Westport Fuel Systems Inc. (“

Westport”) (TSX:WPRT

/ Nasdaq:WPRT) today reported financial results for the fourth

quarter and year ended December 31, 2022 and provided an update on

operations. All figures are in U.S. dollars unless otherwise

stated.

Highlights

- Revenue of $305.7 million for

2022 and $78.0 million for the fourth quarter, down slightly

over comparable periods in 2021 due to the weakening of the Euro

against the U.S dollar.

- Net loss of $(32.7) million or

$(0.19) per share, compared to net income of $13.7 million in the

prior year. For the fourth quarter 2022 net loss was

$(16.9) million.

- Adjusted EBITDA1 of $(27.8)

million, compared to $17.5 million in the prior year. Adjusted

EBITDA for the fourth quarter was $(12.9) million.

- Cash and cash equivalents were $86.2

million for the year ended December 31, 2022. Cash used in

operating activities during the year was $31.6 million.

- Awarded two programs to develop and

supply LPG systems to a global original equipment manufacturer

("OEM") accommodating several Euro 6 and Euro 7

vehicle platforms.

- Announced significant H2 HPDI test

results with Scania, that demonstrated the tremendous value and

best-in-class performance of our proprietary technology.

- Announced a collaboration with

Johnson Matthey, a global leader in sustainable technologies, to

develop an emissions after treatment system for H2 HPDI.

- Announced expanded global

manufacturing footprint in China to support ongoing and future

growth in hydrogen.

- Announced collaboration with a

global OEM to evaluate the performance, efficiency and emissions of

the OEMs engine equipped with our H2 HPDI fuel system, Westport’s

third collaboration of its kind to date.

- Successfully marketed H2 HPDI to a

broad global audience of industry participants, OEMs, policymakers,

and investors at leading industry events in Brussels, California,

Hanover and Washington.

"Amid a challenging macro environment in 2022,

Westport was transitioning past its partnership with Cummins

towards growth and a hydrogen future. The termination and sale of

the Cummins Westport joint venture along with the impact of foreign

exchange negatively impacted both top and bottom line results.

Absent the impact of foreign exchange, revenue would have increased

by 9% year-over-year, a significant improvement given the

environment our industry has faced. Our delayed OEM business, fuel

storage, hydrogen components, and electronics products all saw

significant sales growth in addition to growth in volumes to our

OEM customers in India. Unfortunately, these strengths were offset

by the impact of high natural gas prices on European market sales

to light-duty and heavy-duty OEMs.

Looking to 2023, and supported by strengthening

fundamentals, our focus is on what we can control: driving margin

expansion, revenue growth and technology development will drive our

success in the future. We remain focused on growth in our key

markets – Europe, India, and China which helps us achieve

sustainable profitability as the demand for clean, affordable low

emissions transportation solutions grows.

As innovation and technology development is a

cornerstone of our business, we plan to build on the success we saw

in 2022 introducing, and educating our customers, and the market

about our H2 HPDI™ solution. We will continue to work directly with

key OEMs to advance evaluation of our solution for long-haul,

heavy-duty transport. Westport is part of the solution with

products that are accelerating the reduction of GHG emissions,

now."

David M. Johnson, Chief Executive Officer

|

Consolidated Results |

|

($ in millions, except per share amounts) |

|

Over / (Under)% |

|

Over / (Under)% |

|

4Q22 |

4Q21 |

FY22 |

FY21 |

|

Revenues |

$ |

78.0 |

|

$ |

82.7 |

|

(6) |

% |

$ |

305.7 |

|

$ |

312.4 |

|

(2) |

% |

|

Gross Margin(2) |

|

4.6 |

|

|

9.3 |

|

(50) |

% |

|

36.2 |

|

|

48.2 |

|

(25) |

% |

|

Gross Margin %(2) |

|

6 |

% |

|

11 |

% |

— |

|

|

12 |

% |

|

15 |

% |

— |

|

| Income

from investments accounted for by the equity method(1) |

|

— |

|

|

15.0 |

|

(100) |

% |

|

0.9 |

|

|

33.7 |

|

(97) |

% |

| Net

Income (Loss) from Continuing Operations |

|

(16.9) |

|

|

5.4 |

|

(411) |

% |

|

(32.7) |

|

|

13.7 |

|

(339) |

% |

| Net

Income (Loss) per Share from Continuing Operations |

|

(0.10) |

|

|

0.04 |

|

(350) |

% |

|

(0.19) |

|

|

0.09 |

|

(311) |

% |

|

EBITDA(2) |

|

(13.5) |

|

|

8.4 |

|

(261) |

% |

|

(17.5) |

|

|

23.0 |

|

(176) |

% |

|

Adjusted EBITDA(2) |

|

(12.9) |

|

|

10.0 |

|

(229) |

% |

|

(27.8) |

|

|

17.5 |

|

(259) |

% |

(1) This includes income primarily from our Minda Westport and

Westport Weichai Inc. joint ventures.(2) These financial measures

and ratios are non-GAAP measures. Please refer to GAAP and NON-GAAP

FINANCIAL MEASURES for the reconciliation.

4Q22 and Full Year 2022

Operations

We generated revenues of $78.0 million and

$305.7 million in the three months and year ended December 31,

2022, compared to $82.7 million and $312.4 million for three months

and year ended December 31, 2021, respectively.

Revenues for the full year 2022 decreased

primarily due to the weakening of the Euro against the U.S. dollar.

Excluding foreign currency translation, total revenues would have

increased by $27.7 million or 9%. The full year impact of the

acquisition of our fuel storage business in June 2021, increased

sales volume of our hydrogen and electronics products, higher

delayed-OEM volumes and increased sales volumes to OEMs in India of

our light-duty OEM products contributed to the growth in revenues,

which were negatively impacted by the fuel price volatility, lower

sales volume to Russian customers in the independent aftermarket

and OEM businesses from the ongoing Russian-Ukraine conflict, and

lower sales of CNG and LNG products due to higher natural gas

prices in the European market.

Net loss for the fourth quarter in 2022 was

$(16.9) million, or $(0.10) per share, compared to net income of

$5.4 million, or $0.04 per share, for the same period in 2021. Net

loss for the year ended December 31, 2022 was $(32.7) million, or

$(0.19) per share, compared to net income of $13.7 million for the

prior year. The net loss was primarily attributed to lower gross

margins a result of a combination of the foreign exchange rate and

increasing material, manufacturing and labour costs and the loss of

equity income from the termination and sale of the Cummins Westport

Inc. ("CWI") joint venture.

We reported Adjusted Earnings Before Interest,

Taxes, Depreciation and Amortization ("Adjusted

EBITDA"), see "Non-GAAP Measures" section in the MD&A)

of $(27.8) million for the year ended December 31, 2022, compared

to $17.5 million in the prior year.

Segment Information

Original Equipment Manufacturer

OEM revenue for the three months and year ended

December 31, 2022 was $47.8 million and $198.0 million,

respectively, compared with $57.4 million and

$195.5 million for the three months and year ended December

31, 2021. The decrease of $9.6 million as compared to the fourth

quarter 2021 was primarily driven by the decrease in average Euro

rate versus the U.S. dollar and a decrease in sales for our

light-duty OEM business, partially offset by higher sales volumes

of our fuel storage, delayed-OEM, hydrogen, and electronics

businesses.

Our heavy-duty OEM sales volumes decreased by 50%

in the fourth quarter of 2022 compared to the prior year period

mainly due to the unfavorable fuel price differential between LNG

and diesel in Europe driven by the shortage of LNG supply, which

caused a reduction in volumes.

Revenue for the OEM business segment increased by

$2.5 million for the year, primarily driven increased sales

volumes to OEMs in India of our light-duty CNG products where we

continue to see strong government support and policies in place for

the significant expansion of CNG vehicles, increased sales volumes

of our electronics, fuel storage, hydrogen and delayed-OEM

products. This was partially offset by lower sales volumes in

Western Europe for our light-duty OEM products, lower

year-over-year revenues in our heavy-duty OEM business, and foreign

exchange impact from the strengthening of US dollar against the

Euro when translating our financial statements.

Independent Aftermarket

Revenue for the three months and year ended

December 31, 2022 was $30.2 million and $107.7 million,

respectively, compared with $25.3 million and

$116.9 million for the three months and year ended December

31, 2021. The increase in revenue for the three months ended

December 31, 2022 compared to the prior year period was primarily

driven by increased sales to Eastern Europe, Western Europe

particularly Italy, and Asia Pacific. This was partially offset by

the aforementioned foreign exchange impact of the Euro versus U.S.

dollars.

The decrease in revenue for the year ended

December 31, 2022 compared to the prior year was primarily driven

by lower sales volumes to the Russian market due to the ongoing

Russia-Ukraine conflict, lower sales volumes to Turkey and

Argentina, and the aforementioned foreign exchange impact. Revenue

for the year ended December 31, 2021 included a large one-time

infrastructure project of $5.3 million in Tanzania to build fueling

infrastructure to enable the sale and operation of gaseous fueled

vehicles.

|

SEGMENT RESULTS |

4Q22 |

|

|

Revenue |

|

Operating income (loss) |

|

Depreciation & amortization |

|

Equity income |

|

OEM |

$ |

47.8 |

|

$ |

(12.8) |

|

$ |

1.8 |

|

$ |

— |

| IAM |

|

30.2 |

|

|

0.6 |

|

|

0.8 |

|

|

— |

|

Corporate |

|

— |

|

|

(5.0) |

|

|

0.1 |

|

|

— |

|

Total consolidated |

$ |

78.0 |

|

$ |

(17.2) |

|

$ |

2.7 |

|

$ |

— |

|

SEGMENT RESULTS |

4Q21 |

|

|

Revenue |

|

Operating income (loss) |

|

Depreciation &amortization |

|

Equity income |

|

OEM |

$ |

57.4 |

|

$ |

(5.0) |

|

$ |

2.1 |

|

$ |

0.3 |

| IAM |

|

25.3 |

|

|

(1.3) |

|

|

1.4 |

|

|

— |

|

Corporate |

|

— |

|

|

(3.7) |

|

|

0.1 |

|

|

14.7 |

|

Total consolidated |

$ |

82.7 |

|

$ |

(10.0) |

|

$ |

3.6 |

|

$ |

15.0 |

2023 Outlook

2023 is a year of change for Westport, as we

continue to deliver sustainably in our existing markets while

unlocking new and emerging markets through the delivery of our

cleaner, affordable transportation solutions. Though headwinds

still remain for our industry, including the Russia/Ukraine

conflict, supply chain issues, and inflationary concerns, we remain

confident in our ability to execute on our plans for 2023, focusing

on what we can control, driving margin and revenue expansion and

developing technology for the future.

Effecting change in our cost structure is a

priority in 2023. New customer supply agreements have been secured

and work is underway to enhance top line revenue further with

additional volume expansion throughout the business which has the

added benefit of driving economies of scale. On the cost side, a

slate of efficiency improvements will be put in place throughout

the year focused on optimizing various business units and improving

financial performance, while working constantly to lower and

mitigate input costs.

We remain prudent in our liquidity management.

The capital program in place for 2023 of $12-$15 million is focused

on advancing our work with hydrogen and adding test cell

capacity.

In 2024 and beyond, we expected improved

profitability and growth as we begin to benefit from the changes

made in 2023, in addition to demonstrated growth in our core

business. Adoption of alternative fuels for transportation

applications continues to accelerate and is expected to experience

a step change increase as the regulatory requirements become

increasingly more stringent beginning in 2025 in many of our key

markets, including Europe, India and China. Our HPDI fuel system

solution using Bio LNG or hydrogen is one of Westport's clean,

affordable products that addresses these regulatory requirements

now and into the future.

Conference call

Westport has scheduled a conference call for

Tuesday March 14, 2023 at 7:00 am Pacific Time (10:00 am Eastern

Time) to discuss these results. To access the conference call by

telephone, please dial: 1-800-319-4610 (Canada & USA toll-free)

or 604-638-5340. The live webcast of the conference call can be

accessed through the Westport website

at https://investors.wfsinc.com/

To access the conference call replay, please

dial 1-800-319-6413 (Canada & USA toll-free) or 1-604-638-9010

using the pass code 9886. The telephone replay will be available

until March 21, 2023. Shortly after the conference call, the

webcast will be archived on the Westport Fuel Systems website and

replay will be available in streaming audio and a downloadable MP3

file.

Financial Statements and Management's

Discussion and Analysis

To view Westport full financials for the fourth

quarter and year ended December 31, 2022 please visit

https://investors.wfsinc.com/financials/

2023 Annual General and Special

Meeting

Westport will host its Annual General and

Special Meeting of shareholders (the “Meeting”)

virtually on Thursday, April 6, 2023 at 9:30 a.m. Pacific Time. To

streamline the virtual meeting process, Westport encourages

shareholders to vote in advance of the Meeting using the voting

instruction form or the form of proxy which will be emailed or

mailed with the Meeting materials in the middle of March. Further

instructions on voting and accessing the meeting will be contained

in the Management Information Circular under “Section 1: Voting” –

upon receipt, please review these materials carefully.

Guest Access:

| Dial-In |

+1-800-319-4610 (Canada / USA) or +1-604-638-5340

(International) |

| Webcast |

https://services.choruscall.ca/links/westportagsm202304.html |

Registered Shareholders or Duly

Appointed Proxyholders Access:

Shareholder or Duly Appointed Proxyholders

access to the virtual Meeting requires early registration at the

following link:

https://services.choruscall.ca/DiamondPassRegistration/register?confirmationNumber=10021279&linkSecurityString=18f7dd8b53

Please register at your earliest convenience as

registration will close April 4, 2023 at 9:30 a.m. Pacific Time (48

hours prior to the meeting). Before the Meeting, shareholders of

record at the close of business on March 7, 2023 may vote by

completing the form of proxy or voting instruction form in

accordance with the instructions provided.

Non-registered shareholders should carefully

follow all instructions provided by their intermediaries to ensure

that their Westport Fuel Systems voting shares are voted at the

Meeting. Please refer to “Section 1: Voting” of Westport Fuel

Systems Management Information Circular dated March 6, 2023 in

respect of the Meeting for additional details on how to vote by

proxy before the Meeting and the matters to be voted upon.

Votes placed prior to the Meeting must be

received by our transfer agent, Computershare Investor Services

Inc. by April 4, 2023 at 10:00 a.m. Pacific Time.

About Westport Fuel Systems

At Westport Fuel Systems, we are driving

innovation to power a cleaner tomorrow. We are a leading supplier

of advanced fuel delivery components and systems for clean,

low-carbon fuels such as natural gas, renewable natural gas,

propane, and hydrogen to the global transportation industry. Our

technology delivers the performance and fuel efficiency required by

transportation applications and the environmental benefits that

address climate change and urban air quality challenges.

Headquartered in Vancouver, Canada, with operations in Europe,

Asia, North America, and South America, we serve our customers in

more than 70 countries with leading global transportation brands.

At Westport Fuel Systems, we think ahead. For more information,

visit www.wfsinc.com.

Cautionary Note Regarding Forward

Looking StatementsThis press release contains

forward-looking statements, including statements regarding revenue

and cash usage expectations, future strategic initiatives and

future growth, future of our development programs (including those

relating to HPDI and Hydrogen), our focus for 2023 and the results

of those activities (including those related to margin and revenue

expansion and optimization of our business units and financial

performance), our expectations for 2024 and beyond, the demand for

our products, the future success of our business and technology

strategies, intentions of partners and potential customers, the

performance and competitiveness of Westport Fuel Systems' products

and expansion of product coverage, future market opportunities,

speed of adoption of natural gas for transportation and terms and

timing of future agreements as well as Westport Fuel Systems

management's response to any of the aforementioned factors. These

statements are neither promises nor guarantees, but involve known

and unknown risks and uncertainties and are based on both the views

of management and assumptions that may cause our actual results,

levels of activity, performance or achievements to be materially

different from any future results, levels of activities,

performance or achievements expressed in or implied by these

forward looking statements. These risks, uncertainties and

assumptions include those related to our revenue growth, operating

results, industry and products, the general economy, conditions of

and access to the capital and debt markets, solvency, governmental

policies and regulation, technology innovations, fluctuations in

foreign exchange rates, operating expenses, continued reduction in

expenses, ability to successfully commercialize new products, the

performance of our joint ventures, the availability and price of

natural gas, global government stimulus packages and new

environmental regulations, the acceptance of and shift to natural

gas vehicles, the relaxation or waiver of fuel emission standards,

the inability of fleets to access capital or government funding to

purchase natural gas vehicles, the development of competing

technologies, our ability to adequately develop and deploy our

technology, the actions and determinations of our joint venture and

development partners, the effects and duration of the

Russia-Ukraine conflict, supply chain disruptions as well as other

risk factors and assumptions that may affect our actual results,

performance or achievements or financial position discussed in our

most recent Annual Information Form and other filings with

securities regulators. Readers should not place undue reliance on

any such forward-looking statements, which speak only as of the

date they were made. We disclaim any obligation to publicly update

or revise such statements to reflect any change in our expectations

or in events, conditions or circumstances on which any such

statements may be based, or that may affect the likelihood that

actual results will differ from those set forth in these forward

looking statements except as required by National Instrument

51-102. The contents of any website, RSS feed or twitter account

referenced in this press release are not incorporated by reference

herein.

Inquiries:Investor RelationsT:

+1 604-718-2046invest@wfsinc.com

GAAP and Non-GAAP Financial

Measures

Our financial statements are prepared in

accordance with U.S. generally accepted accounting principles

("U.S. GAAP"). These U.S. GAAP financial

statements include non-cash charges and other charges and benefits

that may be unusual or infrequent in nature or that we believe may

make comparisons to our prior or future performance difficult. In

addition to conventional measures prepared in accordance with U.S.

GAAP, Westport and certain investors use EBITDA and Adjusted EBITDA

as an indicator of our ability to generate liquidity by producing

operating cash flow to fund working capital needs, service debt

obligations and fund capital expenditures. Management also uses

these non-GAAP measures in its review and evaluation of the

financial performance of Westport. EBITDA is also frequently used

by investors and analysts for valuation purposes whereby EBITDA is

multiplied by a factor or "EBITDA multiple" that is based on an

observed or inferred relationship between EBITDA and market values

to determine the approximate total enterprise value of a company.

We believe that these non-GAAP financial measures also provide

additional insight to investors and securities analysts as

supplemental information to our U.S. GAAP results and as a basis to

compare our financial performance period-over-period and to compare

our financial performance with that of other companies. We believe

that these non-GAAP financial measures facilitate comparisons of

our core operating results from period to period and to other

companies by, in the case of EBITDA, removing the effects of our

capital structure (net interest income on cash deposits, interest

expense on outstanding debt and debt facilities), asset base

(depreciation and amortization) and tax consequences. Adjusted

EBITDA provides this same indicator of Westports' EBITDA from

continuing operations and removing such effects of our capital

structure, asset base and tax consequences, but additionally

excludes any unrealized foreign exchange gains or losses,

stock-based compensation charges and other one-time impairments and

costs which are not expected to be repeated in order to provide

greater insight into the cash flow being produced from our

operating business, without the influence of extraneous events.

EBITDA and Adjusted EBITDA are intended to

provide additional information to investors and analysts and do not

have any standardized definition under U.S. GAAP, and should not be

considered in isolation or as a substitute for measures of

performance prepared in accordance with U.S. GAAP. EBITDA and

Adjusted EBITDA exclude the impact of cash costs of financing

activities and taxes, and the effects of changes in operating

working capital balances, and therefore are not necessarily

indicative of operating profit or cash flow from operations as

determined under U.S. GAAP. Other companies may calculate EBITDA

and Adjusted EBITDA differently.

NON-GAAP FINANCIAL MEASURES

RECONCILIATION

| Gross

Margin |

| |

|

Years ended December 31, |

|

|

|

|

2022 |

|

|

2021 |

| (expressed in

millions of U.S. dollars) |

| Revenue |

|

$ |

305.7 |

|

$ |

312.4 |

| Less: Cost of revenue |

|

$ |

269.5 |

|

$ |

264.2 |

| Gross

Margin |

|

$ |

36.2 |

|

$ |

48.2 |

| Gross

Margin as a percentage of Revenue |

| |

|

Years ended December 31, |

|

|

|

|

2022 |

|

|

|

2021 |

|

| (expressed in

millions of U.S. dollars) |

| Revenue |

|

$ |

305.7 |

|

|

$ |

312.4 |

|

| Gross Margin |

|

$ |

36.2 |

|

|

$ |

48.2 |

|

| Gross Margin as a

percentage of Revenue |

|

|

12 |

% |

|

|

15 |

% |

| EBITDA

and Adjusted EBITDA |

| Three months

ended |

|

31-Mar-21 |

|

30-Jun-21 |

|

30-Sep-21 |

|

31-Dec-21 |

|

31-Mar-22 |

|

30-Jun-22 |

|

30-Sep-22 |

|

31-Dec-22 |

|

Income (loss) before income taxes |

|

$ |

(2.8 |

) |

|

$ |

9.1 |

|

|

$ |

(5.4 |

) |

|

$ |

4.6 |

|

$ |

7.6 |

|

|

$ |

(11.5 |

) |

|

$ |

(11.0 |

) |

|

$ |

(16.4 |

) |

| Interest expense, net |

|

|

1.2 |

|

|

|

1.1 |

|

|

|

0.9 |

|

|

|

0.3 |

|

|

1.0 |

|

|

|

0.7 |

|

|

|

0.2 |

|

|

|

0.1 |

|

| Depreciation and

amortization |

|

|

3.5 |

|

|

|

3.7 |

|

|

|

3.3 |

|

|

|

3.5 |

|

|

3.1 |

|

|

|

3.1 |

|

|

|

2.8 |

|

|

|

2.8 |

|

| EBITDA |

|

$ |

1.9 |

|

|

$ |

13.9 |

|

|

$ |

(1.2 |

) |

|

$ |

8.4 |

|

$ |

11.7 |

|

|

$ |

(7.7 |

) |

|

$ |

(8.0 |

) |

|

$ |

(13.5 |

) |

| Stock based compensation |

|

$ |

0.1 |

|

|

$ |

0.5 |

|

|

$ |

0.7 |

|

|

$ |

0.6 |

|

$ |

0.5 |

|

|

$ |

0.9 |

|

|

$ |

0.8 |

|

|

$ |

0.2 |

|

| Unrealized foreign exchange

(gain) loss |

|

$ |

0.7 |

|

|

$ |

(2.3 |

) |

|

$ |

(0.9 |

) |

|

$ |

0.5 |

|

$ |

0.8 |

|

|

$ |

2.5 |

|

|

$ |

2.7 |

|

|

$ |

0.4 |

|

| Asset impairment |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

0.5 |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

| Bargain purchase gain |

|

$ |

— |

|

|

$ |

(5.9 |

) |

|

$ |

— |

|

|

$ |

— |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

| (Gain) loss on sale of

investments |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

$ |

(19.1 |

) |

|

$ |

— |

|

|

$ |

— |

|

|

|

| Adjusted EBITDA |

|

$ |

2.7 |

|

|

$ |

6.2 |

|

|

$ |

(1.4 |

) |

|

$ |

10.0 |

|

$ |

(6.1 |

) |

|

$ |

(4.3 |

) |

|

$ |

(4.5 |

) |

|

$ |

(12.9 |

) |

|

WESTPORT FUEL SYSTEMS INC. |

|

Consolidated Balance Sheets |

|

(Expressed in thousands of United States dollars, except share

amounts) |

|

December 31, 2022 and 2021 |

| |

|

December 31, 2022 |

|

December 31, 2021 |

|

Assets |

|

|

|

|

|

Current assets: |

|

|

|

|

|

Cash and cash equivalents (including restricted cash) |

|

$ |

86,184 |

|

|

$ |

124,892 |

|

|

Accounts receivable |

|

|

101,640 |

|

|

|

101,508 |

|

|

Inventories |

|

|

81,635 |

|

|

|

83,128 |

|

|

Prepaid expenses |

|

|

7,760 |

|

|

|

6,997 |

|

|

Current assets held for sale |

|

|

— |

|

|

|

22,039 |

|

|

Total current assets |

|

|

277,219 |

|

|

|

338,564 |

|

|

Long-term investments |

|

|

4,629 |

|

|

|

3,824 |

|

|

Property, plant and equipment |

|

|

62,641 |

|

|

|

64,420 |

|

|

Operating lease right-of-use assets |

|

|

23,727 |

|

|

|

28,830 |

|

|

Intangible assets |

|

|

7,817 |

|

|

|

9,286 |

|

|

Deferred income tax assets |

|

|

10,430 |

|

|

|

11,653 |

|

|

Goodwill |

|

|

2,958 |

|

|

|

3,121 |

|

|

Other long-term assets |

|

|

18,030 |

|

|

|

11,615 |

|

|

Total assets |

|

$ |

407,451 |

|

|

$ |

471,313 |

|

|

Liabilities and Shareholders’ Equity |

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

Accounts payable and accrued liabilities |

|

$ |

98,863 |

|

|

$ |

99,238 |

|

|

Current portion of operating lease liabilities |

|

|

3,379 |

|

|

|

4,190 |

|

|

Short-term debt |

|

|

9,102 |

|

|

|

13,652 |

|

|

Current portion of long-term debt |

|

|

11,698 |

|

|

|

10,590 |

|

|

Current portion of long-term royalty payable |

|

|

1,162 |

|

|

|

5,200 |

|

|

Current portion of warranty liability |

|

|

11,315 |

|

|

|

13,577 |

|

|

Total current liabilities |

|

|

135,519 |

|

|

|

146,447 |

|

|

Long-term operating lease liabilities |

|

|

20,080 |

|

|

|

24,362 |

|

|

Long-term debt |

|

|

32,164 |

|

|

|

45,125 |

|

|

Long-term royalty payable |

|

|

4,376 |

|

|

|

4,747 |

|

|

Warranty liability |

|

|

2,984 |

|

|

|

5,214 |

|

|

Deferred income tax liabilities |

|

|

3,282 |

|

|

|

3,392 |

|

|

Other long-term liabilities |

|

|

5,080 |

|

|

|

5,607 |

|

|

Total liabilities |

|

|

203,485 |

|

|

|

234,894 |

|

|

Shareholders’ equity: |

|

|

|

|

|

Share capital: |

|

|

|

|

|

Unlimited common and preferred shares, no par value |

|

|

|

|

|

171,303,165 (2021 - 170,799,325) common shares issued and

outstanding |

|

|

1,243,272 |

|

|

|

1,242,006 |

|

|

Other equity instruments |

|

|

9,212 |

|

|

|

8,412 |

|

|

Additional paid-in-capital |

|

|

11,516 |

|

|

|

11,516 |

|

|

Accumulated deficit |

|

|

(1,024,716 |

) |

|

|

(992,021 |

) |

|

Accumulated other comprehensive loss |

|

|

(35,318 |

) |

|

|

(33,494 |

) |

|

Total shareholders' equity |

|

|

203,966 |

|

|

|

236,419 |

|

|

Total liabilities and shareholders' equity |

|

$ |

407,451 |

|

|

$ |

471,313 |

|

|

WESTPORT FUEL SYSTEMS INC. |

|

|

Consolidated Statements of Operations and Comprehensive Income

(Loss) |

|

|

(Expressed in thousands of United States dollars, except share and

per share amounts) |

|

|

Years ended December 31, 2022 and 2021 |

|

|

|

|

Years ended December 31, |

|

|

|

|

2022 |

|

|

|

2021 |

|

|

Revenue |

|

$ |

305,698 |

|

|

$ |

312,412 |

|

|

Cost of revenue and expenses: |

|

|

|

|

|

Cost of revenue |

|

|

269,496 |

|

|

|

264,260 |

|

|

Research and development |

|

|

23,497 |

|

|

|

25,194 |

|

|

General and administrative |

|

|

37,042 |

|

|

|

36,290 |

|

|

Sales and marketing |

|

|

15,073 |

|

|

|

13,495 |

|

|

Foreign exchange loss (gain) |

|

|

6,378 |

|

|

|

(1,984 |

) |

|

Depreciation and amortization |

|

|

4,416 |

|

|

|

5,390 |

|

|

Loss (gain) on sale of assets |

|

|

62 |

|

|

|

(146 |

) |

|

Impairment on long lived assets, net |

|

|

— |

|

|

|

459 |

|

|

|

|

|

355,964 |

|

|

|

342,958 |

|

|

Loss from operations |

|

|

(50,266 |

) |

|

|

(30,546 |

) |

| |

|

|

|

|

|

Income from investments accounted for by the equity method |

|

|

930 |

|

|

|

33,741 |

|

|

Bargain purchase gain from acquisition |

|

|

— |

|

|

|

5,856 |

|

|

Gain on sale of investment |

|

|

19,119 |

|

|

|

— |

|

|

Interest on long-term debt and amortization of discount |

|

|

(3,351 |

) |

|

|

(4,937 |

) |

|

Other income (loss), net |

|

|

879 |

|

|

|

1,053 |

|

|

Interest income, net of bank charges |

|

|

1,406 |

|

|

|

360 |

|

|

Income (loss) before income taxes |

|

|

(31,283 |

) |

|

|

5,527 |

|

|

Income tax expense (recovery): |

|

|

|

|

|

Current |

|

|

1,852 |

|

|

|

2,172 |

|

|

Deferred |

|

|

(440 |

) |

|

|

(10,303 |

) |

|

|

|

|

1,412 |

|

|

|

(8,131 |

) |

|

Net income (loss) for the year |

|

|

(32,695 |

) |

|

|

13,658 |

|

|

Other comprehensive loss: |

|

|

|

|

|

Cumulative translation adjustment |

|

|

(1,824 |

) |

|

|

(8,953 |

) |

|

Comprehensive loss |

|

$ |

(34,519 |

) |

|

$ |

4,705 |

|

|

Income (loss) per share: |

|

|

|

|

|

Net income (loss) per share - basic |

|

$ |

(0.19 |

) |

|

$ |

0.09 |

|

|

Net income (loss) per share - diluted |

|

$ |

(0.19 |

) |

|

$ |

0.08 |

|

|

Weighted average common shares outstanding: |

|

|

|

|

|

Basic |

|

|

171,225,305 |

|

|

|

160,232,742 |

|

|

Diluted |

|

|

171,225,305 |

|

|

|

162,099,175 |

|

|

WESTPORT FUEL SYSTEMS INC. |

|

Consolidated Statements of Cash Flows |

|

(Expressed in thousands of United States dollars) |

|

Years ended December 31, 2022 and 2021 |

| |

|

Years ended December 31, |

|

|

|

|

2022 |

|

|

|

2021 |

|

| |

|

|

|

|

|

Operating activities: |

|

|

|

|

|

Net income (loss) for the year |

|

$ |

(32,695 |

) |

|

$ |

13,658 |

|

|

Adjustments to reconcile net income (loss) to net cash used in

operating activities: |

|

|

|

|

|

Depreciation and amortization |

|

|

11,800 |

|

|

|

14,035 |

|

|

Stock-based compensation expense |

|

|

2,066 |

|

|

|

1,911 |

|

|

Unrealized foreign exchange loss (gain) |

|

|

6,378 |

|

|

|

(1,984 |

) |

|

Deferred income tax |

|

|

(440 |

) |

|

|

(10,303 |

) |

|

Income from investments accounted for by the equity method |

|

|

(930 |

) |

|

|

(33,741 |

) |

|

Interest on long-term debt and accretion of royalty payable |

|

|

3,351 |

|

|

|

4,937 |

|

|

Impairment on long lived assets, net |

|

|

— |

|

|

|

459 |

|

|

Change in inventory write-downs to net realizable value |

|

|

722 |

|

|

|

914 |

|

|

Net gain on sale of investments |

|

|

(19,119 |

) |

|

|

— |

|

|

Net (gain) loss on sale of assets |

|

|

62 |

|

|

|

(146 |

) |

|

Other (income) loss, net |

|

|

(879 |

) |

|

|

— |

|

|

Bargain purchase gain from acquisition |

|

|

— |

|

|

|

(5,856 |

) |

|

Change in bad debt expense |

|

|

810 |

|

|

|

(326 |

) |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

Accounts receivable |

|

|

(1,528 |

) |

|

|

(11,117 |

) |

|

Inventories |

|

|

(3,505 |

) |

|

|

(31,744 |

) |

|

Prepaid expenses |

|

|

(134 |

) |

|

|

3,964 |

|

|

Accounts payable and accrued liabilities |

|

|

122 |

|

|

|

11,313 |

|

|

Warranty liability |

|

|

2,341 |

|

|

|

233 |

|

|

Net cash used in operating activities |

|

|

(31,578 |

) |

|

|

(43,793 |

) |

|

Investing activities: |

|

|

|

|

|

Purchase of property, plant and equipment |

|

|

(14,242 |

) |

|

|

(14,158 |

) |

|

Purchase of intangible assets |

|

|

(287 |

) |

|

|

— |

|

|

Acquisitions, net of acquired cash |

|

|

— |

|

|

|

(5,948 |

) |

|

Proceeds on sale of investments |

|

|

31,445 |

|

|

|

— |

|

|

Proceeds on sale of assets |

|

|

731 |

|

|

|

600 |

|

|

Dividends received from joint ventures |

|

|

— |

|

|

|

21,796 |

|

|

Net cash provided by investing activities |

|

|

17,647 |

|

|

|

2,290 |

|

|

Financing activities: |

|

|

|

|

|

Drawings on operating lines of credit and long-term facilities |

|

|

41,218 |

|

|

|

74,408 |

|

|

Repayment of operating lines of credit and long-term

facilities |

|

|

(58,478 |

) |

|

|

(82,958 |

) |

|

Proceeds from share issuance, net |

|

|

— |

|

|

|

120,727 |

|

|

Repayment of royalty payable |

|

|

(5,200 |

) |

|

|

(7,451 |

) |

|

Net cash (used in) provided by financing activities |

|

|

(22,460 |

) |

|

|

104,726 |

|

|

Effect of foreign exchange on cash and cash equivalents |

|

|

(2,317 |

) |

|

|

(2,593 |

) |

|

Net (decrease) increase in cash and cash equivalents |

|

|

(38,708 |

) |

|

|

60,630 |

|

|

Cash and cash equivalents, beginning of year (including restricted

cash) |

|

|

124,892 |

|

|

|

64,262 |

|

|

Cash and cash equivalents, end of year (including restricted

cash) |

|

|

86,184 |

|

|

|

124,892 |

|

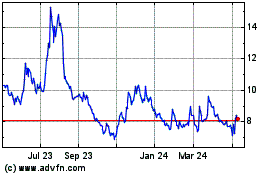

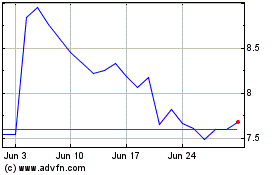

Westport Fuel Systems (TSX:WPRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Westport Fuel Systems (TSX:WPRT)

Historical Stock Chart

From Apr 2023 to Apr 2024