Aura Minerals Inc. (TSX: ORA) (B3: AURA33) (OTCQX:

ORAAF) (“

Aura” or the

“

Company”) announces that it has filed its audited

consolidated financial statements and management discussion and

analysis (together, “

Financial and Operational

Results”) for the period ended December 31, 2024. The full

version of the Financial and Operational Results can be viewed on

the Company’s website at www.auraminerals.com or on SEDAR+ at

www.sedarplus.ca. All amounts are in thousands of U.S. dollars

unless stated otherwise.

Rodrigo Barbosa, President, and CEO of Aura,

commented: “In 2024, we doubled our EBITDA to US$267 million, with

average gold prices of nearly US$2,400 / Oz—well below current

levels—while keeping costs firmly under control with our all-in

sustaining costs (AISC) at US$1,320/Oz, below the industry average.

Almas operation overcame a challenging first half to deliver an

outstanding full-year performance, producing 54,129 Oz at an AISC

of US$1,139/Oz. This success sets a strong foundation for

Borborema, which remains on track and on budget for its 2025

startup, promising higher average production and costs below our

average AISC.

Additionally, we bolstered our portfolio with

the acquisition of a world-class deposit and achieved significant

exploration progress. In all, 2024 marked another year of

production growth, up 18% at constant metal prices, and advancement

of new projects with US$159 million invested in growth for future

years, all while delivering returns to shareholders through

dividends and ongoing share buybacks, yielding 9.2% in the LTM.

Remarkably, while expanding operations, ramping up new mines, and

building another mine, our safety record remains among the best in

the industry, with only one non-severe lost-time incident (LTI) in

two years”

Q4 2024 and 2024 Financial and

Operational Highlights:(US$ thousand):

|

|

For the threemonths endedDecember 31,2024 |

For the threemonths endedDecember 31,2023 |

For the twelvemonths endedDecember 31,2024 |

For the twelvemonths endedDecember 31,2023 |

|

Total Production1 (GEO) |

66,473 |

|

69,194 |

|

267,232 |

|

235,856 |

|

|

Sales2 (GEO) |

69,341 |

|

68,571 |

|

269,833 |

|

233,923 |

|

|

Net Revenue |

171,517 |

|

124,322 |

|

594,163 |

|

416,894 |

|

|

Adjusted EBITDA |

79,319 |

|

40,893 |

|

266,768 |

|

134,107 |

|

|

AISC per GEO sold |

1,373 |

|

1,311 |

|

1,320 |

|

1,325 |

|

|

Ending Cash balance |

270,189 |

|

237,295 |

|

270,189 |

|

237,295 |

|

|

Net Debt |

188,079 |

|

85,165 |

|

188,079 |

|

85,165 |

|

|

Income/(Loss) for the period |

16,644 |

|

(5,908 |

) |

(30,271 |

) |

31,880 |

|

|

Adjusted Net Income |

24,636 |

|

19,926 |

|

81,547 |

|

58,602 |

|

(1) Considers capitalized

production(2) Does not consider capitalized

production

- Total production

in Q4 2024 reached 66,473 gold equivalent ounces (“GEO”), 1% below

the third quarter of 2024 and consistent with the same period last

year at constant metal prices. Total production for 2024 reached

267,232 GEO at current prices, a 13% increase when compared to 2023

at current prices and 18% increase when compared at constant

prices. At guidance metal prices, production achieved 276,305 GEO,

placing it at the upper end of the consolidated production guidance

(“Guidance”) range of 244,000 to 292,000 GEO for the year.

- Aranzazu:

Production reached 23,379 GEO in Q4 2024, once again stable, both

when compared to Q3 2024 and when compared to Q4 2023, at constant

prices, reflecting continued operational stability and adherence to

mine sequencing in the quarter. For the full year of 2024,

Aranzazu`s production reached 97,558 GEO at current prices. During

2024, the variation in metal prices significantly influenced GEO

conversion, particularly due to an increase of approximately 20% in

gold price compared to the levels used to define the year’s

production guidance. For the guidance projection ending 2024, the

Company considered the following prices: Copper at $3.95/lb, Gold

at $1,988/oz, and Silver at $24.17/oz. When applying these same

price levels to the annual production at Aranzazu, the total

production for the year reached 106,631 GEO, aligning with the

upper range of the Guidance of 94,000 to 108,000 GEO.

- Minosa (San

Andres): Production totaled 19,294 GEO in Q4 2024, reflecting a 7%

decrease over the previous quarter, primarily caused by the

expected rainfall during the period, particularly in November and

December, but still consistently above 19,000 ounces as achieved

during all quarters during the year. When compared to the same

quarter last year, production increased by 8%, due to an increase

of 9% in grades between quarters. For the full year of 2024,

production reached 78,372 GEO, a 19% increase compared to 2023,

exceeding the 2024 Guidance range of 60,000 to 75,000 GEO.

- Almas:

Production reached 16,679 GEO in Q4 2024, representing an increase

of 11% compared to the previous quarter, and 74% when compared to

the same period last year. This growth was primarily driven by an

increase in ore mined and stable grades during the period, both

aligned with the mine production plan, as well as an increase in

ore feed to the plant, consistent with the plant’s expansion plan.

This quarter, once again, reflects continuous improvements in

production and efficiency resulting from the contractor replacement

in Q3 2024. For the full year of 2024, despite the challenges of

replacing the contractor during the second quarter, production

totaled 54,129 GEO, exceeding the upper end of the 2024 guidance

range of 45,000 to 53,000 GEO.

- Apoena (EPP):

Production reached 7,121 GEO in Q4 2024, down 11% from Q3 2024 and

53% from Q4 2023. This drop was due to lower ore grades caused by

delays in getting permits for the Nosde pit expansion, which was

vital for accessing higher-grade

ore . Aura has

already obtained all relevant permits in early 2025. The delay

meant lower grades and that 2024's total production was 37,173 GEO,

a 19% decrease from 2023, below the 46,000 to 56,000 GEO

guidance.

- Sales volumes

increased by 2% in Q4 2024 from Q3 2024 and 1% when compared to the

same period of 2023. In the 2024, sales volume increased by 15%.

The annual increase was primarily driven by higher sales volumes

from Almas and Minosa, partially offset by a decline at Apoena,

which reported reduced production in the second half of the year

due to delays in obtaining the permits previously mentioned, which

directly impacted sales. Aranzazu was adversely affected by the

conversion of its production to gold equivalent ounces (GEO), as a

consequence of fluctuations in gold prices during the year. When

considering guidance prices, Aranzazu´s production remained stable

in the quarter.

- Net Revenues

reached US$171,517 in Q4 2024, representing an increase of 10%

compared to Q3 2024 and 38% compared to the same period in 2023. In

2024, revenues reached US$594,163, a 43% increase in comparison to

2023.

- Average gold

sale prices increased 7% in Q4 2024 compared to Q3 2024, with an

average of US$2,586/oz in the quarter. Compared to the same period

in 2023, average gold sale prices increased 36% in Q4 2024. In

2024, average gold sale prices reached US$2,308, a 23% increase

when compared to 2023.

- Average copper

sale prices decreased 1% when compared to Q3 2024, with an average

of US$4.15/lb in the quarter. Compared to the same period in 2023,

average copper prices increased by 12% in Q4 2024. In 2024, average

copper prices reached US$4.17/lb, an 8% increase when compared to

2023.

- Another

record-high Adjusted EBITDA of US$79,319 during Q4 2024, surpassing

Q3 2024 performance by 2%. It was the second record high quarterly

Adjusted EBITDA reported by Aura in a row. This increase was driven

by an increase in gold prices and supported by a consistent sales

volume in the quarter. When compared to Q4 2023, Adjusted EBITDA

more than doubled. For the full year 2024, the Company achieved

record-high Adjusted EBITDA of US$266,768, marking a 99% increase

compared to the full year 2023, mainly due to higher sales volumes,

strong cost control and favorable increases in gold prices. This

growth was primarily driven by the first full year of production at

Almas, which not only exceeded its initial capacity but also

outperformed the 2024 guidance, further supported by higher gold

prices.

- AISC1 for Q4

2024 was US$1,373/GEO, an increase compared to Q3 2024

(US$1,292/GEO), impacted by increased AISCs in Minosa and Apoena,

and by lower AISCs in Almas. For 2024, AISC averaged US$1,320/GEO,

an US$ 5/GEO decrease from 2023, (US$1,325/GEO), reflecting the

Company´s focus on cost.

- The standout

performer in AISC for both the quarter and the year was Almas,

which reported US$713/Oz in Q4 2024 (US$849 excluding non-recurring

accounting items) and $1,139/Oz for the full year. This positioned

Almas as Aura’s lowest AISC operation—a remarkable achievement,

particularly considering it was the mine’s first full year of

production and that it successfully transitioned to a new mining

contractor in the first half of the year due to performance issues.

This milestone aligns with Aura’s growth strategy of bringing new

mines online with AISC below the Company’s average

- Recurring Free

Cash Flow to Firm reached US$67 million in the quarter and US$195

million in 2024, largely driven by the increase in EBITDA in the

period.

- The company's

Net Debt reached US$188,079 by the end of 2024, due to investments

in expansion of US$ 137 million in the year, including Borborema

(US$ 108 million) and dividends and buybacks (US$ 53 million

together). The LTM net debt-to-EBITDA ratio ended 2024 at

0.70x.

________________________1 AISC is a non-GAAP financial measure

with no standardized meaning under IFRS, and therefore may not be

comparable to similar measures presented by other issuers. For

further information and detailed reconciliations to the most

directly comparable IFRS measures, see Section 17: Non-GAAP

Performance Measures in this MD&A.

Dividends and BuybacksIn March,

Aura announced simultaneous buyback programs for Ordinary Shares on

the Toronto Stock Exchange (TSX) and Brazilian Depositary Receipts

(BDRs) on B3. As of December 31, 2024, the Company had repurchased

1,082,497 common shares of its Brazilian Depositary Receipts2 and

183,710 under the Normal Course Issuer Bidder program and canceled

116,948 shares from the total repurchased. To date, US$13,576 were

invested in shares and BDRs buybacks.

________________________2 Each common share is

equivalent to 3 Brazilian Depositary Receipts.

Safety

- The company

maintained a strong safety record with zero lost time incidents

across all operations and projects during Q4 2024. The Company has

achieved 6 months without LTIs in any of its operations and

projects and has incurred in just one LTI in the last 2 years

across all its operations and projects.

- Aura’s inaugural

Safety Day, called by “D Day” was held on October 10 and showcased

the Company’s unwavering commitment to safety. The event began with

an impactful video message from Aura´s COO, highlighting the

importance of safety and the dedication of Aura employees and

business partners. Leadership from all units participated,

reinforcing Aura´s core values with a focus on "people first,"

emphasizing safe work practices and adherence to procedures. The

video also featured messages from the families of employees across

all units, deepening the sense of community and responsibility. The

video was broadcast across all shifts, making it a day of

reflection, celebration, and engagement for the entire workforce.

This initiative reinforces Aura’s dedication to fostering a culture

of continuous improvement and safety in every aspect of Aura´s

operations.

Borborema constructionAs of the

date of this MD&A, the Borborema Project construction is on

track to be completed in the first quarter of 2025. Construction

capex is 100% committed. Significant developments include the

conclusion of the Main Substation, Power Line, Mechanical assembly

of the Crushing Area and the CIL area. The mine pre-stripping is

ongoing according to the plan and moved a total of 5.7Mt. The

project currently employs 2,184 direct and indirect personnel.

Bluestone Acquisition ClosingOn

January 13, 2025, Aura completed the previously announced plan of

arrangement with Bluestone Resources (the “Acquisition”). The

Acquisition includes a high-grade gold deposit with

approximately2.4 million ounces of gold and 10.4 ounces of silver

(41 Mt at average grade 1.8 g/t Au and 7.9 g/t Ag) in Measured

category and approximately 700 thousand ounces of gold and 3.0

million ounces of silver (22.6 Mt at average grade of 1.0 g/t Au

and 4.2 g/t silver) in Indicated category of mineral resources and

an advanced renewable energy project. In the coming months, the

Company will conduct a review of the feasibility study and evaluate

alternatives to optimize scale, risk, and return profile of the

project. Concurrently, Aura will implement Aura 360 concept,

adhering to the highest environmental and social standards, in

preparation to begin construction. Additionally, the geothermal

energy project at Cerro Blanco, which has the potential to generate

up to 50MW, offers a distinctive opportunity to utilize renewable

energy and possibly sell any excess to Guatemala.

Guidance 2024 Achievement:The

Company achieved its guidance for 2024, including production, cash

cost, All-In Sustaining Cost (AISC), and capital expenditures, as

demonstrated by the results of the year.

|

Gold equivalent thousand ounces('000 GEO) production -

2024 |

|

|

Low - 2024 |

High - 2024 |

2024 A |

% |

2024 A atGuidance Prices |

% |

|

Minosa (San Andrés) |

60 |

75 |

78 |

104% - 130% |

78 |

104% - 130% |

|

Apoena (EPP) |

46 |

56 |

37 |

66% - 81% |

37 |

66% - 81% |

|

Aranzazu |

94 |

108 |

98 |

90% - 104% |

107 |

98% - 114% |

|

Almas |

45 |

53 |

54 |

103% - 121% |

54 |

103% - 121% |

|

Total |

244 |

292 |

267 |

91% - 109% |

276 |

94% - 113% |

|

Cash Cost per equivalent ounceof gold produced -

2024 |

|

|

Low - 2024 |

High - 2024 |

2024 A |

Δ Low |

Δ High |

2024 A at Guidance Prices |

Δ Low |

Δ High |

|

Minosa (San Andrés) |

1,120 |

1,288 |

1,126 |

0% |

-13% |

1,126 |

0% |

-13% |

|

Apoena (EPP) |

1,182 |

1,300 |

1,189 |

1% |

-9% |

1,189 |

1% |

-9% |

|

Aranzazu |

826 |

1,009 |

965 |

17% |

-4% |

886 |

7% |

-12% |

|

Almas |

932 |

1,025 |

950 |

2% |

-7% |

950 |

2% |

-7% |

|

Total |

984 |

1,140 |

1,041 |

6% |

-9% |

1,009 |

3% |

-11% |

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

AISC per equivalent ounceof gold produced -

2024 |

|

|

Low - 2024 |

High - 2024 |

2024 A |

Δ Low |

Δ High |

2024 A at Guidance Prices |

Δ Low |

Δ High |

|

Minosa (San Andrés) |

1,216 |

1,398 |

1,205 |

-1% |

-14% |

1,205 |

-1% |

-14% |

|

Apoena (EPP) |

1,588 |

1,747 |

1,833 |

15% |

5% |

1,833 |

15% |

5% |

|

Aranzazu |

1,089 |

1,331 |

1,308 |

20% |

-2% |

1,201 |

10% |

-10% |

|

Almas |

1,179 |

1,297 |

1,139 |

-3% |

-12% |

1,139 |

-3% |

-12% |

|

Total |

1,290 |

1,459 |

1,320 |

2% |

-10% |

1,279 |

-1% |

-12% |

|

Capex (US$ million) - 2024 |

|

|

Low - 2024 |

High - 2024 |

2024 A |

% |

|

Sustaining |

37 |

43 |

36 |

83% - 96% |

|

Exploration |

7 |

8 |

8 |

102% - 119% |

|

New projects + expansion |

144 |

169 |

137 |

81% - 95% |

|

Total |

188 |

219 |

181 |

82% - 96% |

Guidance 2025The Company’s

updated gold equivalent production, AISC and cash operating cost

per gold equivalent ounce sold, and CAPEX guidance for 2025 are

detailed below.

ProductionThe table below

details the Company’s updated GEO production guidance for 2025 by

business unit:

|

|

|

Gold equivalent thousand ounces('000 GEO) production -

2025 |

|

|

|

|

Low - 2025 |

High - 2025 |

|

|

|

Minosa (San Andrés) |

64 |

73 |

|

|

|

Apoena (EPP) |

29 |

32 |

|

|

|

Aranzazu |

88 |

97 |

|

|

|

Almas |

51 |

58 |

|

|

|

Borborema |

33 |

40 |

|

|

|

Total |

266 |

300 |

|

For current guidance, the Company considered:

Copper price = $4.29/lb; Gold Price = $2,634,41/oz; Silver Price =

$31.66/oz

2025 Production Guidance:

- Minosa (San

Andres): Minosa is expected to maintain reliable performance

throughout 2025, similar to 2024. However, the projected production

for 2025 is lower than the previous year, mainly due to expected

grade reduction during the period due to mine sequencing.

Additionally, in 2024, the operation benefited from

lower-than-expected rainfall, which favored mining and plant feed

activities.

- Apoena (EPP): In

2025, Apoena will be focusing on opening a new phase in the Nosde

pit to expand production, following the delays in obtaining the

Nosde pit permit in 2024. This strategic step will initially

negatively affect production levels, with a more robust recovery

anticipated by 2027.

- Aranzazu:

Aranzazu's production in 2025 is expected to be once again stable,

compared to 2024, assuming constant metal prices. However, given

the guidance average gold price of $2,636.41/oz, an increase of 33%

over the guidance price of 2024, and copper price of $4.3/lb, the

total volume in GEO will be impacted by an unfavorable metal-to-GEO

conversion factor.

- Almas: In 2025,

Almas' production is expected to reach its installed capacity

following process optimization and throughput enhancements

implemented in 2024, which increased the plant's ore feed capacity

from 1.6 to 1.8 million tonnes per month

- Borborema: With

ramp-up scheduled to commence in Q1 2025, Borborema is expected to

reach between 40% and 48% of its designed nominal capacity in 2025,

equivalent to an annualized rate of 83k oz. Aura anticipates

achieving commercial production at Borborema in the second half of

2025.

All in all, the 2025 production guidance expects

production of 266-300 kGEO, represents an increase of up to 33k GEO

when compared to 2024 at current prices and up to 37k GEO at

constant metal prices.

Cash CostsThe table below shows

the Company’s cash operating costs per GEO sold guidance for 2025

by Business Unit:

|

|

|

Cash Cost per equivalent ounceof gold produced -

2025 |

|

|

|

|

Low - 2025 |

High - 2025 |

|

|

|

Minosa (San Andrés) |

1,108 |

1,219 |

|

|

|

Apoena (EPP) |

1,258 |

1,384 |

|

|

|

Aranzazu |

1,029 |

1,132 |

|

|

|

Almas |

1,013 |

1,114 |

|

|

|

Borborema |

1,084 |

1,232 |

|

|

|

Total |

1,078 |

1,191 |

|

|

|

Total ex-Apoena |

1,055 |

1,167 |

|

|

|

|

|

|

|

2025 Cash Cost Guidance:

- Apoena (EPP):

Cash costs are projected to increase in 2025 vs. 2024. Apoena is

expected to have two years of lower production and higher cash cost

profile as Aura pushes back its Nosde deposit, before reaching

higher production again from 2027. As result, in the table above,

Aura also shows the average Cash Cost with and without including

the impact of Apoena cash costs in 2025.

- Minosa (San

Andres): Cash costs are expected to rise compared to 2024, driven

by lower ore grades planned in mine sequencing and reduced mine

movement. The decrease in mine movement is due to the unusually low

rainfall in 2024, which has raised the comparative base.

- Aranzazu: At

constant metal prices, cash costs are expected to increase mainly

due to the impact of a full year under the renewed main mine

agreement, which underwent a price adjustment in the latter half of

2024, as well as the increase in gold prices unfavorably impact

metal-to-GEO conversion factor.

- Almas: An

increase in cash cost is expected in 2025, primarily due to mine

sequencing that forecasts lower ore grades and a higher strip ratio

over the year. Nonetheless, this increase will be partially

mitigated by the capacity expansion completed in 2024.

- Borborema: cash

costs included in the table above apply only to the period after

Borborema enters commercial production. Cash costs for the first

year are expected to be higher than the cash cost indicated in the

Borboremas Feasibility Study published in 2023 for the following

reasons: (a) inflation between the date of the Feasibility Study

(effective as of July 2023) and first year of production; (b)

changes in the mine sequencing; (c) only few months of commercial

production in 2025 (vs. 12 months considered for first year in the

Feasibility Study), when the mine is expected to be stabilizing its

performance On the other hand, current gold prices (above

$2,800/oz) are significantly higher than the assumption used in the

study ($1,745/oz); as result, the company expects the profitability

to be above those reported the Feasibility Study in case gold

prices remain at similar levels.

All In Sustaining costsThe

table below shows the Company’s all-in sustaining costs per GEO

sold guidance for 2025 by Business Unit:

|

|

|

AISC per equivalent ounceof gold produced -

2025 |

|

|

|

|

Low - 2025 |

High - 2025 |

|

|

|

Minosa (San Andrés) |

1,263 |

1,364 |

|

|

|

Apoena (EPP) |

2,425 |

2,619 |

|

|

|

Aranzazu |

1,348 |

1,455 |

|

|

|

Almas |

1,113 |

1,202 |

|

|

|

Borborema |

1,113 |

1,304 |

|

|

|

Total |

1,374 |

1,492 |

|

|

|

Total ex-Apoena |

1,241 |

1,353 |

|

|

|

|

|

|

|

2025 All-In Sustaining Cost Guidance:

- Apoena (EPP):

AISC are projected to increase in 2025 vs. 2024. Apoena is expected

to have two years of lower production and higher AISC profile as

Aura pushes back its Nosde deposit, before reaching higher

production again from 2027. As result, in the table above, Aura

also shows the average Cash Cost with and without including the

impact of Apoena cash costs in 2025.

- Minosa (San

Andres): The increase in expected AISC compared to 2024 is mainly

driven by lower production for the reasons discussed above., and

the introduction of a new structures designed to improve recovery

rates.

- Aranzazu: AISC

are expected to be higher when compared to 2024 mainly driven by

the expected increase in cash costs discussed above and the

increase in gold prices unfavorably impact metal-to-GEO conversion

factor. This increase is partially offset by a reduction in

sustaining capex expected for the year.

- Almas: AISC is

expected to be in line with the previous year, with the effects of

a higher cash cost being offset by a lower sustaining capex in the

year.

- Borborema: AISC

included in the table above apply only to the period after

Borborema enters in commercial production. Borboremas’ AISC for the

first year are expected to be higher than the AISC indicated in its

Feasibility Study for the same reasons affecting its first-year

cash costs as discussed above.

Capex:The table below shows the

breakdown of estimated capital expenditures by type of

investment:

|

|

|

Capex (US$ million) - 2025 |

|

|

|

|

Low - 2025 |

High - 2025 |

|

|

|

Sustaining |

40 |

47 |

|

|

|

Exploration |

10 |

13 |

|

|

|

New projects + Expansion |

99 |

106 |

|

|

|

Total |

149 |

167 |

|

|

|

|

|

|

|

- Sustaining:

Sustaining capex are expected to increase compared to 2024. Key

initiatives include improvements to the tailings dams at Apoena,

mine development activities, enhancements in both the mine and

plant at Minosa, and the sustaining capital expenditures for

Borborema.

- Exploration:

Increase driven mainly by exploration in Matupa’s Reserves. Other

exploration initiatives are included in exploration expenses.

- Expansion: There

is a projected reduction in capital expenditures compared to last

year, primarily because most of the Capex for the Borborema Project

was incurred in 2024. However, this decrease is partially offset by

expansion Capex aimed at developing the higher-grade Nosde phase

III deposit in Apoena, with completion expected by end of

2026.

2024 and Q4 2024 Earnings

CallThe Company will hold an earnings conference call on

Thursday, February 27, 2025, at 8:00 AM (Eastern Time). To register

and participate, please click the link below.

Date: February 27,

2025Time: 8:00 AM (New York and Toronto) | 10:00

AM (Brasília)Access Link: Click here.

Key FactorsThe Company’s future

profitability, operating cash flows, and financial position will be

closely related to the prevailing prices of gold and copper. Key

factors influencing the price of gold and copper include, but are

not limited to, the supply of and demand for gold and copper, the

relative strength of currencies (particularly the United States

dollar), and macroeconomic factors such as current and future

expectations for inflation and interest rates. Management believes

that the short-to-medium term economic environment is likely to

remain relatively supportive for commodity prices but with

continued volatility.

To decrease risks associated with commodity

prices and currency volatility, the Company will continue to

evaluate and implement available protection programs. For

additional information on this, please refer to the AIF.

Other key factors influencing profitability and

operating cash flows are production levels (impacted by grades, ore

quantities, process recoveries, labor, country stability, plant,

and equipment availabilities), production and processing costs

(impacted by production levels, prices, and usage of key

consumables, labor, inflation, and exchange rates), among other

factors.

Non-GAAP MeasuresIn this press

release, the Company has included Adjusted EBITDA, cash operating

costs per gold equivalent ounce sold, AISC and net debt which are

non-GAAP measures. These non-GAAP measures do not have any

standardized meaning within IFRS and therefore may not be

comparable to similar measures presented by other companies. The

Company believes that these measures provide investors with

additional information which is useful in evaluating the Company’s

performance and should not be considered in isolation or as a

substitute for measures of performance prepared in accordance with

IFRS. The below tables provide a reconciliation of the non-GAAP

measures presented:

|

Reconciliation from Income for the Quarter for EBITDA and

Adjusted EBITDA (US$

thousand): |

|

|

|

|

For the threemonths endedDecember 31,2024 |

For the threemonths endedDecember 31,2023 |

For the twelvemonths endedDecember 31,2024 |

For the twelvemonths endedDecember 31,2023 |

|

Profit (loss) from continued and discontinued operation |

16,644 |

|

(5,908 |

) |

(30,271 |

) |

31,880 |

|

|

Income tax (expense) recovery |

16,383 |

|

1,598 |

|

52,971 |

|

18,798 |

|

|

Deferred income tax (expense) recovery |

23,982 |

|

(6,049 |

) |

29,720 |

|

(12,372 |

) |

|

Finance costs |

9,791 |

|

36,874 |

|

151,679 |

|

49,379 |

|

|

Other gains (losses) |

315 |

|

5,077 |

|

1,267 |

|

(659 |

) |

|

Depreciation |

13,534 |

|

9,301 |

|

62,732 |

|

47,082 |

|

|

EBITDA |

80,649 |

|

40,893 |

|

268,098 |

|

134,107 |

|

|

Impairment |

- |

|

- |

|

- |

|

- |

|

|

ARO Change |

(1,330 |

) |

- |

|

(1,330 |

) |

- |

|

|

Adjusted EBITDA |

79,319 |

|

40,893 |

|

266,768 |

|

134,107 |

|

| |

|

|

|

|

|

|

|

Reconciliation from the consolidated financial statements

to cash operating costs per gold equivalent ounce sold

(US$ thousand): |

| |

|

|

|

|

|

|

For the threemonths endedDecember 31,2024 |

For the threemonths endedDecember 31,2023 |

For the twelvemonths endedDecember 31,2024 |

For the twelvemonths endedDecember 31,2023 |

|

Cost of goods sold |

(90,418 |

) |

(84,186 |

) |

(342,893 |

) |

(290,877 |

) |

|

Depreciation |

14,270 |

|

9,844 |

|

61,847 |

|

46,816 |

|

|

COGS w/o Depreciation |

(76,148 |

) |

(74,342 |

) |

(281,046 |

) |

(244,061 |

) |

|

Gold Equivalent Ounces sold |

69,341 |

|

68,571 |

|

269,833 |

|

233,923 |

|

|

Cash costs per gold equivalent ounce sold |

1,098 |

|

1,084 |

|

1,042 |

|

1,043 |

|

| |

|

|

|

|

|

|

|

Reconciliation from the consolidated financial statements

to all in sustaining costs per gold equivalent ounce sold

(US$ thousand): |

| |

|

|

|

|

|

|

For the threemonths endedDecember 31,2024 |

For the threemonths endedDecember 31,2023 |

For the twelvemonths endedDecember 31,2024 |

For the twelvemonths endedDecember 31,2023 |

|

Cost of goods sold |

(90,418 |

) |

(84,186 |

) |

(342,893 |

) |

(290,877 |

) |

|

Depreciation |

14,270 |

|

9,844 |

|

61,847 |

|

46,816 |

|

|

COGS w/o Depreciation |

(76,148 |

) |

(74,342 |

) |

(281,046 |

) |

(244,061 |

) |

|

Capex w/o Expansion |

9,212 |

|

10,378 |

|

43,937 |

|

44,481 |

|

|

Site G&A |

6,124 |

|

1,687 |

|

14,024 |

|

8,217 |

|

|

Lease Payments |

3,712 |

|

3,473 |

|

17,202 |

|

13,109 |

|

|

Sub-Total |

|

|

|

|

|

Gold Equivalent Ounces sold |

69,341 |

|

68,571 |

|

269,833 |

|

233,923 |

|

|

All In Sustaining costs per ounce sold |

1,373 |

|

1,311 |

|

1,320 |

|

1,325 |

|

|

Reconciliation Net Debt (US$

thousand): |

|

|

For the threemonths endedDecember 31,2024 |

For the threemonths endedDecember 31,2023 |

|

Short Term Loans |

82,007 |

|

82,865 |

|

|

Long-Term Loans |

361,097 |

|

250,724 |

|

|

Plus / (Less): Derivative Financial Instrument for Debentures |

15,164 |

|

(11,129 |

) |

|

Less: Cash and Cash Equivalents |

(270,189 |

) |

(237,295 |

) |

|

Less: Restricted cash |

- |

|

- |

|

|

Less: Short term investments |

- |

|

- |

|

|

Net Debt |

188,079 |

|

85,165 |

|

| |

|

|

About Aura 360° MiningAura is

focused on mining in complete terms – thinking holistically about

how its business impacts and benefits every one of our

stakeholders: our company, our shareholders, our employees, and the

countries and communities we serve. We call this 360° Mining.

Aura is a mid-tier gold and copper production

company focused on operating and developing gold and base metal

projects in the Americas. The Company has 4 operating mines

including the Aranzazu copper-gold-silver mine in Mexico, the

Apoena (EPP) and Almas gold mines in Brazil, and the Minosa (San

Andres) gold mine in Honduras. The Company’s development projects

include Borborema and Matupá both in Brazil. Aura has unmatched

exploration potential owning over 630,000 hectares of mineral

rights and is currently advancing multiple near-mine and regional

targets along with the Aura Carajas copper project in the prolific

Carajás region of Brazil.

Forward-Looking InformationThis

press release contains “forward-looking information” and

“forward-looking statements”, as defined in applicable securities

laws (collectively, “forward-looking statements”) which may

include, but is not limited to, statements with respect to the

activities, events or developments that the Company expects or

anticipates will or may occur in the future. Often, but not always,

forward-looking statements can be identified by the use of words

and phrases such as “plans,” “expects,” “is expected,” “budget,”

“scheduled,” “estimates,” “forecasts,” “intends,” “anticipates,” or

“believes” or variations (including negative variations) of such

words and phrases, or state that certain actions, events or results

“may,” “could,” “would,” “might” or “will” be taken, occur or be

achieved.

Known and unknown risks, uncertainties and other

factors, many of which are beyond the Company’s ability to predict

or control, could cause actual results to differ materially from

those contained in the forward-looking statements. Specific

reference is made to the most recent Annual Information Form on

file with certain Canadian provincial securities regulatory

authorities for a discussion of some of the factors underlying

forward-looking statements, which include, without limitation,

volatility in the prices of gold, copper and certain other

commodities, changes in debt and equity markets, the uncertainties

involved in interpreting geological data, increases in costs,

environmental compliance and changes in environmental legislation

and regulation, interest rate and exchange rate fluctuations,

general economic conditions and other risks involved in the mineral

exploration and development industry. Readers are cautioned that

the foregoing list of factors is not exhaustive of the factors that

may affect the forward-looking statements.

All forward-looking statements herein are

qualified by this cautionary statement. Accordingly, readers should

not place undue reliance on forward-looking statements. The Company

undertakes no obligation to update publicly or otherwise revise any

forward-looking statements whether as a result of new information

or future events or otherwise, except as may be required by law. If

the Company does update one or more forward-looking statements, no

inference should be drawn that it will make additional updates with

respect to those or other forward-looking statements.

Financial Outlook and Future-Oriented

Financial InformationTo the extent any forward-looking

statements in this press release constitute “financial outlooks”

within the meaning of applicable Canadian securities legislation,

such information is being provided as certain estimated financial

metrics and the reader is cautioned that this information may not

be appropriate for any other purpose and the reader should not

place undue reliance on such financial outlooks. Such information

was approved by the company’s Board of Directors on February 26,

2025. Financial outlooks, as with forward-looking statements

generally, are, without limitation, based on the assumptions and

subject to various risks as set out herein. The Company’s actual

financial position and results of operations may differ materially

from management’s current expectations and, as a result, may differ

materially from values provided in this press release.

For more information, please contact:

Investor Relations

ri@auraminerals.com

www.auraminerals.com

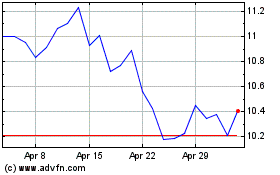

Aura Minerals (TSX:ORA)

Historical Stock Chart

From Jan 2025 to Feb 2025

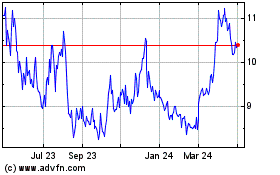

Aura Minerals (TSX:ORA)

Historical Stock Chart

From Feb 2024 to Feb 2025