Salona Global Medical Device Corporation (the

“

Company”, “

SGMD” or

“

Salona Global”) (TSXV:SGMD), an

acquisition-focused medical device company, has secured its first

European customer in Spain as part of its organic growth plan to

increase revenue growth of acquisition targets by expanding sales

in Europe and other global markets. The initial order, placed with

SDP, SGMD’s first acquisition, is expected to ship to the Spanish

customer before the end of the fiscal second quarter (August 31,

2021), and is for $193,000 of specialized drug delivery electrode

products with 35% margins. The Company anticipates recurring orders

from the same customer every four months which would result in

total estimated annual revenue of $550,000, which would be an

increase of about 3.5% of pre-Covid SDP annual revenues.

SGMD targets acquisitions with quality products

that have succeeded in the US medical device market but have little

or no revenue from Europe or other developed markets where SGMD

executives have relationships and a strong revenue track

record.

Global expansion post acquisition is a key part

of the SGMD organic growth strategy. As a result of the rapidly

maturing pipeline for potential acquisitions, management has

launched a European sales and marketing division in advance of

potentially closing on additional acquisitions. Leading that

division is Stephen Murphy. Mr. Murphy, a resident of the United

Kingdom, will work from the division headquarters near London. He

is the former President of DJO Global’s (“DJO”)

international business, with full P&L responsibility of the

European & International division. Mr. Murphy started his

27-year career at DJO in 1992 with responsibility for Ireland, and

ultimately being promoted to lead the international division of

DJO, where he grew revenue from $20M to in excess of $300M over 15

years in the European and International markets, then reporting to

Les Cross, the current SGMD Chair.

“I’m looking forward to SGMD closing additional

acquisitions quickly so that we can expand our products into our

existing relationships in Europe and around the world,” said Les

Cross, Chairman and interim CEO of SGMD. “It is good to see our

growth plan in action. While this is just one product in one

country, it is the first step in a plan where the execution path is

familiar to me and my team. We plan to complete more acquisitions,

which will provide us more products and I am confident we can break

into more EU countries. When I was CEO of DJO, we grew our sales

outside the US to one-third of total revenue. I have worked with

Stephen for 20 years as he grew the international business from

just a few million dollars to over 300 million dollars in sales. I

am confident that over time he can execute the same strategy for

Salona Global.”

The Company has posted its latest corporate

presentation, along with a webcast led by Chairman & interim

CEO Les Cross, at www.salonaglobal.com/investors.

Salona Global Today:

-

Revenue: SGMD’s first acquisition (SDP), has

standing purchase orders for 2021 of $6.6M or 40% of its earn out

target. SDP had $15.8M in 2019 audited annual revenue (Pre-COVID),

generating positive operational cash flow.* It recently secured a

contract with a Spanish customer estimated to generate $550,000 in

annual sales with margins of 35%.

- Cap Table and Concurrent

Financing: SGMD has approximately 63.8 million shares (on

a partially diluted basis)** upon commencement of trading, with

over 30 million shares either restricted or held by management or

advisors. (See below share capital table.)

- M&A Capacity:

Salona Global has a deep and full pipeline of private firms that

are discussing a potential acquisition by Salona Global – all

medical device companies with between $5M - $20M in revenues with

positive cash flow.

- The Salona Global team believes it has the capacity to close

1-2 acquisitions per quarter starting Q2 2021.

- Strong Balance Sheet, No

Parent Debt: The Company has an estimated $13M in net

assets, predominantly in cash and cash equivalents, with no parent

debt. Management has earmarked between $4-6M in cash and 15-18M

shares to close potential acquisitions in negotiations this

quarter.

- The majority of consideration would be tied to performance over

a future measurement period and could be financed with debt, as

priority acquisition targets under consideration are cash flow

positive and debt free.

- Experienced Wall Street Management

Team: Les Cross (Chairman of the Board) is former

Chairman of DJO Global (a medical device roll up that was listed on

the NYSE until Blackstone bought it for $2B); Jane Kiernan (Vice

Chairwoman) is former Chair of the Audit Committee for American

Medical Systems (purchased by Endo Pharmaceuticals for $3.5B).

- M&A advisors/bankers from PHM

(Now Viemed on the Nasdaq/TSX and Quipt on the Nasdaq/TSXV).

The SGMD post acquisition organic growth

plan:

European Sales

Expansion: SGMD is targeting companies that have

quality products that have succeeded in the US medical device

market but have little or no revenue from Europe or other developed

markets where SGMD executives have a history of marketing

success.

Leveraging the Operational

Platform: The State-of-the-Art FDA approved SDP

facility, the building block of the SGMD plan, will be used to

optimize production strategies, control costs and provide supply

chain assurances to US customers who are wary of risks from trade

tensions and poor-quality outsourced production methods.

Share Capital and Balance

Sheet

|

|

Shares |

|

Shares** |

44,677,545 |

|

Maximum shares reserved for issuance to SDP pending earn outs |

19,162,000 |

|

Shares outstanding at listing (partially diluted)*** |

63,839,545 |

|

|

|

|

Net Assets (estimated) |

$13,000,000 |

* For more

information on SDP and historical performance please see the

Company’s Management Information Circular dated 01/26/2021

available on the Company’s Sedar Profile at www.sedar.com.** The

Company completed a 7.37-for-10 share consolidation on

12/21/2020.*** Does not include the 15-18 million shares (described

above) earmarked for potential acquisitions (with between $5m and

$20m in sales) in negotiations or shares issuable pursuant to

options, warrants and Class A shares.

In addition, the Company announces that its

board of directors has granted stock options exercisable for an

aggregate of up to 400,000 common shares of the Company at $1.39

per share for five years. All options have been granted to eligible

persons (director and employee of the Company) pursuant to the

Company's 2021 Amended and Restated Stock Option Plan and will vest

over three years with the initial vesting after 1 year.

For more information please contact:

Les CrossChairman of the Board and Interim Chief

Executive OfficerTel: 1 (800) 760-6826Email:

Info@Salonaglobal.com

Additional Information

There can be no assurance that any of the

potential acquisitions in advanced negotiations will be completed

as proposed or at all and no definitive agreements have been

executed. Completion of any transaction will be subject to

applicable directors, shareholder and regulatory approvals.

Neither the TSXV nor its Regulation Services

Provider (as that term is defined in the policies of the TSXV)

accepts responsibility for the adequacy or accuracy of this

release.

Certain statements contained in this press

release constitute "forward-looking information" as such term is

defined in applicable Canadian and United States securities

legislation. The words "may", "would", "could", "should",

"potential", "will", "seek", "intend", "plan", "anticipate",

"believe", "estimate", "expect" and similar expressions as they

relate to the Company, including: information relating to the

business plans of the Company; the timing of the shipment to the

Spanish customer; the potential recurring revenue from the Spanish

customer; statements regarding anticipated revenue and positive

cash of acquired companies; the Company’s acquisition strategy;

future acquisitions and the structure and financing of such

acquisitions; information with respect to future growth and growth

strategies; the Company’s organic growth plan and strategy and

the manner in which the Company proposes to accomplish it; and

anticipated trends in the Company’s industry; are intended to

identify forward-looking information. All statements other than

statements of historical fact may be forward-looking

information. Such statements reflect the Company's current views

and intentions with respect to future events, and current

information available to the Company, and are subject to certain

risks, uncertainties and assumptions, including: the Company and a

target being satisfied with due diligence; the Company successfully

negotiating and executing definitive agreements for an acquisition;

closing conditions being satisfied or waived; and the Company

obtaining all requisite approvals for a transaction. Many factors

could cause the actual results, performance or achievements that

may be expressed or implied by such forward-looking

information to vary from those described herein should one or more

of these risks or uncertainties materialize. Examples of such

risk factors include, without limitation: credit; market (including

equity, commodity, foreign exchange and interest rate);

liquidity; operational (including technology and infrastructure);

reputational; insurance; strategic; regulatory; legal;

environmental; capital adequacy; the general business and

economic conditions in the regions in which the Company

operates; the ability of the Company to execute on key

priorities, including the successful completion of acquisitions,

business retention, and strategic plans and to attract,

develop and retain key executives; difficulty integrating newly

acquired businesses; the ability to implement business

strategies and pursue business opportunities; disruptions in or

attacks (including cyber-attacks) on the Company's information

technology, internet, network access or other voice or data

communications systems or services; the evolution of various types

of fraud or other criminal behavior to which the Company is

exposed; the failure of third parties to comply with their

obligations to the Company or its affiliates; the impact of

new and changes to, or application of, current laws and

regulations; granting of permits and licenses in a highly

regulated business; the overall difficult litigation

environment, including in the United States; increased competition;

changes in foreign currency rates; increased funding costs

and market volatility due to market illiquidity and competition for

funding; the availability of funds and resources to pursue

operations; critical accounting estimates and changes to

accounting standards, policies, and methods used by the

Company; the occurrence of natural and unnatural catastrophic

events and claims resulting from such events; and risks

related to COVID-19 including various recommendations, orders and

measures of governmental authorities to try to limit the

pandemic, including travel restrictions, border closures,

non-essential business closures, quarantines,

self-isolations, shelters-in-place and social distancing,

disruptions to markets, economic activity, financing, supply

chains and sales channels, and a deterioration of general

economic conditions including a possible national or global

recession; as well as those risk factors discussed or referred

to in the Company’s disclosure documents filed with United States

Securities and Exchange Commission and available at www.sec.gov,

and with the securities regulatory authorities in certain provinces

of Canada and available at www.sedar.com. Should any factor affect

the Company in an unexpected manner, or should assumptions

underlying the forward-looking information prove incorrect, the

actual results or events may differ materially from the

results or events predicted. Any such forward-looking information

is expressly qualified in its entirety by this cautionary

statement. Moreover, the Company does not assume responsibility

for the accuracy or completeness of such forward-looking

information. The forward-looking information included in this

press release is made as of the date of this press release and

the Company undertakes no obligation to publicly update or

revise any forward-looking information, other than as required by

applicable law.

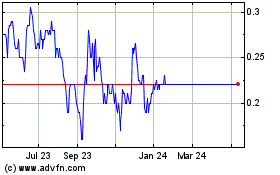

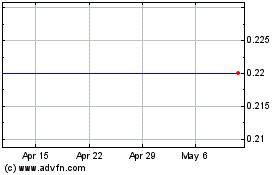

Salona Global Medical De... (TSXV:SGMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Salona Global Medical De... (TSXV:SGMD)

Historical Stock Chart

From Apr 2023 to Apr 2024