Sprott Inc. (TSX: SII) ("Sprott") and Tocqueville Asset Management

(“Tocqueville”) today announced that Sprott Asset Management LP

(“SAM”) and Tocqueville have entered into a definitive agreement

regarding the acquisition by SAM of the Tocqueville gold

strategies.

“We are pleased to be acquiring Tocqueville’s

gold strategy asset management business,” said Whitney George,

President of Sprott. “John Hathaway and his team are among the

world’s most respected gold equities managers and we have enjoyed

an excellent working relationship during the planning and launch of

our joint venture over the past year. This transaction is a natural

extension of that partnership, through which John will become a

Sprott shareholder. We look forward to working closely together to

serve our clients.”

“We believe that this transaction is an

excellent fit for our mutual fund shareholders and our clients,”

said Robert W. Kleinschmidt, President, CEO and CIO of Tocqueville.

“It ensures us continued participation in the gold space, as well

as access to the best investment talent and resources in the

sector. We look forward to partnering with Sprott in this endeavor

and to developing closer ties between the two firms in the

future.”

“Sprott has a globally recognized brand with a

dedicated precious metals platform and a long history in the

sector,” said John Hathaway, Senior Portfolio Manager of

Tocqueville. “We share a similar world view and investment

philosophy and believe our clients will benefit from access to

Sprott’s team of technical experts and investment

professionals.”

“Based on current asset levels, this transaction

is expected to add US$1.9 billion (C$2.5 billion) in assets under

management (AUM) to our managed equities platform,” said Peter

Grosskopf, CEO of Sprott. “The addition of these strategies will

complement our other resource investment and financing businesses,

expand our global footprint and allow us to service clients in all

major gold markets.”

Additional Details Regarding the

Proposed Transaction

The proposed transaction remains subject to

security holder approval for certain acquired strategies,

regulatory and stock exchange approvals, including listing approval

of the Toronto Stock Exchange for the issuance of Sprott common

shares to Tocqueville, and other customary conditions to closing,

following which it would be expected to close in January 2020.

In consideration for the acquisition of the

Tocqueville gold strategies, Sprott will pay Tocqueville total

consideration of up to US$50 million comprised of a payment at

closing of US$10 million in cash and Sprott common shares valued at

US$5 million. Tocqueville will also be eligible to receive

contingent consideration valued at up to an additional US$30

million in cash and Sprott common shares valued at US$5 million,

subject to the achievement of certain financial performance

conditions over the two years following the closing of the proposed

transaction. The terms and conditions of the definitive agreement

are customary for transactions of this nature and Sprott will use

cash on hand to finance the cash portion of the purchase

price. Approval of Sprott shareholders will not be

required.

About Sprott

Sprott is an alternative asset manager and a

global leader in precious metal and real asset investments. Through

its subsidiaries in Canada, the US and Asia, Sprott is dedicated to

providing investors with best-in-class investment strategies that

include Exchange Listed Products, Lending, Managed Equities and

Brokerage. Sprott is based in Toronto with offices in New York,

Carlsbad and Vancouver and its common shares are listed on the

Toronto Stock Exchange under the symbol (TSX:SII). For more

information, please visit www.sprott.com.

About Tocqueville

The Tocqueville Trust was organized as an

open-end management company in 1986 to hold the Tocqueville Fund,

which launched in 1987. Over the next several decades,

complementary funds were added to create the Tocqueville Family of

Funds (“the Funds”). Tocqueville Asset Management L.P. (“TAM”)

provides investment management and advisory services to all of the

Funds. TAM has been managing institutional and private client

accounts since its founding in 1985 with a focus on growing and

preserving clients’ long-term capital. The experienced investment

professionals of TAM manage accounts, including the Funds,

utilizing independent thinking and rigorous research. For more

information, please visit www.tocquevillefunds.com.

Forward Looking Statements

This press release contains statements that

constitute "forward-looking information" (collectively,

“forward-looking statements”) within the meaning of applicable

securities laws. Often, but not always, forward-looking statements

can be identified by the use of words such as "plans", "expects",

"is expected", "budget", "scheduled", "estimates", "forecasts",

"intends", "anticipates", or "believes" or variations (including

negative variations) of such words and phrases, or state that

certain actions, events or results "may", "could", "would", "might"

or "will" be taken, occur or be achieved. In particular, but

without limiting the forgoing, this press release contains

forward-looking statements pertaining to the acquisition of the

Tocqueville gold strategies asset management business, including

that the transaction will be completed and the timing thereof, the

AUM to be added as a result of the transaction, certain portfolio

managers joining SAM upon the completion of the transaction and the

impact of the transaction on Sprott’s business and strategies.

Forward-looking statements involve known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of Sprott to be materially different

from any future results, performance or achievements expressed or

implied by the forward-looking statements. Such risks and

uncertainties include, without limitation, risk and uncertainties

that are inherent in the nature of the transaction, including:

failure to realize anticipated synergies; risks regarding

integration; incorrect assessments of the values of the acquired

assets; and failure to obtain any required security holder,

regulatory, stock exchange and other approvals (or to do so in a

timely manner). The anticipated timeline for completion of the

transaction may change for a number of reasons, including the

inability to secure necessary security holder, regulatory, stock

exchange and other approvals in the time assumed or the need for

additional time to satisfy the conditions to the completion of the

transaction. As a result of the foregoing, readers should not place

undue reliance on the forward-looking statements contained in this

press release concerning the completion of the transaction or the

timing thereof.

Forward-looking statements contained herein are

made as of the date of this press release and Sprott disclaims any

obligation to update any forward-looking statements, whether as a

result of new information, future events or results or otherwise.

There can be no assurance that forward-looking statements will

prove to be accurate, as actual results and future events could

differ materially from those anticipated in such statements. The

Company undertakes no obligation to update forward-looking

statements if circumstances, management's estimates or opinions

should change, except as required by securities legislation.

Accordingly, the reader is cautioned not to place undue reliance on

forward-looking statements.

Investor contact

information:

Glen WilliamsManaging Director Investor

Relations & Corporate Communications(416)

943-4394gwilliams@sprott.com

Media contact information:

Dan Gagnier / Jeff Mathews Gagnier

Communications (646) 569-5897sprott@gagnierfc.com

_______________________1 As of August 6, 2019

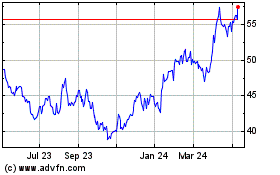

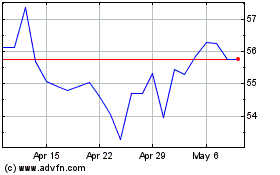

Sprott (TSX:SII)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sprott (TSX:SII)

Historical Stock Chart

From Apr 2023 to Apr 2024