Athabasca Minerals Inc. Announces Q1 2019 Financial Results

May 14 2019 - 6:25PM

Athabasca Minerals Inc. (“AMI” or the “Corporation”) (TSX Venture:

ABM) announces its financial results for the first quarter ended

March 31, 2019. The Corporation’s financial statements and

management’s discussion and analysis (“MD&A”) for the quarter

ended March 31, 2019 are available on SEDAR at www.sedar.com and on

the Athabasca Minerals Inc. website at www.athabascaminerals.com.

Robert Beekhuizen, Chief Executive Officer,

states: “During Q1 2019 the Corporation has been re- positioning

for growth across multiple business fronts – growth of its base

Aggregates division, growth of its AMI Silica sand division, and

growth of its Aggregates Marketing division. AMI’s vision is to

become the leading publicly trading aggregates company in Canada;

and its mission is to do so with discipline by capturing

progressive and innovative opportunities that will differentiate

the Corporation’s performance in the market.”

Business Highlights:

- The Corporation was awarded a 15-year government contract with

a 10-year renewal option to manage the Coffey Lake Public Pit on

behalf of Alberta Environment & Parks (“AEP”). The pit is

located approximately 50 km north of Susan Lake Public Pit, on

approximately 1345 acres of crown land. The Corporation will be

seeking regulatory approvals and permits in 2019 to open the Coffey

Lake Public Pit for operation;

- The Corporation continues to make advancements and progress

with AMI Silica and its in-basin frac sand solutions. AMI acquired

a 16.2% interest in the Duvernay Frac Sand Project in January 2019,

which was increased to 49.6% in May 2019 following the drilling of

55 auger holes with positive field results. The Corporation also

announced preliminary test results on January 11, 2019 for its

Montney in-Basin Frac Sand Project (“MIB Project”), where these

preliminary results indicate that the MIB Project sand aligns with

API Standard 19C for hydraulic fracturing;

- Aggregates Marketing Inc. secured a $1.5 million order for

aggregates from a major oil sands entity with deliveries

anticipated to commence in June 2019;

- Revenue for Q1 2019 of $434K (net after royalty), up 281%

compared to Q1 2018 revenue (net after royalty) of $114K;

- The Corporation was granted Metallic and Industrial Mineral

(“MIM”) leases for the Richardson Dolomite / Granite Aggregate

Project ("Richardson Project"). The Richardson Project comprises

three contiguous subsurface leases totaling 3,904 hectares located

70 kilometers from the heart of major oilsands operations north of

Fort McMurray. These leases include a deposit which was evaluated

in a National Instrument 43-101 ("NI 43-101") Technical Report

("Richardson Resource Estimate"), disclosed March 26, 2019, that

estimates an inferred resource of approximately 683 million tonnes

of crush rock aggregate resource. The Corporation will commence

with preliminary activities to support the development in Q4

2019;

- Susan Lake Public Pit Closure Plan remains under review with

AEP. As of the end of Q1 2019, commercial operations have

concluded, and closure activities have been completed. The

Corporation is awaiting final approval of the Closure Plan by AEP.

Thereafter, a monitoring period will follow until a reclamation

certificate is granted by the Province;

- The Corporation has submitted an application for regulatory

approval to open up and operate the Hargwen corporate pit located

west of Edmonton near the Obed Rail Transload terminal, for which

AMI has rights to access.

Financial Highlights

|

($ thousands of CDN, except per share amounts and tonnes sold) |

Three Months Q1 2019 |

Three Months Q1 2018 |

|

Aggregate management fees - net |

$434 |

$107 |

|

Aggregate sales revenue |

$- |

$7 |

|

Total revenue |

$434 |

$114 |

|

Gross profit |

$(136) |

$(444) |

|

Total loss and comprehensive loss |

$(1,057) |

$(740) |

|

Cash position |

$5,276 |

$2,626 |

|

Net cash generated (used) |

$198 |

$(3) |

|

Total aggregate tonnes sold (MT) |

341,459 |

95,306 |

|

Loss per share, basic and fully diluted

($/share) |

$(0.026) |

$(0.022) |

2019 Operational Outlook

Over the coming year the Corporation is actively

addressing and working on various strategic and operational

initiatives relating to restructuring the Corporation's business

model and expanding its operating lines with the advent of AMI

Silica Inc and Aggregates Marketing Inc as wholly owned

subsidiaries:

- Obtaining regulatory approvals for Coffey Lake Public Pit with

a planned opening in second half of 2019;

- Conclude the Susan Lake Public Pit Closure Program (still

pending approval by AEP) and agreements with Oilsands Operators for

the transition of overlapping Mineral Surface Lease lands;

- Validate the Montney In-Basin and Duvernay frac sand deposits

(with delineation drilling and National Instrument 43-101 reports)

and increase AMI’s ownership position accordingly. Also, submit

regulatory application(s) to commence development;

- Secure offtake agreements for the supply of frac sand through

AMI Silica Inc, and augment with 'Last-Mile' delivery solutions for

customers;

- Secure financing for AMI's frac sand facilities in conjunction

with third-party processing options;

- Establish royalty agreements to monetize corporate-owned and

third-party aggregate pits with strategic partners;

- Adding to its Corporate growth with Merger & Acquisition

initiatives, and a carefully executed process for successful

integrating select companies who bring synergies and bolster AMI’s

revenues;

- Establish aggregate management and sales partnerships with

aboriginal communities;

- Win contracts and key client accounts through Aggregates

Marketing Inc by providing integrated supply and transportation

solutions using a technology-based platform with extensive market

data, improved transactional speed and pricing;

- Obtain regulatory approval to open up and operate the Hargwen

corporate pit near the Obed Rail Transload terminal, for which AMI

has rights to access.

About Athabasca Minerals

The Corporation is an integrated group of

aggregates companies involved in resource development, aggregates

marketing and midstream supply-logistics solutions. Business

activities include aggregate production, pit management services,

sales from corporate-owned and third-party pits, acquisitions of

sand and gravel operations, and new venture development. Athabasca

Minerals is the parent company of Aggregates Marketing Inc. – a

midstream business providing integrated supply and transportation

solutions for industrial and construction markets. It is also the

parent company of AMI Silica Inc. – a subsidiary positioning to

become a leading supplier of premium domestic in-basin frac sand

with regional deposits in Alberta and NE British Columbia. It is

the joint venture owner of the Montney In-Basin and Duvernay Basin

Frac Sand Projects. Additionally, the Corporation has industrial

mineral leases, such as those supporting the Richardson Quarry

Project, that are strategically positioned for future development

in industrial regions of high potential aggregates demand.

For further information on Athabasca,

please contact:Dean StuartT: 403-617-7609E:

dean@boardmarker.net

Robert Beekhuizen T: 587-525-9610

Neither the TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

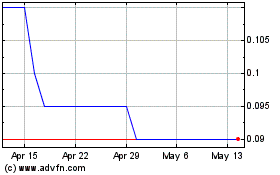

Aben Minerals (TSXV:ABM)

Historical Stock Chart

From Oct 2024 to Nov 2024

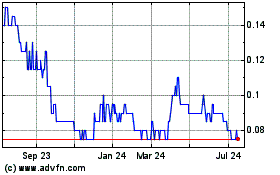

Aben Minerals (TSXV:ABM)

Historical Stock Chart

From Nov 2023 to Nov 2024