TC PipeLines, LP acknowledges TC Energy Corporation’s offer to acquire its outstanding common units

October 05 2020 - 6:50AM

TC PipeLines, LP (TCP) (NYSE: TCP) today announced that it has

received a non-binding offer from TC Energy Corporation (TC Energy)

(TSX, NYSE: TRP) to acquire all of the outstanding common units of

TCP not beneficially owned by TC Energy or its affiliates in

exchange for common shares of TC Energy. Under the proposal, TCP

common unitholders would receive 0.650 common shares of TC Energy

for each issued and outstanding publicly-held TCP common unit,

representing an implied value of US$27.31 per common unit based on

the closing price of TC Energy common shares on the New York Stock

Exchange (NYSE) on October 2, 2020. This reflects a 7.5 per cent

premium to the exchange ratio implied by the 20-day volume weighted

average prices of TCP’s common units and TC Energy’s common shares

on the NYSE as of October 2, 2020.

The offer has been made to the Board of

Directors of the general partner of TCP (the TCP Board). As the

general partner of TCP is an indirect wholly-owned subsidiary of TC

Energy, a Conflicts Committee composed of independent directors of

the TCP Board will be formed to consider the offer pursuant to its

processes.

The transaction is subject to the review and

favorable recommendation by the Conflicts Committee of the TCP

Board and approvals by the TCP Board, the Board of Directors of TC

Energy, and the holders of a majority of the outstanding common

units of TCP. It is also subject to the negotiation and execution

of an agreement and plan of merger, which would provide the

definitive terms of the transaction, including the exchange ratio,

and customary regulatory approvals. Any definitive agreement is

expected to contain customary closing conditions. There can be no

assurance that any such approvals will be forthcoming, that a

definitive agreement will be executed or that any transaction will

be consummated.

About TC PipeLines,

LP

TC PipeLines, LP is a Delaware master limited partnership with

interests in eight federally regulated U.S. interstate natural gas

pipelines which serve markets in the Western, Midwestern and

Northeastern United States. The Partnership is managed by its

general partner, TC PipeLines GP, Inc., a subsidiary of TC Energy

Corporation (NYSE: TRP). For more information about TC PipeLines,

LP, visit the Partnership’s website at www.tcpipelineslp.com.

Forward-Looking Statements

Certain non-historical statements in this

release relating to future plans, projections, events or conditions

are intended to be “forward-looking statements” including, but not

limited to, information with respect to a proposed transaction

between TCP and TC Energy. These statements are based on current

expectations and, therefore, subject to a variety of risks and

uncertainties that could cause actual results to differ materially

from the projections, anticipated results or other expectations

expressed in this release, including, without limitation to the

following: the negotiation and execution, and the terms and

conditions, of a definitive agreement relating to the proposed

transaction and the ability of TC Energy or TCP to enter into or

consummate such agreement; the risk that the proposed merger does

not occur; negative effects from the pendency of the proposed

merger; failure to obtain the required vote of TCP's unitholders or

board support; the timing to consummate the proposed transaction;

the focus of management time and attention on the proposed

transaction and other disruptions arising from the proposed

transaction; potential changes in the TC Energy share price which

may negatively impact the value of consideration offered to TCP

unitholders; general economic conditions, including the risk of a

prolonged economic slowdown or decline; the impact of downward

changes in oil and natural gas prices, including any effects on the

creditworthiness of our shippers or the availability of natural gas

in a low oil price environment, uncertainty surrounding the impact

of global health crises that reduce commercial and economic

activity, including the recent outbreak of the COVID-19 virus, and

the potential impact on our business and our ability to

access debt and equity markets that negatively impacts TCP’s

ability to finance its capital spending. These and other factors

that could cause future results to differ materially from those

anticipated are discussed in “Item 1A. Risk Factors” in our Annual

Report on Form 10-K for the year-ended December 31, 2019 filed with

the Securities and Exchange Commission (the SEC), as updated and

supplemented by subsequent filings with the SEC. All

forward-looking statements are made only as of the date made and

except as required by applicable law, we undertake no obligation to

update any forward-looking statements to reflect new information,

subsequent events or other changes.

Important Notice to

Investors

This news release is not a solicitation of a

proxy, an offer to purchase nor a solicitation of an offer to sell

common units of TCP, and it is not a substitute for any proxy

statement or other filings that may be made with the SEC should

this proposed transaction go forward. If such documents are filed

with the SEC, investors will be urged to thoroughly review and

consider them because they will contain important information,

including risk factors. Any such documents, once filed, will be

available free of charge at the SEC’s website (www.sec.gov) and

from TCP.

-30-

Media

Inquiries:

Jaimie Harding 403.920.7859 or 800.608.7859

Unitholder and Analyst Inquiries:

Rhonda Amundson

877.290.2772

investor_relations@tcpipelineslp.com

PDF

available: http://ml.globenewswire.com/Resource/Download/447b1bac-b36e-45b5-8fc8-c88b9d929e42

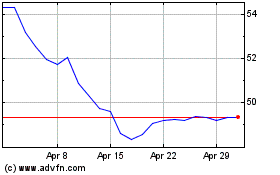

TC Energy (TSX:TRP)

Historical Stock Chart

From Mar 2024 to Apr 2024

TC Energy (TSX:TRP)

Historical Stock Chart

From Apr 2023 to Apr 2024