Mandalay Resources Corporation Announces Production and Sales Results for the Second Quarter of 2019

July 09 2019 - 5:00PM

Mandalay Resources Corporation ("Mandalay" or the "Company") (TSX:

MND, OTCQB: MNDJD) announced today its production and sales results

for the second quarter of 2019.

In the second quarter of 2019, Mandalay produced

19,500 saleable ounces of gold equivalent and sold 20,259 ounces of

gold equivalent.

Dominic Duffy, President and Chief Executive

Officer of Mandalay, commented, “Mandalay’s production during the

second quarter highlights the continued strong performance at

Björkdal with 14,243 ounces of gold produced. This can be

attributed to delivery of constant tonnage from the underground

mine which is producing at a stabilized rate, and to the mining of

a small pocket of higher-grade skarn. We anticipate Björkdal’s

production will remain stable throughout the remainder of 2019 and

will focus on the Aurora zone, main zone and skarn ore development.

The open pit operation is scheduled to pause production at the end

of July, and this is not anticipated to have any effect on the year

end cost and production guidance at Björkdal for 2019.”

Mr. Duffy continued, “At Costerfield, we

maintained our capital development focus on reaching the

higher-grade Youle lode, which is expected to increase the grade of

material mined starting in the fourth quarter of 2019. Total gold

equivalent production during the quarter of 5,257 ounces was lower

than the previous quarter due to poor ground conditions in the

Brunswick lode slowing down production and lowering grades through

increased dilution. To improve mining in these conditions,

additional shotcrete capacity has been initiated on site to allow

for the increased production in the Brunswick lode going

forward.”

Mr. Duffy concluded, “Moving forward, the

Company’s main operational objectives for the second half of 2019

continue to be advancing development to the Youle lode at

Costerfield to achieve production from this deposit starting in the

fourth quarter and continuing the current strong underground

production rate at Björkdal. On the exploration side, the focus at

Costerfield is on the deep drilling program, initiated in June this

year, and extensional drilling on the Youle lode. At Björkdal,

explorational drilling is further expanding the Aurora zone, and

drilling of the higher-grade skarn deposits throughout the mine.”

Please see the press release dated June 18, 2019, for more

information on the Company’s exploration program, priorities and

results.

Saleable production for the quarter

ended June 30, 2019:

- In the second quarter of 2019, the Company produced a total of

17,544 ounces of gold and 371 tonnes of antimony, representing a

total of 19,500 ounces of gold equivalent, versus 19,154 ounces of

gold and 503 tonnes of antimony in the second quarter of 2018 and a

total of 22,348 ounces of gold equivalent in that

period.

- Production at Björkdal was 14,243 ounces of gold in the second

quarter of 2019, as compared to 14,017 ounces of gold in the second

quarter of 2018.

- Production at Costerfield was 3,301 ounces of gold and 371

tonnes of antimony in the second quarter of 2019, versus 5,137

ounces gold and 503 tonnes antimony in the second quarter of

2018.

Saleable production for the six

months ended June 30, 2019:

- The Company produced a total of 36,034 ounces gold and 946

tonnes antimony, representing a total of 41,440 ounces of gold

equivalent production, versus 38,457 ounces gold and 1,108 tonnes

of antimony in the corresponding six months of 2018 and a total of

45,520 ounces of gold equivalent in that period.

- Production at Björkdal was 28,628 ounces gold.

- Production at Costerfield was 7,406 ounces gold and 946 tonnes

antimony.

Table 1 – Second Quarter and Six Month

Saleable Production for 2019 and 2018

|

Metal |

Source |

Three monthsendedJune 30

2019 |

Three monthsendedJune 30

2018 |

Six monthsendedJune

302019 |

Six monthsendedJune

302018 |

|

Gold (oz) |

Björkdal |

14,243 |

14,017 |

28,628 |

26,733 |

|

|

Costerfield |

3,301 |

5,137 |

7,406 |

11,724 |

|

|

Total |

17,544 |

19,154 |

36,034 |

38,457 |

|

Antimony (t) |

Costerfield |

371 |

503 |

946 |

1,108 |

|

Average quarterly prices: |

|

|

|

|

|

|

Gold US$/oz |

|

1,309 |

1,307 |

|

|

|

Antimony US$/t |

|

6,894 |

8,295 |

|

|

|

Au Eq. (oz)1 |

Björkdal |

14,243 |

14,017 |

28,628 |

26,733 |

|

|

Costerfield |

5,257 |

8,331 |

12,812 |

18,787 |

|

|

Total |

19,500 |

22,348 |

41,440 |

45,520 |

1 Quarterly gold equivalent ounces (“Au Eq.

oz”) produced is calculated by multiplying the saleable quantities

of gold (“Au”), and antimony (“Sb”) in the period by the respective

average market prices of the commodities in the period, adding the

two amounts to get a “total contained value based on market price”,

and then dividing that total contained value by the average market

price of Au in the period. Average Au price in the period is

calculated as the average of the daily LME PM fixes in the period,

with price on weekend days and holidays taken of the last business

day; average Sb price in the period is calculated as the average of

the daily average of the high and low Rotterdam warehouse prices

for all days in the period, with price on weekend days and holidays

taken from the last business day. The source for all prices is

www.metalbulletin.com.

Sales for the second quarter ended June

30, 2019:

- In the second quarter of 2019, the Company sold a total of

18,026 ounces of gold and 424 tonnes of antimony, representing a

total of 20,259 ounces of gold equivalent, versus 18,497 ounces of

gold and 560 tonnes of antimony in the second quarter of 2018,

representing a total of 22,052 ounces of gold

equivalent.

- Björkdal sold 14,376 ounces of gold in the second quarter of

2019, versus 12,428 ounces of gold in the second quarter of

2018.

- Costerfield sold 3,650 ounces of gold and 424 tonnes of

antimony in the second quarter of 2019, versus 6,069 ounces of gold

and 560 tonnes of antimony in the second quarter of 2018.

Sales for the six months ended

June 30, 2019:

- The Company sold 37,883 ounces gold and 949 tonnes antimony,

representing a total of 43,266 ounces of gold equivalent, versus

43,305 ounces gold and 1,239 tonnes antimony in the second quarter

of 2018, representing a total of 51,203 ounces of gold

equivalent.

- Björkdal sold 30,154 ounces gold.

- Costerfield sold 7,729 ounces gold and 949 tonnes

antimony.

Table 2 – Second Quarter and Six Month

Sales for 2019 and 2018

|

Metal |

Source |

Three monthsendedJune

302019 |

Three monthsendedJune 30

2018 |

Six monthsendedJune

302019 |

Six monthsendedJune

302018 |

|

Gold (oz) |

Björkdal |

14,376 |

12,428 |

30,154 |

30,105 |

|

|

Costerfield |

3,650 |

6,069 |

7,729 |

13,200 |

|

|

Total |

18,026 |

18,497 |

37,883 |

43,305 |

|

Antimony (t) |

Costerfield |

424 |

560 |

949 |

1,239 |

|

Average quarterly prices: |

|

|

|

|

|

|

Gold US$/oz |

|

1,309 |

1,307 |

|

|

|

Antimony US$/t |

|

6,894 |

8,295 |

|

|

|

Au Eq. (oz)1 |

Björkdal |

14,376 |

12,428 |

30,154 |

30,105 |

|

|

Costerfield |

5,883 |

9,624 |

13,112 |

21,098 |

|

|

Total |

20,259 |

22,052 |

43,266 |

51,203 |

1Quarterly Au Eq. oz sold is calculated by

multiplying the saleable quantities of Au and Sb in the period by

the respective average market prices of the commodities in the

period, adding the two amounts to get a “total contained value

based on market price”, and then dividing that total contained

value by the average market price of Au for the period. The source

for all prices is www.metalbulletin.com with price on weekend days

and holidays taken of the last business day.

For Further Information:

Dominic DuffyPresident and Chief Executive

Officer

Edison NguyenManager, Analytics and Investor

Relations

Contact: 647.260.1566

About Mandalay Resources

Corporation:

Mandalay Resources is a Canadian-based natural

resource company with producing assets in Australia and Sweden, and

care and maintenance and development projects in Chile. The Company

is focused on growing production at its gold and antimony operation

in Australia, and gold production from its operation in Sweden to

generate near-term cash flow.

Forward-Looking Statements:

This news release contains "forward-looking

statements" within the meaning of applicable securities laws,

including statements regarding the Company’s production of gold and

antimony for the 2019 fiscal year. Readers are cautioned not to

place undue reliance on forward-looking statements. Actual results

and developments may differ materially from those contemplated by

these statements depending on, among other things, changes in

commodity prices and general market and economic conditions. The

factors identified above are not intended to represent a complete

list of the factors that could affect Mandalay. A description of

additional risks that could result in actual results and

developments differing from those contemplated by forward-looking

statements in this news release can be found under the heading

“Risk Factors” in Mandalay’s annual information form dated March

28, 2019, a copy of which is available under Mandalay’s profile at

www.sedar.com. In addition, there can be no assurance that any

inferred resources that are discovered as a result of additional

drilling will ever be upgraded to proven or probable reserves.

Although Mandalay has attempted to identify important factors that

could cause actual actions, events or results to differ materially

from those described in forward-looking statements, there may be

other factors that cause actions, events or results not to be as

anticipated, estimated or intended. There can be no assurance that

forward-looking statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward-looking statements.

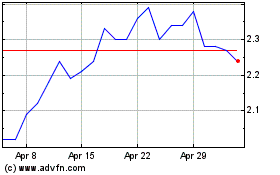

Mandalay Resources (TSX:MND)

Historical Stock Chart

From Mar 2024 to Apr 2024

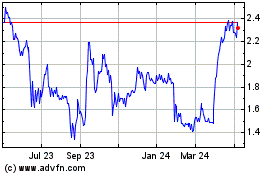

Mandalay Resources (TSX:MND)

Historical Stock Chart

From Apr 2023 to Apr 2024