SYNEX INTERNATIONAL INC - SECOND QUARTER REPORT FOR FISCAL 2011

February 08 2011 - 11:07AM

PR Newswire (Canada)

VANCOUVER, Feb. 8 /CNW/ -- TSX : SXI VANCOUVER, Feb. 8 /CNW/ - The

net loss for the first six months of fiscal 2011 ended December 31,

2010 was $47,068 as compared to a net loss of $270,148 for the

corresponding period in fiscal 2010. The decrease in net loss is

primarily due to the proceeds of $300,000 for an option to a third

party for the purchase of some water licences of the Company in the

first quarter of fiscal 2011. The loss per share for the six months

ended December 31, 2010 was $0.00 as compared to a loss per share

of $0.01 for the corresponding period in fiscal 2010. For the six

months ended December 31, 2010, energy sales and consulting revenue

increased to $1,390,817 as compared to $1,162,544 for the

corresponding period in fiscal 2010. The increase in revenue is due

mainly to an increase in consulting revenue as well as increases in

electricity sales from each of the Mears Plant, Cypress Plant and

Kyuquot Utility. On August 19, 2010, the Company announced that the

Engineering Division had entered into an Option Agreement dated

July 23, 2010 with an unrelated third party. The Option Agreement

provides the third party with the right to purchase a number of

applications for water licences and land tenures held by the

Engineering Division as well as other related rights. The Option

Agreement has a latest exercise date of December 2011. The Option

Payment was $300,000 and has been included as other income in the

financial statements of the Company. During the first six months of

fiscal 2011, the Barr Creek Limited Partnership ("BCLP") and its

general partner Barr Creek Hydro Ltd. ("BCHL") continued to advance

the Barr Creek Hydro Project. Site works included the construction

of access roads and excavation of the powerhouse. Work has been

halted until the late spring of 2011 due to snow conditions. On

October 4, 2010, the Company announced that the Power Division and

the Ehattesaht Tribe (the "EFN") had subscribed for partnership

units of BCLP and shares of BCHL. Subsequent to December 31, 2010,

the EFN has exercised its option to purchase additional units and

shares from the Power Division. The Power Division now holds 80% of

the units and shares of BCLP and BCHL and the EFN holds 20% of the

units and shares. At December 31, 2010, the Company had a cash

balance, excluding BCLP and BCHL, of $412,245. In addition the

Company had available $140,000 of its $500,000 revolving credit

line with the Canadian Western Bank. The Company currently has over

70 water license and land tenure applications, mostly on Vancouver

Island and in the Prince Rupert/Terrace area in British Columbia.

Synex International Inc. is a public company, trading on the TSX

since 1987, with business interests that cover the development,

ownership and operation of electrical generation facilities and the

provision of consulting engineering services in water resources,

particularly hydroelectric facilities. "signed"

______________________________________ Greg Sunell, President This

press release contains forward-looking statements that involve

risks and uncertainties. These statements reflect our current

expectations and are subject to change. They are subject to a

number of risks and uncertainties including, but not limited to,

changes in economic conditions, risks associated with the

construction and operation of hydroelectric facilities and changes

in government policies. To view this news release in HTML

formatting, please use the following URL:

http://www.newswire.ca/en/releases/archive/February2011/08/c8895.html

p400 - 1444 Alberni Street, Vancouver B C V6G 2Z4br/ Phone (604)

688 8271 Ext. 309 Fax (604) 688 1286br/ E-mail: a

href="mailto:gsunell@synex.com"gsunell@synex.com/a Web Site: a

href="http://www.synex.com/"www.synex.com//a/p

Copyright

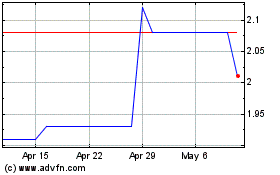

Synex Renewable Energy (TSX:SXI)

Historical Stock Chart

From Aug 2024 to Sep 2024

Synex Renewable Energy (TSX:SXI)

Historical Stock Chart

From Sep 2023 to Sep 2024