Tilray Brands, Inc. (“Tilray Brands” or the “Company”) (Nasdaq |

TSX: TLRY) today announced that the Company has entered into

amendments to improve the terms of its previously-disclosed

agreements to acquire all of the outstanding principal, plus

accrued and unpaid interest, under a secured convertible note (the

“HEXO Note”) issued by HEXO Corp. (“HEXO”) to HT Investments MA LLC

(“HTI”). These amendments provide for, among other things, an

additional discount to Tilray Brands’ purchase price as well as the

reduction of the conversion price under the HEXO Note from CAD$0.85

to CAD$0.40 per share.

Irwin D. Simon, Tilray Brands’ Chairman and CEO,

said, “We believe HEXO continues to be the right strategic partner

for Tilray Brands in Canada and, therefore, look forward to closing

this transaction in July and working with HEXO to deliver on the

promise and the potential of this partnership for our shareholders,

consumers, and employees.”

Charlie Bowman, HEXO’s President and CEO, added,

“The strategic alliance with Tilray Brands accelerates HEXO’s

operational turnaround and unlocks capital to expand our market

leadership globally. The partnership is an essential next step in

improving our capital structure, and we’re confident that the

synergies realized will reset the industry.”

As previously announced, the strategic alliance

between Tilray Brands and HEXO is expected to provide several

financial and commercial benefits, including:

- Substantial

Synergies: the strategic alliance between Tilray Brands

and HEXO is expected to deliver up to $80 million of shared

cost-saving synergies within two years of the completion of the

Transaction. Both companies have already begun working on

evaluating operations and production efficiencies with respect to

cultivation and processing services, including pre-rolls, beverages

and edibles, as well as shared services and procurement. In

conjunction with the sharing of synergies, HEXO will pay Tilray

Brands an annual fee of $18 million for advisory services with

respect to cultivation, operation, and production matters.

- Accretion: as a

result of the substantial synergies, the acquisition of the HEXO

Note by Tilray Brands will be immediately accretive to the

Company.

- Strengthening Product

Innovation in Canada and International Markets: Tilray

Brands and HEXO will bring together industry leading expertise in

the global cannabis industry, including cannabis cultivation,

product innovation, brand building, and distribution. Leveraging

both companies’ commitment to innovation and operational

efficiencies, both companies will share their respective expertise

and know-how to strengthen market positioning and capitalize on

opportunities for growth through a broadened product offering and

accelerated CPG innovation.

Upon closing, Tilray Brands will nominate two

directors to HEXO’s Board of Directors (“Board”)

and one Board observer.

Amended Transaction Details

Under the terms of the amended agreements, and

subject to the satisfaction of specific closing conditions, Tilray

Brands would acquire the HEXO Note from HTI, which includes 100% of

the current remaining $185 million outstanding principal balance of

the HEXO Note, plus any accrued and unpaid interest thereon. As

consideration for Tilray Brands’ acquisition of the HEXO Note,

Tilray Brands will pay 89.2% of the then outstanding principal

balance for the HEXO Note (the “Purchase Price”). This equates to a

10.8% discount on the outstanding principal amount. Until closing,

HTI may continue to redeem the HEXO Note pursuant to their terms;

however, in no event shall the outstanding principal balance of the

HEXO Note, when ultimately purchased by Tilray Brands, be less than

$160 million.

The initial conversion price of the HEXO Note

will be amended and adjusted down from CAD$0.85 to CAD$0.40 per

share (the “Conversion Price”). This implies that, as of June 13,

2022, Tilray Brands would have the right to convert into

approximately 50% of the outstanding common stock of HEXO (on a

non-diluted basis).

The Purchase Price shall be satisfied, in part,

by the issuance to HTI of a $50 million convertible unsecured note

(the “Tilray Convertible Note”) and the balance in either cash or

Class 2 common stock of Tilray Brands or any combination thereof,

at Tilray Brands’ option. The Tilray Convertible Note will bear

interest at a rate of 4.00% per annum, calculated and paid on a

quarterly basis and maturing on September 1, 2023. HEXO will not

receive any proceeds as a result of Tilray Brands’ proposed

purchase of the HEXO Note from HTI.

The parties expect to close on or about July 15, 2022, and the

amended agreements also extend the outside date for closing the

transactions to August 1, 2022.

Commercial Agreements

As previously announced, Tilray Brands and HEXO

have also agreed to continue to work together to finalize and enter

into Commercial Agreements at the closing of the transactions on

mutually agreeable terms covering the following key areas (i)

Tilray Brands will complete production and processing as a

third-party manufacturer of products for HEXO (ii) HEXO will source

all of its cannabis products for international markets, excluding

Canada and the US, exclusively from Tilray Brands; and (iii) HEXO

and Tilray Brands will share savings on a 50:50 basis related to

facilities optimization activities, procurement, general and

administrative costs, including insurance and certain shared

services, and certain production and processing activities for

straight-edge pre-rolls, edibles and beverages. The Commercial

Agreements will also provide that HEXO pay Tilray Brands an annual

fee of $18 million for advisory services with respect to

cultivation, operation and production matters.

About Tilray Brands

Tilray Brands, Inc. (Nasdaq: TLRY; TSX: TLRY),

is a leading global cannabis-lifestyle and consumer packaged goods

company with operations in Canada, the United States, Europe,

Australia, and Latin America that is changing people's lives for

the better – one person at a time. Tilray Brands delivers on this

mission by inspiring and empowering the worldwide community to live

their very best life and providing access to products that meet the

needs of their mind, body, and soul while invoking wellbeing.

Patients and consumers trust Tilray Brands to deliver a cultivated

experience and health and wellbeing through high-quality,

differentiated brands and innovative products. A pioneer in

cannabis research, cultivation, and distribution, Tilray Brands’

unprecedented production platform supports over 20 brands in over

20 countries, including comprehensive cannabis offerings,

hemp-based foods, and craft beverages.

For more information on Tilray Brands, visit

www.Tilray.com and follow @Tilray

Cautionary Statement Concerning Forward-Looking

Statements

Certain statements in this communication that

are not historical facts constitute forward-looking information or

forward-looking statements (together, “forward-looking statements”)

under Canadian securities laws and within the meaning of Section

27A of the Securities Act of 1933, as amended, and Section 21E of

the Securities Exchange Act of 1934, as amended, that are intended

to be subject to the “safe harbor” created by those sections and

other applicable laws. Forward-looking statements can be identified

by words such as “forecast,” “future,” “should,” “could,” “enable,”

“potential,” “contemplate,” “believe,” “anticipate,” “estimate,”

“plan,” “expect,” “intend,” “may,” “project,” “will,” “would” and

the negative of these terms or similar expressions, although not

all forward-looking statements contain these identifying words.

Certain material factors, estimates, goals, projections or

assumptions were used in drawing the conclusions contained in the

forward-looking statements throughout this communication.

Forward-looking statements include statements regarding our

intentions, beliefs, projections, outlook, analyses or current

expectations concerning, among other things: the Company’s

successful closing of the transactions as well as satisfaction of

the transaction conditions generally; the Company’s issuance of the

Tilray Convertible Note; accretion related to acquisition of the

HEXO Note; expected production efficiencies, strengthened market

positioning and potential cost saving synergies resulting from the

transactions and agreed commercial arrangements; the Company’s

ability to commercialize new and innovative products; and HEXO

management’s stated expectations for its operational turnaround and

growth in global markets. Many factors could cause actual results,

performance or achievement to be materially different from any

forward-looking statements, and other risks and uncertainties not

presently known to the Company or that the Company deems immaterial

could also cause actual results or events to differ materially from

those expressed in the forward-looking statements contained herein.

For a more detailed discussion of these risks and other factors,

see the most recently filed annual information form of Tilray

Brands and the Annual Report on Form 10-K (and other periodic

reports filed with the SEC) of Tilray Brands made with the SEC and

available on EDGAR. The forward-looking statements included in this

communication are made as of the date of this communication and the

Company does not undertake any obligation to publicly update such

forward-looking statements to reflect new information, subsequent

events or otherwise unless required by applicable securities

laws.

For further information:

Tilray BrandsMedia: Berrin Noorata, news@tilray.comInvestors:

Raphael Gross, +1-203-682-8253, Raphael.Gross@icrinc.com

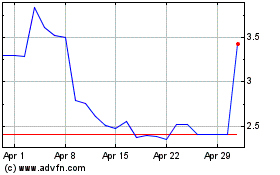

Tilray Brands (TSX:TLRY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tilray Brands (TSX:TLRY)

Historical Stock Chart

From Apr 2023 to Apr 2024