Current Report Filing (8-k)

November 12 2021 - 4:22PM

Edgar (US Regulatory)

0000737207

false

0000737207

2021-10-07

2021-10-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): October 7, 2021

Adhera

Therapeutics, Inc.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

000-13789

|

|

11-2658569

|

|

(State

or Other Jurisdiction

of

Incorporation)

|

|

(Commission

File

Number)

|

|

(I.R.S.

Employer

Identification

No.)

|

8000

Innovation Parkway, Baton Rouge, LA 70820

(Address

of Principal Executive Office) (Zip Code)

919-518-3748

(Registrant’s

telephone number, including area code)

N/A

(Former

name or address if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

|

☐

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act: None

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

On

October 7, 2021, Adhera Therapeutics, Inc. (the “Company”) entered into a Securities Purchase Agreement (“SPA”)

with an institutional investor (the “Buyer”), pursuant to which the Company issued the Buyer a 10% Convertible Redeemable

Note in the principal amount of $131,250 (the “Note”) and a three-year warrant to purchase 476,190 shares of common stock

of the Company (the “Warrant”) for which the Company received net proceeds of $110,000. This investment is in addition to

the investment made by another institutional investor which closed within two days of the investment and was previously disclosed in

a Current Report on Form 8-K.

The

Note is due October 7, 2022. The Note provides for guaranteed interest at the rate of 10% per annum, payable at maturity. The Note is

convertible into shares of common stock at any time following the date of cash payment at the Buyer’s option at a conversion price

of $0.075 per share, subject to certain adjustments. Furthermore, the Buyer will not be allowed to effect a conversion if such conversion,

along with all other shares of the Company’s common stock beneficially owned by the Buyer and its affiliates would exceed 4.99%

of the outstanding shares of common stock of the Company, which may be increased up to 9.9% upon 60 days’ prior written notice

by the Buyer.

The

Warrants are exercisable for three-years from October 5, 2021 at an exercise price of $0.095 per share, subject to certain adjustments,

which exercise price may be paid on a cashless basis.

Pursuant

to the SPA, the Company shall have filed a registration statement within 90 days providing for the registration of all shares issuable

upon conversion of the Note and exercise of the Warrant.

For

services rendered in connection with the SPA, the Company paid Carter, Terry & Company a fee of $10,000. In addition, the Company

reimbursed the Buyer $5,000 for legal expenses incurred in connection with the transaction.

The

foregoing description of the terms of the SPA, the Note, the Warrant and the transactions contemplated thereby does not purport to be

complete and is qualified in its entirety by reference to the form of SPA, the form of Note, and the form of Warrant, a copy which is

filed as Exhibits 10.1, 4.1, and 4.2, respectively, to this Current Report on Form 8-K and is incorporated herein by reference.

Item

2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The

information contained above in Item 1.01 is hereby incorporated by reference into this Item 2.03.

Item

3.02 Unregistered Sale of Equity Securities.

The

information contained above in Item 1.01 is hereby incorporated by reference into this Item 3.02. The Note and Warrant were

offered and sold in a transaction exempt from registration under the Securities Act of 1933 in reliance on Section 4(a)(2) thereof and

Rule 506(b) of Regulation D thereunder.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(d)

On

November 5, 2021, the Company appointed Zahed Subhan as a member of the Board of Directors of the Company. There is no arrangement or

understanding between Mr. Subhan, and any other persons pursuant to which Mr. Subhan was selected as a director. Since the beginning

of fiscal 2021 through the date hereof, there have been no transactions with the Company, and there are currently no proposed transactions

with the Company in which Mr. Subhan had or will have a direct or indirect material interest within the meaning of Item 404(a) of Regulation

S-K.

Item

9.01 Financial Statements and Exhibits

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

ADHERA

THERAPEUTICS, INC.

|

|

|

|

|

|

Date:

November 12, 2021

|

By:

|

/s/

Andrew Kucharchuk

|

|

|

Name:

|

Andrew

Kucharchuk

|

|

|

Title:

|

Chief

Executive Officer

|

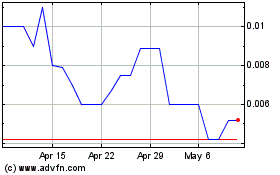

Adhera Therapeutics (CE) (USOTC:ATRX)

Historical Stock Chart

From Nov 2024 to Dec 2024

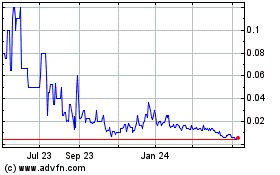

Adhera Therapeutics (CE) (USOTC:ATRX)

Historical Stock Chart

From Dec 2023 to Dec 2024