Anglo American: De Beers to Post $467 Million Diamond Sales for 8th Cycle

October 14 2020 - 3:01AM

Dow Jones News

By Jaime Llinares Taboada

Anglo American PLC said Wednesday that its subsidiary De Beers

Group expects to report diamond sales of $467 million during the

current sales cycle, as demand for rough stones improves

steadily.

The FTSE 100 mining company said the $467 million revenue is for

the period between Sept. 21 and Oct. 9. This would be up from $297

million a year earlier, and from $334 million in the seventh cycle

of 2020--which ran from Aug. 19 until Sept. 10.

Anglo American said it has implemented a more flexible approach

to rough-diamond sales in the period, with the "sight," or sales,

event extended beyond its normal duration.

"We continue to see a steady improvement in demand for rough

diamonds in the eighth sales cycle of the year, with cutters and

polishers increasing their purchases as retail orders come through

ahead of the key holiday season," De Beers Group Chief Executive

Bruce Cleaver said.

Anglo American owns 85% of De Beers Group.

Write to Jaime Llinares Taboada at jaime.llinares@wsj.com;

@JaimeLlinaresT

(END) Dow Jones Newswires

October 14, 2020 02:46 ET (06:46 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

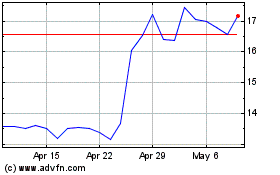

Anglo American (QX) (USOTC:NGLOY)

Historical Stock Chart

From Mar 2024 to Apr 2024

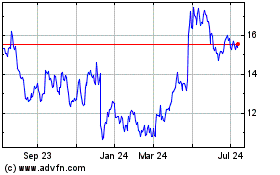

Anglo American (QX) (USOTC:NGLOY)

Historical Stock Chart

From Apr 2023 to Apr 2024