WSP Global Inc. (TSX:WSP) (“WSP” or the “Corporation”) is pleased

to announce that it has entered into a definitive agreement (the

“Agreement”) to acquire the Environment & Infrastructure

business (“E&I”) of John Wood Group plc (“Wood”) for aggregate

cash consideration of US$1.810 billion (the “Acquisition”),

including the net present value of US$200 million derived from a

transaction related tax benefit. The net transaction value of

US$1.61B represents 14.6x E&I’s estimated 2022 pre-IFRS 16

adjusted EBITDA1,3 or 11.5x post-synergies.

“The acquisition of Wood’s E&I business will

directly contribute to the realization of the ambitions we set out

in our 2022-2024 Global Strategic Action Plan. WSP’s leading Global

Earth & Environment Consultancy will now have approximately

20,000 experts globally with increased capabilities and reach,

including key expertise in the high growth water sector and an

expanded offering to Federal and government clients,” commented

Alexandre L’Heureux, President and Chief Executive Officer of WSP.

“Our platform will be increasingly diversified and resilient, with

increased scale in geographies which we have identified for growth

such as the United States, where our E&E team will double in

size. We look forward to having the team from E&I join us as we

expand our leadership in Earth & Environment together,” he

added.

“Throughout this process, I’ve been impressed

with WSP’s growth story, excellent capabilities, focus on clients

and the future aspirations for its business,” said Joe Sczurko,

Executive President, Environment & Infrastructure Consulting.

“I’m incredibly proud of what our team has accomplished to get

here, and I look forward to the new opportunities that will be

created for our employees and clients by joining WSP.”

FINANCIAL HIGHLIGHTS

- Acquisition of E&I for a total

cash consideration of US$1.81 billion (approximately C$2.31

billion) including the net present value of a US$200 million

transaction-related tax benefit. The net transaction value of

US$1.61B (Approximately C$2.04 billion) represents 14.6x E&I’s

estimated 2022 pre-IFRS 16 EBITDA1,3 or 11.5x post-synergies.

- Immediately accretive to WSP’s

adjusted earnings per share , and 2024 accretion increasing to

mid-teens once synergies are fully realized3.

- Expected annual cost synergies of

approximately US$30 million (approximately C$38 million) expected

to be achieved over a 24-month period, with 50% to be realized

within the first twelve months after the closing date. Costs

required to realize such annual cost synergies estimated not to

exceed US$30 million (approximately C$38 million) in the

aggregate3.

- Transaction to be financed with a

new US$1.81 billion (approximately C$2.31 billion) fully committed

term credit facility, expected to result in an estimated 2.0x pro

forma net debt to adjusted EBITDA ratio1,3 upon closing, remaining

within WSP’s targeted leverage range of 1.0x to 2.0x.

- Acquisition expected to be

completed in the fourth quarter of 2022.

ACQUISITION FINANCINGThe

Acquisition is to be funded by a new fully committed US$1.81

billion term credit facility with various tenors of up to 5 years

in length. Canadian Imperial Bank of Commerce is acting as sole

bookrunner with respect to the bank financing. This new term credit

facility allows WSP to maintain its current liquidity, while

keeping pro forma net debt to adjusted EBITDA ratio at an estimated

2.0x3.

CONDITIONS TO THE

ACQUISITIONClosing of the Acquisition is subject to

certain customary closing conditions, including (i) the approval of

Wood’s shareholders, (ii) completion by Wood of a group

reorganization to achieve separation of the E&I business, and

(iii) applicable regulatory conditions. The Acquisition is expected

to be completed in the fourth quarter of 2022.

FINANCIAL AND LEGAL

ADVISORSPerella Weinberg Partners LP is acting as

exclusive financial advisor to WSP on the transaction. Legal advice

is being provided to WSP by Linklaters LLP in the United Kingdom,

Stikeman Elliott LLP in Canada, and Skadden, Arps, Slate, Meagher

& Flom LLP in the United States.

CONFERENCE CALLWSP will host a

conference call to discuss the Acquisition today, June 1, 2022, at

8:00 a.m. (Eastern Standard Time). To participate in the conference

call, dial (409) 216-6433 or (855) 385-1271 (toll free). A live

webcast of the conference call will also be available at

www.wsp.com/investors. For those unable to attend, a replay will be

available within 24 hours following the call.

Non-IFRS measures. Please refer to the "non-IFRS

measures" disclaimer below.

2 Non-IFRS measures. These measures are defined

in section 19, “Glossary of segment reporting measures”, non-IFRS

and other financial measures of the Corporation's Management's

Discussion & Analysis for the three-month period ended April 2,

2022. Please refer to "non-IFRS measures" disclaimer below.

3 Please refer to the “forward-looking

statements” disclaimer below.

4 Estimate based on twelve-month period ending

December 31, 2022.

5 Pro Forma with E&I based on twelve-month

period ended December 31, 2021.

ABOUT WSPAs one of the world’s

leading professional services firms, WSP exists to future-proof our

cities and environment. We provide strategic advisory, engineering,

and design services to clients in the transportation,

infrastructure, environment, building, power, energy, water,

mining, and resources sectors. Our 55,000 trusted professionals are

united by the common purpose of creating positive, long-lasting

impacts on the communities we serve through a culture of

innovation, integrity, and inclusion. Sustainability and science

permeate our work. WSP derived about half of its $10.3B (CAD) 2021

revenues from clean sources. The Corporation’s shares are listed on

the Toronto Stock Exchange (TSX: WSP). To find out more, visit

wsp.com

ABOUT E&IE&I was formed

through various acquisitions under Amec and Foster Wheeler

(subsequently “Amec Foster Wheeler”) between 2008 and 2014 and was

later acquired through Wood’s purchase of Amec Foster Wheeler.

E&I provides engineering, remediation consulting, environmental

permitting, inspection & monitoring, and environmental

management services to clients in the government, industrial,

infrastructure, oil & gas, power, water and mining industries.

E&I operates in approximately 100 offices with approximately

6,000 environmental consulting staff across more than 10

countries.

FORWARD-LOOKING STATEMENTSThis

press release contains information or statements that are or may be

“forward-looking statements” within the meaning of applicable

Canadian securities laws. When used in this press release, the

words “may”, “will”, “should”, “expect”, “plan”, “anticipate”,

“believe”, “estimate”, “predict”, “forecast”, “project”, “intend”,

“target”, “potential”, “continue” or the negative of these terms or

terminology of a similar nature as they relate to the Corporation,

an affiliate of the Corporation or the combined firm following the

Acquisition, are intended to identify forward-looking statements.

Forward-looking statements in this press release include, without

limitation, those information and statements related to the

Acquisition, the new term credit facility, the expected timing of

completion and benefits of the Acquisition, the conditions

precedent to the closing of the Acquisition and the Corporation's

future growth, results of operations, performance business,

prospects and opportunities, the expected synergies to be realized

and certain expected financial ratios. Although the Corporation

believes that the expectations and assumptions on which such

forward-looking statements are based are reasonable, undue reliance

should not be placed on the forward-looking statements since no

assurance can be given that they will prove to be correct. These

statements are subject to certain risks and uncertainties and may

be based on assumptions that could cause actual results to differ

materially from those anticipated or implied in the forward-looking

statements, including risks and uncertainties relating to the

following: the possible failure to realize anticipated benefits of

the Acquisition, the integration of E&I’s business, the loss of

certain key personnel of E&I, the possible failure to achieve

the anticipated synergies, the failure to close the Acquisition or

change in the terms of the Acquisition, failure to obtain the

regulatory approvals in a timely manner, or at all, increased

indebtedness, transitional risk, the fact that WSP does not

currently own E&I, potential undisclosed costs or liabilities

associated with the Acquisition, the absence of a financing

condition in the Agreement, the reliance on information provided by

E&I, change of control and other similar provisions and fees,

the nature of acquisitions, the exchange rate on the closing date

of the Acquisition, the fact that the combined firm will continue

to face the same risks that the Corporation currently faces,

potential litigation and other factors discussed or referred to in

the “Risk Factors” section of WSP's Management’s Discussion and

Analysis for the year ended December 31, 2021, and WSP's

Management’s Discussion and Analysis for the three-month period

ended April 2, 2022 (together, the “MD&As”), which are

available under WSP’s profile on SEDAR at www.sedar.com. The

foregoing list is not exhaustive and other unknown or unpredictable

factors could also have a material adverse effect on the

performance or results of WSP or E&I. WSP’s forward-looking

statements are expressly qualified in their entirety by this

cautionary statement. For additional information on this cautionary

note regarding forward-looking statements as well as a description

of the relevant assumptions and risk factors likely to affect WSP’s

actual or projected results, reference is made to the MD&As,

which are available on SEDAR at www.sedar.com. The forward-looking

statements contained in this press release are made as of the date

hereof and except as required under applicable securities laws, WSP

does not undertake to update or revise these forward-looking

statements, whether written or verbal, that may be made from time

to time by itself or on its behalf, whether as a result of new

information, future events or otherwise. The forward-looking

statements contained in this press release are expressly qualified

by these cautionary statements.

NON-IFRS MEASURESThe

Corporation reports its financial results in accordance with IFRS.

In this press release, the following non-IFRS measures are used by

the Corporation: net revenues; adjusted EBITDA; adjusted net

earnings; adjusted net earnings per share; and net debt to adjusted

EBITDA ratio. These measures are defined in section 19, “Glossary

of segment reporting measures, non-IFRS and other financial

measures” of WSP's Management’s Discussion and Analysis for the

three-month period ended April 2, 2022 (the “Q1 MD&A”), which

is posted on WSP’s website at www.wsp.com, and filed on SEDAR at

www.sedar.com. Additional details for these non-IFRS measures can

also be found in the Q1 MD&A.The following non-IFRS measures

are also used by the Corporation in this press release and defined

as follows: “Net revenues” as it relates to E&I has the same

definition as WSP’s definition of “net revenues”, being revenues

less direct costs for subconsultants and other direct expenses that

are recoverable directly from clients. “Accretion” or “accretive”

is defined as the expected change in WSP’s adjusted net earnings

per share after giving effect to the Acquisition and any

Acquisition related adjustments. “Pre-IFRS 16 adjusted EBITDA”

means the estimated adjusted EBITDA of E&I minus lease payments

as included in the cash flow statements for the twelve-month period

ending December 31, 2022. “Pro forma adjusted EBITDA” means the

estimated adjusted EBITDA of WSP and E&I for the twelve-months

period ending December 31, 2022. “Pro forma net debt” means net

debt after giving effect to the Acquisition, the new term credit

facility and any Acquisition related adjustments. “Pro forma net

debt to adjusted EBITDA ratio” is calculated using pro forma net

debt to the pro forma adjusted EBITDA.The non-IFRS financial

measures used in this press release do not have a standardized

meaning as prescribed by IFRS. Management of the Corporation

believes that these non-IFRS measures provide useful information to

investors and analysts for analyzing the Acquisition. These

non-IFRS measures are not recognized under IFRS and may differ from

similarly-named measures as reported by other issuers, and

accordingly may not be comparable. These measures should not be

viewed as a substitute for the related financial information

prepared in accordance with IFRS.

NO OFFER OR SOLICITATIONTHIS

PRESS RELEASE IS NOT INTENDED TO AND SHALL NOT CONSTITUTE AN OFFER

TO SELL OR BUY, OR THE SOLICITATION OF AN OFFER TO SELL OR THE

SOLICITATION OF AN OFFER TO BUY ANY SECURITIES OR A SOLICITATION OF

ANY VOTE OR PROXY FROM ANY PERSON. NOT FOR RELEASE, PUBLICATION OR

DISTRIBUTION IN OR INTO THE UNITED STATES OF AMERICA OR TO ANY

PERSON LOCATED OR RESIDENT IN THE UNITED STATES OF AMERICA, ITS

TERRITORIES AND POSSESSIONS, ANY STATE OF THE UNITED STATES OR THE

DISTRICT OF COLUMBIA.

FOR ADDITIONAL INFORMATION, PLEASE CONTACT:

Alain MichaudChief Financial OfficerWSP Global

Inc.alain.michaud@wsp.com Phone: 438-843-7317

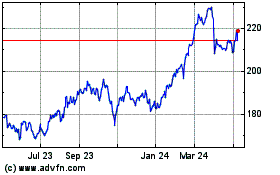

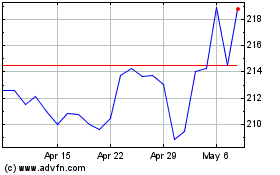

WSP Global (TSX:WSP)

Historical Stock Chart

From Mar 2024 to Apr 2024

WSP Global (TSX:WSP)

Historical Stock Chart

From Apr 2023 to Apr 2024