Regulators in Asia Sound Alarm on Social Media-Driven Stocks

February 03 2021 - 7:50AM

Dow Jones News

By Quentin Webb

Officials in two of Asia's biggest financial centers are

watching U.S. markets warily, concerned that local investors could

get hurt by piling into American meme stocks, or that the behavior

could spread to their home turf.

On Wednesday, Hong Kong's Securities and Futures Commission

warned investors about "the risks of trading highly volatile

securities, including overseas-listed stocks as investment

discussion forums in social media gain prominence and become

increasingly influential."

"Investors should carefully manage market risks arising in any

very volatile market," the regulator said

(https://apps.sfc.hk/edistributionWeb/gateway/EN/news-and-announcements/news/doc?refNo=21PR11),

noting potential pitfalls around trading suspensions and margin

requirements.

A day earlier, Singaporean authorities had advised investors to

"be on heightened alert" about the risks posed by trading driven by

online forums and chat groups, and to beware the potential for

pump-and-dump schemes.

Singapore's monetary authority and its stock exchange noted

local interest "in recent activities in U.S. markets relating to

stocks such as GameStop, AMC Entertainment Holdings, and

BlackBerry," and said online discussions suggested similar

speculation could happen in Singapore. The duo cautioned

(https://www.mas.gov.sg/news/media-releases/2021/beware-of-risks-related-to-trading-incited-by-online-discussions)

they were looking out for "false trading" and other misconduct.

NOTE: In-line links reference additional content of interest

chosen by the WSJ news team.

This item is part of a Wall Street Journal live coverage event.

The full stream can be found by searching P/WSJL (WSJ Live

Coverage).

(END) Dow Jones Newswires

February 03, 2021 07:35 ET (12:35 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

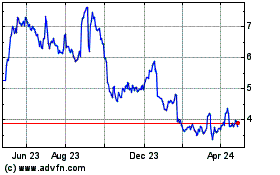

BlackBerry (TSX:BB)

Historical Stock Chart

From Mar 2024 to Apr 2024

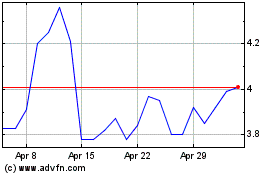

BlackBerry (TSX:BB)

Historical Stock Chart

From Apr 2023 to Apr 2024