SCHEDULE 14C

(Rule 14c-101)

INFORMATION REQUIRED IN INFORMATION STATEMENT

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c) of the Securities

Exchange Act of 1934

Check the appropriate box:

|

☐ Preliminary Information Statement

|

☐ Confidential, For Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

|

|

☒ Definitive Information Statement

|

|

|

ABCO ENERGY, INC.

|

|

(Name of Registrant as Specified in Its Charter)

|

|

2505 No. Alvernon Way

Tucson, AZ 85712

|

Payment of Filing Fee (Check the appropriate box):

☒ No fee required

☐ Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount previously paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

ABCO Energy, Inc.

2505 No. Alvernon Way

Tucson, AZ 85712

December 14, 2020

To our stockholders:

This information statement provides information to you regarding recent action taken by the Board of Directors of ABCO Energy, Inc. (“Company”) to authorize a reverse split of the outstanding and issued common stock of Company, at a Board of Director’s Meeting on December 1, 2020. The reverse split will result in a reduction of (i) the number of authorized shares of common stock of the Company from 5,000,000,000 shares currently authorized to 29,411,765 shares of common stock after the reverse split and also (ii) the reduction of the number of outstanding and issued shares of common stock so that after the split becomes effective the shares of common stock issued and outstanding will be reduced to 1 share for each 170 shares currently issued and outstanding. Currently there are 2,687,999,095 shares issued and outstanding. After the split the Company will have 15,811,760 issued and outstanding shares of common stock. This reverse split is authorized pursuant to Nevada Revised Statutes 78-207. No fractional shares will be issued, and no cash or other consideration will be paid. Instead, the Company will issue one whole share of the post-reverse stock split common stock to any stockholder who otherwise would have received a fractional share as a result of the reverse stock split. The reverse split will become effective at the opening of business on January 15, 2021.

Your vote is not required to approve any of these actions, and the enclosed information statement is not a request for your vote or a proxy. This information statement is furnished only to inform you of the action taken by the Board of Directors of the Company on November 20, 2020 above and before it takes effect in accordance with Rule 14c-2 promulgated under the Securities and Exchange Act of 1934, as amended. This information statement is first being mailed on or about December 14, 2020 to holders of record on December 9, 2020 and we anticipate the effective date of the actions to be January 15, 2021, or as soon thereafter as practicable in accordance with applicable law, including the Nevada Revised Statutes.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

Please read the accompanying information statement carefully.

Very truly yours,

ABCO Energy, Inc.

By: /s/ David Shorey

David Shorey

Acting President

ABCO Energy, Inc.

2505 No. Alvernon Way

Tucson, AZ 85712

INFORMATION STATEMENT

PURSUANT TO SECTION 14(C)

OF THE SECURITIES EXCHANGE ACT OF 1934

AND RULE 14C-2 THEREUNDER

NO VOTE OR OTHER ACTION OF THE COMPANY'S STOCKHOLDERS IS REQUIRED IN CONNECTION WITH THIS INFORMATION STATEMENT.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY

The Company is distributing this Information Statement to its stockholders in full satisfaction of any notice requirements it may have under Securities and Exchange Act of 1934, as amended and applicable Nevada law. No additional action will be undertaken by the Company with respect to the receipt of written consents, and no dissenters' rights with respect to the receipt of the written consents, and no dissenters' rights under applicable Nevada law are afforded to the Company's stockholders as a result of the adoption of these resolutions.

Reason for the Reverse Stock Split

The Board of Directors of the Company has determined that it is in the best interests of the Company to reverse split the common stock of the Company on a one (1) for one hundred and seventy (170) basis because the Company’s stock is currently closed at $0.0005 affording little or no liquidity for the shareholders. It is the belief of the Board that the reverse split will cause the bid and asked prices to increase, creating the possibility for the stock to trade at more reasonable prices and a more reasonable spread between the bid and asked prices.

The Board of Directors of the Company have the right to reverse split the stock of the Company in accordance with the Nevada Revised Statutes (NRS Section 78.207) to effect a reverse stock split of the Common Stock and the By Laws of the Company do not preclude the Board of Directors from taking such action. The reverse split will become effective at the opening of business on January 15, 2021.

Effects of the Reverse Stock Split

The Company is currently authorized to issue 5,000,000,000 shares of Common Stock. As a result of the one (1) for one hundred and seventy (170) share reverse stock split, the authorized shares will also be reversed one (1) for 171 shares. Thereafter, the Company’s authorized Common Stock will be 29,411,765 shares.. As of December 21, 2020, there were 2,687,999,095 shares of Common Stock outstanding. As a result of the reverse stock split, there will be approximately 15,811,760 shares of Common Stock outstanding (subject to adjustment due to the effect of rounding fractional shares into whole shares). The reverse stock split will not have any effect on the stated par value of the Common Stock.

Effective Date; Symbol; CUSIP Number

The reverse stock split becomes effective with FINRA (the Financial Industry Regulatory Authority) and in the marketplace at the open of business on January 15, 2021 (the “Effective Date”), whereupon the shares of common stock will begin trading on a split-adjusted basis. On the Effective Date, the Company’s trading symbol will change to “ABCED” for a period of 20 business days, after which the “D” will be removed from the Company’s trading symbol, which will revert to the original symbol of “ABCE”. In connection with the Reverse Stock Split, the Company’s CUSIP number will change to 00287V4023.

Split Adjustment; No Fractional Shares

On the Effective Date, the total number of shares of the Company’s common stock held by each stockholder will be converted automatically into the number of whole shares of common stock equal to (i) the number of issued and outstanding shares of common stock held by such stockholder immediately prior to the reverse stock split, divided by (ii) 171.

No fractional shares will be issued, and no cash or other consideration will be paid. Instead, the Company will issue one whole share of the post-reverse stock split common stock to any stockholder who otherwise would have received a fractional share as a result of the reverse stock split.

Non-Certificated Shares; Certificated Shares

Stockholders who are holding their shares in electronic form at brokerage firms do not have to take any action as the effect of the reverse stock split will automatically be reflected in their brokerage accounts.

Stockholders holding paper certificates may (but are not required to) send the certificates to the Company’s transfer agent at the address given below. The transfer agent will issue a new share certificate reflecting the terms of the reverse stock split to each requesting stockholder.

VStock Transfer, LLC

18 Lafayette Place

Woodmere, New York 11598

(212) 828-8436 voice

(646) 536-3179 fax

State Filing

The reverse stock split was effected by the Company filing a Certificate of Change (the “Certificate”) pursuant to Nevada Revised Statutes (“NRS”) Section 78.209 with the Secretary of State of the State of Nevada on or about January 14, 2021. The Certificate is not effective until the Effective Date. Under Nevada law, no amendment to the Company’s Articles of Incorporation is required in connection with the reverse stock split.

No Stockholder Approval Required

Under Nevada law, because the reverse stock split was approved by the Board of Directors of the Company in accordance with NRS Section 78.207. No stockholder approval is required. NRS Section 78.207 provides that the Company may effect the reverse stock split without stockholder approval if (x) both the number of authorized shares of Common Stock and the number of outstanding shares of Common Stock are proportionally reduced as a result of the reverse stock split (y) the reverse stock split does not adversely affect any other class of stock of the Company and (z) the Company does not pay money or issue scrip to stockholders who would otherwise be entitled to receive a fractional share as a result of the reverse stock split. As described herein, the Company has complied with these requirements. Because the authorized number of shares has been reduced to 29,411,765, the Company intends to amend its Articles of Incorporation to increase the authorized number of shares to ten billion shares. This is anticipated to happen within 90 days of the Effective Date.

Capitalization

The reverse stock split does not affect the Company’s authorized preferred stock. There are 30,000,000 outstanding shares of the Company’s preferred stock. After the reverse stock split, the Company’s authorized preferred Stock of 100,000,000 shares will remain unchanged.

Immediately after the reverse stock split, each stockholder’s percentage ownership interest in the Company and proportional voting power will remain virtually unchanged except for minor changes and adjustments that will result from rounding fractional shares into whole shares. The rights and privileges of the holders of shares of Common Stock will be substantially unaffected by the reverse stock split.

OTHER MATTERS

The entire cost of furnishing this information statement will be borne by Company. We will request brokerage houses, nominees, custodians, fiduciaries and other like parties to forward this information statement to the beneficial owners of common stock held of record by them and will reimburse such persons for their reasonable charges and expenses in connection therewith.

IF YOU HAVE ANY QUESTIONS REGARDING THIS INFORMATION STATEMENT, PLEASE CONTACT:

David Shorey, Acting President

ABCO Energy, Inc.

2505 No. Alvernon Way

Tucson AZ 85712

BY ORDER OF THE BOARD OF DIRECTORS OF ABCO ENERGY, INC.

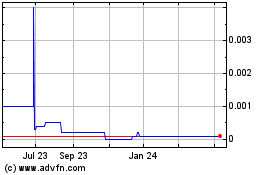

ABCO Energy (CE) (USOTC:ABCE)

Historical Stock Chart

From Mar 2024 to Apr 2024

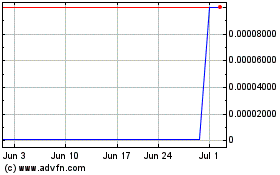

ABCO Energy (CE) (USOTC:ABCE)

Historical Stock Chart

From Apr 2023 to Apr 2024