Trading Craze Stirs Bubble Debate

February 03 2021 - 9:48AM

Dow Jones News

By Joe Wallace

Is the retail-trading frenzy a sign the market is near its

top?

Edward Smith, head of asset allocation research at U.K.

investment firm Rathbones, is skeptical.

"Often, in some corners [of the market] things get carried

away," he said. "In the most-shorted names, clearly that's going on

today."

Historically, bubbles in the broad market have been preceded by

a rally of 300% or more in the three years before they pop, far

exceeding the advance in U.S. stocks in recent years, Mr. Smith

said.

To be sure, valuations of U.S. stocks are high by historical

standards. "But those investors who apply a mean reversion approach

to valuations are misguided," Mr. Smith said. "We're living in a

world of structurally low interest rates that have been

exacerbated, but not caused, by Covid."

"Structurally lower interest rates mean structurally higher

valuations," he added, saying future profits are worth more in

present-value terms when the rate at which they are discounted

declines.

This item is part of a Wall Street Journal live coverage event.

The full stream can be found by searching P/WSJL (WSJ Live

Coverage).

(END) Dow Jones Newswires

February 03, 2021 09:33 ET (14:33 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

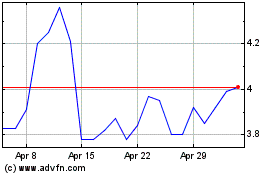

BlackBerry (TSX:BB)

Historical Stock Chart

From Mar 2024 to Apr 2024

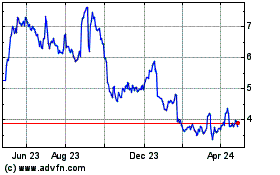

BlackBerry (TSX:BB)

Historical Stock Chart

From Apr 2023 to Apr 2024