UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D/A

Under the Securities Exchange Act of 1934

(Amendment No. 1)*

ACURA PHARMACEUTICALS, INC.

|

|

(Name of Issuer)

|

|

|

Common Stock

|

|

(Title of Class of Securities)

|

|

|

|

00509L802

|

|

(CUSIP Number)

|

|

|

|

John Schutte

c/o Main Pointe Pharmaceuticals, LLC

333 W. Main Street, Suite 200

Louisville, KY 40202

502-423-0351

|

|

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

|

|

|

June 28, 2019

|

|

(Date of Event which Requires Filing of this Statement)

|

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box ☐.

Note

: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies are to be sent.

*

The remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any

subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934 ("Act") or otherwise subject to the liabilities of that section of the Act but shall

be subject to all other provisions of the Act (however, see the Notes).

|

1

|

NAMES OF REPORTING PERSONS

|

|

|

|

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

|

|

|

|

John Schutte

|

|

|

|

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

|

☐

|

|

|

(b)

|

☒

|

|

|

|

|

3

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

4

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

|

|

|

|

PF

|

|

|

|

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

|

|

☐

|

|

|

|

|

|

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

United States

|

|

|

|

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

|

|

|

|

10,695,186

|

|

|

|

|

|

|

8

|

SHARED VOTING POWER

|

|

|

|

See response to Item 5.

|

|

|

|

|

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

|

|

10,695,186

|

|

|

|

|

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

|

|

See response to Item 5.

|

|

|

|

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

See response to Item 5.

|

|

|

|

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

|

☒

|

|

|

|

|

|

|

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

See response to Item 5.

|

|

|

|

|

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

|

|

|

|

IN

|

|

|

|

|

|

|

1

|

NAMES OF REPORTING PERSONS

|

|

|

|

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

|

|

|

|

Abuse Deterrent Pharma, LLC

|

|

|

|

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

|

☐

|

|

|

(b)

|

☒

|

|

|

|

|

3

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

4

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

|

|

|

|

PF

|

|

|

|

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

|

|

☐

|

|

|

|

|

|

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

United States

|

|

|

|

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

|

|

|

|

47,500,000

|

|

|

|

|

|

|

8

|

SHARED VOTING POWER

|

|

|

|

0

|

|

|

|

|

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

|

|

47,500,000

|

|

|

|

|

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

|

|

0

|

|

|

|

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

47,500,000

|

|

|

|

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

|

☐

|

|

|

|

|

|

|

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

69.3%

|

|

|

|

|

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

|

|

|

|

OO

|

|

|

|

|

|

With this amendment, the Reporting Persons are amending the disclosures in the text of Items 2, 3, 4, 5, 6 and 7 to update information about Acura Pharmaceuticals, Inc. (the “Issuer” or the “Company”) and the Reporting

Persons and the Reporting Persons' ownership of shares of the Company.

Item 2. Identity and Background.

This Schedule 13D is being filed on behalf of John Schutte and Abuse Deterrent Pharma, LLC

(individually, each is referred to as a "Reporting Person" and

collectively, the "Reporting Persons").

The name, citizenship or state of organization, principal employment or business, and the address of the principal office of each Reporting Person, are set

forth below:

John Schutte

(a) The name of this Reporting Person is John Schutte (“Mr. Schutte”).

(b) Mr. Schutte’s business address is c/o Main Pointe Pharmaceuticals, LLC, 333 E. Main Street, Suite 200, Louisville, Kentucky 40202.

(c) Mr. Schutte’s principal occupation is chief executive officer of Main Pointe Pharmaceuticals, LLC whose principal business is the development, licensing and sale of pharmaceuticals and whose

address is 333 E. Main Street, Suite 200, Louisville, Kentucky 40202.

(d) During the last five (5) years Mr. Schutte has not been convicted in any criminal proceeding (excluding traffic violations or similar misdemeanors).

(e) During the last five years Mr. Schutte has not been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction resulting in him being subject to a judgment

decree or final order in joining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws, or finding any violations with respect to such laws.

(e) Mr. Schutte is a citizen of the United States.

Abuse Deterrent Pharma, LLC

(a) The name of this Reporting Person is Abuse Deterrent Pharma, LLC, a Kentucky limited liability company (“AD Pharma”).

(b) The state of organization of AD Pharma is Kentucky.

(c) The principal business of AD Pharma is the development, licensing and sale of pharmaceuticals. The address of the principal office of AD Pharma is 333 E. Main Street, Suite 200, Louisville,

Kentucky 40202.

(d) During the last five (5) years AD Pharma has not been convicted in any criminal proceeding (excluding traffic violations or similar misdemeanors).

(e) During the last five years AD Pharma has not been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction resulting in it being subject to a judgment decree

or final order in joining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws, or finding any violations with respect to such laws.

The members of the Board of Managers of AD Pharma are Mr. Schutte and James A. Patterson, II (“Mr. Patterson”). Information about Mr. Schutte is set forth above in this Item 2. Mr. Patterson’s

business address is 10350 Ormsby Park Place, Louisville, Kentucky 40223. Mr.Patterson’s principal occupation is entrepreneur. During the last five (5) years Mr. Patterson has not been convicted in any criminal proceeding (excluding traffic

violations or similar misdemeanors). During the last five years Mr. Patterson has not been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction resulting in him being subject to a judgment decree or final

order in joining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws, or finding any violations with respect to such laws. Mr. Patterson is a citizen of the United States.

Item 3. Source or Amount of Funds or Other Consideration.

On June 28, 2019, the Company entered into a Promissory Note with Mr. Schutte that consolidated existing promissory notes into a single note in favor of Mr. Schutte for $6.0 million. Terms of the

consolidated note provide for a July 1, 2023 maturity date, a fixed interest rate of 7.5% per annum, and deferral of all payments of principal and interest to maturity. The Company also (i) granted to Mr. Schutte conversion rights of the $6.0 million

loan into the Company’s common stock at $0.16 per share, convertible immediately, (ii) issued to him a warrant to purchase 10.0 million shares of the Company’s common stock at a price of $0.01 per share, exercisable immediately, and (iii) granted a

security interest in all of the Company’s assets. With the Company’s consent, Mr. Schutte assigned and transferred to AD Pharma all of his right, title and interest in this note, security agreement and warrant effective June 28, 2019.

Item 4. Purpose of Transaction.

Mr. Schutte is owner of Main Pointe Pharmaceuticals, LLC, which acquired two products from the Issuer in March 2017 and has options on several other products. The purpose of the transaction was to

provide funding to the Company so that it could continue to develop its LimitX™ technology and enhance its Impede® technology of which Main Pointe Pharmaceuticals, LLC is a licensee. On June 28, 2019, the Company granted authority to Main Pointe

Pharmaceuticals, LLC (“Main Pointe”) to assign to AD Pharma the option and the right to add, as an Option Product to the Nexafed® Agreement, a Nexafed® 12-hour dosage.

Mr. Schutte owns 61.1% of AD Pharma. On June 28, 2019, the Company entered into an agreement with AD Pharma pursuant to which AD Pharma will provide financing for the Company’s operations and

completion of development of LTX-03 immediate-release tablets utilizing Acura’s patented LIMITx™ technology. The agreement grants AD Pharma exclusive commercialization rights in the United States to LTX-03. The agreement provides for monthly license

payments by AD Pharma to the Company of $350,000 up to the earlier of 18 months or FDA’s acceptance of a New Drug Application (“NDA”) for LTX-03 and reimbursement by AP Pharma of the Company’s LTX-03 outside development expenses. Upon

commercialization, as defined, of LTX-03, the Company will receive stepped-up royalties on sales and is eligible for additional payments based upon the achievement of certain milestones. AD Pharma may terminate the agreement at any time. Additionally,

if the NDA for LTX-03 is not accepted by the FDA within 18 months, AD Pharma may terminate the agreement and take ownership of the intellectual property rights of the Company to LTX-03.

In March 2017, Mr. Schutte also entered into a voting agreement pursuant to which he is entitled to designate a director to the Board of Directors and to committees thereof and pursuant to which he is

required to vote for the designees of two other entities and the Chief Executive Officer as directors.

The Reporting Persons seek to enhance the value of the Company. However, they have not formulated definitive plans. The Reporting Persons may purchase additional shares of the Issuer in the immediate future; however,

they presently have no intention to substantially increase their ownership in the Issuer. In addition, under appropriate circumstances the Reporting Persons may support a sale of the Company or a merger with another entity.

Except as described above, the Reporting Persons do not have any plans or proposals which relate to or would result in:

(1)

the acquisition by any person of additional securities of the Company or the

disposition of additional securities of the Company;

(2)

an extraordinary corporate transaction such as a merger, reorganization or

liquidation of the Company, involving the Company or any of its subsidiaries;

(3)

the sale or transfer of a material amount of assets of the Company or any of its

subsidiaries;

(4)

any change in the present board of directors or management of the Company;

(5)

any material change in the Company’s present capitalization or dividend policy;

(6)

any other material change in the Company’s business or corporate structure;

(7)

changes in the Company’s charter, bylaws or instruments corresponding thereto or

other actions which may impede the acquisition of control of the Company by any person;

(8)

causing a class of securities of the Company to be delisted from a national

securities exchange or to cease to be authorized to be quoted in an inter-dealer quotation system of a registered national securities association;

(9)

a class of securities of the Company becoming eligible for termination of

registration pursuant to Section 12(g)(4) of the Act; or

(10)

any action similar to any of those enumerated above.

Item 5. Interest in Securities of the Issuer.

(a)

Mr. Schutte individually owns 10,695,186 shares of common stock of the Issuer which

represents a 46.9% beneficial interest in the Issuer. Such securities consist of 8,912,655 shares of common stock and warrants to purchase 1,782,531 shares of common stock. These calculations are based on 21,033,528 shares of common stock the Issuer

outstanding as reported by the Issuer in its Quarterly Report on Form 10-Q filed November 26, 2018. By virtue of his position as manager of AD Pharma, Mr. Schutte may be deemed to beneficially own the total number of shares owned by AD Pharma.

AD Pharma beneficially owns 47,500,000 shares of common stock of the Issuer which represents a 69.3% beneficial interest in the Issuer. Such securities consist of 37,500,000 shares

of common stock issuable upon conversion of a convertible promissory note and warrants to purchase 10,000,000 shares of common stock. These calculations are based on 21,033,528 shares of common stock the Issuer outstanding as reported by the Issuer

in its Quarterly Report on Form 10-Q filed November 26, 2018.

(b)

Mr. Schutte holds sole power to vote or to direct the vote and sole power to

dispose or to direct the dispositions of all 10,695,186 shares, or 46.9% of the Issuer’s common stock. By virtue of his position as manager of AD Pharma, he shares power to vote or direct the vote or to dispose or direct the disposition of 47,500,000

shares of the Issuer’s common stock issuable upon conversion of a promissory note and exercise of a warrant with AD Pharma.

AD Pharma holds sole power to vote or to direct the vote and sole power to dispose or to direct the disposition of 47,500,000 shares, or 69.3% of the Issuer’s common stock,

issuable upon conversion of a promissory note and exercise of a warrant.

(c)

Transactions during the last 60 days.

On June 28, 2019, the Company entered into a Promissory Note with Mr. Schutte that consolidated existing promissory notes into a single note in favor of Mr. Schutte for $6.0 million. Terms of the

consolidated note provide for a July 1, 2023 maturity date, a fixed interest rate of 7.5% per annum, and deferral of all payments of principal and interest to maturity. The Company also (i) granted to Mr. Schutte conversion rights of the $6.0 million

loan into the Company’s common stock at $0.16 per share, convertible immediately, (ii) issued to him a warrant to purchase 10.0 million shares of the Company’s common stock at a price of $0.01 per share, exercisable immediately, and (iii) granted a

security interest in all of the Company’s assets. With the Company’s consent, Mr. Schutte assigned and transferred to AD Pharma all of his right, title and interest in this note, security agreement and warrant effective June 28, 2019.

On July 24, 2017 Mr. Schutte entered into an agreement to acquire and acquired units comprised of 8,912,655 shares of common stock and warrants to purchase 1,782,531 shares of common stock of the

Issuer exercisable at an exercise price of $0.528 per share and expiring on July 23, 2022. The acquisition price was $4 million. The transaction was effected directly between Mr. Schutte and the Issuer without the participation of any broker.

(d)-(e) not applicable.

Item 6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

Mr. Schutte purchased common stock and warrants in July 2017 as described in Item 5 pursuant to a subscription agreement incorporated herein as exhibit 99.2. The form of warrant is incorporated herein

as Exhibit 99.1.

Mr. Schutte also entered into a Second Amended and Restated Voting Agreement dated as of July 24, 2017 with the Issuer, Galen Partners III, LP (“Galen”) and Essex Woodlands Health Ventures Fund V, LP

(“Essex”), incorporated herein as Exhibit 99.3. The Second Amended and Restated Voting Agreement provides that the Issuer’s Board of Directors shall be comprised of no more than seven members (subject to certain exceptions), (i) one of whom is the

Company’s Chief Executive Officer, (ii) three of whom are independent under Nasdaq standards, and (iii) one of whom shall be designated by each of Essex, Galen and John Schutte. The right of each of Essex, Galen and John Schutte

to designate one director to the Issuer’s Board will continue as long as he or it and their affiliates collectively hold at least 600,000 shares of Issuer’s Common Stock (including warrants exercisable for such

shares. In addition, each of Galen, Investor

and Essex also has the right to designate their directors to any committee established by the Issuer’s Board of Directors, so long as they meet the relevant

independence standards, in the case of the Issuer’s Audit Committee and Compensation Committee.

On June 28, 2019, the Company (i) entered into a $6.0 million promissory note with Mr. Schutte that granted to Mr. Schutte conversion rights of the $6.0 million loan into the Company’s common stock at

$0.16 per share, convertible immediately, and (ii) issued to him a Common Stock Purchase Warrant to purchase 10.0 million shares of the Company’s common stock at a price of $0.01 per share, exercisable immediately. With the Company’s consent, Mr.

Schutte assigned and transferred to AD Pharma all of his right, title and interest in this note, security agreement and warrant effective June 28, 2019. The form of promissory note is incorporated herein as Exhibit 99.4. The form of Common Stock

Purchase Warrant is incorporated herein as Exhibit 99.5. The form of assignment is incorporated herein as Exhibit 99.6.

On July 29, 2019, Mr. Schutte and AD Pharma entered into an Agreement among Reporting Persons attached hereto and incorporated herein

as Exhibit 99.7.

Item 7. Material to Be Filed as Exhibits.

|

Exhibit

Number

|

Exhibit Description

|

|

|

99.1

|

Form of Warrant (incorporated by reference to Exhibit 4.1 of the Form 8-K filed by the Issuer on July 28, 2017).

|

|

99.2

|

Subscription Agreement dated July 24, 2017 between Acura Pharmaceuticals, Inc. and John Schutte (incorporated by reference to Exhibit 10.1 of the Form 8-K filed by the Issuer on July 28, 2017).

|

|

99.3

|

Second Amended and Restated Voting Agreement dated as of July 24, 2017 between Acura Pharmaceuticals, Inc., Galen Partners III, LP, Essex Woodlands Health Ventures Fund V, LP and John Schutte (incorporated by

reference to Exhibit 10.1 of the Form 8-K filed by the Issuer on August 1, 2017).

|

|

99.4

|

Form of Amended, Consolidated and Restated Convertible Secured Promissory Note by Acura Pharmaceuticals, Inc. in favor of John Schutte dated June 28, 2019.

|

|

99.5

|

Form of Common Stock Purchase Warrant dated June 28, 2019.

|

|

99.6

|

Form of Assignment of Promissory Note, Warrant and Security Agreement by John Schutte in favor of Abuse Deterrent Pharma, LLC dated June 28, 2019.

|

99.7

|

Agreement among Reporting Persons dated July 29, 2019 for the filing of a single Schedule 13D pursuant to Rule 13d-1(K).

|

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated:

July 29, 2019

|

|

|

|

/s/ John Schutte

|

|

|

John Schutte

|

|

|

|

|

Dated:

|

ABUSE DETERRENT PHARMA, LLC

|

|

|

|

July 29, 2019

|

|

|

|

By:

|

/s/ John Schutte

|

|

|

|

Name: John Schutte

|

|

|

|

Title: Manager

|

Exhibit Index

|

Exhibit

Number

|

Exhibit Description

|

|

99.1

|

Form of Warrant (incorporated by reference to Exhibit 4.1 of the Form 8-K filed by the Issuer on July 28, 2017).

|

|

99.2

|

Subscription Agreement dated July 24, 2017 between Acura Pharmaceuticals, Inc. and John Schutte (incorporated by reference to Exhibit 10.1 of the Form 8-K filed by the Issuer on July 28, 2017).

|

|

99.3

|

Second Amended and Restated Voting Agreement dated as of July 24, 2017 between Acura Pharmaceuticals, Inc., Galen Partners III, LP, Essex Woodlands Health Ventures Fund V, LP and John Schutte (incorporated by

reference to Exhibit 10.1 of the Form 8-K filed by the Issuer on August 1, 2017).

|

|

99.4

|

Form of Amended, Consolidated and Restated Convertible Secured Promissory Note by Acura Pharmaceuticals, Inc. in favor of John Schutte dated June 28, 2019.

|

|

99.5

|

Form of Common Stock Purchase Warrant dated June 28, 2019.

|

|

99.6

|

Form of Assignment of Promissory Note, Warrant and Security Agreement by John Schutte in favor of Abuse Deterrent Pharma, LLC dated June 28, 2019.

|

99.7

|

Agreement among Reporting Persons dated July 29, 2019 for the filing of a single Schedule 13D pursuant to Rule 13d-1(K).

|

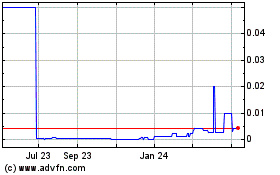

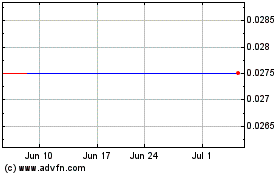

Acura Pharmaceuticals (CE) (USOTC:ACUR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Acura Pharmaceuticals (CE) (USOTC:ACUR)

Historical Stock Chart

From Apr 2023 to Apr 2024