UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(RULE

14a-101)

Proxy

Statement Pursuant to Section 14(a) of the Securities

Exchange

Act of 1934

Filed

by the Registrant [X]

Filed

by a Party other than the Registrant [ ]

Check

the appropriate box:

|

[ ]

|

Preliminary

Proxy Statement

|

|

[ ]

|

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

[X]

|

Definitive

Proxy Statement

|

|

[ ]

|

Definitive

Additional Materials

|

|

[ ]

|

Soliciting

Material Pursuant to §240.14a-12

|

ACORN

ENERGY, INC.

(Name

of Registrant as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

Payment

of Filing Fee (Check the appropriate box):

|

|

|

|

|

[X]

|

No

fee required.

|

|

|

|

|

[ ]

|

Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

(1)

|

Title

of each class of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

|

|

(2)

|

Aggregate

number of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

|

|

(3)

|

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which

the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

|

|

|

|

(4)

|

Proposed

maximum aggregate value of transaction:

|

|

|

|

|

|

|

|

|

|

|

(5)

|

Total

fee paid:

|

|

|

|

|

|

|

|

|

[ ]

|

Fee

paid previously with preliminary materials.

|

|

|

|

|

[ ]

|

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date

of its filing.

|

|

|

|

|

|

(1)

|

Amount

Previously Paid:

|

|

|

|

|

|

|

|

|

|

|

(2)

|

Form,

Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

|

|

|

(3)

|

Filing

Party:

|

|

|

|

|

|

|

|

|

|

|

(4)

|

Date

Filed:

|

|

|

|

|

ACORN

ENERGY, INC.

1000

N West Street, Suite 1200

Wilmington,

Delaware 19801

NOTICE

OF 2020 ANNUAL MEETING OF STOCKHOLDERS

To

the Stockholders:

NOTICE

IS HEREBY GIVEN that the Annual Meeting of Stockholders of Acorn Energy, Inc. (“Acorn Energy” or the “Company”)

will be held at 1:00 PM EDT, on September 14, 2020 at 10451 Mill Run Circle, Owings Mills, Maryland 21117 and virtually via Zoom,

for the following purposes, all as more fully described in the attached Proxy Statement:

|

(1)

|

|

election

of four directors to hold office until the 2021 Annual Meeting and until their respective successors are elected and qualified;

|

|

|

|

|

|

(2)

|

|

approval

of an amendment to the Company’s restated certificate of incorporation to authorize a reverse split of the Company’s

common stock at any time prior to September 14, 2021, at a ratio between one-for-ten and one-for-twenty, if and as determined

by the Company’s Board of Directors, which is referred to as the Reverse Split proposal (the full text of the proposed

amendment is attached as Annex A to the proxy statement accompanying this notice);

|

|

|

|

|

|

(3)

|

|

approval

of any motion to adjourn the Annual Meeting from time to time, if necessary or appropriate, to solicit additional proxies

in the event there are not sufficient votes at the time of the Annual Meeting to approve the Reverse Split proposal;

|

|

|

|

|

|

(4)

|

|

ratification

of the selection by the Audit Committee of the Company’s Board of Directors of Friedman LLP as the independent registered

public accounting firm for the Company for the year ending December 31, 2020;

|

|

|

|

|

|

(5)

|

|

consideration

of an advisory vote on the compensation of the Company’s named executive officers; and

|

|

|

|

|

|

(6)

|

|

such

other business as may properly come before the Annual Meeting or any adjournment thereof.

|

Stockholders

who wish to attend the Annual Meeting virtually via Zoom must register in advance by contacting the undersigned by e-mail at AcornMeeting2020@gmail.com.

You

are requested to complete your proxy whether or not you expect to attend the Meeting. The proxy is revocable by you at any time

prior to its exercise and will not affect your right to vote at the Meeting in the event you attend the Meeting or any adjournment

thereof.

A

copy of the Company’s Annual Report for the year ended December 31, 2019 is enclosed.

All

stockholders may read, print and download our 2019 Annual Report and our Proxy Statement at https://materials.proxyvote.com/004848.

|

|

By

Order of the Board of Directors,

|

|

|

|

|

Wilmington,

Delaware

|

SHELDON

KRAUSE

|

|

August

11, 2020

|

Assistant

Secretary

|

ACORN

ENERGY, INC.

1000

N West Street, Suite 1200

Wilmington,

Delaware 19801

PROXY

STATEMENT FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO

BE HELD ON SEPTEMBER 14, 2020

This

proxy statement and the accompanying proxy are being furnished in connection with the solicitation of proxies by the Board of

Directors (the “Board”) of the Company for use in voting at the 2020 Annual Meeting of Stockholders (the “Annual

Meeting”) to be held at 1:00 PM EDT on September 14, 2020, at 10451 Mill Run Circle, Owings Mills, Maryland 21117 and virtually

via Zoom, and any adjournments thereof. Distribution to stockholders of this proxy statement and a proxy form is scheduled to

begin on or about August 12, 2020 to each stockholder of record at the close of business on July 31, 2020 (the “Record Date”).

Your

vote is important. Whether or not you plan to attend the Annual Meeting, please take the time to vote your shares as early as

possible. You can ensure that your shares are voted at the meeting by completing, signing, dating and returning the enclosed proxy

card in the envelope provided if you are a stockholder of record or, if you hold your shares through a broker, bank or other nominee,

by submitting your voting instructions by mail, phone or Internet as provided in the enclosed voting instruction form from your

nominee. Submitting your proxy will not affect your right to attend the meeting (in person or via Zoom) and vote. A stockholder

of record who gives a proxy may revoke it at any time before it is exercised by voting (in person or via Zoom) at the Annual Meeting,

by delivering a subsequent proxy or by notifying our corporate Secretary in writing of such revocation.

Important

notice regarding the availability of proxy materials for the Annual Meeting to be held on September 14, 2020: all stockholders

may read, print and download our 2019 Annual Report and our Proxy Statement at https://materials.proxyvote.com/004848.

INFORMATION

ABOUT THE 2020 ANNUAL MEETING AND PROXY VOTING

How

can I attend the Annual Meeting virtually via Zoom?

Stockholders

may register to attend the Acorn Energy Annual Meeting virtually via Zoom by contacting the Assistant Secretary at AcornMeeting2020@gmail.com and requesting admission to the meeting via Zoom. You will receive information about how to join the meeting via Zoom by return

email. The Company encourages stockholders that wish to attend the Annual Meeting via Zoom to request admission promptly and in

any event no later than September 11, 2020, the last business day preceding the Meeting, to assure admission to the Meeting via

Zoom. Stockholders of record and stockholders that hold their shares through a broker or other nominee that have requested and

received a legal proxy and that register for and attend the Annual Meeting via Zoom will have the opportunity to vote their shares

at the meeting via Zoom. Stockholders may contact the Assistant Secretary at the e-mail address above to obtain directions to

be able to attend the meeting in person. All stockholders, whether or not they plan to attend the meeting (in person or via Zoom),

are encouraged to complete and return the enclosed proxy to allow orderly tabulation of their votes.

What

matters are to be voted on at the Annual Meeting?

Acorn

Energy intends to present the following proposals for stockholder consideration and voting at the Annual Meeting:

|

(1)

|

|

election

of four directors to hold office until the 2021 Annual Meeting and until their respective successors are elected and qualified;

|

|

|

|

|

|

(2)

|

|

approval

of an amendment to the Company’s restated certificate of incorporation to authorize a reverse split of the Company’s

common stock at any time prior to September 14, 2021, at a ratio between one-for-ten and one-for-twenty, if and as determined

by the Company’s Board of Directors, which is referred to as the Reverse Split proposal (the full text of the proposed

amendment is attached as Annex A to the proxy statement accompanying this notice);

|

|

|

|

|

|

(3)

|

|

approval

of any motion to adjourn the Annual Meeting from time to time, if necessary or appropriate, to solicit additional proxies

in the event there are not sufficient votes at the time of the Annual Meeting to approve the Reverse Split proposal;

|

|

|

|

|

|

(4)

|

|

ratification

of the selection by the Audit Committee of the Company’s Board of Directors of Friedman LLP as the independent registered

public accounting firm for the Company for the year ending December 31, 2020;

|

|

|

|

|

|

(5)

|

|

consideration

of an advisory vote on the compensation of the Company’s named executive officers; and

|

|

|

|

|

|

(6)

|

|

such

other business as may properly come before the Annual Meeting or any adjournment thereof.

|

What

is the Board’s recommendation?

The

Board of Directors recommends that you vote your shares FOR each of the director nominees in Proposal 1, and FOR each of Proposals

2, 3, 4 and 5.

Will

any other matters be presented for a vote at the Annual Meeting?

We

do not expect that any other matters might be presented for a vote at the Annual Meeting. However, if another matter were to be

properly presented, the proxies would use their own judgment in deciding whether to vote for or against the proposal.

Who

is entitled to vote?

All

Acorn Energy stockholders of record at the close of business on the Record Date are entitled to vote at the Annual Meeting. Each

share outstanding on the Record Date will be entitled to one vote. There were 39,687,589 shares outstanding on the Record Date.

How

do I vote my shares?

|

|

●

|

If

you are a stockholder of record, you may grant a proxy with respect to your shares by

mail using the proxy card included with the proxy materials. Stockholders who own their

shares through brokers, banks or other nominees may grant their proxy by mail, by telephone

or over the Internet in accordance with the instructions provided in the enclosed voting

instruction form. Internet and telephone voting by beneficial owners will generally be

available through 11:59 p.m. Eastern Daylight Time on September 13, 2020.

|

|

|

●

|

If

you are a stockholder of record or a duly appointed proxy of a stockholder of record,

you may attend the Annual Meeting and vote in person or via Zoom. However, if your shares

are held in the name of a broker, bank or other nominee, and you wish to attend the Annual

Meeting to vote in person or via Zoom or to designate a proxy to vote on your behalf,

you will have to contact your broker, bank or other nominee to obtain its proxy to vote

the shares that you beneficially own. Have that document with you when you attend the

meeting.

|

|

|

●

|

All

proxies submitted will be voted in the manner you indicate by the individuals named on

the proxy. If you do not specify how your shares are to be voted, the proxies will vote

your shares FOR all director nominees in Proposal 1, and FOR Proposals 2, 3, 4 and 5.

|

May

I change or revoke my proxy after it is submitted?

Yes,

you may change or revoke your proxy at any time before its exercise at the Annual Meeting by:

|

|

●

|

returning

a later-dated proxy card;

|

|

|

|

|

|

|

●

|

attending

the Annual Meeting and voting (either in person or via Zoom) or having a proxy designated by you attend the meeting and vote

on your behalf; or

|

|

|

|

|

|

|

●

|

sending

your written notice of revocation to Sheldon Krause, our Assistant Secretary.

|

Your

changed proxy or revocation must be received before the polls close for voting.

What

is a “quorum?”

In

order for business to be conducted at the Annual Meeting, a quorum must be present. A quorum will be present if stockholders of

record holding a majority in voting power of the outstanding shares of our common stock entitled to vote at the Annual Meeting

are present (in person or via Zoom) or are represented by proxies. For purposes of determining the presence or absence of a quorum,

we intend to count as present shares present (in person or via Zoom) but not voting and shares for which we have received proxies

but for which holders thereof have abstained. Furthermore, shares represented by proxies returned by a broker holding the shares

in nominee or “street” name will be counted as present for purposes of determining whether a quorum is present, even

if the broker is not entitled to vote the shares on matters where discretionary voting by the broker is not allowed (“broker

non-votes”).

What

vote is necessary to pass the items of business at the Annual Meeting?

Holders

of our common stock will vote as a single class and will be entitled to one vote per share with respect to each matter to be presented

at the Annual Meeting. With respect to Proposal 1, the four nominees for director receiving a plurality of the votes cast by holders

of common stock, at the Annual Meeting (in person or via Zoom) or by proxy, will be elected to our Board. Approval of Proposal

2 requires the affirmative vote of a majority of the outstanding shares of our common stock entitled to vote at the Annual Meeting

(in person or via Zoom) or by proxy. Because approval is based on the affirmative vote of a majority of the outstanding shares,

abstentions from voting, as well as broker non-votes, if any, will have the effect of votes being cast against Proposal 2. Approval

of Proposals 3, 4 and 5 requires the votes cast in favor of each such proposal to exceed the votes cast against such proposal.

Abstentions from voting, as well as broker non-votes, if any, are not treated as votes cast and, therefore, will have no effect

on Proposals 3, 4, and 5.

Who

pays the costs of this proxy solicitation?

This

solicitation of proxies is made by our Board of Directors, and all related costs will be borne by us. In addition, we may reimburse

brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding solicitation materials

to such beneficial owners.

What

is the deadline for submission of stockholder proposals for the 2021 Annual Meeting?

Proposals

that our stockholders may wish to include in our proxy statement and form of proxy for presentation at our 2021 Annual Meeting

of Stockholders must be received by or delivered to us at Acorn Energy, Inc., 1000 N West Street, Suite 1200, Wilmington, Delaware

19801, Attention: Secretary, no later than the close of business on April 18, 2021.

Any

stockholder proposal must be in accordance with the rules and regulations of the SEC. In addition, with respect to proposals submitted

by a stockholder other than for inclusion in our 2021 proxy statement, our By-Laws have established advance notice procedures

that stockholders must follow. Pursuant to the By-laws of the Company, stockholders who wish to nominate any person for election

to the Board of Directors or bring any other business before the 2021 Annual Meeting must generally give notice thereof to the

Company at its principal executive offices not less than 60 days nor more than 90 days before the date of the meeting. All nominations

for director or other business sought to be transacted that are not timely delivered to the Company, or that fail to comply with

the requirements set forth in the Company’s By-Laws, will be excluded from the Annual Meeting, as provided in the By-Laws.

A copy of the By-Laws of the Company is available upon request from the Assistant Secretary of the Company, 1000 N West Street,

Suite 1200, Wilmington, Delaware 19801.

Where

can I find the voting results of the Annual Meeting?

The

preliminary voting results will be announced at the Annual Meeting. The final results will be published in our current report

on Form 8-K to be filed with the Securities and Exchange Commission within four business days after the date of the Annual Meeting,

provided that the final results are available at such time. In the event the final results are not available within such time

period, the preliminary voting results will be published in our current report on Form 8-K to be filed within such time period,

and the final results will be published in an amended current report on Form 8-K/A to be filed within four business days after

the final results are available. Any stockholder may also obtain the results from the Assistant Secretary of the Company, 1000

N West Street, Suite 1200, Wilmington, Delaware 19801.

INFORMATION

ABOUT COMMUNICATING WITH OUR BOARD OF DIRECTORS

How

may I communicate directly with the Board of Directors?

The

Board provides a process for stockholders to send communications to the Board. You may communicate with the Board, individually

or as a group, as follows:

|

BY

MAIL

|

BY

PHONE

|

|

The

Board of Directors

|

1-302-656-1708

|

|

Acorn

Energy, Inc.

|

|

|

Attn:

Assistant Secretary

|

BY

EMAIL

|

|

1000

N West Street, Suite 1200

|

c/o

Samuel M. Zentman

|

|

Wilmington,

Delaware 19801

|

samzentman@yahoo.com

|

OWNERSHIP

OF THE COMPANY’S COMMON STOCK

The

following table and the notes thereto set forth information, as of the Record Date, July 31, 2020 (except as otherwise set forth

herein), concerning beneficial ownership (as defined in Rule 13d-3 under the Securities Exchange Act of 1934) of common stock

by (i) each director of the Company, (ii) each executive officer (iii) all executive officers and directors as a group, and (iv)

each holder of 5% or more of the Company’s outstanding shares of common stock.

|

Name and Address of Beneficial Owner (1) (2)

|

|

Number of

Shares of

Common Stock Beneficially

Owned (2)

|

|

|

Percentage of Common Stock Outstanding (2)

|

|

|

Jan H. Loeb

|

|

|

7,752,263

|

(3)

|

|

|

19.5

|

%

|

|

Gary Mohr

|

|

|

1,117,647

|

(4)

|

|

|

2.8

|

%

|

|

Michael F. Osterer

|

|

|

2,848,808

|

(5)

|

|

|

7.2

|

%

|

|

Samuel M. Zentman

|

|

|

228,539

|

(6)

|

|

|

*

|

|

|

Tracy S. Clifford

|

|

|

60,000

|

(7)

|

|

|

*

|

|

|

All executive officers and directors of the Company as a group (5 people)

|

|

|

11,173,925

|

(8)

|

|

|

27.9

|

%

|

*

Less than 1%

|

(1)

|

Unless

otherwise indicated, the address for each of the beneficial owners listed in the table is in care of the Company, 1000 N West

Street, Suite 1200, Wilmington, Delaware 19801.

|

|

|

|

|

(2)

|

Unless

otherwise indicated, each person has sole investment and voting power with respect to the shares indicated. For purposes of

this table, a person or group of persons is deemed to have “beneficial ownership” of any shares as of a given

date which such person has the right to acquire within 60 days after such date. Percentage information is based on the 39,687,589

shares outstanding as of July 31, 2020.

|

|

|

|

|

(3)

|

Consists

of 1,857,330 shares held by Mr. Loeb directly, 1,366,666 shares held by PENSCO Trust Company Custodian FBO JAN LOEB IRA, 4,372,017

shares held by Leap Tide Capital Acorn LLC, 121,250 shares underlying currently exercisable options held by Mr. Loeb, and

35,000 currently exercisable warrants held by Leap Tide Capital Management LLC. Mr. Loeb is the sole manager of each of Leap

Tide Capital Acorn LLC and Leap Tide Capital Management LLC, with sole voting and dispositive power over the securities held

by such entities. Mr. Loeb disclaims beneficial ownership of the securities held by Leap Tide Capital Acorn LLC and Leap Tide

Capital Management LLC except to the extent of his pecuniary interest therein.

|

|

|

|

|

(4)

|

Consists

of 258,481 shares held by Mr. Mohr, 833,332 shares held by UE Systems Inc., and 25,834 shares underlying currently exercisable

options.

|

|

|

|

|

(5)

|

Consists

of 1,984,392 shares held by Mr. Osterer, 833,332 shares held by UE Systems Inc., and 31,084 shares underlying currently exercisable

options.

|

|

|

|

|

(6)

|

Consists

of 80,615 shares and 147,924 shares underlying currently exercisable options.

|

|

|

|

|

(7)

|

Consists

solely of currently exercisable options.

|

|

|

|

|

(8)

|

Consists

of 10,752,833 shares, 386,092 shares underlying currently exercisable options and 35,000 shares underlying currently exercisable

warrants.

|

PROPOSAL

1

ELECTION

OF DIRECTORS

Our

Board of Directors currently consists of four seats. The Board of Directors has nominated Jan H. Loeb, Gary Mohr, Michael F. Osterer

and Samuel M. Zentman, all current directors, for election as directors at the 2020 Annual Meeting to serve until the 2021 Annual

Meeting and until their successors have been duly elected and qualified. The nominees were recommended by our Nominating Committee

and approved by our Board of Directors. All nominees have consented to be named as such and to serve if elected.

With

respect to the election of directors, stockholders may vote in favor of all nominees, withhold their votes as to all nominees

or withhold their votes as to specific nominees. Stockholders cannot vote for more than the four nominees. Stockholders should

specify their choices on the accompanying proxy card. If no specific instructions are given, the shares represented by a signed

proxy will be voted FOR the election of all four of the Board’s nominees. If any nominee becomes unavailable for any reason

to serve as a director at the time of the Annual Meeting (which event is not anticipated), proxies will be voted in the discretion

of the persons acting pursuant to the proxy for any nominee who shall be designated by the current Board of Directors as a substitute

nominee.

Persons

nominated in accordance with the notice requirements of our By-laws are eligible for election as directors of the Company. All

nominations for director that are not timely delivered to us or that fail to comply with the requirements set forth in our By-laws

will be excluded from the Annual Meeting, as provided in the By-laws. A copy of our By-laws can be obtained from our Secretary,

1000 N West Street, Suite 1200, Wilmington, Delaware 19801. Directors will be elected at the Annual Meeting by a plurality of

the votes cast (i.e., the four nominees receiving the greatest number of votes will be elected as directors).

Nominees

for Election

Jan

H. Loeb has served as our President and CEO since January 28, 2016 and as Acting CEO of OmniMetrix since December 1, 2019.

He was appointed to our Board in August 2015 pursuant to the terms of our Loan and Security Agreement with Leap Tide Capital Partners

III, LLC (the “Leap Tide Loan Agreement”). He was also appointed to the Board of our then subsidiary DSIT in August

2015 pursuant to the terms of the Leap Tide Loan Agreement and held that position until the sale of our remaining interest in

DSIT in February 2018. Mr. Loeb has more than 35 years of money management and investment banking experience. He has been the

Managing Member of Leap Tide Capital Management LLC since 2007. From 2005 to 2007, he served as the President of Leap Tide’s

predecessor, Leap Tide Capital Management Inc., which was formerly known as AmTrust Capital Management Inc. He served as a Portfolio

Manager of Chesapeake Partners from February 2004 to January 2005. From January 2002 to December 2004, he served as Managing Director

at Jefferies & Company, Inc. From 1994 to 2001, he served as Managing Director at Dresdner Kleinwort Wasserstein, Inc. (formerly

Wasserstein Perella & Co., Inc.). He served as a Lead Director of American Pacific Corporation from July 8, 2013 to February

27, 2014, and also served as its Director from January 1997 to February 27, 2014. He served as an Independent Director of Pernix

Therapeutics Holdings Inc. (formerly, Golf Trust of America, Inc.) from 2006 to August 31, 2011. He served as a Director of TAT

Technologies, Ltd. from August 2009 to December 21, 2016. He served as a Director of Keweenaw Land Association, Ltd. from December

2016 until May 2019.

Key

Attributes, Experience and Skills. Mr. Loeb brings to the Acorn Board significant financial expertise, cultivated over more

than 35 years of money management and investment banking experience, together with a background in public company management and

audit committee experience.

Gary

Mohr was elected to the Board in August 2018 and is a member of our Audit, Compensation and Nominating Committees. Mr. Mohr

is President of UE Systems, Incorporated, an international technology company specializing in the field of plant asset reliability

through ultrasound. Mr. Mohr started with UE Systems in 1988 as a salesman and rapidly progressed through the ranks as regional

sales manager, National Sales Manager, Vice President and eventually President of the company. It is through Mr. Mohr’s

stewardship that UE Systems has grown from a national brand to an international company with offices in Toronto, Mexico City,

Hong Kong, India and the Netherlands, and developed a list of loyal customers, including those in the Fortune 500.

Key

Attributes, Experience and Skills. Mr. Mohr brings to the Board a broad range of operational and managerial experience, including

a successful track record in product development and marketing leadership.

Michael

F. Osterer was elected to the Board in August 2018 and is a member of our Audit, Compensation and Nominating Committees. He

served as an advisor to our Board from October 2017 until his election as director. Since 1973, Mr. Osterer has served as Chairman

of the Board of UE Systems, Incorporated, a leader in the field of plant asset reliability through ultrasound, which he founded

in 1973. He also served as President of UE Systems from 1973 to 1985. Since 1987, Mr. Osterer has served as President of Libom

Oil, an oil exploration, drilling and purchasing company, which he founded in 1987. He is the Acting Chairman of the Board of

Radon Testing Corporation of America, Inc., which he founded in 1985 and where he served as President from 1985 through 1989.

Mr. Osterer also founded Westchester Consultants, a general business consultancy nationally recognized for branding expertise

of food products. He served in the United States Air Force/Air National Guard, 105th Airborne Division, from 1964 through 1970.

Mr. Osterer graduated from Fordham University with a BA in Social Sciences, Magna Cum Laude.

Key

Attributes, Experience and Skills. Mr. Osterer brings to Acorn a wealth of operational and managerial experience gained over

his long history of successful entrepreneurial pursuits, corporate leadership and oversight.

Samuel

M. Zentman has been one of our directors since November 2004 and currently serves as Chairman of our Audit Committee and as

a member of our Compensation and Nominating Committees. From 1980 until 2006, Dr. Zentman was the president and chief executive

officer of a privately-held textile firm, where he also served as vice president of finance and administration from 1978 to 1980.

From 1973 to 1978, Dr. Zentman served in various capacities in the Information Systems department at American Motors Corporation

including Director of the Corporate Data Center and the Engineering Computer Centers. He holds a Ph.D. in Complex Analysis. Dr.

Zentman serves on the board of Hinson & Hale Medical Technologies, Inc., as well as several national charitable organizations

devoted to advancing the quality of education.

Key

Attributes, Experience and Skills. Dr. Zentman’s long-time experience as a businessman together with his experience

with computer systems and software enables him to bring valuable insights to the Board. Dr. Zentman has a broad, fundamental understanding

of the business drivers affecting our Company and also brings leadership and oversight experience to the Board.

THE

BOARD UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE FOR EACH OF THE NOMINEES FOR ELECTION. PROXIES SOLICITED BY THE BOARD

WILL BE SO VOTED UNLESS STOCKHOLDERS SPECIFY OTHERWISE IN THEIR PROXIES.

Certain

Information Regarding Directors and Officers

In

addition to the information set forth above about the Company’s directors who have been nominated for election at the Annual

Meeting, set forth below is additional information concerning such directors and certain officers of the Company:

|

Name

|

|

Age

|

|

Position

|

|

Jan

H. Loeb

|

|

61

|

|

Director,

President and Chief Executive Officer

|

|

Gary

Mohr

|

|

61

|

|

Director

and member of our Audit, Nominating and Compensation Committees

|

|

Michael

F. Osterer

|

|

74

|

|

Director

and member of our Audit, Nominating and Compensation Committees

|

|

Samuel

M. Zentman

|

|

74

|

|

Director,

Chairman of our Audit Committee and member of our Nominating and Compensation Committees

|

|

Tracy

S. Clifford

|

|

51

|

|

Chief

Financial Officer

|

Tracy

S. Clifford has served as the Company’s Chief Financial Officer since June 1, 2018 and as the COO of OmniMetrix since

December 1, 2019. She serves in such positions pursuant to a Consulting Agreement between the Company and Tracy Clifford Consulting,

LLC. Ms. Clifford is President and Owner of Tracy Clifford Consulting, LLC, through which she has been providing contract CFO/COO

services and other advisory services and project engagements since June 2015. Between October 1999 and May 2015, she served as

CFO, Principal Accounting Officer, Corporate Controller and Secretary for a publicly-traded pharmaceutical company and a publicly-traded

REIT. Her prior experience includes accounting leadership positions at United Healthcare (Atlanta) and the North Broward Hospital

District (Fort Lauderdale) and as an auditor for Deloitte & Touche (Miami). She serves on the board of Novelstem International

Corp. Ms. Clifford obtained a Bachelor of Science Degree in Accounting from the College of Charleston and a Master’s Degree

in Business Administration with a concentration in Finance from Georgia State University. Ms. Clifford is a licensed CPA in the

state of South Carolina and holds a Certification in the Fundamentals of Forensic Accounting from the AICPA.

Biographical

information about the Company’s directors who have been nominated for election at the Annual Meeting is set forth above

under “Nominees for Election.”

CORPORATE

GOVERNANCE MATTERS

Section

16(a) Beneficial Ownership Reporting Compliance

Section

16(a) of the Securities Exchange Act of 1934 (the “Exchange Act”) requires our executive officers and directors, and

persons who own more than 10% of a registered class of our equity securities to file reports of ownership and changes in ownership

with the SEC. These persons are also required by SEC regulation to furnish us with copies of all Section 16(a) forms they file.

Further, we have implemented measures to assure timely filing of Section 16(a) reports by our executive officers and directors.

Based solely on our review of such forms or written representations from certain reporting persons, we believe that during 2019

our executive officers and directors complied with the filing requirements of Section 16(a).

Board

Composition and Director Independence

Our

Board of Directors is composed of one class, with four Board seats. Four directors are currently serving until their reelection

or replacement at the 2020 Annual Meeting of Stockholders. Jan H. Loeb serves as both President and Chief Executive Officer as

well as serving as a Member of our Board of Directors. Applying the definition of independence provided under the NASDAQ rules,

the Board has determined that, with the exception of Mr. Loeb, all of the members of the Board of Directors are independent.

Board

Structure and Role in Risk Oversight

The

Board believes Mr. Loeb’s service as President and Chief Executive Officer and as a member of our Board is appropriate because

it bridges a critical gap between the Company’s management and the Board, enabling the Board to benefit from management’s

perspective on the Company’s business while the Board performs its oversight function. Further, the Board believes Mr. Loeb’s

significant ownership of Acorn Energy stock aligns his interests with those of Acorn Energy’s stockholders.

Management

is responsible for Acorn Energy’s day-to-day risk management, and the Board’s role is to engage in informed oversight.

The entire Board performs the risk oversight role. Mr. Loeb, Acorn Energy’s Chief Executive Officer is a member of the Board

of Directors, which helps facilitate discussions regarding risk between the Board and Acorn Energy’s senior management,

as well as the exchange of risk-related information or concerns between the Board and the senior management. Further, the independent

directors periodically meet in executive session following regularly scheduled Board meetings to voice their observations or concerns

and to shape the agendas for future Board meetings.

The

Board of Directors believes that, with these practices, each director has an equal stake in the Board’s actions and oversight

role and equal accountability to Acorn Energy and its stockholders.

Meetings

and Meeting Attendance

During

2019, there were six meetings of the Board of Directors, and the Board acted by unanimous written consent three times. All incumbent

directors attended 75% or more of the Board meetings and meetings of the committees on which they served during the last fiscal

year. Directors are encouraged to attend the annual meeting of stockholders. Three of the four directors then serving attended

our most recent annual meeting in 2019.

Audit

Committee; Audit Committee Financial Expert

The

Company has a separate designated standing Audit Committee established and administered in accordance with SEC rules. The three

members of the Audit Committee are Samuel M. Zentman (who serves as Chairman of the Audit Committee), Gary Mohr and Michael F.

Osterer. The Board of Directors has determined that each member of the Audit Committee meets the independence criteria prescribed

by NASDAQ governing the qualifications for audit committee members and each Audit Committee member meets NASDAQ’s financial

knowledge requirements. Our Board has determined that Dr. Zentman qualifies as an “audit committee financial expert,”

as defined in the rules and regulations of the SEC. During 2019, the Audit Committee met four times. The charter of the Audit

Committee is available on our website www.acornenergy.com under the “Investor Relations” tab.

Audit

Committee Report. The Audit Committee has (1) reviewed and discussed the audited financial statements with management; (2)

discussed with the independent auditors the matters required to be discussed by the statement of Auditing Standard No. 16 as amended;

and (3) received the written disclosures and the letter from the independent accountants required by applicable requirements of

the Public Company Accounting Oversight Board regarding the independent accountants’ communications with the Audit Committee

concerning independence, and has discussed with the independent accountant the independent accountant’s independence.

Based

on the review and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial

statements be included in the Company’s annual report on Form 10-K for the fiscal year ended December 31, 2019, which was

filed with the Securities and Exchange Commission on March 25, 2020.

|

|

THE

AUDIT COMMITTEE OF THE BOARD OF DIRECTORS OF ACORN ENERGY, INC.

|

|

|

|

|

|

Samuel

M. Zentman

|

|

|

Gary

Mohr

|

|

|

Michael

F. Osterer

|

Compensation

Committee

Our

executive compensation is administered by the Compensation Committee of the Board of Directors, which was reconstituted in 2017.

The members of the Compensation Committee are Gary Mohr, Michael F. Osterer and Samuel M. Zentman, all of whom have been determined

by the Board to be independent in accordance with NASDAQ’s requirement for independent director oversight of executive officer

compensation.

Nominating

Committee

The

Nominating Committee of our Board of Directors, which was reconstituted in 2017, has overall responsibility for identifying, evaluating,

recruiting and selecting qualified candidates for election, re-election or appointment to the Board. The Members of the Nominating

Committee are Gary Mohr, Samuel M. Zentman and Michael Osterer all of whom have been determined by the Board to meet the independence

criteria prescribed by NASDAQ governing the qualifications of nominating committee members.

Our

stockholders may recommend potential director candidates by contacting the Secretary of the Company to receive a copy of the procedure

to recommend a potential director candidate for consideration by the Nominating Committee, who will evaluate recommendations from

stockholders in the same manner that they evaluate recommendations from other sources.

Code

of Ethics

We

have adopted a Code of Business Conduct and Ethics that applies to all our directors, officers and employees. This code of ethics

is designed to comply with the NASDAQ marketplace rules related to codes of conduct.

Our code of ethics may be accessed on the Internet under “Investor Relations” on our website at www.acornenergy.com.

We intend to satisfy any disclosure requirement under Item 5.05 of Form 8-K regarding an amendment to, or waiver from, a provision

of our code of ethics by posting such information on our website, www.acornenergy.com.

EXECUTIVE

AND DIRECTOR COMPENSATION

Summary

Compensation Table

|

Name and Principal Position

|

|

Year

|

|

|

Salary

($)

|

|

|

Bonus

($)

|

|

|

Option Awards

($)

|

|

|

All Other

Compensation

($)

|

|

|

Total

($)

|

|

|

Jan H. Loeb

|

|

|

2019

|

|

|

|

174,000

|

(4)

|

|

|

―

|

|

|

|

|

|

|

|

—

|

|

|

|

174,000

|

|

|

President and CEO of the Company and Acting CEO of OmniMetrix (1)

|

|

|

2018

|

|

|

|

159,000

|

(4)

|

|

|

100,000

|

(5)

|

|

|

9,800

|

(6)

|

|

|

—

|

|

|

|

268,800

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tracy S. Clifford

|

|

|

2019

|

|

|

|

129,000

|

(4)

|

|

|

—

|

|

|

|

6,353

|

(7)

|

|

|

—

|

|

|

|

135,353

|

|

|

CFO of the Company and COO of OmniMetrix (2)

|

|

|

2018

|

|

|

|

61,875

|

(4)

|

|

|

―

|

|

|

|

8,100

|

(8)

|

|

|

|

|

|

|

69,975

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Walter Czarnecki

|

|

|

2019

|

|

|

|

207,801

|

|

|

|

—

|

|

|

|

7,883

|

|

|

|

—

|

|

|

|

215,684

|

|

|

Former CEO and President of OmniMetrix (3)

|

|

|

2018

|

|

|

|

222,696

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

222,696

|

|

|

|

(1)

|

Mr.

Loeb began serving as President and CEO of the Company on January 28, 2016 and as Acting CEO of OmniMetrix on December 1,

2019.

|

|

|

|

|

|

|

(2)

|

Ms.

Clifford began serving as CFO of the Company on June 1, 2018 and as COO of OmniMetrix on December 1, 2019.

|

|

|

|

|

|

|

(3)

|

Mr.

Czarnecki resigned as CEO and President of OmniMetrix effective December 6, 2019.

|

|

|

|

|

|

|

(4)

|

Represents

the consulting fee paid for the provision of Mr. Loeb’s services to the Company as President and CEO of the Company

and Acting CEO of OmniMetrix and of Ms. Clifford’s services as CFO of the Company and COO of OmniMetrix, respectively.

|

|

|

|

|

|

|

(5)

|

Consists

of a bonus paid in connection with the closing of the sale of the remaining interest in DSIT.

|

|

|

|

|

|

|

(6)

|

Represents

the grant date fair value calculated in accordance with applicable accounting principles with respect to 35,000 options granted

on May 1, 2018 with an exercise price of $0.35. The fair value of the options was determined using the Black-Scholes option

pricing model using the following assumptions: (i) a risk-free interest rate of 2.69% (ii) an expected term of 3.4 years (iii)

an assumed volatility of 129% and (iv) no dividends.

|

|

|

|

|

|

|

(7)

|

Represents

the grant date fair value calculated in accordance with applicable accounting principles with respect to 30,000 options granted

on June 25, 2019 with an exercise price of $0.28. The fair value of the options was determined using the Black-Scholes option

pricing model using the following assumptions: (i) a risk-free interest rate of 1.7% (ii) an expected term of 4.0 years (iii)

an assumed volatility of 122% and (iv) no dividends.

|

|

|

|

|

|

|

(8)

|

Represents

the grant date fair value calculated in accordance with applicable accounting principles with respect to 30,000 options granted

on June 1, 2018 with an exercise price of $0.41. The fair value of the options was determined using the Black-Scholes option

pricing model using the following assumptions: (i) a risk-free interest rate of 2.67% (ii) an expected term of 4.0 years (iii)

an assumed volatility of 124% and (iv) no dividends.

|

Executive

Compensation for 2019

Changes

in each named executive officer’s base compensation for 2019, together with the methodology for determining their respective

bonuses, if any, are described below. The Board of Directors of OmniMetrix determined the compensation of its own executive officers

and other employees.

Jan

H. Loeb. On April 9, 2018, the Company entered into a new consulting agreement (the “2018 Consulting Agreement”)

with Mr. Loeb extending its arrangements for compensation of Mr. Loeb for his services as President and CEO of the Company. Following

the expiration of his 2017 Consulting Agreement on January 7, 2018, and through April 30, 2018, Mr. Loeb continued to provide

the consulting and other services to the Company called for in the agreement, and was compensated at the rate of $17,000 per month

provided for in the 2017 Consulting Agreement.

Pursuant

to the 2018 Consulting Agreement, Mr. Loeb received cash compensation of $12,000 per month commencing May 1, 2018, and $16,000

per month commencing August 15, 2019. When he assumed the additional position of Acting CEO of OmniMetrix, his monthly cash compensation

was increased to $26,000 effective December 1, 2019. Mr. Loeb also received a bonus of $100,000 in recognition of his performance

in the sale of the Company’s shares of DSIT Solutions Ltd. He was eligible for two additional bonuses during the term of

the 2018 Consulting Agreement: $150,000 upon consummation of a corporate acquisition transaction approved by the Company’s

Board, and $150,000 upon consummation of a corporate financing/funding transaction approved by the Company’s Board. On August

13, 2019, Mr. Loeb waived his right to receive the $150,000 bonus otherwise due to him under the terms of the 2018 Consulting

Agreement in connection with the consummation of the Company’s June 2019 Rights Offering. Mr. Loeb also received a grant

on May 1, 2018, of options to purchase 35,000 shares of the Company’s common stock, which shall be exercisable at a price

of $0.35 per share (the closing price for the common stock on the last trading day preceding the date of the grant). Fifty percent

(50%) of the options vested immediately; the remaining options vested in two equal increments on July 1, 2018 and October 1, 2018.

The options will expire on the earlier of January 1, 2025 or 18 months from the date Mr. Loeb ceases to be a director, officer,

employee or consultant of the Company.

The

2018 Consulting Agreement expired on December 31, 2019; the Company and Mr. Loeb have entered into a new Consulting Agreement

for 2020 as described below.

Tracy

S. Clifford. On June 1, 2018, Tracy S. Clifford was appointed CFO of the Company, replacing outgoing CFO, Michael Barth,

who resigned from this position as of that date. Concurrent with the appointment of Ms. Clifford as CFO, the Company entered into

a consulting arrangement with Ms. Clifford pursuant to which she initially received a monthly fee of $8,500, increased to $9,500

effective November 1, 2018 as allowed by the agreement for the additional hours worked in excess of the average monthly hours

covered by the original retainer, in exchange for her services as CFO. Her monthly fee was increased to $11,500 effective August

15, 2019. Ms. Clifford was appointed to the additional position of COO of OmniMetrix on November 18, 2019 and her monthly fee

was increased to $16,500 effective December 1, 2019. Ms. Clifford is not an employee of the Company. Unless otherwise terminated

in accordance with its provisions, her consulting agreement with the Company automatically renews for an additional year upon

the expiration of each one-year term. Ms. Clifford also received a grant on June 1, 2018 of options to purchase 30,000 shares

of our common stock, with an exercise price of $0.41 per share, which was the closing price of the common stock on May 31, 2018.

The options vested and became exercisable on the first anniversary of the date of grant and shall expire upon the earlier of (a)

seven years from the date of the grant or (b) 18 months from the date Ms. Clifford ceases to be a consultant to the Company. At

the beginning of each additional one-year term, the Company shall grant Ms. Clifford an additional 30,000 stock options, which

shall have an exercise price equal to the most recent closing price immediately preceding the grant date and otherwise have the

same terms as the options described above. Ms. Clifford received a grant on June 25, 2019 of options to purchase 30,000 shares

of our common stock, with an exercise price of $0.28 per share, which was the closing price of the common stock on June 24, 2019,

and similar vesting and expiration terms as her 2018 option grant.

Walter

Czarnecki. Mr. Czarnecki’s base compensation was increased to $242,000 from $220,000 effective June 1, 2018 pursuant

to the terms of his employment agreement. Mr. Czarnecki resigned from the Company effective December 6, 2019.

Stockholder

Input on Executive Compensation

Stockholders can provide the Company with their views on executive compensation matters at each year’s annual meeting through

the stockholder advisory vote on executive compensation and during the interval between stockholder advisory votes. The Company

welcomes stockholder input on our executive compensation matters, and stockholders are able to reach out directly to our independent

directors by emailing to samzentman@yahoo.com to express their views on executive compensation matters.

Employment

Arrangements

The

employment arrangements of each named executive officer and certain other officers are described below. From time to time, the

Company has made discretionary awards of management options as reflected in the table above.

Jan

H. Loeb. On January 30, 2020, the Company entered into a new consulting agreement (the “2020 Consulting Agreement”)

with Jan H. Loeb, extending its arrangements for compensation of Mr. Loeb for his services as President and CEO of the Company

and as principle executive officer of the Company’s OmniMetrix subsidiary in the capacity of Acting CEO.

Pursuant

to the 2020 Consulting Agreement, Mr. Loeb will receive cash compensation, effective retroactively as of January 1, 2020, of $16,000

per month for service as President and CEO of the Company, and an additional $10,000 per month for so long as he serves as Acting

CEO of OmniMetrix. Mr. Loeb also received a grant of options on January 30, 2020, to purchase 35,000 shares of the Company’s

common stock, which are exercisable at an exercise price equal to the December 31, 2019, closing price of the common stock of

$0.37 per share. Twenty-five percent (25%) of the options were vested immediately; the remaining options shall vest in three equal

increments on April 1, 2020, July 1, 2020 and October 1, 2020. The exercise period and other terms are otherwise substantially

the same as the terms of the options granted by the Company to its outside directors.

Tracy

S. Clifford serves as both CFO of the Company and COO of OmniMetrix pursuant to a Consulting Agreement with Tracy Clifford

Consulting, LLC, for the provision of Ms. Clifford’s services. In such capacity, Ms. Clifford acts as a consultant to, and

not an employee of, Acorn. The current term of the Consulting Agreement began on June 1, 2020, and expires on June 1, 2021. The

Consulting Agreement automatically renews for an additional year upon the expiration of each one-year term. Pursuant to the Consulting

Agreement, Ms. Clifford currently receives cash compensation of $16,500 per month. Ms. Clifford also receives additional cash

compensation at the rate of $200 per hour for each hour worked in excess of an aggregate of five hundred twenty (520) hours during

any one-year term. At the beginning of each one-year term of the Consulting Agreement, Ms. Clifford also receives a grant of options

to purchase 50,000 shares of the Company’s common stock, with an exercise price equal to the closing price of the common

stock on trading day immediately preceding the commencement of such one-year term. The options will vest and become exercisable

on the first anniversary of the date of grant and shall expire upon the earlier of (a) seven years from the date of grant or (b)

18 months from the date Ms. Clifford ceases to be a consultant to the Company.

Walter

Czarnecki. Mr. Czarnecki resigned as President and COO of OmniMetrix effective December 6, 2019. Mr. Czarnecki served

as President and COO of OmniMetrix beginning in March 2014 and as CEO beginning in March 2015. Until June 1, 2017, Mr. Czarnecki

had no employment agreement and was employed on an “at-will” basis. Mr. Czarnecki’s annual salary for 2016 and

until June 1, 2017 was $200,000. Mr. Czarnecki and OmniMetrix entered into an Employment Agreement on June 19, 2017. The Employment

Agreement had a three-year term and provided for a base annual salary of $220,000 which was increased to $242,000 on June 1, 2018.

Upon the achievement by OmniMetrix and Mr. Czarnecki of certain performance goals established annually by the Board of OmniMetrix,

Mr. Czarnecki would have been entitled to increases in his annual salary and an annual bonus. If his employment had been terminated

without Cause (as defined in the Employment Agreement), Mr. Czarnecki would have been eligible for a severance payment equal to

six-months’ base salary at the rate in effect at the time of termination, to be paid in equal installments over a six-month

period subject to his continuing fulfillment of his ongoing obligations under the Agreement. Mr. Czarnecki did not receive a bonus

for 2016 or 2017. Mr. Czarnecki continues to hold a 1% interest in OMX Holdings, Inc., which is itself the holder of 100% of the

membership interests of OmniMetrix.

Outstanding

Equity Awards at 2019 Fiscal Year End

The

following tables set forth all outstanding equity awards made to each of the Named Executive Officers that were outstanding at

December 31, 2019.

|

OPTIONS TO PURCHASE ACORN ENERGY, INC. STOCK

|

|

Name

|

|

Number of

Securities

Underlying

Unexercised

Options (#)

Exercisable

|

|

|

Number of

Securities

Underlying

Unexercised

Options (#)

Unexercisable

|

|

|

Option

Exercise

Price

($)

|

|

|

Option

Expiration Date

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jan H. Loeb

|

|

|

25,000

|

|

|

|

―

|

|

|

|

0.20

|

|

|

|

August 13, 2022

|

|

|

|

|

|

35,000

|

|

|

|

—

|

|

|

|

0.36

|

|

|

|

January 8, 2024

|

|

|

|

|

|

35,000

|

|

|

|

―

|

|

|

|

0.35

|

|

|

|

January 1, 2025

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tracy S. Clifford

|

|

|

30,000

|

|

|

|

30,000

|

|

|

|

0.41

|

|

|

|

June 1, 2025

|

|

|

|

|

|

―

|

|

|

|

30,000

|

|

|

|

0.28

|

|

|

|

June 24, 2026

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Walter Czarnecki

|

|

|

―

|

|

|

|

—

|

|

|

|

―

|

|

|

|

―

|

|

|

WARRANTS TO PURCHASE ACORN ENERGY, INC. STOCK

|

|

Name

|

|

Number of

Securities

Underlying

Unexercised

Warrants (#)

Exercisable

|

|

|

Number of

Securities

Underlying

Unexercised

Warrants (#)

Unexercisable

|

|

|

Warrant

Exercise

Price

($)

|

|

|

Warrant

Expiration Date

|

|

|

Jan H. Loeb

|

|

|

35,000

|

(1)

|

|

|

—

|

|

|

|

0.13

|

|

|

|

March 16, 2023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tracy S. Clifford

|

|

|

―

|

|

|

|

―

|

|

|

|

―

|

|

|

|

―

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Walter Czarnecki

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

(1)

|

Warrants

held by Leap Tide Capital Management, LLC.

|

Option

and Warrant Exercises

None.

Non-qualified

Deferred Compensation

The

following table provides information on the executive non-qualified deferred compensation activity for each of our named executive

officers for the year ended December 31, 2019.

|

Named Executive Officer

|

|

|

Executive

Contributions in Last

Fiscal Year

($)

|

|

|

|

Registrant

Contributions

in Last

Fiscal Year

($)

|

|

|

|

Aggregate

Earnings

(Losses) in

Last Fiscal

Year ($)

|

|

|

|

Aggregate

Withdrawals/

Distributions

($)

|

|

|

|

Aggregate

Balance at

Last Fiscal

Year End

($)

|

|

|

Jan H. Loeb

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tracy S. Clifford

|

|

|

―

|

|

|

|

―

|

|

|

|

―

|

|

|

|

―

|

|

|

|

―

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Walter Czarnecki

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

Payments

and Benefits Upon Termination or Change in Control

Jan

H. Loeb

Under

the terms of the consulting agreement with Mr. Loeb, there are no amounts due under any termination scenario.

Tracy

S. Clifford

Under

the terms of the consulting agreement under which Ms. Clifford serves as our CFO, there are no amounts due under any termination

scenario.

Walter

Czarnecki

Mr.

Czarnecki resigned from the Company effective December 6, 2019. He was not paid any severance or any other benefits in connection

with his resignation. Under the terms of the employment agreement with Mr. Czarnecki (which terminated upon his resignation),

we would have been obligated to make certain payments to him upon the termination of his employment not for cause.

The

following table describes the potential payments and benefits that would have been due upon termination of employment for Mr.

Czarnecki, as if his employment terminated as of December 31, 2019, the last day of our last fiscal year assuming that there had

been no earned, but unpaid base salary at the time of termination.

|

|

|

Circumstances of Termination

|

|

|

Payments and benefits

|

|

Voluntary resignation

|

|

|

Termination

not for cause

|

|

|

Change of control

|

|

|

Death or disability

|

|

|

Compensation:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Base salary

|

|

$

|

—

|

|

|

$

|

121,000

|

(1)

|

|

$

|

—

|

|

|

$

|

—

|

|

|

Benefits and perquisites:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Perquisites and other personal benefits

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Total

|

|

$

|

—

|

|

|

$

|

121,000

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

|

(1)

|

Represents a payment of six months’ salary that

would have been due, payable in equal installments over a six-month period to Mr. Czarnecki.

|

Compensation

of Directors

The

Board reviews non-employee director compensation on an annual basis. Our compensation policy for non-employee Directors for 2019

was as follows:

Each

non-employee Director receives an annual retainer of $15,000, plus an annual grant on January 1 of an option to purchase 10,000

shares of Company Common Stock.

Upon

a non-employee Director’s first election or appointment to the Board, such newly elected/appointed Director will be granted

an option to purchase 25,000 shares of Company Common Stock. Each option so granted to a newly elected/appointed Director shall

vest for the purchase of one-third of the shares purchasable under such option on each of the three anniversaries following the

date of first election or appointment.

All

options granted to non-employee Directors shall have an exercise price equal to closing price of the Company’s Common Stock

on its then-current trading platform or exchange on the last trading day immediately preceding the date of grant, and shall, except

as described in the preceding paragraph, vest in four installments quarterly in advance. Once vested, such options shall be exercisable

in whole or in part at all times until the earliest of (i) seven years from the date of grant or (ii) 18 months from the date

such Director ceases to be a Director, officer, employee of, or consultant to, the Company.

The

chair of the Audit Committee receives an additional annual retainer of $10,000; each Audit Committee member other than the chair

receives an additional annual retainer of $2,000.

Each

Director may, in his or her discretion, elect by written notice delivered on or before the first day of each calendar year whether

to receive, in lieu of some or all of his or her retainer and board fees, that number of shares of Company Common Stock as shall

have a value equal to the applicable retainer and board fees, based on the closing price of the Company’s Common Stock on

its then-current trading platform or exchange on the last trading day immediately preceding the first day of the applicable year.

Once made, the election shall be irrevocable for such election year and the shares subject to the election shall vest and be issued

one-fourth upon the first day of the election year and one-fourth as of the first day of each of the second through fourth calendar

quarters thereafter during the remainder of the election year. A newly-elected or appointed Director may, in his or her discretion,

make such an election for the balance of the year in which he or she was elected/appointed by written notice delivered on or before

the tenth day after his or her election/appointment to the Board, with the number of shares of Company Common Stock subject to

such newly elected/appointed Director’s election to be based on closing price of the Company’s Common Stock on its

then-current trading platform or exchange on the last trading day immediately preceding the day of such newly elected/appointed

Director’s election/appointment.

The

following table sets forth information concerning the compensation earned for service on our Board of Directors during the fiscal

year ended December 31, 2019 by each individual (other than Mr. Loeb who was not separately compensated for his Board service)

who served as a Director at any time during the fiscal year.

DIRECTOR

COMPENSATION IN 2019

|

Name

|

|

Fees Earned or

Paid in Cash ($)

|

|

|

Option

Awards ($) (1)

|

|

|

All Other

Compensation ($)

|

|

|

Total ($)

|

|

|

Samuel M. Zentman

|

|

|

25,000

|

(2)

|

|

|

2,383

|

|

|

|

—

|

|

|

|

27,383

|

|

|

Gary Mohr

|

|

|

17,000

|

(3)

|

|

|

2,383

|

|

|

|

―

|

|

|

|

19,383

|

|

|

Michael F. Osterer

|

|

|

8,500

|

(4)

|

|

|

2,383

|

|

|

|

―

|

|

|

|

10,883

|

|

|

|

(1)

|

On

February 5, 2019, Samuel M. Zentman, Gary Mohr, and Michael F. Osterer were each granted 10,000 options to acquire stock in

the Company. The options had an exercise price of $0.31 and were to expire on February 5, 2026. The fair value of the options

was determined using the Black-Scholes option pricing model using the following assumptions: (i) a risk-free interest rate

of 2.5% (ii) an expected term of 3.7 years (iii) an assumed volatility of 122% and (iv) no dividends.

|

|

|

|

|

|

|

(2)

|

Represents

the annual retainer of $15,000 as a non-employee director and $10,000 received for services rendered as Chairman of the Audit

Committee.

|

|

|

|

|

|

|

(3)

|

Represents

the annual retainer of $15,000 as a non-employee director plus $2,000 received for services rendered as a member of the Audit

Committee.

|

|

|

|

|

|

|

(4)

|

Mr.

Osterer waived his right to receive board fees for the first half of 2019. Represents half of the annual retainer of $15,000

plus $1000 received for services rendered as a member of the Audit Committee.

|

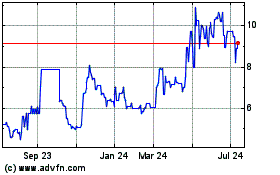

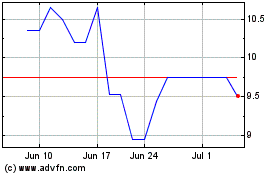

PROPOSAL

2

AMENDMENT

OF THE COMPANY’S RESTATED CERTIFICATE OF INCORPORATION TO AUTHORIZE A REVERSE SPLIT OF THE COMPANY’S COMMON STOCK

AT ANY TIME PRIOR TO SEPTEMBER 14, 2021, AT A RATIO BETWEEN ONE-FOR-TEN AND ONE-FOR-TWENTY, IF AND AS DETERMINED BY THE COMPANY’S

BOARD OF DIRECTORS

Article

FOURTH of our Certificate of Incorporation currently authorizes the issuance of up to 42 million shares of our common stock, par

value $0.01 per share (no shares of preferred stock are authorized). As of July 31, 2020, a total of 39,687,589 shares of common

stock were issued and outstanding.

The

Board of Directors has approved, subject to stockholder approval, an amendment to Article FOURTH of the Certificate of Incorporation

to effect a reverse stock split of our common stock any time prior to the first anniversary of its approval by the stockholders

at a ratio to be selected by our Board of Directors between one-for-ten and one-for-twenty, which is referred to as the Reverse

Split proposal (the full text of the proposed amendment is attached as Annex A to this proxy statement).

At

last year’s annual meeting, our stockholders approved a similar proposal that authorized the Board of Directors to implement

a reverse stock split, at its discretion, at any time prior to the first anniversary of the date of the annual meeting. To date,

our Board of Directors has not deemed the implementation of a reverse split to be beneficial to our Company and our stockholders,

and, as a result, has not exercised the authority to effect a reverse split granted at last year’s annual meeting. That

authority will expire on September 25, 2020.

If

the current Reverse Split proposal is approved by a majority of our stockholders, the Board will have the discretion to determine,

as it deems to be in the best interest of our stockholders, the specific ratio to be used within the range described above and

the timing of the reverse stock split, which must occur at any time prior to the first anniversary of its approval by the stockholders.

The Board may also, in its discretion, determine not to effect the reverse stock split if it concludes, subsequent to obtaining

stockholder approval, that such action is not in the best interests of our Company and our stockholders. Our Board of Directors

believes that the availability of a range of reverse stock split ratios will provide it with the flexibility to implement the

reverse stock split in a manner designed to maximize the anticipated benefits for us and our stockholders. In determining whether

to implement the reverse split following the receipt of stockholder approval, our Board of Directors may consider, among other

things, factors such as:

|

|

●

|

the

historical trading price and trading volume of our common stock;

|

|

|

|

|

|

|

●

|

the

then-prevailing trading price and trading volume of our common stock and the anticipated impact of the reverse split on the

trading market for our common stock;

|

|

|

|

|

|

|

●

|

the

anticipated impact of the reverse split on our ability to raise additional financing; and

|

|

|

|

|

|

|

●

|

prevailing

general market and economic conditions.

|

If

our Board determines that effecting the reverse stock split is in our best interest, the reverse stock split will become effective

upon filing of an amendment to our Certificate of Incorporation with the Secretary of State of the State of Delaware. The amendment

will set forth the number of shares to be combined into one share of our common stock within the limits set forth in this proposal.