Boeing Subsidies Merit EU Tariffs on $4 Billion in U.S. Goods, WTO Rules -- 3rd Update

October 13 2020 - 12:47PM

Dow Jones News

By Josh Zumbrun and Daniel Michaels

The World Trade Organization said the European Union may impose

tariffs on $3.99 billion in Boeing Co. jets and other U.S. goods

annually as part of a long-running trade dispute.

Tuesday's ruling clears the way for the EU to respond to tariffs

that the trade body last October authorized the U.S. to impose on

$7.5 billion in Airbus SE jets and other imported European

products, the largest arbitration award in WTO history.

EU officials have said they hope to negotiate a settlement with

the U.S., and many observers expect Europe to refrain from levying

tariffs quickly. The bloc last year said it had prepared a

preliminary list of U.S. products to target in retaliation, if

necessary.

The jetliner dispute is the longest since the WTO's inception.

In 2004, the U.S. took European countries to the WTO over subsidies

to Airbus, and Europe responded soon after with a case against U.S.

support for Boeing.

WTO rulings since then have found that both sides provided

prohibited subsidies, but Europe did so to a greater extent.

"The U.S. is in a strong position, since its award is almost

twice the EU's, but $4 billion is not to be sneezed at," said Bill

Reinsch, a senior adviser at the Center for Strategic and

International Studies in Washington. "It sets the stage for a

negotiation, but there is a long way to go."

EU Trade Commissioner Valdis Dombrovskis said on Twitter that he

would immediately re-engage with the U.S. "Our strong preference is

for a negotiated settlement," he said. "Otherwise, we will be

forced to defend our interests & respond in a proportionate

way."

Airbus said it supports any action the EU takes. The company is

"ready to support a negotiation process that leads to a fair

settlement," said Chief Executive Guillaume Faury. "It is time to

find a solution now so that tariffs can be removed on both sides of

the Atlantic."

U.S. Trade Representative Robert Lighthizer, the top U.S. trade

negotiator, said the EU has "no lawful basis to impose tariffs"

because the subsidies for Boeing have already been repealed. He

suggested the U.S. would consider retaliating if Brussels moved

forward with tariffs. "Any imposition of tariffs based on a measure

that has been eliminated is plainly contrary to WTO principles and

will force a U.S. response," he said.

European officials say they can levy an additional $4 billion in

tariffs based on a previous finding of other U.S. violations, which

would be on top of the $3.99 billion awarded on Tuesday.

Mr. Lighthizer said that the U.S. would prefer to negotiate a

solution and is "waiting for a response from the EU to a recent

U.S. proposal and will intensify our ongoing negotiations with the

EU to restore fair competition and a level playing field to this

sector."

Boeing said it is disappointed that Airbus and the EU are

seeking tariffs on the U.S. "Rather than escalating this matter

with threats to U.S. businesses and their European customers,

Airbus and the EU should be focusing their energies on good-faith

efforts to resolve this long-running dispute," the company

said.

Helping broker a deal over government aid for jetliners would be

a crucial victory for the WTO's efforts to build credibility as a

global arbitrator, even as the coronavirus pandemic amplifies

already-simmering trade spats.

The pandemic-driven decline in air travel has made many airlines

unwilling or unable to take most new aircraft deliveries, reducing

the current and potential impact of such disputes.

Both the U.S. and the EU have taken steps in recent months to

defuse their dispute, which spawned a series of claims, WTO

rulings, concessions and appeals that have colored broader trade

relations between them and led to tariffs on goods ranging from

cheese to industrial parts.

Boeing earlier this year stepped away from tax breaks provided

by Washington state for 787 production. The company recently said

it planned to end assembly of the plane in the state and move it to

South Carolina. Airbus announced a deal in July with Spain and

France to change some financial-support agreements.

Both sides now maintain they are in full compliance with WTO

guidelines.

The dispute has become an element of the Trump administration's

trade talks with Europe. The two sides have been in formal

negotiations since 2018 over a range of issues but have made little

progress.

Many other industries have been pulled into the aircraft dispute

after the U.S.'s tariffs last year affected a range of cultural

products from Europe such as wines, liquors, olives and

cheeses.

"Instead of further escalation, we hope the U.S. and the EU will

come back to the negotiating table and agree to the immediate and

simultaneous removal of tariffs," said the Distilled Spirits

Council of the U.S., a trade group representing distillers.

--Doug Cameron contributed to this article.

Write to Josh Zumbrun at Josh.Zumbrun@wsj.com and Daniel

Michaels at daniel.michaels@wsj.com

(END) Dow Jones Newswires

October 13, 2020 12:32 ET (16:32 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

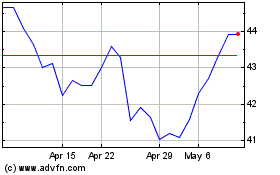

Airbus (PK) (USOTC:EADSY)

Historical Stock Chart

From Mar 2024 to Apr 2024

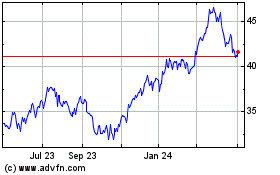

Airbus (PK) (USOTC:EADSY)

Historical Stock Chart

From Apr 2023 to Apr 2024