enCore Energy Corp. (TSXV: EU;

OTCQX:ENCUF) (the “

Company”) is

pleased to announce that effective December 31, 2020, as described

in the September 1, 2020 binding Letter of Intent, it has executed

a Share Purchase Agreement (“Agreement”) with Westwater Resources

Inc. (Nasdaq: WWR) (“Westwater”) to acquire all of Westwater’s

United States uranium assets. The terms of that Agreement were

completed and the transaction was closed on December 31, 2020. The

assets include two licensed Texas-based in-situ recovery uranium

production facilities, significant given there are only eleven ISR

production facilities in the United States. Other assets included

are mineral exploration leases in Texas, and more than 270 square

miles (180,000 acres) of deeded mineral rights in New Mexico with

four projects containing significant historical resources. This

acquisition more than double the Company’s current mineral rights

and historical resource holdings and adds two already licensed

uranium production facilities.

William M. Sheriff, Executive Chairman of enCore

Energy stated “This transformational acquisition is the first

significant step to build enCore into a domestic uranium producer.

Our experienced and accomplished management team believes that a

major change is coming in the uranium market in the next 12 to 24

months. The recent impressive strength in the uranium equity market

is evidence of a broader realization within the financial community

of the early changes in the dynamics of the uranium market. In

addition to the key acquisition of licensed production facilities

in Texas, enCore will hold the leading land position in New Mexico,

consolidating the large Santa Fe and Frisco railroad “checkerboard”

mineral rights land grant running through most of the Grants

mineral belt.

“As market conditions continue to improve, we

look forward to updating and preparing the Rosita, Texas processing

facility for commercial uranium production and restarting uranium

production in one of the most favorable uranium districts in the

United States. These licensed production facilities have

demonstrated histories of lower cost uranium production, and they

are in a local region with known historic uranium resources.” added

enCore Energy’s Chief Executive Officer, W. Paul Goranson. “We

believe the timing of this acquisition coincides with dramatic

changes in the supply-demand balance in the global uranium markets

as several major primary uranium production centers have either

significantly curtailed production due to market conditions or are

being closed all together. At the same time, the U.S. Government

has taken several actions to support domestic uranium production,

including funding of the Uranium Reserve, codifying in statute the

terms of the recently amended Russian Suspension Agreement, and

funding the start of a domestic nuclear fuel cycle to support the

advancement of advanced reactor designs and small modular

reactors”.

The Texas Production

Assets

Two licensed Texas uranium production facilities

have been acquired, the Kingsville plant in Kleberg County, Texas

and the Rosita plant in Duval County, Texas. These are two of only

eleven licensed and constructed ISR production facilities in the

United States. Both facilities were established to process Ion

Exchange resin from multiple satellite facilities. Each facility

currently has an operating capacity of 800,000 pounds U3O8 per

year, and the ability to expand that capacity, if needed. The

package also includes several key mineralized leaseholds with

excellent exploration potential and historic resources, an

extensive Texas database, and key equipment including PFN logging

trucks, resin transfer trucks and remote ion exchange

facilities.

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/7fc0a177-ef2f-4ce3-bc2a-ea66652cb66c

New Mexico Assets

The Westwater acquisition, combined with

enCore’s already existing large New Mexico holdings, make enCore

the dominant holder of high-quality uranium properties in New

Mexico. The New Mexico assets in the transaction include more than

175,000 acres of deeded mineral estate (formerly the Santa Fe

railroad “checkerboard” land grant), 4,200 acres of surface and/or

mineral leases and 1,200 acres of mining claims, encompassing much

of the uranium-rich Grants mineral belt shown on the attached map,

as well as an extensive and comprehensive database. Properties

being acquired with significant in place historic uranium resources

include the Nose Rock, West Largo and Ambrosia Lake projects in

McKinley County and the Juan Tafoya project in Cibola, McKinley and

Sandoval Counties.

A summary of the significant historic mineral resources

follows:

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/1d3ad784-b46c-44f0-a534-e37151a285cc

To view historic mineral estimates please

visit:

http://www.encoreenergycorp.com/_resources/images/WWR%20Historic%20Resources.png

Historic estimates on (a) Ambrosia Lake used the

circle tangent method and cut-off grades ranging from 0.03% to

0.10% over variable intervals and on a per section basis; (b) Juan

Tafoya use the d polygonal method and a cut-off grade of 0.05% over

a six foot interval; (c) West Largo did not include a cutoff grade

and used a general outline method described by the US Atomic Energy

Commission; and (d) Nose Rock used polygonal method and a cutoff

grade of 0.07% over a six foot interval. Although the historical

estimates above are believed to have been calculated and completed

to industry standards at the time of their publication, and are

considered reliable based on such standards, a qualified person has

not done sufficient work to classify any of the historic estimates

listed above as current mineral resource estimates. Current

definitions of measured, indicated and inferred resources have

changed since the date of the report and the impact of those

changes on historical estimates has not been assessed by the

Company. Additional work, including review of existing exploration

data and additional drilling is required to update the historical

estimate to a current mineral resource. The Company does not treat

these historical estimates as current mineral resource estimates

and they should not be relied upon.

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/1506840d-dc5d-4c9b-b910-883702b52553

Located in New Mexico, the Grants mineral belt

is an approximately 100-mile-long northwesterly trending belt of

sandstone-hosted uranium deposits that have been the largest source

of uranium production in the United States. During the period of

mining activity in the Grants mineral belt, betweenthe early 1950s

and the mid-2000s, more than eighty underground and open pit mines

were developed and operated. At various times during the past

productive life of the belt, as many as six uranium processing

mills were built and operated by Anaconda Company, Homestake Mining

Company, Kerr-McGee, Phillips Petroleum, Sohio, Western Nuclear and

United Nuclear. For perspective, the Grants mineral belt has

yielded more uranium than any other district in the U.S.A.: about

340 million pounds uranium oxide. The reported remaining Identified

Resources have been estimated at 409 million pounds of uranium

oxide and are greater than for any other U.S. uranium bearing

district.6

Terms of the Transaction

Pursuant to the Agreement, the Company has

acquired seven Westwater subsidiaries, holding all of Westwater’s

United States uranium assets in exchange for 2,571,598 common

shares issues for a total value of US$1,795,000 and the grant of a

2% net smelter return royalty on mineral rights held by the

subsidiaries in the State of New Mexico, excluding the Juan Tafoya

and Cebolleta projects which retain a 2.5% net profits

interest.

As provided in the binding Letter of Intent, the

Company and Westwater worked to reduce the liability carried under

the existing reclamation bonds, and for meeting specific

milestones, the Company would pay Westwater US$500,000 in Company

Shares. Westwater made significant progress toward completing those

milestones, but due to conditions related to the COVID-19 pandemic,

only partially completed the milestones. The Company and Westwater

agreed to reduce the payment for this work to US$345,000 in Company

shares (included in the total share issuance above) in recognition

of the work accomplished, which is included in the issuance of

common shares.

The Company assumed the existing reclamation

bonds on Westwater’s uranium projects totaling approximately

US$9.25 million. The Company retained US$3,000,000 of the cash

collateral supporting these reclamation bonds with Westwater

receiving US$742,642 of the cash collateral at closing. No other

payments were made for reclamation work and reclamation bond

reduction.

Dr. Douglas H. Underhill, CPG, a Qualified

Person as defined by National Instrument 43-101 and Chief Geologist

for the Company, has reviewed, verified, and approved disclosure of

the technical information contained in this news release.

About enCore Energy Corp.

enCore Energy Corp. is U.S. domestic uranium

developer focused on becoming a leading in-situ recovery (ISR)

uranium producer. The Company is led by a team of industry experts

with extensive knowledge and experience in the development and

operations of in situ recovery uranium operations. enCore Energy’s

opportunities are created from the Company’s transformational

acquisition of its two South Texas production facilities, the

changing global uranium supply/demand outlook and opportunities for

industry consolidation. These short-term opportunities are

augmented by our strong long term commitment to working with local

indigenous communities in New Mexico where the company holds

significant uranium resources.

For additional

information:William M. SheriffExecutive

Chairman972-333-2214info@encoreenergycorp.com

www.encoreenergycorp.com

Behre Dolbear & Company (USA) Inc., 2010, Technical Report

on the Ambrosia Lake Project of Uranium Resources Inc., prepared by

Robert D. Maxwell, CPG and Bernard J. Guarnera, RPG, CPG. Behre

Dolbear & Company (USA) Inc., 2011, Technical Report on the

West Largo Project of Uranium Resources Inc., prepared by Robert D.

Maxwell, CPG. 3. Behre Dolbear & Company (USA) Inc., 2011,

Technical Report on the Nose Rock Project of Uranium Resources

Inc., prepared by Robert D. Maxwell, CPG. 4. Broad Oak Associates,

2014, NI 43-101 Technical Report on Mineral Resources: Juan Tafoya

Uranium Project, Cibola, McKinley, and Sandoval Counties, New

Mexico, USA, reported and effective May 15, 2014, prepared for

Uranium Resources Inc. by Geoffrey S. Carter, P.Eng. Wilton, Dean

T., CPG, PG, MAIG, Chief Geologist Westwater Resources, 2018,

Technical Report on the Ambrosia Lake Uranium Project, McKinley

County, USA. McLemore, Virginia T., Prin. Senior Economic

Geologist, “ Uranium Resources in New Mexico”, New Mexico Bureau of

Geology & Mineral Resources, Website updated Jan. 27, 2020.

Cautionary Note Regarding Forward-Looking

Statements

This news release includes certain

forward-looking statements within the meaning of applicable

securities law including the anticipated completion of the

transaction and acquisition of the Marquez, Nose Rock and other

properties, and the potential advancement thereof. Forward- looking

statements are statements that relate to future, not past, events.

In this context, forward - looking statements often address

expected future business and financial performance, and often

contain words such as "anticipate", "believe", "plan", "estimate",

"expect", and "intend", statements that an action or event "may",

"might", "could", "should", or "will" be taken or occur, or other

similar expressions. Estimates of mineral resources and reserves

are also forward looking statements because they constitute

projections regarding the amount of minerals that may be

encountered in the future. All statements, other than statements of

historical fact, included herein including, without limitation;

statements about the terms and completion of the transaction are

forward-looking statements. By their nature, forward-looking

statements involve known and unknown risks, uncertainties and other

factors, which may cause the actual results, performance or

achievements, or other future events, to be materially different

from any future results, performance or achievements expressed or

implied by such forward-looking statements. Forward-looking

statements are made based on management's beliefs, estimates and

opinions on the date that statements are made and the respective

companies undertakes no obligation to update forward-looking

statements if these beliefs, estimates and opinions or other

circumstances should change, except as required by applicable

securities laws. Investors are cautioned against attributing undue

certainty to forward-looking statements.

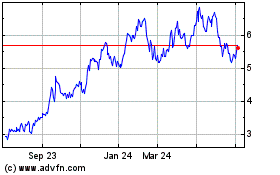

Encore Energy (TSXV:EU)

Historical Stock Chart

From Mar 2024 to Apr 2024

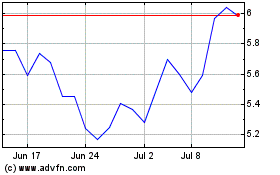

Encore Energy (TSXV:EU)

Historical Stock Chart

From Apr 2023 to Apr 2024