Reconnaissance Energy Africa Ltd. (the “

Company”

or “

ReconAfrica”) (TSXV: RECO) (OTCQX: RECAF)

(Frankfurt : 0XD) is pleased to announce that it has entered into

an amended agreement with Research Capital Corporation as the sole

bookrunner and lead underwriter, on behalf of a syndicate of

underwriters (collectively, the “

Underwriters”) to

increase the size of its previously announced bought-deal public

offering, pursuant to which the Underwriters have agreed to

purchase, on a bought-deal basis, 16,666,700 units of the Company

(the “

Units”) at a price of C$0.90 per Unit for

aggregate gross proceeds to the Company of C$15,000,030 (the

"

Offering").

Each Unit shall be comprised of one common share

of the Company (a "Common Share") and one common

share purchase warrant of the Company (a

"Warrant"). Each Warrant shall entitle the holder

thereof to purchase one Common Share (a “Warrant

Share”) at an exercise price of C$1.15 at any time up to

24 months from the closing of the Offering. In the event that, at

any time four months and one day after the date of issuance and

prior to the expiry date of the Warrants, the moving volume

weighted average trading price of the Common Shares on the TSX

Venture Exchange (“TSXV”), or other principal

exchange on which the Common Shares are listed, is equal to or

greater than C$2.50 for any 20 consecutive trading days, the

Company may, within 10 business days of the occurrence of such

event, deliver a notice to the holders of Warrants accelerating the

expiry date of the Warrants to the date that is 30 days following

the date of such notice (the “Accelerated Exercise

Period”). Any unexercised Warrants shall automatically

expire at the end of the Accelerated Exercise Period.

The Company has granted to the Underwriters an

option (the “Over-Allotment Option”) to increase

the size of the Offering by up to an additional number of Units,

and/or the components thereof, that in aggregate would be equal to

15% of the total number of Units to be issued under the Offering,

to cover over-allotments, if any, and for market stabilization

purposes, exercisable at any time and from time to time up to 30

days following the closing of the Offering.

The net proceeds from the Offering will be used

for exploration and development activities, working capital and

other general corporate purposes.

The closing of the Offering is expected to occur

on or about April 3, 2024 (the “Closing”), or on

such other date as the Underwriters may determine, and is subject

to the Company receiving all necessary regulatory approvals,

including the acceptance of the TSXV to list, on the Closing, the

Common Shares and the Warrant Shares.

In connection with the Offering, the Company

intends to file a prospectus supplement, to the Company’s short

form base shelf prospectus dated February 29, 2024, with the

securities regulatory authorities in each of the provinces of

Canada (except Québec). Copies of the base shelf prospectus and any

supplement thereto to be filed in connection with the Offering, are

and will be available under the Company’s profile on SEDAR+ at

www.sedarplus.ca.

This press release is not an offer to sell or

the solicitation of an offer to buy the securities in the United

States or in any jurisdiction in which such offer, solicitation or

sale would be unlawful prior to qualification or registration under

the securities laws of such jurisdiction. The securities being

offered have not been, nor will they be, registered under the

United States Securities Act of 1933, as amended, and such

securities may not be offered or sold within the United States or

to, or for the account or benefit of, U.S. persons absent

registration or an applicable exemption from U.S. registration

requirements and applicable U.S. state securities laws.

About ReconAfrica

ReconAfrica is a Canadian oil and gas company

engaged in the opening of the newly discovered deep Kavango

Sedimentary Basin in the Kalahari Desert of northeastern Namibia

and northwestern Botswana, where the Company holds petroleum

licenses comprising ~8 million contiguous acres. In all aspects of

its operations ReconAfrica is committed to minimal disturbance of

habitat in line with international standards and will implement

environmental and social best practices in all of its project

areas.

Neither the TSXV nor its Regulation Services

Provider (as that term is defined in policies of the TSXV) accepts

responsibility for the adequacy or accuracy of this release.

For further information

contact:

Brian Reinsborough, President and Chief Executive Officer | Tel:

+1-877-631-1160Grayson Andersen, Vice President Investor Relations

| Tel: +1-877-631-1160

Email: admin@reconafrica.comIR

Inquiries Email: investors@reconafrica.comMedia

Inquiries Email: media@reconafrica.com

Cautionary Note Regarding Forward-Looking

Statements:

Certain statements contained in this press

release constitute forward-looking information under applicable

Canadian, United States and other applicable securities laws, rules

and regulations, including, without limitation, statements with

respect to the expected use of proceeds from the Offering, the

expected closing date of the Offering, the completion of the

Offering being subject to the receipt of all necessary regulatory

approvals, including acceptance of the TSXV, any potential

acceleration of the expiry date of the Warrants and the Company’s

commitment to minimal disturbances in line with international best

standards and its implementation of environmental and social best

practices in all of its project areas. These statements relate to

future events or future performance. The use of any of the words

"could", "intend", "expect", "believe", "will", "projected",

“potential”, "estimated", “significant” and similar expressions and

statements relating to matters that are not historical facts are

intended to identify forward-looking information and are based on

ReconAfrica's current beliefs or assumptions as to the outcome and

timing of such future events. There can be no assurance that such

statements will prove to be accurate, as the Company's actual

results and future events could differ materially from those

anticipated in these forward-looking statements as a result of the

factors discussed in the "Risk Factors" section in the Company's

annual information form dated December 4, 2023, available under the

Company's profile on SEDAR+ at www.sedarplus.ca. Actual future

results may differ materially. Various assumptions or factors are

typically applied in drawing conclusions or making the forecasts or

projections set out in forward-looking information. Those

assumptions and factors are based on information currently

available to ReconAfrica. The forward-looking information contained

in this release is made as of the date hereof and ReconAfrica

undertakes no obligation to update or revise any forward-looking

information, whether as a result of new information, future events

or otherwise, except as required by applicable securities laws.

Because of the risks, uncertainties and assumptions contained

herein, investors should not place undue reliance on

forward-looking information. The foregoing statements expressly

qualify any forward-looking information contained herein.

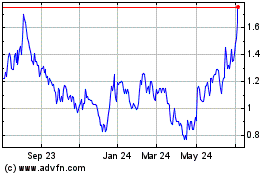

Reconnaissance Energy Af... (TSXV:RECO)

Historical Stock Chart

From Nov 2024 to Dec 2024

Reconnaissance Energy Af... (TSXV:RECO)

Historical Stock Chart

From Dec 2023 to Dec 2024