WSP Global Inc. (TSX: WSP) (“WSP” or the “Corporation”) is

pleased to announce that it has completed today its previously

announced bought deal public offering (the “Offering”) of common

shares (the “Common Shares”) of the Corporation (the “Offering

Common Shares”) and private placement (the “Concurrent Private

Placement”) of Common Shares (the “Placement Common Shares”) for

aggregate gross proceeds of approximately $572 million.

The Corporation issued from treasury 5,842,000

Offering Common Shares, including the 762,000 Offering Common

Shares issued as a result of the full exercise of the

over-allotment option granted to the syndicate of underwriters

co-led by CIBC Capital Markets, National Bank Financial Inc. and TD

Securities Inc. at a price of $86.00 per Offering Common Share, for

aggregate gross proceeds of approximately $502 million.

In addition, the Corporation issued an aggregate

of 817,200 Placement Common Shares, at a price of $86.00 per

Placement Common Share, through the Concurrent Private Placement

with Caisse de dépôt et placement du Québec (“CDPQ”) and a

subsidiary of Canada Pension Plan Investment Board (“CPP

Investments”), for aggregate gross proceeds of approximately $70

million, which includes 76,200 Placement Common Shares issued

pursuant to the exercise by CDPQ of its additional subscription

option in connection with the exercise of the underwriters’

over-allotment option. CDPQ now beneficially owns, exercises

control or direction over, directly or indirectly, an aggregate of

20,769,048 Common Shares, representing 18.4% of the issued and

outstanding Common Shares, and CPP Investments now

beneficially owns, exercises control or direction over, directly or

indirectly, an aggregate of 21,344,068 Common Shares, representing

18.9% of the issued and outstanding Common Shares. Both CDPQ and

CPP Investments have undertaken to have all of the Common

Shares held by them (including the Placement Common Shares)

participate in the Corporation’s dividend reinvestment plan (the

“DRIP”) and to have such Common Shares enrolled in the DRIP for all

dividends for which the record date is on or before June 30,

2021.

WSP intends to use the net proceeds of the

Offering and the Concurrent Private Placement for general corporate

purposes as well as to fund future acquisition opportunities.

Pending such use, WSP intends to repay indebtedness outstanding

under its credit facilities, which may be withdrawn again as

opportunities arise.

Copies of documents relating to the Offering and

the Concurrent Private Placement, such as the short form base shelf

prospectus of the Corporation, the prospectus supplement of the

Corporation qualifying the distribution of the Offering Common

Shares and the subscription agreements in respect of the Concurrent

Private Placement are available under WSP’s profile on SEDAR at

www.sedar.com.

No securities regulatory authority has either

approved or disapproved the contents of this press release. The

Offering Common Shares have not been, and will not be, registered

under the U.S. Securities Act, or any state securities laws.

Accordingly, the Offering Common Shares may not be offered or sold

within the United States unless registered under the U.S.

Securities Act and applicable state securities laws or pursuant to

exemptions from the registration requirements of the U.S.

Securities Act and applicable state securities laws. This press

release shall not constitute an offer to sell or the solicitation

of an offer to buy, nor shall there be any sale of the Offering

Common Shares in any jurisdiction in which such offer, solicitation

or sale would be unlawful.

FORWARD-LOOKING STATEMENTSThis

press release contains forward-looking information within the

meaning of applicable securities laws. All information and

statements other than statements of historical facts contained in

this press release are forward-looking information. These

statements are “forward-looking” because they are based on current

expectations, estimates, assumptions, risks and uncertainties.

These forward-looking statements are typically identified by future

or conditional verbs or words such as “may”, “could”, “will”,

“outlook”, “believe”, “anticipate”, “estimate”, “project”,

“expect”, “intend”, “plan” and terms and expressions of similar

import. Such forward-looking information may include, without

limitation, statements with respect to the use of proceeds from the

sale of securities under the Offering and the Concurrent Private

Placement, and estimates, plans, expectations, opinions, forecasts,

projections, guidance or other statements that are not statements

of facts. Although WSP believes that the expectations reflected in

such forward-looking statements are reasonable, it can give no

assurance that such expectations will prove to have been correct.

These statements are subject to certain risks and uncertainties and

may be based on assumptions that could cause actual results to

differ materially from those anticipated or implied in the

forward-looking statements. These risks and uncertainties are

described in section 18, “Risk Factors”, of the Corporation’s

Management’s Discussion and Analysis for the first quarter ended

March 28, 2020, which is available on the Corporation’s website at

www.wsp.com/investors and under the Corporation’s profile on

SEDAR at www.sedar.com.

The forward-looking information contained herein

is expressly qualified in its entirety by this cautionary

statement. The forward-looking information contained herein is made

as of the date of this press release, and the Corporation

undertakes no obligation to publicly update such forward-looking

information to reflect new information, subsequent or otherwise,

unless required by applicable securities laws.

ABOUT WSPAs one of the world’s

leading professional services firms, WSP provides engineering and

design services to clients in the Transportation &

Infrastructure, Property & Buildings, Environment, Power &

Energy, Resources and Industry sectors, as well as offering

strategic advisory services. WSP’s global experts include

engineers, advisors, technicians, scientists, architects, planners,

environmental specialists and surveyors, in addition to other

design, program and construction management professionals. Our

talented people are well positioned to deliver successful and

sustainable projects, wherever clients need us. wsp.com.

Not for distribution to U.S. Newswire services or

for dissemination in the United States

FOR ADDITIONAL INFORMATION, PLEASE

CONTACT:

Alain Michaud

Chief Financial OfficerWSP Global

Inc.alain.michaud@wsp.comPhone: 438-843-7317

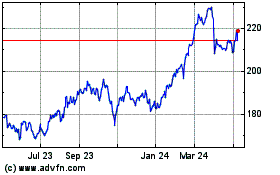

WSP Global (TSX:WSP)

Historical Stock Chart

From Mar 2024 to Apr 2024

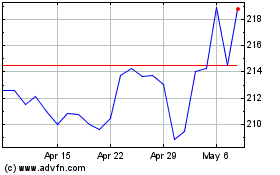

WSP Global (TSX:WSP)

Historical Stock Chart

From Apr 2023 to Apr 2024