EA's Bad News for GameStop

February 03 2021 - 10:25AM

Dow Jones News

By Dan Gallagher

Once the Reddit-fueled frenzy on GameStop shares has faded,

investors will have to come back to reckoning with a tough business

made worse by the pandemic.

A hint of how much worse can be seen in the latest earnings

report from Electronic Arts.

The game publishing giant reported late Tuesday a 19% jump in

net bookings for the December quarter, driven by digital sales and

its live services. The company noted that 62% of its new game sales

for the quarter were digital, compared to 49% in last year's

holiday period.

Digital game sales create two problems for GameStop. One, they

generally don't move through GameStop stores, with the exception of

those driven by cards that the retailer sells.

They also don't generate used sales down the road --hurting what

has typically been GameStop's largest source of profits.

The shift to digital sales has been going on for a while, which

is why GameStop's current management is pursuing an "omni-channel"

strategy to build up its online business.

As EA's results show, it's a race against time.

This item is part of a Wall Street Journal live coverage event.

The full stream can be found by searching P/WSJL (WSJ Live

Coverage).

(END) Dow Jones Newswires

February 03, 2021 10:10 ET (15:10 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

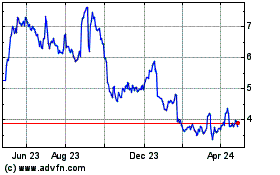

BlackBerry (TSX:BB)

Historical Stock Chart

From Mar 2024 to Apr 2024

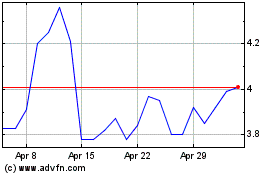

BlackBerry (TSX:BB)

Historical Stock Chart

From Apr 2023 to Apr 2024