January 2nd, 2020

PERIOD and DOCUMENT: 10KSB for the FULL YEAR 12/31/2019

COMPANY CONFIRMED NAME: ACCESS-POWER, INC.

CENTRAL INDEX KEY: 0001041588

FORM TYPE: 10KSB

SEC FILE NUMBER: 333-65069

BUSINESS ADDRESS:

STREET 1: 17164 DUNE VIEW DRIVE

STREET 2: APT 106

CITY: GRAND HAVEN

STATE: MI

ZIP: 49417

|

Respectfully submitted to the,

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

The Division of Corporation Finance,

100 F Street NE, Washington, D.C. 20549

FORM 10-KSB

/X/ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED

DECEMBER 31, 2019.

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM ______ TO _____

COMMISSION FILE NUMBER: 333-65069

ACCESS-POWER, INC.

[Exact name of Registrant as

specified in its charter]

*** FLORIDA ***

Domicile State or other jurisdiction of

incorporation or organization

http://www.sunbiz.org

*** MICHIGAN ***

State of Operations

https://cofs.lara.state.mi.us/SearchApi/Search/Search

59-3420985

(I.R.S. Employer

Identification No.)

17164 DUNE VIEW DRIVE

APT 106

GRAND HAVEN, MI 49417

or

PO BOX 598

Grand Haven, MI 49417

(Address of principal executive offices)

REGISTRANTS TELEPHONE NUMBER, INCLUDING AREA CODE: 616-312-5390

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT: NONE

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT:

COMMON STOCK, $0.001 PAR VALUE - 500,000,000 shares authorized.

Indicate by check mark if the registrant is a well-known

seasoned issuer, as defined in Rule 405 of the Securities

Act. Yes No X

Indicate by check mark if the registrant is not required to file

reports pursuant to Section 13 or Section 15(d) of the Act.

Yes No X

The Company has had discussions with the SEC regarding a FRAUD

FORM 15 that was filed by previous management in 2007. We believe

that we have a fiduciary responsibility to report transaprent

information to our Shareholders.

We were victims of toxic death spiral debentures from 1998 to

2008. PLEASE FORGIVE OUR PAST. The past it the past, and

we wish to move forward with a plan to become fully

current with the SEC. We are trying the best we can within the

Spirit of the Law.

https://www.sec.gov/Archives/edgar/data/1041588/

000117347307000043/0001173473-07-000043-index.htm

Indicate by check mark whether the registrant (1) has

filed all reports required to be filed be Section 13 or 15(d)

of the Securities Exchange Act of 1934 during the preceding 12

months (or for such shorter period that the registrant was

required to file such reports), and (2) has been subject

to such filing requirements for the past 90 days. Yes X No

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Web site, if any,

every Interactive Data File required to be submitted and

posted pursuant to Rule 405 of Regulation S-T (232.405 of

this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit

and post such files). Yes X No

Indicate by check mark if disclosure of delinquent filers

pursuant to Item 405 of Regulation S-K (Section 229.405

of this chapter) is not contained herein, and will not be

contained, to the best of registrants knowledge, in definitive

proxy or information statements incorporated by reference in

Part III of this Form 10-K or any amendment to this Form 10-K.

Indicate by check mark whether the registrant is a large a

ccelerated filer, an accelerated filer, a non-accelerated

filer, smaller reporting company, or an emerging growth

company. See the definitions of large accelerated filer,

accelerated filer, smaller reporting company, and

emerging growth company in Rule 12b-2 of the Exchange Act.

Large accelerated filer NO Accelerated filer NO

Non-accelerated filer NO (Do not check if a smaller

reporting company)

Smaller reporting company YES

Emerging growth company YES

If an emerging growth company, indicate by check mark if

the registrant has elected not to use the extended

transition period for complying with any new or revised

financial accounting standards provided pursuant to

ection 13(a) of the Exchange Act.

Indicate by check mark whether the registrant is a shell

company (as defined in Rule 12b-2 of the Exchange Act).

Yes No X

The aggregate market value of the voting common stock held by non-affils.

of the registrant (assuming officers and directors are affiliates) was

approximately $1,017,140.59 as of 12/3119, computed on the basis of

the closing price on such date.

As of January 2nd, 2020, there were 244,144,121 shares of the

registrant's

Common Stock outstanding. PATRICK J JENSEN, Director of Access-Power, Inc.

has 131,128,500 Restricted Shares. 113,015,621 + 131,128,500 =

244,144,121

total shares available of Access-Power, Inc. common stock.

*****WE ONLY HAVE COMMON STOCK*****

*****WE DO NOT HAVE CONVERTIBLE NOTES or WARRANTS*****

THE TOTAL MARKET CAPITALIZATION AS OF THE CLOSE OF BUSINESS

January 2nd, 2020 IS 2,197,297.09 BASED ON A CLOSING PRICE OF

$.009 PER SHARE.

**** CURRENT UPDATE ****

Our comeback journey continues. We are very excited about our future.

We filed our first tax return in 18 years. We hired H&R Block of Muskegon

to look over and supervise and review all of our financial bank records

and statements for 2018 and 2019. We believe in 100% Transparency. We are

making very good informed decisions. H&R BLOCK engagement--->

This occured on November 5, 2019 - our date of engagement with HR&BLOCK

In November of 2019 , we have started an application with the State of

Michigan to obtain a MicroMarijuana business. We only plan to operate

our futuristic plan of delivering Marijuana Plants by Drones via a

service called Clones by Drones TM. This process could take

2-3 years to implement. The application was started at:

https://aca3.accela.com/MIMM/Login.aspx

The Company believes it has the right to commence operations with a

pending license application. ACCR has a very super cool business model

that will defy conventional logic---> LOGISTICs are simple.

We expect to get the licenses, zoning requirements, and permits

necessary to operate our BUSINESS PLAN. WE HAVE A SALES BUSINESS PLAN.

ACCR has a business plan that represents my DREAMs in life. I will

not hurt my Shareholders. Everyone is welcome, and ACCR is grateful

and thankful. We are not sellers of our common stock. PERIOD.

Access-Power, Inc. has a big task ahead of itself. We have many

obstancles to grow our 20' x 20' Master Mother Grow and Cloning Rooms. We

would expect to be fully operational with inventory in 3 months of

beginning construction. We do not have Clones by Drones operational yet

to accept Visa/Martercard or Pay/Pal payments. We expect to turn on

our eCommerce website sometime in 2020 or possibly 2021. Probably in

2020. We believe in only MEDICAL MARIJUANA, and will not offer at the

moment any products to people that do not possess a valid Medical

Marijuana Card issued by any State. There are dispensaries here in

Michigan that accept patients from out of State. We plan to

mirror the growth's of the Dispensaries. We plan to grow around

the dispensaries, and offer our cool and futuristic service

by Drones. Access-Power, Inc. has in its business plan a way to

logistically deliver in a very cost effective way.

BACK to our engagement with H&R Block on November 5, 2019.

We realize that this is not a PCAOB firm, PLEASE...

however, this is all the Company can afford. Within the spirit of the

law, we are filing these documents to report transparency to our

Shareholders. We have spoken to the SEC regarding this requirement, and

it is the Companies intention to hire a PCAOB firm in 2020 or in 2021.

We have to start somewhere and again it is our goal to fully hire a PCAOB

accountant in the year 2020 or 2021. We have communicated our 2 year

plan with the SEC. We have a very transparent relationship

with many divisions of FINRA. The Company has great contacts at

OTC Markets. The Company also has a trusting relationship that is

very open with the SEC.

Access-Power, Inc. was the victim of toxic convertible death spiral

debentures from inception through 2008. I purchased common stock

during this time, and slowly became a 10% stock holder over the years.

The Florida Law which allowed us to fire all previous crooked Directors

is Chap 607.0702 of the 2012 Florida Senate Law.

The Company has survived a short attack, and the Company will attempt

to hire an attorney in 2020 to represent us.

ON DECEMBER 13, 2019, ACCESS-POWER, INC. eFILED ITS FIRST STATE AND

FEDERAL TAX RETURN IN OVER 18 YEARS. THE eFILE WAS ACCEPTED BY ALL

PARTIES ON DECEMBER 19, 2019. ACCESS-POWER, INC. PLANS TO CONTINUE TO

WORK WITH OUR TEMPORARY AUDITOR THROUGHOUT 2020. WE ARE STRIVING TO BE

A VERY TRANSPARENT AND CURRENT REPORTING ENTITY. THERE ARE ONLY

98,144,246 SHARES IN OUR PUBLIC FLOAT. THIS IS FIXED, AND THERE IS NO

DILUTION, I REPEAT....NO DILUTION IN THE COMPANY COMMON SHARES

THROUGHOUT 2020 AND 2021. AGAIN, THE SUPPLY OF STOCK IS FIXED.

We are a micro-cap business with very struggling revenues at

the moment, and we are developing the first eCommerce website to deliver

Marijuana, Marijuana plants, and other Marijuana products such as Edibles

by Drones. We are going through a rough economic business cycle.

We applied for a Trademark SERVICE MARK on November 13, 2019.

We will succeed. This may take a few years to develop. At the present

time, I am still waiting for our Companies previously announced

$50,000.00 donation. This may take another 6-9 months.

There are many entities that do not want ACCR to comeback.

As of the close of business January 1st 2020, our commomn stock

structure is as follows:

Authorized Common Stock: 500,000,000 shares

Outstanding Common Stock: 244,144,121 shares

Estimated Float: Substanstially less than 98,244,146 shares

Restricted Common Stock: 145,769,975 shares

https://www.otcmarkets.com/stock/ACCR/profile

We have public profiles at:

https://www.linkedin.com/in/patrick-j-jensen-564946b4

https://www.twitter.com/AccessOtc

https://www.twitter.com/AccrOtc

https://brokercheck.finra.org/individual/summary/1952963

OUR CORPORATE WEBSITEs ARE:

http://www.myaccess-power.com

http://www.clonesbydrones.com

http://www.mycbdpets.com

http://www.nyumarijuana.com

Access-Power, Inc.'s contact is pjensen@myaccess-power.com.

We applied for a Trademark for Clones By Drones TM. The service

will be very futuristic, and will be the first of its kind.

Access-Power, Inc. is in good standing and has a very good relationship

with our Transfer Agent, Standard Transfer & Co.

Our Transfer Agent is SEC registered, and except for one

change in ownership in 2007, is our original transfer agent dating

back to 1996. Our transfer agent is SEC registered and has a profile at:

https://www.sec.gov/divisions/marketreg/mrtransfer.shtml

https://www.otcmarkets.com/learn/service-providers/2433?t=6

https://standardtransferco.com

Standard Transfer & Co.

440 East 400 South Suite 200, Salt Lake City, Utah 84111

Phone (801) 571-8844 Fax: (801) 328-4058

Our ticker symbol ACCR and further information may be found at:

https://www.sec.gov/cgi-bin/browse-edgar?CIK=accr

State the aggregate market value of the voting stock held by

non-affiliates

computed by reference to the price at which the stock was sold,

or the average

bid and asked prices of such stock as of a specified date

within the past 60

days: $1,130,156.21

At January 1st 2020, there were issued and outstanding 244,144,121

shares of Common Stock, and Patrick J. Jensen owns 131,128,500 shares

or 53.7090

percent of all the Common Stock. I am willing to give up Control and

a

percentage of the Company, for an Equity Partner in our Company.

All

131,128,500 are currently restricted and held in book entry form at the

Transfer Agent. I am actively looking for a MERGER DEAL.

There are currently a total of 98,244,146 shares registered in our

float.

Management continues to believe that there is a massive short position

in our Company stock that was accumulated from 1999 to 2008, and we

estimate

this short position to be massive. As Director of this Company, I

want to

apologize to my Shareholders for previously stating that our estimated

float

was between 5,000,000 and 10,000,000. Although I firmly believe the

float

in our Company stock is substantially lower than the official

98,244,146 shares

reported to OTC Markets.

We care about our Shareholders dearly, and our top priority is investor

protection. There is NO DILUTION IN THE COMMON STOCK OF ACCR.

PART I

ITEM 1. DESCRIPTION OF BUSINESS

Access-Power, Inc, is a for profit business looking for a

MERGER CANDIDATE.

We currently pay bills through a Work at Home business. Our monthly

fixed expenses are previosuly documented in an 8K at $2,350.00. We

operate a part time work at home business. The company subcontracts

through a big call center, and provides sales and customer service

to big Fortune 500 companies. In 2019, we operated via Hunter Vunter,

our subsidiary through www.liveops.com. We ended the relationship

with LiveOps on May 1st 2019. As a result, Hunter Venture was

officially dissolved.

The Company struggled from May 1, 2019 to October 18, 2019. We had no

income during this period, and our operational expenses were paid for

by myself, Patrick J. Jensen as a donation to the Company. I personally

paid out of my own pocket all the expenses during this dark time.

On October 2, 2019---> I dreamed of getting off the greys. ACCR is a

DREAM right now...This is how builders work.

On October 18, 2019, we acquired Grand Haven MM LLC, and this entity

is our subsidiary now. This is an operating entity very similar

to Hunter Venture. The entity is registered in the State of Michigan

here:

https://cofs.lara.state.mi.us/CorpWeb/CorpSearch/CorpSummary.aspx?

ID=802220565

Grand Haven MM now operates a part time work at home program through

another national call center very similar and much bigger in size

than our previour contracter. We provide work at home sales and

customer services subcontracted on a part time basis. I am a builder.

I am building a Clone Delivery Service for Marijuana Plants .... in

West Michigan.

The Company also operates 2 eCommerce websites at the present time.

http://www.clonesbydrones.com

http://www.mycbdpets.com

We continue to strive to build up our revenues. We want to succeed

and we will comeback to a higher reporting standard. On October 18,

2019 we were upgraded in trading tier from the dark grey market

to the PINK NO INFORMATION market. We have no intention of going

back to the grey market, as the Company currently trades on an

"unsolicited basis" in the PINK NO INFORMATION tier at OTC

Markets. There are so many unknowns, however I have a vision

and a promise to my Shareholders that there will be NO DILUTION

PERIOD in ACCR. The market transparency in our stock is AMAZING!

I have not sold 1 single share of stock in over a Decade.

Access-Power, Inc.'s revenue shortfalls are supported by personal

donations from Patrick J. Jensen, our Company Director.

The future of ACCR is Clones by Drones TM. We expect to be

very successful in this new venture. We believe that ordering

Marijuana Plants online will be a huge business in the future. We

plan to operate the Clones by Drones TM locally in 2020. We expect

demand to be pretty good for this product once we begin our

operations. The logistics for this business is easy. ACCR plans to

only sell Marijuana Plant Clones to the residents of Grand Haven

where the city council on April 23, 2019 just approved Medical

Marijuana. At first, we plan to only sell marijuana plants to local

Michigan residents, and we do not plan to cross state lines.

ITEM 1a. RISK FACTORS

Access-Power, Inc. sees RISK EVERYWHERE. THERE IS NO DILUTION IN OUR

COMMON STOCK. We are in control of the treasury of ACCR. We will

guard this treasury with our life, as we believe that NO DILUTION will

be very beneficial to our Shareholders of the long term. There

are no convertible debentures associated with ACCR.

ITEM 1b. UNRESOLVED STAFF COMMENTS

NONE.

ITEM 2. PROPERTY

1. http://tsdr.uspto.gov/#caseNumber=88690325&caseType= SERIAL_NO&

searchType=statusSearch

2. Hollistic Legendary Seeds $1,000.00 estimated value. Shelf

life of 10 years.

3. 2006 Volvo S80 with MI License plate ACCR with a estimated

stated value of $1,000.00.

4. The Mind of Patrick J Jensen.

ITEM 3. LEGAL PROCEEDINGS

NONE.

ITEM 4. Mine Safety Disclosures.

If applicable, provide a statement that the information

concerning mine safety violations or other regulatory matters

required by Section 1503(a) of the Dodd-Frank Wall Street

Reform and Consumer Protection Act and Item 104 of

Regulation S-K (17 CFR229.104) is included in exhibit

95 to the annual report.

NONE.

PART II

ITEM 5. MARKET FOR REGISTRANTS COMMON EQUITY, RELATED STOCKHOLDER

MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

THERE IS NO MARKET MAKER QUOTING OUR COMPANY STOCK. We currently

trade in the PINK NO INFORMATION tier at OTC MARKETs. We are in

search of a Market Maker to file a FORM 211 with Finra. Our public

profile at OTC Markets is:

https://www.otcmarkets.com/stock/ACCR/security

All we have to do is get 2 years of AUDITED FINANCIALS.

ITEM 6. SELECTED FINANCIAL DATA

OUR DREAM IS PRICELESS...Where do I place public value on

https://www.clonesbydrones.com ?

ACCESS-POWER, INC.

(An Emerging Growth Company)

UNAUDITED - REVIEWED by HR & Block

Balance Sheets Comps

Assets

September 30, December 31,

2019 2019

------------------ ------------------

(unaudited)

Current assets:

Cash $ 1.48 $ 1,138.73

CDs

Accounts receivable $ 0 $ 0

Prepaid expenses

Hollistic

Legendary Seeds $ 1,000.00 $ 1,000.00

---------------------------------------

Total current assets $ 1,001.48 $ 2,138.73

----------------------------------------

Property and equipment, net

ACCR Car $ 0 $ 1,000.00

Other assets $ 0 $ 0

---------------------------------------

Total assets $ 1,001.48 $ 3,138.73

=======================================

=======================================

Liabilities and

Stockholders' Equity

(Deficit)

|

Current liabilities:

Accounts payable and accrued

expenses rent $ 1,500.00 $ 1,500.00

Cable, Internet, and TV $ 185.00 $ 185.00

Electricity, Gas,

Water, and Sewer $ 100.00 $ 100.00

Marketing Expenses $500.00 $ 500.00

Food, Office supplies, etc $ 100.00 $ 100.00

Current portion of

long-term debt - -

Total current liabilities $ 0 $ 0

Convertible debentures/notes

and Warrants $ 0 $ 0

------------------ ------------------

|

Total short term

liabilities (($ 2,385.00)) (($ 2,385.00))

Stockholders' equity

(deficit):

Common stock,

$.001 par value,

authorized

500,000,000 shares,

issued and outstanding

244,144,121

and 244,144,121 shares

as of December 31st, 2019

and Dec 31, 2018

ACCR TREASURY OF

COMMON STOCK IS

SOLID STEEL

STRUCTURE

NO DILUTION

2020 and 2021

Par Value of

Equity Structure $ 244,144.12 $ 244,144.12

=======================================

ACCR

Total liabilities

and stockholders'

equity (deficit) $ 244,144.12 $ 244,144.12

=======================================

|

ACCESS-POWER, INC

CONDENSED CONSOLIDATED STATEMENTS

OF OPERATIONS (unaudited)

FISCAL YEAR ENDED December 31st, 2019

CASH FLOW OF OPERATIONS

Patrick J Jensen Personal Donation $ 12,432.73

REVENUE $ 17,407.00

COST OF REVENUE $ 0

----------------------------------------------------------

GROSS PROFIT (LOSS) $ 29,839.73

OPERATING EXPENSES

Selling, general and administrative exp

rent, and utilities $ 28,200.00

Consulting fees $ 0.00

Professional fees and related expenses $ 0.00

TOTAL OPERATING EXPENSES $ 28,200.00

Salaries to Patrick J. Jensen $ 1.00

Fair value of derivative liability $ 0.00

OTHER INCOME nonrecurring $ 0.00

Gain on debt extinguishment $ 0.00

INCOME BEFORE PROVISION FOR $ 499.00

INCOME TAXES $ 0.00

PROVISION FOR INCOME TAXES

treated as prepaid expense on

balance sheet $ 0.00

NET (LOSS) INCOME $ 1,138.73

BASIC (LOSS) INCOME PER SHARE

DILUTED (LOSS) INCOME PER SHARE $ 1,138.73

WEIGHTED AVERAGE COMMON SHARES

OUTSTANDING BASIC 244,144,121 shares

TOTAL RESTRICTED SHARES 145,769,975 shares

ESTIMATED FLOAT LESS THAN 98,244,146 shares

Estimated Trading Float substantially

lower than 98,244,146 shares

|

ITEM 7. MANAGEMENTS DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

Access-Power, Inc. is for sale. Access-Power, Inc., is a Grand Haven,

MI based medical marijuana clone company on track to become Michigan's

only manufacturer and distributor of medical marijuana clone products

delivered by Drones from the sky. We are planning and implementing to

become a fully licensed operation in the State of Michigan. Our seed

vault includes famous strains such as Amnesia Haze, Raspberry Cough,

The Original Glue, Girl Scout Cookies, Papaya, Sour Diesel, Tangerine,

Blue Dream, Mango Skunk, Critical CBD, and the original Hawaii Maui

Waui...just to name a few. We are in development of a new service

trademarked under the brand, Clones by Drones (TM), a method for

delivering marijuana and marijuana clones online across the nation.

Our beta website is www.clonesbydrones.com. Additionally, the Company

offers a variety of calming pet products on its website

www.mycbdpets.com. Access-Power, Inc. was formed in 1996 and is a

Florida-based profit Corporation. We only have common stock, and

the Corporation has zero debt and no convertible notes. Our

Shareholders will enjoy no dilution in our Common shares through

the end of 2021. Finally, Access-Power, Inc., is seeking to merge

with another entity with experienced management to create value for

our shareholders. The Director is Actively looking for a MERGER

DEAL.

ITEM 7a. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Access-Power, Inc. is not concerned about market risk.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

See item 6.

(b) A smaller reporting company may provide the information

required by Article 8 of Regulation S-X in lieu of any

financial statements required by Item 8 of this Form.

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING

AND FINANCIAL DISCLOSURE

NONE.

ITEM 9A. CONTROLS AND PROCEDURES

Access-Power, Inc. has strict rules to follow and a Corporate Governance.

ITEM 9B. OTHER INFORMATION

Access-Power, Inc. will succeed, and will come back further. On October 18,

2019 Access-Power, Inc. was upgraded in tier at OTC Markets from

the grey market back to the Pink No Information Tier. We spent 11 dark

years on the OTC Grey Market. BAD things happen to some of the

Companies that trade, but we have life and we came back. We believe

in a higher reporting standard. We will not dilute our Shareholders

in 2020 and 2021. Patrick J. Jensen made a critical decision in 2018 which

enabled ACCR to get upgraded in tier. There is an SEC 15c211 Modernization

Rule update coming in 2020.

Corporate Actions

Market Changes

ACTION TYPE EFFECTIVE DATE SYMBOL DESCRIPTION

Market Change 10/30/2008 ACCR Market change from Pink No

|

Information to Grey Market

Market Change 10/18/2019 ACCR Market change from Grey Market

to Pink No Information

We spent 11 years on the grey market "Cellar Boxed."

Everyone wants to know how I did it, as there are only a handful

of companies that have ever returned from the dark greys. ACCR has

accomplished the unthinkable. We have liquidity and further

transparency.

Pink No Information

Dark or Defunct

Verified Profile 11/2019

https://www.otcmarkets.com/stock/ACCR/security

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERANCE

Patrick J. Jensen - Registered owner of 131,128,500 restricted shares

of ACCR.

All of these shares are federally RESTRICTED shares. I signed a lock

up agreement pledging never to sell or pledge to sell my restricted

stock until October 26, 2021. At that time, I will follow all

current SEC rules and regulations with regard to Company Directors.

I have 2 very close advisors who advise me on day to day operations.

ACCR

will soon announce an ADVISORY BOARD at no cost to the Company.

ITEM 11. EXECUTIVE COMPENSATION

Patrick J. Jensen is the only KEY EMPLOYEE. I donate all my time

and money to the ACCR Treasury. I donate my own personaly funds to

fund the operations, as ACCR has ZERO CONVERTIBLE NOTES and ZERO

long term debt. I take on a $1 salary from ACCR.

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND

MANAGEMENT AND RELATED STOCKHOLDER MATTERS

Patrick J. Jensen - Registered owner of 131,128,500

restricted shares of ACCR.

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR

INDEPENDENCE

NONE.

ITEM 14. PRINCIPAL ACCOUNTING FEES AND SERVICES

H&R BLOCK of Muskegon. We expect only to pay $450.00 every year for

review and support of the 2019 ACCR US Tax Return. We expect to

complete our 2020 US TAX BUSINESS RETURN sometime in April 2020.

***** CERTIFIED *****

https://www.otcmarkets.com/stock/ACCR/security

Our next step will be to amend our Company 10k from 2018.

We also will secure a letter signed by H&R Block attesting to

verification of all monthly bank records, revenue, and expenses.

We have a 2 year plan going forward to become CURRENT REGISTERED

with the SEC.

We have agreed to sign up for http://www.wave.com so that H&R Block

can have access to daily bank accounts records of the Company.

After 2 years, we plan to get an accountant that is

registered with the PCAOB, like BDO of Grand Rapids. We will

continue to be a CURRENT REPORTING company. We believe in our plan,

and we are secure in our future. Again, as of today, December

17, 2019...the verified outstanding share is 244,144,121 shares and at

a closing price of $.009, this represents a total Company

market value of $2,197,297.09.

PART IV

Item 15. Exhibits, Financial Statement Schedules.

See above.

Item 16. Form 10Ksb Summary

See above.

ALL OTHER QUESTIONS and PARTS OF THE FORM: THE ANSWER IS NONE or

I DO NOT KNOW.

This filing is a technical requirement in order to maintain our current

reporting status. As of the close of business December 31, 2020

there were issued and outstanding 244,144,121 shares of our Common stock.

Access-Power Inc. has $ 1,138.73 in our premiere checking account.

We are a For Profit Corporation active in the State of Florida,

operating in Michigan for the time being. Access-Power, Inc. is for sale.

We believe in Shareholder Value, and have promised NO DILUTION to my

SEC Section Chief's at the Corporate Finance Division of the SEC.

The following should be considered in connection with an evaluation of our

business and recent market activities as described above:

There are various risk factors that should be carefully considered in

evaluating our business; because such factors may have a significant

impact on our business, our operating results, our liquidity and financial

condition. As a result of these various risk factors, actual results could

differ materially from those projected in any forward-looking statements.

Additional risks and uncertainties not presently known to us, or that we

currently consider to be immaterial, may also impact our business, result

of operations, liquidity and financial condition. If any such risks occur,

our business, its operating results, liquidity and financial condition

could be materially affected in an adverse manner. Under such

circumstances, if a stable trading market for our securities is

established, the trading price of our securities could decline, and you

may lose all or part of your investment.

SECURITIES ISSUED BY THE COMPANY INVOLVE A HIGH DEGREE OF RISK AND,

THEREFORE, SHOULD BE CONSIDERED EXTREMELY SPECULATIVE. THEY SHOULD NOT BE

PURCHASED BY PERSONS WHO CANNOT AFFORD THE POSSIBILITY OF THE LOSS OF THE

ENTIRE INVESTMENT. PROSPECTIVE INVESTORS SHOULD READ ALL OF THE COMPANY'S

FILINGS, INCLUDING ALL EXHIBITS, AND CAREFULLY CONSIDER, AMONG OTHER

FACTORS THE VARIOUS RISK FACTORS THAT MAY BE PRESENT.

You should be aware that there are many substantial risks to an investment

in our common stock. Carefully consider these risk factors, along with any

available information currently reported by the Company (of which there

are note), before you decide to invest in shares of our common stock.

If these risk factors were to occur, our business, financial condition,

results of operations or future prospects could be materially adversely

affected. If that happens, the market price for our common stock, if any,

could decline, and prospective investors would likely lose all or even

part of their investment.

Cautionary Language Concerning Forward-Looking Statements

Statements in this press release may be "forward-looking statements" within

the meaning of the Private Securities Litigation Reform Act of 1995. Words

such as "anticipate", "believe", "estimate", "expect", "intend", and similar

expressions, as they relate to the Company or its management, identify

forward-looking statements. These statements are based on current

expectations, estimates, and projections about the Company's business,

based, in part, on assumptions made by management. These statements

are not guarantees of future performance and involve risks, uncertainties,

and assumptions that are difficult to predict. Therefore, actual

outcomes and results may, and probably will, differ materially from what

is expressed or forecasted in such forward-looking statements

due to numerous factors.

SIGNATURES*

Pursuant to the requirements of Section 13 or 15(d) of the Securities

Exchange Act of 1934, the registrant has duly caused this report to

be signed on its behalf by the undersigned, thereunto duly

authorized, on January 2nd, 2020.

Pursuant to the requirements of the Securities Exchange Act of 1934,

this report has been signed below by the following persons on behalf

of the registrant and in the capacities and on the dates indicated.

Supplemental Information to be Furnished With Reports Filed Pursuant

to Section 15(d) of the Act by Registrants Which Have Not Registered

Securities Pursuant to Section 12 of the Act

I am following the Spirit of the Law to comeback and fight for my

Shareholders.

I am commited to bringing back our Company to a fully reporting

and registered status with the SEC. The plan is to have 2 years of

audited tax returns filed for 2018 and 2019, and then in 2020/2021 to

have the $25,000.00 fee required by a PCAOB firm to audit the books

of Access-Power, Inc. I have a long and bumpy road ahead. There

is much risk to my plan. I am looking for a partner and a

Merger Deal.

Thank you to all my Shareholders, I won't let you down.

Just keep believing in me...and our comeback song is,

https://www.youtube.com/watch?v=xbhCPt6PZIU

GO ACCR!!!

BY:

/s/

Patrick J. Jensen

President, Treasurer, and Director

|

ACCESS-POWER, INC.

A Medical Marijuana Clone Delivery

Service only in Michigan

January 2nd, 2020

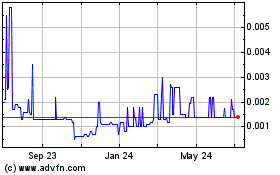

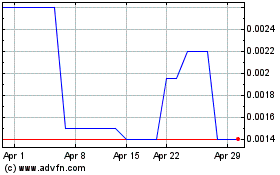

Access Power & (PK) (USOTC:ACCR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Access Power & (PK) (USOTC:ACCR)

Historical Stock Chart

From Apr 2023 to Apr 2024