CloudMD Software & Services Inc. (TSXV: DOC, OTCQB: DOCRF,

Frankfurt: 6PH) (the “

Company” or

“

CloudMD”), a healthcare technology company

revolutionizing the delivery of care, announced its financial

results for the first quarter ended March 31, 2021. All financial

information is presented in Canadian dollars unless otherwise

indicated.

Dr. Essam Hamza, CEO of CloudMD

commented, “We are excited to share our record Q1 2021 financial

results that continue to improve quarter over quarter. Q1 was a

transformative period for CloudMD, as we closed 5 acquisitions,

adding $13 million in annualized revenue and establishing the

foundation for our Enterprise Health Solutions division. I am very

proud of the strategic roadmap we have built and the team’s ability

to execute on our growth strategy. We identified key acquisition

targets that were synergistic to our overall vision and we remain

focused on building a complete healthcare ecosystem, providing

connected, holistic care. We continue to integrate all of our

capabilities into one comprehensive platform, which is the

foundation for scale and expansion. Within our Enterprise Health

Solutions division, we have already seen significant early adoption

and through cross-selling opportunities, attained over $5 million

in new multi-year contracts in the first quarter. Equally exciting

is that CloudMD already has a revenue run rate of over $120

million, and through highly profitable acquisitions coupled with

organic growth and realization of cost synergies, we expect to be

profitable in the second half of 2021.”

First Quarter 2021 Financial Highlights

- Q1 2021 revenue was $8.8 million,

compared to $5.8 million in Q4 2020 and $3.1 million in Q1 2020.

The increase is primarily attributable to acquisition growth with 5

acquisitions completed in the quarter, and 11 acquisitions

completed in the last twelve months. Excluding the impact of Q1

business acquisitions, the Company achieved organic growth from its

existing businesses.

- Q1 2021 gross margin was 41%,

compared to 40% in Q4 2020 and 37% in Q1 2020. The increase is

primarily attributable to revenue mix where higher margin revenues

from Enterprise Health Solutions (“EHS”) and

Digital Services made up a stronger percentage of overall

revenues.

- Net comprehensive loss attributable

to equity holders of the Company in Q1 2021 was $5.3 million or

$0.03 per share, compared to $5.2 million or $0.04 per share in Q4

2020 and $1.6 million or $0.02 per share in Q1 2020. In the

quarter, the Company completed numerous strategic initiatives,

including the completion of 5 acquisitions in the quarter and

raising $58.2 million in gross proceeds from a bought deal short

form prospectus offering, which the Company expects will contribute

to strong future growth of the Company.

- Adjusted Earnings Before Interest,

Taxes, Depreciation and Amortization (“Adjusted

EBITDA”) was a loss of $1.5 million in Q1 2021, compared

to a loss of $1.5 million in Q4 2020 and a loss of $0.8 million in

Q1 2020. The Adjusted EBITDA calculation adjusts for share-based

compensation, costs related to financing, acquisitions,

integration, litigation including associated loss provisions, and

change in fair value of contingent consideration. Adjusted EBITDA

is used by management to evaluate the Company’s cash operating

performance, and a complete definition and calculation are provided

further below.

- Cash and cash equivalents were

$99.2 million as at March 31, 2021, compared to $59.7 million at

December 31, 2020. In Q1 2021, the Company raised gross proceeds of

$58.2 million in a bought deal short form prospectus offering in

March 2021 and the Company’s current cash balance is approximately

$95 million.

First Quarter & Subsequent

Highlights

- During January 2021, the Company

closed the previously announced acquisitions of HumanaCare, Medical

Confidence and Canadian Medical Directory, strengthening the

Company’s EHS division by adding a leading Employee Assistance

Program and healthcare navigation platform.

- On February 8, 2021 the Company

closed the acquisition of 51% of West Mississauga Medical Clinic,

expanding the Company’s hybrid clinic footprint in Ontario.

- On February 16, 2021, the Company

announced that it signed a binding term sheet to acquire

VisionPros, a rapidly growing digital eyecare platform with a

robust suite of digital vision care tools.

- In March 2021, the Company closed

the short form prospectus offering, on a bought deal basis,

including the full over-allotment option for total gross proceeds

of $58.2 million.

- On March 18, 2021, the Company

provided an update on the rapid growth of its Enterprise Health

Solutions division, realizing over $5 million in new multi-year

contracts since the beginning of 2021.

- On March 23, 2021, the Company

announced that it closed the acquisition of IDYA4, the technology

platform used to integrate all of our healthcare solutions,

providing a fully automated, seamless patient experience.

- On April 6, 2021, the Company

announced that it closed the acquisition of Aspiria, adding another

leading Employee and Student-focused assistance program to the

Company’s EHS division.

- On April 8, 2021, the Company

announced that it entered into a binding term sheet to acquire

Oncidium, creating one of the largest providers to the employer

market in Canada.

- On May 12, 2021, the Company

announced that it closed the acquisition of Rxi, a proprietary

specialty drug management and patient support platform.

Outlook

The Company is focused on revolutionizing the

healthcare industry by leveraging technology to digitalize its

delivery in providing more efficient access to care and achieving

better health outcomes. CloudMD is integrating its health

technology solutions to build one, connected healthcare ecosystem

that addresses all points of a patient’s care from one platform.

The Company remains on track to launch a fully automated, connected

solution later in 2021. This connected platform is the foundation

for scale and growth and the Company will continue expanding its

footprint across North America and strategically in Europe.

CloudMD’s current revenue run rate is over $120

million which does not take into consideration any expected organic

growth or cross-selling synergies. CloudMD expects to see continued

organic growth across all divisions of its business largely due to

the integration of its health technology solutions and

cross-selling synergies in the EHS division.

The Company has a strong cash position with

approximately $95 million on hand, and approximately $35 million

remaining after the closing of the acquisitions of VisionPros and

Oncidium, which both are expected to close in June 2021. With a

strong balance sheet, CloudMD is able to seek debt financing

options to conserve cash and equity. The Company is on track to be

profitable and expects to be Adjusted EBITDA-positive in the second

half of 2021.

CloudMD will continue to focus on delivering

meaningful shareholder value by executing on its growth strategy

through accretive, synergistic acquisitions, achieving organic

growth across all divisions, and the full integration of its

healthcare solutions to provide one, connected platform that

addresses all points of care for patients.

Selected Financial

Information

All results were prepared in accordance with

International Financial Reporting Standards (“IFRS”) as issued by

the International Accounting Standards Board.

|

(in thousands of Canadian dollars) |

Three months ended |

|

|

March 31, |

|

|

2021 |

2020 |

(%) |

|

Revenue |

$ |

8,775 |

|

$ |

3,057 |

|

187 |

% |

|

Cost of sales |

|

(5,184 |

) |

|

(1,933 |

) |

168 |

% |

| Gross

profit (1) |

|

3,591 |

|

|

1,124 |

|

219 |

% |

| Gross

margin |

|

40.9 |

% |

|

36.8 |

% |

|

|

|

|

|

|

|

|

|

Expenses |

|

9,132 |

|

|

2,765 |

|

230 |

% |

| Loss

before other items |

|

(5,541 |

) |

|

(1,641 |

) |

238 |

% |

|

Other items, taxes, non-controlling interest |

|

254 |

|

|

18 |

|

|

| Net

comprehensive loss attributable to equity holders of the

Company |

|

(5,307 |

) |

|

(1,623 |

) |

227 |

% |

|

Loss per share, basic and diluted |

$ |

(0.03 |

) |

$ |

(0.02 |

) |

50 |

% |

(1) Gross profit is a non-GAAP

measure as described in the Non-GAAP Financial Measures section of

this News Release.

|

(in thousands of Canadian dollars) |

Three months ended |

|

|

March 31, |

|

|

2021 |

2020 |

(%) |

|

Net comprehensive loss attributable to equity holders of

the Company |

$ |

(5,307 |

) |

$ |

(1,623 |

) |

227 |

% |

| Add: |

|

|

|

|

|

| Interest

and accretion expense |

|

92 |

|

|

61 |

|

50 |

% |

| Income

taxes |

|

40 |

|

|

- |

|

100 |

% |

|

Depreciation and amortization |

|

689 |

|

|

202 |

|

242 |

% |

|

EBITDA(1) for the

period |

|

(4,486 |

) |

|

(1,360 |

) |

230 |

% |

|

Share-based compensation |

|

1,595 |

|

|

445 |

|

258 |

% |

|

Financing-related costs |

|

749 |

|

|

65 |

|

1052 |

% |

|

Acquisition-related and integration costs, net |

|

812 |

|

|

20 |

|

4053 |

% |

|

Litigation costs and loss provision |

|

103 |

|

|

- |

|

100 |

% |

|

Change in fair value of contingent consideration |

|

(315 |

) |

|

- |

|

-100 |

% |

|

Adjusted EBITDA for the period |

$ |

(1,542 |

) |

$ |

(830 |

) |

86 |

% |

(1) EBITDA is a non-GAAP

measure as described in the Non-GAAP Financial Measures section of

this News Release.

First Quarter Earnings Conference

Call

CloudMD invites all interested parties to join

the conference call or webinar:

CloudMD Q1 2021 Earnings CallDate: Today, May

27, 2021Time: 2:00 pm PT / 5:00 pm ET

Toll-Free Dial-In Number: (833) 562-0117 International

Dial-In Number: (661) 567-1009Conference

ID: 7655837

Webcast

Link: https://edge.media-server.com/mmc/p/ozdza9aq

Financial Statements and Management’s

Discussion and Analysis

This news release should be read in conjunction

with the Company’s condensed interim consolidated financial

statements and related notes, and management’s discussion and

analysis for the three months ended March 31, 2021 and 2020, copies

of which can be found at www.sedar.com.

Non-GAAP Financial Measures

In addition to the results reported in

accordance with IFRS, the Company uses various non-GAAP financial

measures, which are not recognized under IFRS, as supplemental

indicators of the Company’s operating performance and financial

position. These non-GAAP financial measures are provided to enhance

the user’s understanding of the Company’s historical and current

financial performance and its prospects for the future. Management

believes that these measures provide useful information in that

they exclude amounts that are not indicative of the Company’s core

operating results and ongoing operations and provide a more

consistent basis for comparison between quarters and years. Details

of such non-GAAP financial measures and how they are derived are

provided below as well as in conjunction with the discussion of the

financial information reported.

Since non-GAAP financial measures do not have

any standardized meanings prescribed by IFRS, other companies may

calculate these non-IFRS measures differently and our non-GAAP

financial measures may not be comparable to similar titled measures

of other companies. Accordingly, investors are cautioned not to

place undue reliance on them and are also urged to read all IFRS

accounting disclosures presented in the audited consolidated

financial statements and the accompanying notes for the years ended

December 31, 2020 and 2019.

EBITDAEBITDA is a non-GAAP

financial measure that does not have a standard meaning and may not

be comparable to a similar measure disclosed by other issuers.

EBITDA referenced herein relates to earnings before interest,

taxes, depreciation and amortization. This measure does not have a

comparable IFRS measure and is used by the Company to manage and

evaluate the cash operating income (loss) of the business. Please

refer to section on EBITDA for reconciliation.

Adjusted EBITDAAdjusted EBITDA

is a non-GAAP financial measure that does not have a standard

meaning and may not be comparable to a similar measure disclosed by

other issuers. Adjusted EBITDA referenced herein relates to

earnings before interest; taxes; depreciation; amortization;

share-based compensation; financing-related costs;

acquisition-related and integration costs, net; litigation costs

and loss provision; change in fair value of contingent

consideration; and loss from discontinued operations. This measure

does not have a comparable IFRS measure and is used by the Company

to evaluate its cash operating income (loss) of the business,

adjusted for factors that are unusual in nature or factors that are

not indicative of the operating performance of the Company. Please

refer to section on Adjusted EBITDA for reconciliation.

Gross ProfitGross Profit is a

non-GAAP financial measure that does not have a standard meaning

and may not be comparable to a similar measure disclosed by other

issuers. Gross Profit referenced herein relates to revenues less

cost sales. This measure does not have a comparable IFRS measure

and is used by the Company to manage and evaluate the operating

performance of the business.

Gross MarginGross Margin is a

non-GAAP financial measure that does not have a standard meaning

and may not be comparable to a similar measure disclosed by other

issuers. Gross Margin referenced herein is defined as gross profit

as a percent of total revenue. This measure does not have a

comparable IFRS measure and is used by the Company to manage and

evaluate the operating performance of the business.

About CloudMD Software &

Services

CloudMD is digitizing the delivery of healthcare

by providing a patient-centric approach, with an emphasis on

continuity of care. By leveraging healthcare technology, the

Company is building one, connected platform that addresses all

points of a patient’s healthcare journey and provides better access

to care and improved outcomes. Through CloudMD’s proprietary

technology, the Company delivers quality healthcare through a

holistic offering including hybrid primary care clinics, specialist

care, telemedicine, mental health support, educational resources

and artificial intelligence (AI). CloudMD’s Enterprise Health

Solutions Division includes one of the top 4 Employee Assistance

Programs in Canada and offers one comprehensive, digitally

connected platform for corporations, insurers and advisors to

better manage the health and wellness of their employees and

customers.

CloudMD currently services a combined ecosystem

of over 7,000 psychiatrists, approximately 4,500 therapists and

counsellors, approximately 4,000 psychologists, over 22,000 family

physicians, over 34,000 medical specialists, over 1,500 allied

health professionals, over 500 clinics, and over 5 million

individuals across North America. For more information visit:

https://investors.cloudmd.ca.

ON BEHALF OF THE BOARD OF DIRECTORS

“Dr. Essam Hamza, MD"Chief Executive Officer

FOR ADDITIONAL INFORMATION CONTACT:

Julia BeckerVP, Investor

Relations julia@cloudmd.ca(604) 785-0850

Forward Looking Statements

This news release contains forward-looking

statements that are based on CloudMD’s expectations, estimates and

projections regarding its business and the economic environment in

which it operates, including with respect to its business plans.

Although CloudMD believes the expectations expressed in such

forward-looking statements are based on reasonable assumptions,

such statements are not guarantees of future performance and

involve risks and uncertainties that are difficult to control or

predict. Therefore, actual outcomes and results may differ

materially from those expressed in these forward-looking statements

and readers should not place undue reliance on such statements.

These forward-looking statements speak only as of the date on which

they are made, and CloudMD undertakes no obligation to update them

publicly to reflect new information or the occurrence of future

events or circumstances, unless otherwise required to do so by

law.

The TSX Venture Exchange does not accept

responsibility for the adequacy or accuracy of this release.

____________________________

1 Gross margin and Adjusted EBITDA are non-GAAP measures as

described in the Non-GAAP Financial Measures section of this News

Release.

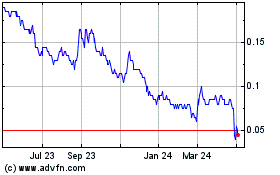

CloudMD Software & Servi... (TSXV:DOC)

Historical Stock Chart

From Mar 2024 to Apr 2024

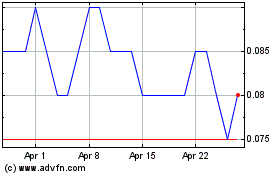

CloudMD Software & Servi... (TSXV:DOC)

Historical Stock Chart

From Apr 2023 to Apr 2024