issuance

or (iii) any combination of the foregoing. If the company fails to make a dividend payment within five business days following a dividend

payment date, the dividend rate shall immediately and automatically increase by 1% from 6.5% of the liquidation preference per offered

share of Series A preferred stock to 7.5% of such liquidation preference. If a payment default shall occur on two consecutive dividend

payment dates, the dividend rate shall immediately and automatically increase to 10% of the liquidation preference for as long as such

payment default continues and shall immediately and automatically return to the Initial dividend rate at such time as the payment default

is no longer continuing.

Transfer Agent and Registrar

The transfer agent and registrar

for our common stock is Continental Stock Transfer & Trust Company.

LEGAL MATTERS

Unless otherwise stated in an accompanying prospectus

supplement, Masur Griffitts Avidor LLP, New York, New York, will provide us with an

opinion as to the legality of the securities offered under this prospectus.

EXPERTS

The consolidated financial statements of Applied

Energetics, Inc. and subsidiary, as of and for the year ended December 31, 2020, have been incorporated by reference herein in reliance

upon the report of RBSM LLP, independent registered public accounting firm, and upon the authority of said firm as expert in accounting

and auditing.

9

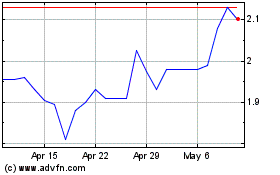

Applied Energetics (QB) (USOTC:AERG)

Historical Stock Chart

From Mar 2024 to Apr 2024

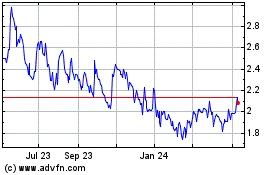

Applied Energetics (QB) (USOTC:AERG)

Historical Stock Chart

From Apr 2023 to Apr 2024