European Press Roundup: Lufthansa Looks to Cut Jobs at Alitalia, German Economy Needs Immigrants

February 12 2019 - 7:31AM

Dow Jones News

In Europe today, stocks are buoyed by hopes that U.S.-China

trade tensions will cool, and auto makers and suppliers rally after

Michelin reports better-than-expected 2018 results. Read about the

above topics on Dow Jones Newswires or WSJ.com.

In Other Media...

Lufthansa's plan for Alitalia includes 2,500 to 2,900 job cuts

and the addition of more long-haul flights to America and South

Africa. -La Repubblica

Germany needs at least 260,000 immigrants each year until 2060

to offset the impact of demographic decline on its workforce to a

level that is manageable for the economy, according to a study by

the Bertelsmann Foundation. The study already assumes a positive

base scenario with a rising birth rate, more women at work and a

higher retirement age. -Frankfurter Allgemeine Zeitung

German retailer Ceconomy is poised to undergo major

restructuring to eliminate duplicate structures in departments in

its Media Markt and Saturn stores and increase the demarcation

between the two chains. Hundreds of jobs in the companies' head

offices could be cut as a result. Details on the restructuring will

likely be determined after Ceconomy's new CEO and CFO take up their

posts March 1. -Handelsblatt

More than a hundred of Air France-KLM managers asked for the

mandate renewal of Pieter Elbers, President and CEO of KLM, as Mr.

Elbers' mandate is threatened despite its good performance at the

head of the unit. -La Tribune

The U.K. won't be able to renegotiate all trade agreements

involving the EU in time for the Brexit deadline, government

officials admit. British negotiators will now focus on securing

deals that cover around 90% of the country's trade, but talks with

Japan and South Korea have hit a roadblock. The U.K. would only

need to sign those treaties if it leaves the bloc without an

agreement. Otherwise, the nearly 40 EU treaties to which it is

currently party would be automatically replicated. -Sky News

A U.K. offshore wind-power project, which is expected to become

the world's largest once it is completed in the second half of

2019, will start supplying power to the electricity grid later this

week. Denmark's Oersted, the developer of the Hornsea One windfarm,

says it is ready to fill the energy gap left by recent failures of

nuclear projects. -The Guardian

Three overseas banks that quit the Irish market during the

financial crisis have seen the number of cases of overcharging more

than double to as many as 655 in just over a year. In October 2017,

Bank of Scotland said that it had identified 184 customers who were

hit by an industry-wide debacle where they were either denied their

right to a cheap home loan linked to the main ECB rate, or put on

an incorrect rate. The other banks are Danske Bank and ACCBank.

-The Irish Times

The Dutch state wants to compile a "black list" of companies

that have agreed settlements for violating the law, according to

unnamed sources familiar with the matter. Following the ING

money-laundering scandal, The Netherlands wants to make it harder

for companies that have violated the law to win government tenders.

-Financieele Dagblad

Dubai-based port operator DP World is ready to increase capacity

at its U.K. sites to ease potential congestion in the country in

case it leaves the EU without a trade deal. Chief Executive Sultan

Ahmed Bin Sulayem said the company could quickly boost capacity by

30% at its Essex terminal, and even further at London Gateway over

time. -FT

Write to Barcelona editors at barcelonaeditors@dowjones.com

(END) Dow Jones Newswires

February 12, 2019 07:16 ET (12:16 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

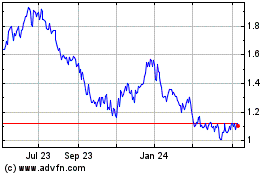

Air France ADS (PK) (USOTC:AFLYY)

Historical Stock Chart

From Mar 2024 to Apr 2024

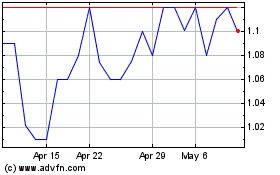

Air France ADS (PK) (USOTC:AFLYY)

Historical Stock Chart

From Apr 2023 to Apr 2024