Colliers International Group Inc. (NASDAQ and TSX: CIGI)

(“Colliers” or the “Company”) today announced operating and

financial results for the second quarter ended June 30, 2024. All

amounts are in US dollars.

For the second quarter ended June 30, 2024,

revenues were $1.14 billion, up 6% (6% in local currency) and

Adjusted EBITDA (note 1) was $155.6 million, up 6% (6% in local

currency) versus the prior year quarter. Adjusted EPS (note 2) was

$1.36, relative to $1.31 in the prior year quarter. Second quarter

adjusted EPS would have been approximately $0.01 higher excluding

foreign exchange impacts. The GAAP operating earnings were $114.7

million as compared to $75.3 million in the prior year quarter. The

GAAP diluted net earnings per share were $0.73 relative to a

diluted net loss per share of $0.16 in the prior year quarter. The

second quarter GAAP diluted net earnings per share EPS would have

been approximately $0.01 higher excluding foreign exchange

impacts.

For the six months ended June 30, 2024, revenues

were $2.14 billion, up 5% (5% in local currency) and adjusted

EBITDA (note 1) was $264.3 million, up 5% (6% in local currency)

versus the prior year period. Adjusted EPS (note 2) was $2.13,

relative to $2.16 in the prior year period. Adjusted EPS for the

year would have been approximately $0.02 higher excluding foreign

exchange impacts. The GAAP operating earnings were $158.1 million

as compared to $97.4 million in the prior year period. The GAAP

diluted net earnings per share were $0.99 compared to a diluted net

loss per share of $0.61 in the prior year period. The GAAP diluted

net earnings per share would have been approximately $0.02 higher

excluding changes in foreign exchange rates.

“Colliers delivered solid second quarter results

with growth across all service lines and segments. Leasing revenues

exceeded expectations while Capital Markets saw modest growth for

the first time since the second quarter of 2022. As expected, our

high-value, recurring service lines – Outsourcing & Advisory

and Investment Management – continued to deliver solid and

predictable growth during the quarter. As our business continues to

meet expectations, we are maintaining our financial outlook for the

year,” said Jay S. Hennick, Chairman & CEO of Colliers.

“Earlier this week, we completed the previously

announced acquisition of Englobe, a leading multi-discipline

engineering, environmental, and inspection services platform. This

acquisition establishes Colliers as one of the top players in

Canada, complements our rapidly growing engineering operations in

the United States and Australia and aligns with our strategy of

expanding our high-value recurring revenue streams, which now

represents 72% of our earnings.”

“Since 2015, our committed leadership team, with

substantial ownership, has continued to reposition our company to

create growth and value for our shareholders. One step at a time,

we have grown Colliers into a global leader in commercial real

estate and expanded our business to include three complementary

growth engines – Real Estate Services, Engineering, and Investment

Management,” he concluded.

About ColliersColliers (NASDAQ,

TSX: CIGI) is a leading diversified professional services and

investment management company. With operations in 68 countries, our

22,000 enterprising professionals work collaboratively to provide

expert real estate and investment advice to clients. For more than

29 years, our experienced leadership with significant inside

ownership has delivered compound annual investment returns of

approximately 20% for shareholders. With annual revenues of more

than $4.4 billion and $96 billion of assets under management,

Colliers maximizes the potential of property and real assets to

accelerate the success of our clients, our investors and our

people. Learn more at corporate.colliers.com, X @Colliers or

LinkedIn.

Consolidated Revenues by Line of

Service

| |

|

|

Three months ended |

Change |

Change |

|

Six months ended |

Change |

Change |

| (in thousands of

US$) |

|

|

June 30 |

in US$ % |

in LC% |

|

June 30 |

in US$ % |

in LC% |

|

(LC = local currency) |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Outsourcing &

Advisory |

|

$ |

541,603 |

|

$ |

519,578 |

4 |

% |

5 |

% |

|

$ |

1,039,092 |

|

$ |

974,508 |

7 |

% |

7 |

% |

| Investment

Management (1) |

|

|

126,051 |

|

|

118,860 |

6 |

% |

6 |

% |

|

|

248,572 |

|

|

239,606 |

4 |

% |

4 |

% |

| Leasing |

|

|

288,918 |

|

|

256,684 |

13 |

% |

13 |

% |

|

|

532,155 |

|

|

495,071 |

7 |

% |

8 |

% |

| Capital

Markets |

|

|

182,796 |

|

|

182,916 |

0 |

% |

1 |

% |

|

|

321,529 |

|

|

334,756 |

-4 |

% |

-3 |

% |

|

Total revenues |

|

|

$ |

1,139,368 |

|

$ |

1,078,038 |

6 |

% |

6 |

% |

|

$ |

2,141,348 |

|

$ |

2,043,941 |

5 |

% |

5 |

% |

|

(1) Investment Management local currency revenues, excluding

pass-through carried interest, were up 6% and 3% for the three and

six-month periods ended June 30, 2024, respectively. |

Second quarter consolidated revenues were up 6%

on a local currency basis driven by growth across all service

lines, led by Leasing. Consolidated internal revenue growth

measured in local currencies was 5% (note 4) versus the prior year

quarter.

For the six months ended June 30, 2024,

consolidated revenues increased 5% on a local currency basis on

robust growth in Leasing and Outsourcing & Advisory, partly

offset by a market-driven slowdown in Capital Markets activity.

Consolidated internal revenues measured in local currencies were up

4% (note 4).

Segmented Second

Quarter ResultsRevenues in the Americas region totalled

$682.7 million, up 8% (8% in local currency) versus $631.3 million

in the prior year quarter, primarily attributable to higher Leasing

activity as well as robust broad-based growth in Outsourcing &

Advisory. Capital Markets revenues were up 2%. Adjusted EBITDA was

$75.7 million, up 9% (9% in local currency) relative to the prior

year quarter on higher revenues. GAAP operating earnings were $53.0

million, relative to $46.5 million in the prior year quarter.

Revenues in the EMEA region totalled $178.7

million, up 3% (3% in local currency) compared to $173.8 million in

the prior year quarter, attributable to higher Leasing activity and

modest growth in Outsourcing & Advisory revenues, while Capital

Markets revenues were essentially flat. Adjusted EBITDA was $6.8

million, up 7% (6% in local currency) compared to $6.3 million in

the prior year quarter on a lower cost base. The GAAP operating

loss was $0.7 million compared to a loss of $5.1 million in the

prior year quarter.

Revenues in the Asia Pacific region totalled

$151.9 million, down 1% (up 1% in local currency), compared to

$153.9 million in the prior year quarter. Adjusted EBITDA was $24.6

million, up 7% (9% in local currency) primarily on lower operating

costs. The GAAP operating earnings were $21.6 million, versus $19.6

million in the prior year quarter.

Investment Management revenues were $126.1

million relative to $118.9 million in the prior year quarter, up 6%

(6% in local currency) on incremental revenues from new investor

capital commitments. No passthrough revenues from historical

carried interest were recognized in the current and prior year

quarters. Adjusted EBITDA was $50.5 million, up 1% (1% in local

currency) compared to the prior year quarter on higher revenues,

partly offset by increased investments in new products, strategies

and fundraising capabilities. The GAAP operating earnings were

$55.0 million in the quarter versus $26.4 million in the prior year

quarter. AUM was $96.4 billion as of June 30, 2024 compared to

$96.3 billion as of March 31, 2024.

Unallocated global corporate costs as reported

in Adjusted EBITDA were $1.9 million in the second quarter, flat

relative to the prior year quarter. The corporate GAAP operating

loss for the quarter was $14.2 million, versus $12.1 million in the

second quarter of 2023.

Outlook for 2024The Company’s

outlook for 2024 is unchanged, except to reflect the partial year

impact of the acquisition of Englobe:

|

|

|

2024 Outlook |

|

Measure |

Actual 2023 |

Prior |

Englobe |

Revised (with Englobe) |

|

Revenue growth |

-3% |

|

+5% to +10% |

+3% |

|

+8% to +13% |

|

Adjusted EBITDA growth |

-6% |

|

+5% to +15% |

+3% |

|

+8% to +18% |

|

Adjusted EPS growth |

-23% |

|

+10% to +20% |

+1% |

|

+11% to +21% |

The financial outlook is based on the Company’s

best available information as of the date of this press release,

and remains subject to change based on numerous macroeconomic,

geopolitical, health, social and related factors. Continued

interest rate volatility and/or lack of credit availability for

commercial real estate transactions could materially impact the

outlook.

Revised Operating SegmentsWith

the acquisition of Englobe, the Company’s engineering and project

management capabilities have reached scale, with over 8,000

employees generating approximately $1.3 billion in annual revenues

across 15 countries.

Starting in the third quarter of 2024, the

Company will re-align its operating segment reporting to better

reflect the overall business and its three complementary growth

engines – Real Estate Services, Engineering, and Investment

Management. The Real Estate Services segment will be comprised of

the former Americas, EMEA and Asia Pacific regions, but excluding

engineering and project management.

Conference CallColliers will be

holding a conference call on Thursday, August 1, 2024 at 11:00 a.m.

Eastern Time to discuss the quarter’s results. The call, as well as

a supplemental slide presentation, will be simultaneously web cast

and can be accessed live or after the call at

corporate.colliers.com in the Events section.

Forward-looking StatementsThis

press release includes or may include forward-looking statements.

Forward-looking statements include the Company’s financial

performance outlook and statements regarding goals, beliefs,

strategies, objectives, plans or current expectations. These

statements involve known and unknown risks, uncertainties and other

factors which may cause the actual results to be materially

different from any future results, performance or achievements

contemplated in the forward-looking statements. Such factors

include: economic conditions, especially as they relate to

commercial and consumer credit conditions and consumer spending,

particularly in regions where the business may be concentrated;

commercial real estate and real asset values, vacancy rates and

general conditions of financial liquidity for real estate

transactions; trends in pricing and risk assumption for commercial

real estate services; the effect of significant movements in

capitalization rates across different asset types; a reduction by

companies in their reliance on outsourcing for their commercial

real estate needs, which would affect revenues and operating

performance; competition in the markets served by the Company; the

ability to attract new clients and to retain clients and renew

related contracts; the ability to attract new capital commitments

to Investment Management funds and retain existing capital under

management; the ability to retain and incentivize employees;

increases in wage and benefit costs; the effects of changes in

interest rates on the cost of borrowing; unexpected increases in

operating costs, such as insurance, workers’ compensation and

health care; changes in the frequency or severity of insurance

incidents relative to historical experience; the effects of changes

in foreign exchange rates in relation to the US dollar on the

Company’s Canadian dollar, Euro, Australian dollar and UK pound

sterling denominated revenues and expenses; the impact of pandemics

on client demand for the Company’s services, the ability of the

Company to deliver its services and the health and productivity of

its employees; the impact of global climate change; the impact of

political events including elections, referenda, trade policy

changes, immigration policy changes, hostilities, war and terrorism

on the Company’s operations; the ability to identify and make

acquisitions at reasonable prices and successfully integrate

acquired operations; the ability to execute on, and adapt to,

information technology strategies and trends; the ability to comply

with laws and regulations, including real estate investment

management and mortgage banking licensure, labour and employment

laws and regulations, as well as the anti-corruption laws and trade

sanctions; and changes in government laws and policies at the

federal, state/provincial or local level that may adversely impact

the business.

Additional information and risk factors are

identified in the Company’s other periodic filings with Canadian

and US securities regulators (which factors are adopted herein and

a copy of which can be obtained at www.sedarplus.ca. Forward

looking statements contained in this press release are made as of

the date hereof and are subject to change. All forward-looking

statements in this press release are qualified by these cautionary

statements. Except as required by applicable law, Colliers

undertakes no obligation to publicly update or revise any

forward-looking statement, whether as a result of new information,

future events or otherwise.

Summary financial information is provided in

this press release. This press release should be read in

conjunction with the Company's consolidated financial statements

and MD&A to be made available on SEDAR+ at

www.sedarplus.ca.

This press release does not constitute an offer

to sell or a solicitation of an offer to purchase an interest in

any fund.

NotesNon-GAAP

Measures1. Reconciliation of net earnings to Adjusted

EBITDA

Adjusted EBITDA is defined as net earnings,

adjusted to exclude: (i) income tax; (ii) other income; (iii)

interest expense; (iv) loss on disposal of operations; (v)

depreciation and amortization, including amortization of mortgage

servicing rights (“MSRs”); (vi) gains attributable to MSRs; (vii)

acquisition-related items (including contingent acquisition

consideration fair value adjustments, contingent acquisition

consideration-related compensation expense and transaction costs);

(viii) restructuring costs and (ix) stock-based compensation

expense. We use Adjusted EBITDA to evaluate our own operating

performance and our ability to service debt, as well as an integral

part of our planning and reporting systems. Additionally, we use

this measure in conjunction with discounted cash flow models to

determine the Company’s overall enterprise valuation and to

evaluate acquisition targets. We present Adjusted EBITDA as a

supplemental measure because we believe such measure is useful to

investors as a reasonable indicator of operating performance

because of the low capital intensity of the Company’s service

operations. We believe this measure is a financial metric used by

many investors to compare companies, especially in the services

industry. This measure is not a recognized measure of financial

performance under GAAP in the United States, and should not be

considered as a substitute for operating earnings, net earnings or

cash flow from operating activities, as determined in accordance

with GAAP. Our method of calculating Adjusted EBITDA may differ

from other issuers and accordingly, this measure may not be

comparable to measures used by other issuers. A reconciliation of

net earnings to Adjusted EBITDA appears below.

| |

|

Three months

ended |

|

Six months

ended |

| |

June

30 |

|

June

30 |

|

(in thousands of US$) |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings |

$ |

71,927 |

|

|

$ |

35,001 |

|

|

$ |

86,063 |

|

|

$ |

34,094 |

|

| Income tax |

|

24,377 |

|

|

|

16,477 |

|

|

|

34,347 |

|

|

|

20,016 |

|

| Other income, including equity earnings from

non-consolidated investments |

|

(932 |

) |

|

|

(886 |

) |

|

|

(1,583 |

) |

|

|

(4,206 |

) |

| Interest expense, net |

|

19,376 |

|

|

|

24,670 |

|

|

|

39,248 |

|

|

|

47,502 |

|

| Operating earnings |

|

114,748 |

|

|

|

75,262 |

|

|

|

158,075 |

|

|

|

97,406 |

|

| Loss on disposal of operations |

|

- |

|

|

|

2,282 |

|

|

|

- |

|

|

|

2,282 |

|

| Depreciation and amortization |

|

49,845 |

|

|

|

50,794 |

|

|

|

100,353 |

|

|

|

100,286 |

|

| Gains attributable to MSRs |

|

(3,712 |

) |

|

|

(6,052 |

) |

|

|

(5,027 |

) |

|

|

(9,087 |

) |

| Equity earnings from non-consolidated

investments |

|

796 |

|

|

|

532 |

|

|

|

1,232 |

|

|

|

3,686 |

|

| Acquisition-related items |

|

(15,221 |

) |

|

|

11,668 |

|

|

|

(13,281 |

) |

|

|

38,136 |

|

| Restructuring costs |

|

1,722 |

|

|

|

7,038 |

|

|

|

8,833 |

|

|

|

7,781 |

|

| Stock-based compensation expense |

|

7,446 |

|

|

|

5,556 |

|

|

|

14,134 |

|

|

|

11,213 |

|

|

Adjusted EBITDA |

$ |

155,624 |

|

|

$ |

147,080 |

|

|

$ |

264,319 |

|

|

$ |

251,703 |

|

2. Reconciliation of net earnings and diluted

net earnings per common share to adjusted net earnings and Adjusted

EPS

Adjusted EPS is defined as diluted net earnings

per share adjusted for the effect, after income tax, of: (i) the

non-controlling interest redemption increment; (ii) loss on

disposal of operations; (iii) amortization expense related to

intangible assets recognized in connection with acquisitions and

MSRs; (iv) gains attributable to MSRs; (v) acquisition-related

items; (vi) restructuring costs and (vii) stock-based compensation

expense. We believe this measure is useful to investors because it

provides a supplemental way to understand the underlying operating

performance of the Company and enhances the comparability of

operating results from period to period. Adjusted EPS is not a

recognized measure of financial performance under GAAP, and should

not be considered as a substitute for diluted net earnings per

share from continuing operations, as determined in accordance with

GAAP. Our method of calculating this non-GAAP measure may differ

from other issuers and, accordingly, this measure may not be

comparable to measures used by other issuers. A reconciliation of

net earnings to adjusted net earnings and of diluted net earnings

per share to adjusted EPS appears below.

Similar to GAAP diluted EPS, Adjusted EPS is

calculated using the “if-converted” method of calculating earnings

per share in relation to the Convertible Notes, which were fully

converted or redeemed by June 1, 2023. As such, the interest (net

of tax) on the Convertible Notes is added to the numerator and the

additional shares issuable on conversion of the Convertible Notes

are added to the denominator of the earnings per share calculation

to determine if an assumed conversion is more dilutive than no

assumption of conversion. The “if-converted” method is used if the

impact of the assumed conversion is dilutive. The “if-converted”

method is dilutive for the Adjusted EPS calculation for all periods

where the Convertible Notes were outstanding.

| |

|

Three months

ended |

|

Six months

ended |

| |

June

30 |

|

June

30 |

|

(in thousands of US$) |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings |

$ |

71,927 |

|

|

$ |

35,001 |

|

|

$ |

86,063 |

|

|

$ |

34,094 |

|

| Non-controlling interest share of earnings |

|

(11,224 |

) |

|

|

(13,816 |

) |

|

|

(20,145 |

) |

|

|

(24,757 |

) |

| Interest on Convertible Notes |

|

- |

|

|

|

561 |

|

|

|

- |

|

|

|

2,861 |

|

| Loss on disposal of operations |

|

- |

|

|

|

2,282 |

|

|

|

- |

|

|

|

2,282 |

|

| Amortization of intangible assets |

|

34,385 |

|

|

|

37,330 |

|

|

|

69,471 |

|

|

|

74,173 |

|

| Gains attributable to MSRs |

|

(3,712 |

) |

|

|

(6,052 |

) |

|

|

(5,027 |

) |

|

|

(9,087 |

) |

| Acquisition-related items |

|

(15,221 |

) |

|

|

11,668 |

|

|

|

(13,281 |

) |

|

|

38,136 |

|

| Restructuring costs |

|

1,722 |

|

|

|

7,038 |

|

|

|

8,833 |

|

|

|

7,781 |

|

| Stock-based compensation expense |

|

7,446 |

|

|

|

5,556 |

|

|

|

14,134 |

|

|

|

11,213 |

|

| Income tax on adjustments |

|

(9,606 |

) |

|

|

(11,845 |

) |

|

|

(20,733 |

) |

|

|

(23,193 |

) |

| Non-controlling interest on adjustments |

|

(7,141 |

) |

|

|

(5,773 |

) |

|

|

(13,271 |

) |

|

|

(10,926 |

) |

|

Adjusted net earnings |

$ |

68,576 |

|

|

$ |

61,950 |

|

|

$ |

106,044 |

|

|

$ |

102,577 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months

ended |

|

Six months

ended |

| |

June

30 |

|

June

30 |

|

(in US$) |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted net earnings (loss) per common

share(1) |

$ |

0.73 |

|

|

$ |

(0.14 |

) |

|

$ |

0.99 |

|

|

$ |

(0.57 |

) |

| Interest on Convertible Notes, net of tax |

|

- |

|

|

|

0.01 |

|

|

|

- |

|

|

|

0.04 |

|

| Non-controlling interest redemption increment |

|

0.48 |

|

|

|

0.59 |

|

|

|

0.33 |

|

|

|

0.77 |

|

| Loss on disposal of operations |

|

- |

|

|

|

0.05 |

|

|

|

- |

|

|

|

0.05 |

|

| Amortization expense, net of tax |

|

0.41 |

|

|

|

0.49 |

|

|

|

0.88 |

|

|

|

0.97 |

|

| Gains attributable to MSRs, net of tax |

|

(0.04 |

) |

|

|

(0.07 |

) |

|

|

(0.06 |

) |

|

|

(0.11 |

) |

| Acquisition-related items |

|

(0.36 |

) |

|

|

0.19 |

|

|

|

(0.37 |

) |

|

|

0.70 |

|

| Restructuring costs, net of tax |

|

0.02 |

|

|

|

0.11 |

|

|

|

0.14 |

|

|

|

0.12 |

|

| Stock-based compensation expense, net of tax |

|

0.12 |

|

|

|

0.08 |

|

|

|

0.22 |

|

|

|

0.19 |

|

| Adjusted EPS |

$ |

1.36 |

|

|

$ |

1.31 |

|

|

$ |

2.13 |

|

|

$ |

2.16 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted

weighted average shares for Adjusted EPS (thousands) |

|

50,479 |

|

|

|

47,422 |

|

|

|

49,671 |

|

|

|

47,442 |

|

| (1) Amounts shown reflect the "if-converted"

method's dilutive impact on the adjusted EPS calculation. |

3. Reconciliation of net cash flow from

operations to free cash flow

Free cash flow is defined as net cash flow from

operating activities plus contingent acquisition consideration

paid, less purchases of fixed assets, plus cash collections on AR

Facility deferred purchase price less distributions to

non-controlling interests. We use free cash flow as a measure to

evaluate and monitor operating performance as well as our ability

to service debt, fund acquisitions and pay dividends to

shareholders. We present free cash flow as a supplemental measure

because we believe this measure is a financial metric used by many

investors to compare valuation and liquidity measures across

companies, especially in the services industry. This measure is not

a recognized measure of financial performance under GAAP in the

United States, and should not be considered as a substitute for

operating earnings, net earnings or cash flow from operating

activities, as determined in accordance with GAAP. Our method of

calculating free cash flow may differ from other issuers and

accordingly, this measure may not be comparable to measures used by

other issuers. A reconciliation of net cash flow from operating

activities to free cash flow appears below.

| |

|

Three months

ended |

|

Six months

ended |

| |

June

30 |

|

June

30 |

|

(in thousands of US$) |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by (used in) operating

activities |

$ |

141,189 |

|

|

$ |

98,973 |

|

|

$ |

3,574 |

|

|

$ |

(33,595 |

) |

| Contingent acquisition consideration paid |

|

300 |

|

|

|

2,719 |

|

|

|

3,038 |

|

|

|

2,991 |

|

| Purchase of fixed assets |

|

(12,480 |

) |

|

|

(22,179 |

) |

|

|

(29,353 |

) |

|

|

(41,062 |

) |

| Cash collections on AR Facility deferred purchase

price |

|

34,930 |

|

|

|

28,539 |

|

|

|

68,848 |

|

|

|

59,311 |

|

| Distributions paid to non-controlling

interests |

|

(38,521 |

) |

|

|

(40,059 |

) |

|

|

(48,827 |

) |

|

|

(51,120 |

) |

|

Free cash flow |

$ |

125,418 |

|

|

$ |

67,993 |

|

|

$ |

(2,720 |

) |

|

$ |

(63,475 |

) |

4. Local currency revenue and Adjusted EBITDA

growth rate and internal revenue growth rate measures

Percentage revenue and Adjusted EBITDA variances

presented on a local currency basis are calculated by translating

the current period results of our non-US dollar denominated

operations to US dollars using the foreign currency exchange rates

from the periods against which the current period results are being

compared. Percentage revenue variances presented on an internal

growth basis are calculated assuming no impact from acquired

entities in the current and prior periods. Revenue from acquired

entities, including any foreign exchange impacts, are treated as

acquisition growth until the respective anniversaries of the

acquisitions. We believe that these revenue growth rate

methodologies provide a framework for assessing the Company’s

performance and operations excluding the effects of foreign

currency exchange rate fluctuations and acquisitions. Since these

revenue growth rate measures are not calculated under GAAP, they

may not be comparable to similar measures used by other

issuers.

5. Assets under management

We use the term assets under management (“AUM”)

as a measure of the scale of our Investment Management operations.

AUM is defined as the gross market value of operating assets and

the projected gross cost of development assets of the funds,

partnerships and accounts to which we provide management and

advisory services, including capital that such funds, partnerships

and accounts have the right to call from investors pursuant to

capital commitments. Our definition of AUM may differ from those

used by other issuers and as such may not be directly comparable to

similar measures used by other issuers.

6. Adjusted EBITDA from recurring revenue

percentage

Adjusted EBITDA from recurring revenue

percentage is computed on a trailing twelve-month basis and

represents the proportion of Adjusted EBITDA (note 1) that is

derived from Outsourcing & Advisory and Investment Management

service lines. Both these service lines represent medium to

long-term duration revenue streams that are either contractual or

repeatable in nature. Adjusted EBITDA for this purpose is

calculated in the same manner as for our debt agreement covenant

calculation purposes, incorporating the expected full year impact

of business acquisitions and dispositions.

| Colliers

International Group Inc. |

| Condensed

Consolidated Statements of Earnings (Loss) |

| (in thousands of

US$, except per share amounts) |

| |

|

|

|

|

Three

months |

|

|

Six

months |

| |

|

|

|

|

ended June

30 |

|

|

ended June

30 |

|

(unaudited) |

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Revenues |

|

$ |

1,139,368 |

|

|

$ |

1,078,038 |

|

|

$ |

2,141,348 |

|

|

$ |

2,043,941 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of revenues |

|

|

687,062 |

|

|

|

640,650 |

|

|

|

1,293,307 |

|

|

|

1,226,910 |

|

| Selling, general and administrative expenses |

|

|

302,934 |

|

|

|

297,382 |

|

|

|

602,894 |

|

|

|

578,921 |

|

| Depreciation |

|

|

15,460 |

|

|

|

13,464 |

|

|

|

30,882 |

|

|

|

26,113 |

|

| Amortization of intangible assets |

|

|

34,385 |

|

|

|

37,330 |

|

|

|

69,471 |

|

|

|

74,173 |

|

| Acquisition-related items (1) |

|

|

(15,221 |

) |

|

|

11,668 |

|

|

|

(13,281 |

) |

|

|

38,136 |

|

| Loss on disposal of operations |

|

|

- |

|

|

|

2,282 |

|

|

|

- |

|

|

|

2,282 |

|

| Operating earnings |

|

|

114,748 |

|

|

|

75,262 |

|

|

|

158,075 |

|

|

|

97,406 |

|

| Interest expense, net |

|

|

19,376 |

|

|

|

24,670 |

|

|

|

39,248 |

|

|

|

47,502 |

|

| Equity earnings from non-consolidated

investments |

|

|

(796 |

) |

|

|

(532 |

) |

|

|

(1,232 |

) |

|

|

(3,686 |

) |

| Other income |

|

|

(136 |

) |

|

|

(354 |

) |

|

|

(351 |

) |

|

|

(520 |

) |

| Earnings before income tax |

|

|

96,304 |

|

|

|

51,478 |

|

|

|

120,410 |

|

|

|

54,110 |

|

| Income tax |

|

|

24,377 |

|

|

|

16,477 |

|

|

|

34,347 |

|

|

|

20,016 |

|

| Net earnings |

|

|

71,927 |

|

|

|

35,001 |

|

|

|

86,063 |

|

|

|

34,094 |

|

| Non-controlling interest share of earnings |

|

|

11,224 |

|

|

|

13,816 |

|

|

|

20,145 |

|

|

|

24,757 |

|

| Non-controlling interest redemption increment |

|

|

23,979 |

|

|

|

28,036 |

|

|

|

16,537 |

|

|

|

36,340 |

|

| Net earnings (loss) attributable to

Company |

|

$ |

36,724 |

|

|

$ |

(6,851 |

) |

|

$ |

49,381 |

|

|

$ |

(27,003 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net earnings (loss) per common

share |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Basic |

|

$ |

0.73 |

|

|

$ |

(0.15 |

) |

|

$ |

1.00 |

|

|

$ |

(0.61 |

) |

| |

Diluted (2) |

|

$ |

0.73 |

|

|

$ |

(0.16 |

) |

|

$ |

0.99 |

|

|

$ |

(0.61 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EPS (3) |

|

$ |

1.36 |

|

|

$ |

1.31 |

|

|

$ |

2.13 |

|

|

$ |

2.16 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average common shares (thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Basic |

|

|

|

50,239 |

|

|

|

45,069 |

|

|

|

49,374 |

|

|

|

44,064 |

|

| |

Diluted |

|

|

|

50,479 |

|

|

|

45,362 |

|

|

|

49,671 |

|

|

|

44,064 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Notes to

Condensed Consolidated Statements of Earnings |

|

(1) |

Acquisition-related items include contingent acquisition

consideration fair value adjustments, contingent acquisition

consideration-related compensation expense and transaction

costs. |

| (2) |

Diluted EPS is calculated using

the “if-converted” method of calculating earnings per share in

relation to the Convertible Notes, which were fully converted or

redeemed by June 1, 2023. As such, the interest (net of tax) on the

Convertible Notes is added to the numerator and the additional

shares issuable on conversion of the Convertible Notes are added to

the denominator of the earnings per share calculation to determine

if an assumed conversion is more dilutive than no assumption of

conversion. The “if-converted” method is used if the impact of the

assumed conversion is dilutive. The “if-converted” method was

dilutive for the three months ended June 30, 2023 and anti-dilutive

for the six months ended June 30, 2023. |

| (3) |

See definition and reconciliation

above. |

| Colliers

International Group Inc. |

|

|

|

|

|

|

|

|

| Condensed

Consolidated Balance Sheets |

|

|

|

|

|

|

|

|

| (in thousands of

US$) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

June 30, |

|

December 31, |

|

June 30, |

|

(unaudited) |

2024 |

|

2023 |

|

2023 |

| |

|

|

|

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

|

| Cash and cash

equivalents |

$ |

162,625 |

|

$ |

181,134 |

|

$ |

172,371 |

| Restricted cash

(1) |

|

78,060 |

|

|

37,941 |

|

|

85,207 |

| Accounts

receivable and contract assets |

|

723,531 |

|

|

726,764 |

|

|

669,311 |

| Mortgage warehouse

receivables (2) |

|

140,974 |

|

|

177,104 |

|

|

77,443 |

| Prepaids and other

assets |

|

329,716 |

|

|

306,829 |

|

|

287,490 |

| Warehouse fund

assets |

|

49,285 |

|

|

44,492 |

|

|

41,084 |

| |

Current

assets |

|

1,484,191 |

|

|

1,474,264 |

|

|

1,332,906 |

| Other non-current

assets |

|

212,301 |

|

|

188,745 |

|

|

182,305 |

| Warehouse fund

assets |

|

286,171 |

|

|

47,536 |

|

|

- |

| Fixed assets |

|

201,315 |

|

|

202,837 |

|

|

182,944 |

| Operating lease

right-of-use assets |

|

380,699 |

|

|

390,565 |

|

|

365,198 |

| Deferred tax

assets, net |

|

58,902 |

|

|

59,468 |

|

|

67,959 |

| Goodwill and

intangible assets |

|

3,048,187 |

|

|

3,118,711 |

|

|

3,167,063 |

| |

Total

assets |

$ |

5,671,766 |

|

$ |

5,482,126 |

|

$ |

5,298,375 |

| |

|

|

|

|

|

|

|

|

|

|

Liabilities and shareholders' equity |

|

|

|

|

|

|

|

|

| Accounts payable

and accrued liabilities |

$ |

966,978 |

|

$ |

1,104,935 |

|

$ |

1,008,318 |

| Other current

liabilities |

|

97,862 |

|

|

75,764 |

|

|

101,528 |

| Long-term debt -

current |

|

9,618 |

|

|

1,796 |

|

|

8,960 |

| Mortgage warehouse

credit facilities (2) |

|

132,869 |

|

|

168,780 |

|

|

70,009 |

| Operating lease

liabilities - current |

|

87,350 |

|

|

89,938 |

|

|

88,659 |

| Liabilities

related to warehouse fund assets |

|

146,636 |

|

|

- |

|

|

- |

| |

Current

liabilities |

|

1,441,313 |

|

|

1,441,213 |

|

|

1,277,474 |

| Long-term debt -

non-current |

|

1,354,241 |

|

|

1,500,843 |

|

|

1,659,461 |

| Operating lease

liabilities - non-current |

|

371,618 |

|

|

375,454 |

|

|

348,707 |

| Other

liabilities |

|

123,691 |

|

|

151,333 |

|

|

157,379 |

| Deferred tax

liabilities, net |

|

37,635 |

|

|

43,191 |

|

|

44,722 |

| Liabilities

related to warehouse fund assets |

|

43,000 |

|

|

47,536 |

|

|

- |

| Redeemable

non-controlling interests |

|

1,105,008 |

|

|

1,072,066 |

|

|

1,093,696 |

| Shareholders'

equity |

|

1,195,260 |

|

|

850,490 |

|

|

716,936 |

|

|

Total liabilities and equity |

$ |

5,671,766 |

|

$ |

5,482,126 |

|

$ |

5,298,375 |

| |

|

|

|

|

|

|

|

|

|

|

Supplemental balance sheet information |

|

|

|

|

|

|

|

|

| Total debt

(3) |

$ |

1,363,859 |

|

$ |

1,502,639 |

|

$ |

1,668,421 |

| Total debt, net of

cash and cash equivalents (3) |

|

1,201,234 |

|

|

1,321,505 |

|

|

1,496,050 |

| Net debt / pro

forma adjusted EBITDA ratio (4) |

|

2.0 |

|

|

2.2 |

|

|

2.4 |

| Notes to Condensed Consolidated Balance

Sheets |

| (1) |

Restricted

cash consists primarily of cash amounts set aside to satisfy legal

or contractual requirements arising in the normal course of

business. |

| (2) |

Mortgage warehouse receivables represent mortgage loans

receivable, the majority of which are offset by borrowings under

mortgage warehouse credit facilities which fund loans that

financial institutions have committed to purchase. |

| (3) |

Excluding mortgage warehouse credit facilities. |

| (4) |

Net debt for financial leverage ratio excludes restricted cash

and mortgage warehouse credit facilities, in accordance with debt

agreements. |

| Colliers International Group

Inc. |

|

|

|

|

|

|

|

|

|

|

|

|

| Condensed Consolidated Statements of Cash

Flows |

|

|

|

|

|

|

|

| (in thousands of US$) |

| |

|

|

|

Three months

ended |

|

|

Six months

ended |

| |

|

|

|

June

30 |

|

|

June

30 |

|

(unaudited) |

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash provided by (used in) |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating activities |

|

|

|

|

|

|

|

|

|

|

|

|

| Net earnings |

|

$ |

71,927 |

|

|

$ |

35,001 |

|

|

$ |

86,063 |

|

|

$ |

34,094 |

|

| Items not affecting cash: |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Depreciation

and amortization |

|

|

49,845 |

|

|

|

50,794 |

|

|

|

100,353 |

|

|

|

100,286 |

|

| |

Loss on disposal of operations |

|

|

- |

|

|

|

2,282 |

|

|

|

- |

|

|

|

2,282 |

|

| |

Gains attributable to mortgage servicing rights |

|

|

(3,712 |

) |

|

|

(6,052 |

) |

|

|

(5,027 |

) |

|

|

(9,087 |

) |

| |

Gains attributable to the fair value of loan |

|

|

|

|

|

|

|

|

|

|

|

|

| |

premiums and origination fees |

|

|

(3,424 |

) |

|

|

(4,009 |

) |

|

|

(5,623 |

) |

|

|

(8,026 |

) |

| |

Deferred income tax |

|

|

(3,406 |

) |

|

|

(10,915 |

) |

|

|

(7,395 |

) |

|

|

(21,904 |

) |

| |

Other |

|

|

1,686 |

|

|

|

31,212 |

|

|

|

15,148 |

|

|

|

66,521 |

|

| |

|

|

|

112,916 |

|

|

|

98,313 |

|

|

|

183,519 |

|

|

|

164,166 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Increase in accounts receivable, prepaid |

|

|

|

|

|

|

|

|

|

|

|

|

| |

expenses and other assets |

|

|

(98,930 |

) |

|

|

(26,970 |

) |

|

|

(94,289 |

) |

|

|

(56,725 |

) |

| Increase (decrease) in accounts payable,

accrued |

|

|

|

|

|

|

|

|

|

|

|

|

| |

expenses and other liabilities |

|

|

43,740 |

|

|

|

(2,654 |

) |

|

|

(2,902 |

) |

|

|

457 |

|

| Decrease (increase) in accrued compensation |

|

|

59,914 |

|

|

|

26,678 |

|

|

|

(87,018 |

) |

|

|

(153,630 |

) |

| Contingent acquisition consideration paid |

|

|

(300 |

) |

|

|

(2,719 |

) |

|

|

(3,038 |

) |

|

|

(2,991 |

) |

| Mortgage origination activities, net |

|

|

3,694 |

|

|

|

6,285 |

|

|

|

7,192 |

|

|

|

9,070 |

|

| Sales to AR Facility, net |

|

|

20,155 |

|

|

|

40 |

|

|

|

110 |

|

|

|

6,058 |

|

| Net cash provided by (used in) operating

activities |

|

|

141,189 |

|

|

|

98,973 |

|

|

|

3,574 |

|

|

|

(33,595 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Investing activities |

|

|

|

|

|

|

|

|

|

|

|

|

| Acquisition of businesses, net of cash

acquired |

|

|

(17,772 |

) |

|

|

(59,698 |

) |

|

|

(17,772 |

) |

|

|

(59,698 |

) |

| Purchases of fixed assets |

|

|

(12,480 |

) |

|

|

(22,179 |

) |

|

|

(29,353 |

) |

|

|

(41,062 |

) |

| Purchases of warehouse fund assets |

|

|

(220,917 |

) |

|

|

(2,580 |

) |

|

|

(257,343 |

) |

|

|

(40,576 |

) |

| Proceeds from disposal of warehouse fund

assets |

|

|

71,494 |

|

|

|

- |

|

|

|

76,438 |

|

|

|

44,000 |

|

| Cash collections on AR Facility deferred purchase

price |

|

|

34,930 |

|

|

|

28,539 |

|

|

|

68,848 |

|

|

|

59,311 |

|

| Other investing activities |

|

|

(22,718 |

) |

|

|

(8,476 |

) |

|

|

(58,133 |

) |

|

|

(29,543 |

) |

| Net cash used in investing activities |

|

|

(167,463 |

) |

|

|

(64,394 |

) |

|

|

(217,315 |

) |

|

|

(67,568 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Financing activities |

|

|

|

|

|

|

|

|

|

|

|

|

| Increase in long-term debt, net |

|

|

106,528 |

|

|

|

47,248 |

|

|

|

1,476 |

|

|

|

219,668 |

|

| Purchases of non-controlling interests, net |

|

|

(7,083 |

) |

|

|

(3,789 |

) |

|

|

(9,737 |

) |

|

|

(16,333 |

) |

| Dividends paid to common shareholders |

|

|

- |

|

|

|

- |

|

|

|

(7,132 |

) |

|

|

(6,440 |

) |

| Distributions paid to non-controlling

interests |

|

|

(38,521 |

) |

|

|

(40,059 |

) |

|

|

(48,827 |

) |

|

|

(51,120 |

) |

| Issuance of subordinate voting shares |

|

|

- |

|

|

|

- |

|

|

|

286,924 |

|

|

|

- |

|

| Other financing activities |

|

|

2,964 |

|

|

|

(1,350 |

) |

|

|

17,093 |

|

|

|

13,637 |

|

| Net cash provided by financing activities |

|

|

63,888 |

|

|

|

2,050 |

|

|

|

239,797 |

|

|

|

159,412 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Effect of exchange rate changes on cash, |

|

|

|

|

|

|

|

|

|

|

|

|

| |

cash equivalents and restricted cash |

|

|

(2,386 |

) |

|

|

(1,704 |

) |

|

|

(4,446 |

) |

|

|

287 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net change in cash and cash |

|

|

|

|

|

|

|

|

|

|

|

|

| |

equivalents and restricted cash |

|

|

35,228 |

|

|

|

34,925 |

|

|

|

21,610 |

|

|

|

58,536 |

|

| Cash and cash equivalents and |

|

|

|

|

|

|

|

|

|

|

|

|

| |

restricted cash, beginning of period |

|

|

205,457 |

|

|

|

222,653 |

|

|

|

219,075 |

|

|

|

199,042 |

|

| Cash and cash equivalents and |

|

|

|

|

|

|

|

|

|

|

|

|

| |

restricted cash, end

of period |

|

$ |

240,685 |

|

|

$ |

257,578 |

|

|

$ |

240,685 |

|

|

$ |

257,578 |

|

| Colliers

International Group Inc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segmented

Results |

| (in thousands of

US dollars) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Asia |

|

Investment |

|

|

|

|

|

(unaudited) |

Americas |

|

EMEA |

|

Pacific |

|

Management |

|

Corporate |

|

Consolidated |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Three

months ended June 30 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

$ |

682,679 |

|

$ |

178,650 |

|

|

$ |

151,884 |

|

$ |

126,051 |

|

$ |

104 |

|

|

$ |

1,139,368 |

| |

Adjusted

EBITDA |

|

75,667 |

|

|

6,777 |

|

|

|

24,553 |

|

|

50,489 |

|

|

(1,862 |

) |

|

|

155,624 |

| |

Operating earnings

(loss) |

|

53,001 |

|

|

(661 |

) |

|

|

21,567 |

|

|

55,032 |

|

|

(14,191 |

) |

|

|

114,748 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Revenues |

$ |

631,332 |

|

$ |

173,818 |

|

|

$ |

153,915 |

|

$ |

118,860 |

|

$ |

113 |

|

|

$ |

1,078,038 |

| |

Adjusted EBITDA |

|

69,588 |

|

|

6,315 |

|

|

|

23,032 |

|

|

50,042 |

|

|

(1,897 |

) |

|

|

147,080 |

|

|

Operating earnings (loss) |

|

46,450 |

|

|

(5,053 |

) |

|

|

19,554 |

|

|

26,407 |

|

|

(12,096 |

) |

|

|

75,262 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Asia |

|

Investment |

|

|

|

|

|

|

Americas |

|

EMEA |

|

Pacific |

|

Management |

|

Corporate |

|

Consolidated |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Six months

ended June 30 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Revenues |

$ |

1,289,090 |

|

$ |

325,218 |

|

|

$ |

278,241 |

|

$ |

248,572 |

|

$ |

227 |

|

|

$ |

2,141,348 |

| |

Adjusted

EBITDA |

|

130,551 |

|

|

(5,209 |

) |

|

|

39,144 |

|

|

103,339 |

|

|

(3,506 |

) |

|

|

264,319 |

| |

Operating earnings

(loss) |

|

82,038 |

|

|

(21,122 |

) |

|

|

33,107 |

|

|

93,912 |

|

|

(29,860 |

) |

|

|

158,075 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Revenues |

$ |

1,212,883 |

|

$ |

317,189 |

|

|

$ |

274,008 |

|

$ |

239,606 |

|

$ |

255 |

|

|

$ |

2,043,941 |

| |

Adjusted EBITDA |

|

123,451 |

|

|

(4,946 |

) |

|

|

31,081 |

|

|

104,936 |

|

|

(2,819 |

) |

|

|

251,703 |

|

|

Operating earnings (loss) |

|

79,321 |

|

|

(30,087 |

) |

|

|

24,593 |

|

|

41,211 |

|

|

(17,632 |

) |

|

|

97,406 |

COMPANY CONTACTS:Jay S. HennickChairman & Chief Executive

Officer

Chris McLernonChief Executive Officer, Real Estate

Services

Christian MayerChief Financial Officer(416) 960-9500

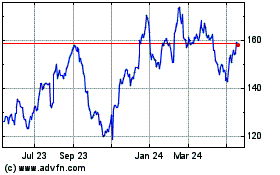

Colliers (TSX:CIGI)

Historical Stock Chart

From Oct 2024 to Nov 2024

Colliers (TSX:CIGI)

Historical Stock Chart

From Nov 2023 to Nov 2024