By A Wall Street Journal Roundup

In the past few weeks, investors have bid up the share prices of

companies such as GameStop Corp. and AMC Entertainment Holdings

Inc., as short sellers have bet against them. Here is an analysis

of the challenges and prospects for these businesses.

GameStop

GameStop is trying to survive a yearslong erosion of its

business, which has relied for nearly four decades on people

visiting its bricks-and-mortar stores to buy the latest videogames

and consoles, as well as to trade-in and purchase used games and

gear.

The company has been stung by mounting competition from retail

giants such as Amazon.com Inc. and Walmart Inc., and the

advancement of technology that enables people to download games

directly from consoles and computers instead of buying hard copies.

It has also gone through a period of high executive turnover with

Chief Executive George Sherman, a longtime retail executive who

joined GameStop in 2019, being the fifth person to hold the role

since November 2017.

To preserve its business, Grapevine, Texas,-based GameStop has

been working to pay down debt and pledged to accelerate its

e-commerce operations. In the recent holiday season, the company's

e-commerce sales rose more than 300% from the comparable

year-earlier period, helped by the release of new videogame

consoles from Microsoft Corp. and Sony Corp.

One of GameStop's newest board members, Chewy Inc. co-founder

Ryan Cohen, urged the company last year to exit underperforming

stores in the U.S. He also called for the company to close

nonessential operations in Europe and Australia and use the

proceeds to make tech improvements, such as revamping GameStop's

online store.

Analysts expect GameStop to post its fourth consecutive annual

decline in revenue in its latest fiscal year amid declines in its

core operations and efforts to streamline its business.

-- Sarah E. Needleman

AMC Entertainment Holdings

AMC, the world's largest cinema chain with nearly 1,000

locations, became the latest darling of the retail trading scene

after it signed a series of financing deals that are expected to

help it ward off bankruptcy.

Since the onset of the coronavirus pandemic forced AMC to

temporarily close most of its theaters, the Leawood, Kan.-based

company has faced the real possibility running out of cash, and

warned investors in October that it may need to file for chapter 11

if it doesn't raise enough money from investors willing to bet on

its recovery.

AMC's fortunes began to turn with the introduction of

coronavirus vaccines late last year, which raised hopes among

investors that it won't be too long before people start going out

to the movies again.

The company has raised about $1.3 billion of debt and equity

financing since December, selling out its latest shelf offering on

Jan. 27 right after users in Reddit's WallStreetBets forum turned

their attention to it as the next stock to prop up.

However, AMC isn't totally out of the woods yet, and Chief

Executive Adam Aron warned on Jan. 25 that while "any talk of an

imminent bankruptcy is completely off the table," investors in AMC

are still advised to exercise caution as the company's future cash

needs are uncertain in light of the continuing pandemic and new

strains of the coronavirus.

-- Alexander Gladstone

Bed Bath & Beyond Inc.

After an activist investor ousted prior management in 2019, the

home-goods retailer is trying to fashion a turnaround under new CEO

Mark Tritton, a former Target Corp. executive. Mr. Tritton has

hired a new leadership team that is decluttering stores,

simplifying prices and streamlining merchandise. "The wider the

assortment, the more confused the customer is," Mr. Tritton said in

November.

The company is closing about 200 of its more than 970 Bed Bath

& Beyond stores and has sold assets deemed noncore such as

Christmas Tree Shops. It has also launched a share repurchase

program totaling as much as $825 million over three years.

The company, which also owns BuyBuy Baby, is benefiting from a

shift in pandemic-driven spending toward items for the home. But

some analysts worry that once life returns to normal, it will give

up some gains as shoppers spend more on travel and eating out. The

retailer also faces heavy competition from mass market chains like

Target and online rivals such as Amazon. On Jan. 26, before the

stock gave up some of its recent gains, UBS downgraded it to sell

over concerns that its turnaround would proceed in fits and starts

and other issues.

-- Suzanne Kapner

Nokia Corp.

Nokia in its heyday dominated the market for hardy handsets

built for making phone calls and not much else. Then the smartphone

revolution robbed the Finnish company of the market share it once

enjoyed, leading the company to abandon cellphones and focus on the

building blocks of the mobile economy: network equipment that links

mobile devices to the rest of the internet.

Nokia's profitability has suffered since its 2016 purchase of

Alcatel-Lucent, another maker of network electronics. The merger

made the new company more complex and forced expensive upgrades for

clients that sought standardized cellular equipment. Rivals

Ericsson AB and Huawei Technologies Co. have used the opportunity

to gain market share in key countries.

The company still supplies much of the world's network gear, a

market poised for growth this year as carriers install new

technology to support faster fifth-generation, or 5G, wireless

service. The company last year shook up its management team by

naming a new chief executive and finance chief.

Nokia is preparing to sell more machines to replace cell-tower

equipment from China-based Huawei, which the U.S. and many allied

countries have effectively banned due to national-security

concerns. But geopolitics cut both ways, and increasing tensions

with the West could dent Nokia's own sales in China.

-- Drew FitzGerald

BlackBerry Ltd.

BlackBerry CEO John Chen successfully rescued the Canadian

company from near collapse after he was hired in 2013 to reinvent a

smartphone maker that had ceded its global market dominance to more

nimble competitors such as Apple Inc. and Samsung Electronics Co.

He shrank the company's staff and global operations and licensed

other manufacturers to make BlackBerry phones.

Mr. Chen, a software veteran, sought to reinvent BlackBerry by

selling software and services designed to shield business and

government communication systems and mobile devices from viruses

and other online threats.

He sought to expand this business in 2018 with a $1.4 billion

purchase of Cylance Inc., a maker of antivirus software. The

acquisition hasn't delivered the promised turnaround. Cylance's

co-founder Stuart McClure departed in 2019 and BlackBerry revenues

continue to shrink. The company has reported net losses for the

last seven quarters.

Another setback is uneven demand for automobiles during the

Covid-19 pandemic. BlackBerry sells security products to auto

makers to protect computer and communication systems in cars from

cyber threats.

-- Jacquie McNish

(END) Dow Jones Newswires

January 31, 2021 16:51 ET (21:51 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

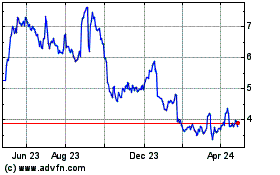

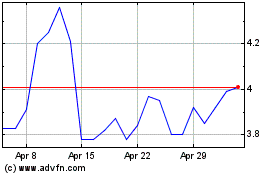

BlackBerry (TSX:BB)

Historical Stock Chart

From Mar 2024 to Apr 2024

BlackBerry (TSX:BB)

Historical Stock Chart

From Apr 2023 to Apr 2024