VIQ Solutions Inc. (“VIQ”, “VIQ Solutions” or the “Company”)

(TSX: VQS), a global provider of secure, AI-driven, digital voice

and video capture technology and transcription services, is pleased

to announce its unaudited financial results for the third quarter

ending September 30, 2024. Results are reported in US dollars and

prepared in accordance with International Financial Reporting

Standards (“IFRS”).

“Our third-quarter results reflect strong financial performance,

driven by revenue growth and improved gross margins. This success

is a direct result of our effective court migrations in Australia

and significant productivity gains. The enhancements made to our

AI-driven Netscribe platform, including the introduction of

AI-based formatting tools for court reporters, have streamlined

operations and boosted efficiency, leading to substantial cost

savings and margin expansion. With key migrations now complete and

a strong focus on cost optimization, we have improved operational

efficiency, positioning the company for continued gross margin

growth and enhanced Adjusted EBITDA in the quarters ahead,” said

Sebastien Paré, CEO of VIQ Solutions.

Third Quarter 2024 Operational Highlights

- Global Tech-AI Migrations: We have successfully

transitioned the majority of our revenue-generating operations to

the NetScribe AI Assist platform on a global scale, driving

increased gross margins and improved operational efficiency.

- Renewals and New Awards: Key renewals and new contract

awards with major clients have strengthened our ARR revenue base

for the coming years.

- Productivity Gains in Australia: Operational

improvements in the Australian court sector have enabled a shift

from fixed staffing to a variable-cost model that adapts to case

volume and court scheduling, enhancing flexibility and cost

efficiency.

- Increased Client Adoption and Utilization: Client

engagement with FirstDraft has grown across all revenue segments,

leading to a twofold increase in FirstDraft SaaS revenue year over

year for the nine months ending September 30, 2024.

- Enhanced AI Platform Performance: Rising volumes

processed on our AI Platform have further optimized our proprietary

Domain-Specific Language Models (DSLMs) and post-processing,

reducing word error rates and improving transcription efficiency,

which cuts the time required to transcribe each minute of

audio.

- Insurance Volume Growth: The Insurance sector continues

to experience steady growth, with a notable acceleration in recent

months. One major client has boosted its volume by 800% since

expanding its contract in April 2024, while another key client’s

recent contract expansion has resulted in a 250% increase in volume

since July 2024. These significant increases highlight the growing

demand for our solutions within the Insurance industry.

“Our third-quarter results demonstrate strong revenue growth and

improved gross margins, driven by successful court migrations in

Australia and a 30% productivity gain among our transcribers. The

enhancements to our AI-driven Netscribe platform have

revolutionized document creation by automating complex,

state-specific templates, bringing greater consistency and

efficiency to court reporting. As demand for court reporting

services continues to rise, our technology is proving essential in

supporting clients facing resource constraints. With key migrations

now completed, we have accelerated cost-reduction initiatives,

further enhancing operational efficiency. We are confident that

these advancements will continue to drive gross margin expansion

and strengthen Adjusted EBITDA in the coming quarters.” said Susan

Sumner, COO and President of VIQ Solutions.

Third Quarter 2024 Financial Highlights

- Revenue of $11.1 million, an increase of $1 million or 10%,

from the same period in the prior year.

- Gross profit of $5.1 million, an increase of $0.8 million or

19% from the same period in the prior year.

- Net loss of $1.1 million, a decrease of $3.3 million or 75%,

from the same period in the prior year.

- Adjusted EBITDA1 of $0.8 million, an improvement of $2.1

million, or 158%, from the same period in the prior year.

“We are thrilled to report a significant improvement of

approximately $2.1M to Adjusted EBITDA from the same period last

year. This growth reflects the success of our strategic

productivity margin initiatives, tight cost management and revenue

expansion in an industry experiencing rapid modernization due to

the integration of AI technology. We remain focused on executing

our strategic priorities and financial targets. Enhancing VIQ’s

Adjusted EBITDA performance remains a top priority” said Alexie

Edwards, VIQ’s Chief Financial Officer.

1 Represents a non-IFRS measure. Non-IFRS measures are not

recognized measures under IFRS, do not have a standardized meaning

prescribed by IFRS and are therefore unlikely to be comparable to

similar measures presented by other companies. Management believes

non-IFRS measures, including Adjusted EBITDA, provide supplementary

information to IFRS measures used in assessing the performance of

the Company’s business. Please refer to the “Non-IFRS Measures”

section below.

A copy of the Company’s unaudited financial statements and

accompanying MD&A for the three and nine months ended September

30, 2024 (collectively, the “Financial Information”) will be

available under the Company’s profile on SEDAR+ at

www.sedarplus.ca.

Conference Call Details

VIQ will host a conference call and webcast to discuss Financial

Information on Wednesday November 13, 2024, at 11:00 a.m. (Eastern

time). The call will consist of updates by Sebastien Paré, VIQ’s

Chief Executive Officer, Alexie Edwards, VIQ’s Chief Financial

Officer, and Susan Sumner, VIQ’s President and Chief Operating

Officer, followed by a question-and-answer period.

Investors may access a live webcast of the call on the Company’s

website at www.viqsolutions.com/investors or by dialing

1-888-440-4052 (North America toll-free) or +1-646-960-0827

(international) to be connected to the call by an operator using

conference ID number 4983233. Participants should dial at least 10

minutes before the call starts.

A replay of the webcast will be available on the Company’s

website through the same link approximately one hour after the

conference call concludes.

About VIQ Solutions

VIQ Solutions is a global provider of secure, AI-driven, digital

voice and video capture technology and transcription services. VIQ

offers a seamless, comprehensive solution suite that delivers

intelligent automation, enhanced with human review, to drive

transformation in the way content is captured, secured, and

repurposed into actionable information. The cyber-secure, AI

technology and services platform are implemented in the most rigid

security environments including criminal justice, legal, insurance,

government, corporate finance, media, and transcription service

provider markets, enabling them to improve the quality and

accessibility of evidence, to easily identify predictive insights

and to achieve digital transformation faster and at a lower

cost.

Forward-looking Statements

Certain statements included in this press release constitute

forward-looking statements or forward-looking information

(collectively, “forward-looking statements”) under applicable

securities legislation. Such forward-looking statements or

information are provided for the purpose of providing information

about management’s current expectations and plans relating to the

future. Readers are cautioned that reliance on such information may

not be appropriate for other purposes.

Forward-looking statements (typically contain statements with

words such as “anticipate”, “believe”, “expect”, “plan”, “intend”,

“estimate”, “propose”, “project” or similar words, including

negatives thereof, suggesting future outcomes or that certain

events or conditions “may” or “will” occur). These statements are

only predictions. Forward-looking statements in this press release

include but are not limited to statements with respect to the

Company’s improved 2024 performance, including to gross margin, the

Company’s focus and its priorities, expected higher volumes,

increases in SaaS sales and the evolution of sectors in 2024, the

filing of the Financial Information on SEDAR+ and the conference

call to discuss the Company’s financial results.

Forward-looking statements are based on several factors and

assumptions which have been used to develop such statements, but

which may prove to be incorrect. Although VIQ believes that the

expectations reflected in such forward-looking statements are

reasonable, undue reliance should not be placed on forward-looking

statements because VIQ can give no assurance that such expectations

will prove to be correct. In addition to other factors and

assumptions which may be identified in this press release,

assumptions have been made regarding, among other things, recent

initiatives, cost savings from workforce optimization, cost

reductions from the Company’s workflow solutions and that sales and

prospects may increase revenue. In addition to other factors and

assumptions that may be identified in this press release,

assumptions have been made regarding, among other things, recent

initiatives, cost savings from workforce optimization, cost

reductions from the Company’s workflow solutions, and that sales

and prospects may increase revenue. Readers are cautioned that the

foregoing list is not exhaustive of all factors and assumptions

that have been used.

Forward-looking statements are necessarily based on a number of

opinions, assumptions and estimates that while considered

reasonable by the Company as of the date of this press release, are

subject to known and unknown risks, uncertainties, assumptions, and

other factors that may cause the actual results, level of activity,

performance or achievements to be materially different from those

expressed or implied by such forward-looking statements, including

but not limited to the factors described in greater detail in the

“Risk Factors” section of the Company’s annual information form and

in the Company’s other materials filed with the Canadian securities

regulatory authorities.

These factors are not intended to represent a complete list of

the factors that could affect the Company; however, these factors

should be considered carefully. Such estimates and assumptions may

prove to be incorrect or overstated. The forward-looking statements

contained in this press release are made as of the date of this

press release and the Company expressly disclaims any obligations

to update or alter such statements, or the factors or assumptions

underlying them, whether as a result of new information, future

events or otherwise, except as required by law.

VIQ Solutions Inc.

Interim Condensed Consolidated

Statements of Financial Position

(Expressed in US dollars,

unaudited)

September 30,

2024

December 31,

2023

Assets

Current assets

Cash

$

1,021,298

$

1,621,778

Trade and other receivables, net of

allowance for doubtful

accounts

5,280,178

4,382,668

Inventories

29,014

29,146

Prepaid expenses and deposits

1,260,383

1,636,349

Non-current assets

7,590,873

7,669,941

Restricted cash

187,850

185,655

Property and equipment

830,091

1,066,194

Right-of-use assets

266,136

596,063

Intangible assets

6,630,741

8,066,733

Goodwill

12,208,897

12,090,609

Total assets

$

27,714,588

$

29,675,195

Liabilities

Current liabilities

Trade and other payables and accrued

liabilities

$

6,453,562

$

6,269,023

Income tax payable

63,433

59,044

Share-based payment liability

23,828

25,246

Derivative warrant liability

75,791

188,042

Current portion of long-term debt

14,271,366

19,812

Current portion of lease obligations

337,671

483,362

Current portion of contract

liabilities

1,402,099

1,809,003

Non-current liabilities

22,627,750

8,853,532

Long-term debt

–

13,246,176

Long-term lease obligations

10,701

220,750

Other long-term liabilities

1,225,393

1,179,639

Total liabilities

23,863,844

23,500,097

Shareholders’ Equity

Capital stock

77,568,598

76,230,158

Contributed surplus

9,151,889

8,671,879

Accumulated other comprehensive loss

(1,324,114

)

(670,788

)

Deficit

(81,545,629

)

(78,056,151

)

Total shareholders’ equity

3,850,744

6,175,098

Total liabilities and shareholders’

equity

$

27,714,588

$

29,675,195

VIQ Solutions Inc. Interim

Condensed Consolidated Statements of Loss and Comprehensive Loss

(Expressed in US dollars, unaudited)

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

Revenue

$

11,116,345

$

10,102,827

$

32,613,632

$

30,674,291

Cost of sales

5,967,429

5,770,743

17,809,341

17,279,369

Gross profit

5,148,916

4,332,084

14,804,291

13,394,922

Expenses

Selling and administrative expenses

4,191,589

5,495,347

12,831,255

16,262,292

Research and development expenses

171,628

186,769

492,154

520,734

Stock-based compensation

254,413

54,974

394,038

893,101

Gain on revaluation of RSUs

(4,457

)

(50,103

)

(51,768

)

(170,091

)

Loss (gain) on revaluation of the

derivative warrant liability

(58,517

)

(543,114

)

(108,203

)

(408,600

)

Foreign exchange (gain) loss

(245,480

)

43,287

(733,366

)

689,575

Depreciation

197,914

209,755

587,135

619,310

Amortization

836,301

1,042,071

2,456,647

3,478,045

Interest expense

464,172

343,882

1,259,061

996,974

Accretion and other financing costs

352,006

742,933

1,104,100

1,147,219

Gain on contingent consideration

–

–

–

(10,389

)

Impairment of goodwill and intangible

assets

–

–

–

157,464

Restructuring costs

75,180

474,597

71,346

531,463

Other income

(9,792

)

(12,031

)

(31,205

)

(21,438

)

Total expenses

6,224,957

7,988,367

18,271,194

24,685,659

Current income tax expense (recovery)

1,468

7,990

22,575

(32,101

)

Deferred income tax recovery

–

714,743

–

138,224

Income tax expense (recovery)

1,468

722,733

22,575

106,123

Net loss for the period

$

(1,077,509

)

$

(4,379,016

)

$

(3,489,478

)

$

(11,396,860

)

Exchange loss (gain) on translation of

foreign operations

141,781

(328,952

)

(653,326

)

89,237

Comprehensive loss for the period

$

(935,728

)

$

(4,707,968

)

$

(4,142,804

)

$

(11,307,623

)

Net loss per share

Basic

(0.02

)

(0.11

)

(0.07

)

(0.32

)

Diluted

(0.02

)

(0.11

)

(0.07

)

(0.32

)

Weighted average number of common shares

outstanding – basic

51,812,252

38,804,967

49,323,526

36,078,834

Weighted average number of common shares

outstanding – diluted

51,812,252

38,804,967

49,323,526

36,078,834

The following is a reconciliation of Net Loss to Adjusted

EBITDA, the most directly comparable IFRS measure for the three and

nine months ended September 30, 2024, and 2023:

Three months ended September

30

Nine months ended September

30

(Unaudited)

2024

2023

2024

2023

Net Loss

(1,077,509

)

(4,379,016

)

(3,489,478

)

(11,396,860

)

Add:

Depreciation

197,914

209,755

587,135

619,310

Amortization

836,301

1,042,071

2,456,647

3,478,045

Interest expense

464,172

343,882

1,259,061

996,974

Current income tax (recovery) expense

1,468

7,990

22,575

(32,101

)

Deferred income tax recovery

–

714,743

–

138,224

EBITDA

422,346

(2,060,575

)

835,940

(6,196,408

)

Accretion and other financing costs

352,006

742,933

1,104,100

1,147,219

Gain on revaluation of RSUs

(4,457

)

(50,103

)

(51,768

)

(170,091

)

Gain on revaluation of the derivative

warrant liability

(58,517

)

(543,114

)

(108,203

)

(408,600

)

Impairment of intangible assets

–

–

–

157,464

Restructuring costs

75,180

474,597

71,346

531,463

Other income

(9,792

)

(12,031

)

(31,205

)

(21,438

)

Stock-based compensation

254,413

54,974

394,038

893,101

Foreign exchange (gain) loss

(245,480

)

43,287

(733,366

)

689,575

Adjusted EBITDA

785,699

(1,350,032

)

1,480,882

(3,377,715

)

Non-IFRS Measures

The Company prepares its financial statements in accordance with

IFRS. Non-IFRS measures are provided by management to provide

additional insight into our performance and financial condition.

VIQ believes non-IFRS measures are an important part of the

financial reporting process and are useful in communicating

information that complements and supplements the consolidated

financial statements. Adjusted EBITDA is not a measure recognized

by IFRS and does not have a standardized meaning prescribed by

IFRS. Therefore, Adjusted EBITDA may not be comparable to similar

measures presented by other issuers. Investors are cautioned that

Adjusted EBITDA should not be construed as an alternative to net

income (loss) as determined in accordance with IFRS. For a

reconciliation of net income (loss) to Adjusted EBITDA please see

the Company’s MD&A for the three and nine months ended

September 30, 2024.

To evaluate the Company’s operating performance as a complement

to results provided in accordance with IFRS, the term “Adjusted

EBITDA” refers to net income (loss) before adjusting earnings for

stock-based compensation, depreciation, amortization, interest

expense, accretion, and other financing expense, (gain) loss on

revaluation of options, (gain) loss on revaluation of restricted

share units, gain (loss) on revaluation of derivative warrant

liability, restructuring costs, (gain) loss on revaluation of

conversion feature liability impairment of property and equipment,

impairment of goodwill and intangibles, other expense (income),

foreign exchange (gain) loss, current and deferred income tax

expense. We believe that the items excluded from Adjusted EBITDA

are not connected to and do not represent the operating performance

of the Company.

We believe that Adjusted EBITDA is useful supplemental

information as it provides an indication of the results generated

by the Company’s main business activities prior to taking into

consideration how those activities are financed and taxed as well

as expenses related to stock-based compensation, depreciation,

amortization, impairment of goodwill and intangibles, loss on

modification or extinguishment of debt, other expense (income), and

foreign exchange (gain) loss. Accordingly, we believe that this

measure may also be useful to investors in enhancing their

understanding of the Company’s operating performance.

Trademarks

This press release includes trademarks, such as “NetScribe”,

which are protected under applicable intellectual property laws and

are the property of VIQ. Solely for convenience, our trademarks

referred to in this press release may appear without the ® or TM

symbol, but such references are not intended to indicate, in any

way, that we will not assert our rights to these trademarks, trade

names, and services marks to the fullest extent under applicable

law. Trademarks that may be used in this press release, other than

those that belong to VIQ, are the property of their respective

owners.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241112248981/en/

Media Contact: Jacob Manning VIQ Solutions Email:

marketing@viqsolutions.com For more information about VIQ, please

visit viqsolutions.com.

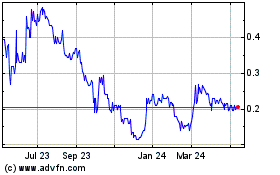

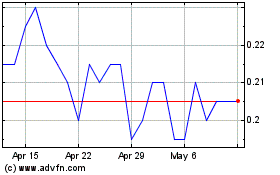

VIQ Solutions (TSX:VQS)

Historical Stock Chart

From Oct 2024 to Nov 2024

VIQ Solutions (TSX:VQS)

Historical Stock Chart

From Nov 2023 to Nov 2024