International Petroleum Corporation (IPC) (TSX, Nasdaq Stockholm:

IPCO) is pleased to announce that it has commenced drilling of the

first well in a planned multi-well drilling program on Block PM307,

located offshore Peninsular Malaysia. IPC is the operator of Block

PM307 and holds a 75% working interest, with Petronas Carigali Sdn

Bhd holding the remaining 25% working interest.

The PM307 drilling program is planned to consist of

two infill landing pilot wells in the southeastern and northeastern

areas of the Bertam field, followed by the Keruing exploration well

and three Bertam field infill wells. The first pilot well will test

the upside potential in the northeastern A15 area, which could lead

to an additional infill well being added to the 2019 program in the

success case. The second pilot well will target the southeastern

A14 area with the aim to confirm commercial quantities of

hydrocarbons and to act as a landing pilot to de-risk development

drilling. The Keruing exploration well will target a prospect in

the I-35 reservoir, approximately 600 metres shallower than the

Bertam field.

Mike

Nicholson, CEO of IPC, comments: “I am very pleased to see the

start of an exciting multi-well drilling program in Malaysia which

follows the two successful infill drilling campaigns in 2016 and

2018. These wells are targeting low cost, high value tiebacks to

our Bertam field facilities, aimed at maximizing the value of our

Malaysian business for all stakeholders.”

International Petroleum Corp. (IPC) is an

international oil and gas exploration and production company with a

high quality portfolio of assets located in Canada, Malaysia and

Europe, providing a solid foundation for organic and inorganic

growth. IPC is a member of the Lundin Group of Companies. IPC is

incorporated in Canada and IPC’s shares are listed on the Toronto

Stock Exchange (TSX) and the Nasdaq Stockholm under the symbol

"IPCO".

For further information, please contact:

|

Rebecca GordonVP Corporate Planning and Investor

Relationsrebecca.gordon@international-petroleum.comTel: +41 22 595

10 50 |

Or |

Robert ErikssonMedia Managerreriksson@rive6.chTel: +46 701 11 26

15 |

Forward-Looking Statements This

press release contains statements and information which constitute

"forward-looking statements" or "forward-looking information"

(within the meaning of applicable securities legislation). Such

statements and information (together, "forward-looking statements")

relate to future events, including IPC’s (the Corporation's) future

performance, business prospects or opportunities. Actual results

may differ materially from those expressed or implied by

forward-looking statements. The forward-looking statements

contained in this press release are expressly qualified by this

cautionary statement. Forward-looking statements speak only as of

the date of this press release, unless otherwise indicated. IPC

does not intend, and does not assume any obligation, to update

these forward-looking statements, except as required by applicable

laws.

All statements other than statements of historical

fact may be forward-looking statements. Any statements that express

or involve discussions with respect to predictions, expectations,

beliefs, plans, projections, forecasts, guidance, budgets,

objectives, assumptions or future events or performance (often, but

not always, using words or phrases such as "seek", "anticipate",

"plan", "continue", "estimate", "expect", "may", "will", "project",

“forecast”, "predict", "potential", "targeting", "intend", "could",

"might", "should", "believe", "budget" and similar expressions) are

not statements of historical fact and may be "forward-looking

statements". Forward-looking statements include, but are not

limited to, statements with respect to: completion of the third

phase of infill drilling in Malaysia, including the ability to

mature additional locations; ability of the landing pilot wells to

identify upside potential, confirm commercial quantities of

hydrocarbons and de-risk future development drilling; the drilling

of the Keruing prospect and the development options if drilling is

successful; the ability to maximize the value of the Corporation’s

Malaysian business; estimates of reserves, contingent resources and

prospective resources; and future drilling and other exploration

and development activities. Statements relating to "reserves",

"contingent resources" and “prospective resources” are also deemed

to be forward-looking statements, as they involve the implied

assessment, based on certain estimates and assumptions, that the

reserves and resources described exist in the quantities predicted

or estimated and that the reserves and resources can be profitably

produced in the future. Ultimate recovery of reserves or

resources is based on forecasts of future results, estimates of

amounts not yet determinable and assumptions of management.

The forward-looking statements are based on certain

key expectations and assumptions made by IPC, including

expectations and assumptions concerning: prevailing commodity

prices and currency exchange rates; applicable royalty rates and

tax laws; interest rates; future well production rates and reserve

and contingent resource volumes; operating costs; the timing of

receipt of regulatory approvals; the performance of existing wells;

the success obtained in drilling new wells; anticipated timing and

results of capital expenditures; the sufficiency of budgeted

capital expenditures in carrying out planned activities; the

timing, location and extent of future drilling operations; the

successful completion of acquisitions and dispositions; the

benefits of acquisitions; the state of the economy and the

exploration and production business in the jurisdictions in which

IPC operates and globally; the availability and cost of financing,

labour and services; and the ability to market crude oil, natural

gas and natural gas liquids successfully.

Although IPC believes that the expectations and

assumptions on which such forward-looking statements are based are

reasonable, undue reliance should not be placed on the

forward-looking statements because IPC can give no assurances that

they will prove to be correct. Since forward-looking statements

address future events and conditions, by their very nature they

involve inherent risks and uncertainties. Actual results could

differ materially from those currently anticipated due to a number

of factors and risks. These include, but are not limited to: the

risks associated with the oil and gas industry in general such as

operational risks in development, exploration and production;

delays or changes in plans with respect to exploration or

development projects or capital expenditures; the uncertainty of

estimates and projections relating to reserves, resources,

production, revenues, costs and expenses; health, safety and

environmental risks; commodity price and exchange rate

fluctuations; interest rate fluctuations; marketing and

transportation; loss of markets; environmental risks; competition;

incorrect assessment of the value of acquisitions; failure to

complete or realize the anticipated benefits of acquisitions or

dispositions; the ability to access sufficient capital from

internal and external sources; failure to obtain required

regulatory and other approvals; and changes in legislation,

including but not limited to tax laws, royalties and environmental

regulations. Readers are cautioned that the foregoing list of

factors is not exhaustive.

Additional information on these and other factors

that could affect IPC, or its operations or financial results, are

included in the Corporation’s management discussion and analysis

for the three months ended March 31, 2019 (See "Cautionary

Statement Regarding Forward-Looking Information" therein), the

Corporation's Annual Information Form (AIF) for the year ended

December 31, 2018 (See "Cautionary Statement Regarding

Forward-Looking Information", "Reserves and Resources Advisory" and

" Risk Factors" therein) and other reports on file with applicable

securities regulatory authorities, which may be accessed through

the SEDAR website (www.sedar.com) or IPC's website

(www.international-petroleum.com).

Disclosure of Oil and Gas

Information Reserve estimates, contingent resource

estimates, prospective resource estimates and estimates of future

net revenue in respect of IPC’s oil and gas assets in Malaysia are

effective as of December 31, 2018, and are included in the report

prepared by ERC Equipoise Ltd. (ERCE), an independent qualified

reserves auditor, in accordance with National Instrument 51-101 –

Standards of Disclosure for Oil and Gas Activities (NI 51-101) and

the Canadian Oil and Gas Evaluation Handbook (the COGE Handbook),

and using the January 1, 2019 price forecasts of McDaniel &

Associates Consultants Ltd. (McDaniel).

BOEs may be misleading, particularly if used in

isolation. A BOE conversion ratio of 6 thousand cubic feet (Mcf)

per 1 barrel (bbl) is based on an energy equivalency conversion

method primarily applicable at the burner tip and does not

represent a value equivalency at the wellhead. As the value

ratio between natural gas and crude oil based on the current prices

of natural gas and crude oil is significantly different from the

energy equivalency of 6:1, utilizing a 6:1 conversion basis may be

misleading as an indication of value.

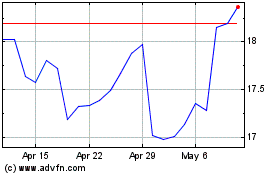

International Petroleum (TSX:IPCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

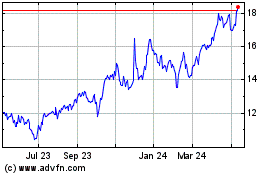

International Petroleum (TSX:IPCO)

Historical Stock Chart

From Apr 2023 to Apr 2024