CMC Announces New Mineral Resource Estimate for the Silver Hart Project

November 27 2024 - 8:06AM

CMC Metals Ltd. (TSX-V: CMB) (Frankfurt: ZM5P) (“CMC” or

the “Company”) is pleased to announce a new Mineral

Resource Estimate (“MRE”) for its silver-lead-zinc Silver Hart

Project (SHP), in Yukon, Canada.

The new MRE totals an Inferred resource of 8.820 Moz @ 145.2 g/t

silver equivalent (“AgEq”) in 1,889,000 tonnes utilizing a cut-off

grade of 50 g/t AgEq (See table 1). This MRE has been prepared

in accordance with the Canadian Securities Administrators’ National

Instrument 43-101 – Standards of Disclosure for Mineral Projects

(“NI 43-101”).

|

Table 1 SHP Pit Constrained Inferred

Mineral Resources as of December 31, 2023 at a Cut-off Grade of

AgEq>=50 g/t |

|

|

|

MiningMethod |

Domain |

Mass(Tonnes) |

Average Value |

Material Content |

|

AgEqg/t |

Agg/t |

Pb% |

Zn% |

AgEqMillion oz |

AgMillion oz |

PbMillion lb |

ZnMillion lb |

|

OpenPit |

TM_Zone |

269,000 |

229.8 |

152.7 |

0.56 |

1.88 |

1.985 |

1.319 |

3.3 |

11.1 |

|

S_Zone |

127,000 |

334.5 |

262.1 |

0.36 |

1.90 |

1.368 |

1.072 |

1.0 |

5.3 |

|

KL_Zone |

1,026,000 |

110.9 |

35.7 |

0.11 |

2.17 |

3.659 |

1.178 |

2.5 |

49.0 |

|

K_Zone |

265,000 |

79.8 |

14.2 |

0.09 |

1.90 |

0.680 |

0.121 |

0.5 |

11.1 |

|

M_Zone |

202,000 |

173.6 |

98.1 |

0.58 |

1.82 |

1.128 |

0.637 |

2.6 |

8.1 |

|

Total |

1,889,000 |

145.2 |

71.3 |

0.24 |

2.03 |

8.820 |

4.327 |

9.9 |

84.7 |

Notes:

- The effective date of this mineral

resource statement is December 31, 2023.

- The qualified person responsible

for this Mineral Resource Estimate (MRE) is Charley Murahwi, M.Sc.,

P.Geo., FAusIMM.

- The mineral resources have been

estimated in accordance with the CIM Best Practice Guidelines

(2019) and the CIM Definition Standards (2014)

- Ordinary Kriging (OK) interpolation

was used with a single block size of 5m x 5m x 5m.

- The mineral resource results are

presented in-situ within the optimized pit. Mineralized material

outside the pit has not been considered as a part of the current

MRE.

- The tonnes and metal contents are

rounded to reflect that the numbers are an estimate and any

discrepancies in the totals are due to the rounding effects.

- AgEq g/t = [(Ag ppm x %Recovery x

Price/g) + (Pb ppm x %Recovery x Price/g) + (Zn ppm x %Recovery x

Price/g)]/ (Ag Price/g x %Recovery).

- Mineral resources unlike mineral

reserves do not have demonstrated economic viability. The estimate

of mineral resources may be materially affected by environmental,

permitting, legal, title, taxation, socio-political, marketing, or

other relevant issues.

A summary of the SHP mineral resource economic

and technical parameters and/or assumptions is presented in Table 2

below.

|

Table 2 Summary of the SHP Economic and

Technical Parameters/Assumptions |

|

|

|

Item |

Units |

Extended |

|

|

Mining cost |

CAD$/t all material |

10.00 |

|

|

Processing cost |

CAD$/t crude feed |

25.50 |

|

|

G&A cost |

CAD$/t crude feed |

5.00 |

|

|

Exchange rate |

CAD$ to US$ |

0.75 |

|

|

Ag price |

USD$/oz |

23.30 |

|

|

Pb price |

US$/metric tonne |

1,892 |

|

|

Zn price |

US$/metric tonne |

2,505 |

|

|

Metallurgical recovery (all metals) |

Percentage |

80 |

|

|

Overall pit slope |

Degrees |

45 |

|

|

|

Further details on the new mineral resource estimate at Silver

Hart and the use of the above-mentioned parameters will be provided

in the upcoming NI 43-101 report by MICON International Limited who

undertook the MRE estimate on behalf of the Company.

Kevin Brewer, President and CEO of the Company noted, “We have a

conceptual development plan that suits the size and grade of the

resource estimate and the nature of the mineralization that starts

at surface. The mineralization at Silver hart comprises of

high-grade veins and mantos that are potentially amenable to open

pit mining. Our plan is to fully evaluate developing these

resources for a seasonal, small scale open pit operation developing

each of the known mineralized areas. We plan to evaluate the

potential ways to minimize project risk that will include the

possible utilization of an ore sorter to enhance ore grades with

the concentrate material then trucked to a processing facility. The

closest potential mill may be at the Silvertip project owned by

Coeur Mining, which would entail a trucking distance of

approximately 100 kilometers from Silver Hart. CMC also hopes to

establish a partnership arrangement with local First Nations to

undertake this project and will be commencing discussions in the

very near future. Our next steps are to engage discussions with

First Nations and conduct the first round or metallurgical testing

and ore sorting capabilities which we hope to commence in the near

future, subject to financing.”

The new MRE also notes that there are opportunities to expand

many of the known mineralized zones (TM, KL, K, S and M) and does

not include any discussions on the potential for additional zones

in the adjacent Blue Heaven Property that is 80% owned by CMC.

The Rancheria Silver District is located approximately 300

kilometers east of Whitehorse, Yukon in a 130 km long by

50 km wide belt that straddles the Yukon and British Columbia

border. CMC has been actively exploring this silver district on the

northern end at its Silver Hart and Blue Heaven properties and

recently acquired a 100% interest in the Amy property and has

optioned its Silverknife Project to Coeur Mining Inc.

Qualified Person

The Qualified Person responsible for this

Mineral Resource Estimate (MRE) is Charley Murahwi, M.Sc., P.Geo.,

FAusIMM of MICON International Limited (as defined by National

Instrument 43-101). The Qualified Person has given his approval of

the technical information pertaining reported herein. The Company

is committed to meeting the highest standards of integrity,

transparency and consistency in reporting technical content,

including geological reporting, geophysical investigations,

environmental and baseline studies, engineering studies,

metallurgical testing, assaying and all other technical data.

About CMC Metals Ltd.

CMC Metals Ltd. is a growth stage exploration

company focused on opportunities for high grade polymetallic

deposits in Yukon, British Columbia and Newfoundland. Our

polymetallic silver-lead-zinc CRD prospects in the Rancheria Silver

District include the Silver Hart Deposit and Blue Heaven claims

(Yukon), Amy and Silverknife claims (British Columbia). Our

polymetallic projects with potential for copper-silver-gold and

other metals include Bridal Veil (central Newfoundland) and Logjam

(Yukon).

On behalf of the Board: “Kevin

Brewer”Kevin Brewer, CEO, President and DirectorCMC METALS

LTD.For Further Information and Investor

Inquiries:

Kevin Brewer, P. Geo., MBA, B.Sc.(Hons), Dip.

Mine Eng.President, CEO and Director Tel: (709)

327-8013kbrewer80@hotmail.comSuite 1000-409 Granville St.,

Vancouver, BC, V6C 1T2

To be added to CMC's news distribution list,

please send an email to info@cmcmetals.ca or contact Mr. Kevin

Brewer directly.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

“This news release may contain certain

statements that constitute “forward-looking information” within the

meaning of applicable securities law, including without limitation,

statements that address the timing and content of upcoming work

programs, geological interpretations, receipt of property titles

and exploitation activities and developments. In this release

disclosure regarding the potential to undertake future exploration

work comprise forward looking statements. Forward-looking

statements address future events and conditions and are necessarily

based upon a number of estimates and assumptions. While such

estimates and assumptions are considered reasonable by the

management of the Company, they are inherently subject to

significant business, economic, competitive and regulatory

uncertainties and risks, including the ability of the Company to

raise the funds necessary to fund its projects, to carry out the

work and, accordingly, may not occur as described herein or at all.

Actual results may differ materially from those currently

anticipated in such statements. Factors that could cause actual

results to differ materially from those in forward looking

statements include market prices, exploitation and exploration

successes, the timing and receipt of government and regulatory

approvals, the impact of the constantly evolving COVID-19 pandemic

crisis and continued availability of capital and financing and

general economic, market or business conditions. Readers are

referred to the Company’s filings with the Canadian securities

regulators for information on these and other risk factors,

available at www.sedar.com. Investors are cautioned that

forward-looking statements are not guarantees of future performance

or events and, accordingly are cautioned not to put undue reliance

on forward-looking statements due to the inherent uncertainty of

such statements. The forward-looking statements included in this

news release are made as of the date hereof and the Company

disclaims any intention or obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as expressly required by

applicable securities legislation.”

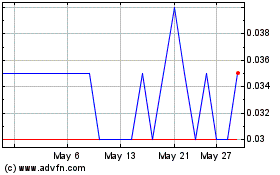

CMC Metals (TSXV:CMB)

Historical Stock Chart

From Oct 2024 to Nov 2024

CMC Metals (TSXV:CMB)

Historical Stock Chart

From Nov 2023 to Nov 2024