Ford to Use Google's Android System in Most Cars -- 2nd Update

February 01 2021 - 1:50PM

Dow Jones News

By Mike Colias

Ford Motor Co. plans to use Google's Android operating system to

power its vehicle display screens starting in 2023, the latest auto

maker to tap Silicon Valley amid the accelerating digitization of

the car business.

The Dearborn, Mich.-based car company said Monday it has entered

into a six-year agreement with the tech giant to embed Google's

suite of apps, including voice commands and navigation, in

multimedia displays on all Ford models outside of China.

Ford also plans to involve Alphabet Inc.'s Google for cloud

services to help the auto maker develop in-car features and manage

the reams of data streaming from its vehicles. The computing

service will also be used to organize production.

Terms of the agreement weren't disclosed.

Silicon Valley firms are pushing further into the auto business,

eager to capitalize on the growth prospects of the car's evolution

as a rolling personal device. Tech companies now provide core

operating systems to run in-vehicle multimedia systems, while also

providing cloud-based service to store and manage the proliferation

of data produced by cars, many of which now are sold with broadband

connections.

Ford's eventual move to Google's Android system will be a hit to

BlackBerry Ltd., which for years has provided its QNX operating

system for Ford's vehicles. BlackBerry didn't immediately respond

to a request for comment.

Other auto makers, including Volvo Cars and Ford rival General

Motors Co., have in recent years chosen Google's Android system to

deliver navigation, voice commands and other services in its

cars.

Google, the No. 3 cloud provider in the U.S., has been stepping

up its efforts to overtake its rivals.

The car industry is one of several markets where Google,

Microsoft Corp, and Amazon.com Inc. are aggressively pushing their

cloud-computing business, in which they rent server capacity and

software tools to customers.

Microsoft has already struck deals to provide its Azure cloud

service to some of the world's largest car companies, including GM

and Volkswagen AG. Amazon's AWS cloud business works with Toyota

Motor Corp. and other auto makers.

The increasing role of technology in cars also is becoming a

source of friction between car makers and tech companies in the

battle to capture the potential billions of dollars from ads and

services that could flow through such systems.

Ford said it will use Google's cloud services for everything

from flagging potential new service offerings to managing equipment

on the factory floor and streamlining supply chains. The companies

said they will jointly staff a group to work on collaborative

projects.

The Google agreement comes after Ford has created its own

facilities in Michigan to store and process data, including a $200

million investment disclosed in 2017. Those data centers will

continue to operate, a Ford spokeswoman said.

Inside the car, both Google and Apple Inc. have for years been

offering dashboard features that mimic the look and feel of their

ubiquitous operating systems. Apple also has been working

secretively on its own car project for many years. Amazon's Alexa

personal assistant is featured across many models.

While most car makers offer so-called mirroring software to

replicate the Android or Apple interfaces on the car's display,

those features require drivers to connect their smartphones to the

vehicle. Ford, GM and others are now working with Google to offer

Android as built-in software, a move that allows owners to download

apps directly to their vehicle's tabletlike display, said Sam

Abuelsamid, an analyst at consultancy Guidehouse Insights.

Auto makers are mobilizing to offer in-car services to customers

that would allow the companies to collect recurring revenue streams

and update features on the fly, from automated-driving features to

new apps. They also are using data from vehicles to develop

features for future models.

Traditional car companies have struggled to offer infotainment

systems and apps that car owners embrace as much as they do their

smartphones. They also are grappling with how to capture, interpret

and monetize the growing amount of vehicle-generated data.

David McClelland, Ford's vice president of strategy and

partnerships, said the Google system will allow Ford to offer

customized features and services that would be different from those

of its competitors.

Write to Mike Colias at Mike.Colias@wsj.com

(END) Dow Jones Newswires

February 01, 2021 13:35 ET (18:35 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

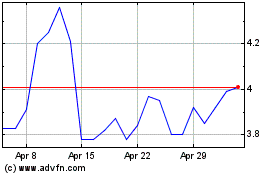

BlackBerry (TSX:BB)

Historical Stock Chart

From Mar 2024 to Apr 2024

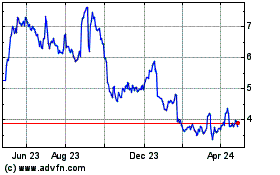

BlackBerry (TSX:BB)

Historical Stock Chart

From Apr 2023 to Apr 2024