Deutsche B�rse agreed with SIX Group AG to take over the

Eurex joint venture and acquire the remaining participation in

Eurex Zürich AG

On June 7, 2011, Deutsche B�rse signed a share purchase

agreement (which is referred to herein as the “share purchase

agreement”) with SIX Group AG and SIX Swiss Exchange AG, a wholly

owned subsidiary of SIX Group AG, to purchase from SIX Group AG the

remaining 50% shareholding in Eurex Zürich AG as well as the Swiss

derivatives business relating to Eurex Zurich AG with economic

effect as of January 1, 2012. Upon closing of the transaction and

with economic effect as of January 1, 2012, Deutsche B�rse will

receive 100% of Eurex’s economic interest instead of the 85% it is

currently entitled to. The purchase price will be €590 million, 50%

of which will consist of shares of Holdco that Deutsche B�rse will

receive for the tender of Deutsche B�rse treasury shares in the

exchange offer and 50% of which will consist of cash. If the

conditions to completing the combination of Deutsche B�rse and NYSE

Euronext have not been satisfied by March 31, 2012, Deutsche B�rse

will pay to SIX Group AG 50% of the purchase price by delivery of

Deutsche B�rse treasury shares and 50% of the purchase price in

cash. For purposes of the purchase price, the Holdco shares (and

the Deutsche B�rse shares, as the case may be) have been valued at

the one-month volume weighted average price of a Deutsche B�rse

share prior to the execution of the share purchase agreement.

The acquisition of the Eurex business by Deutsche B�rse is

structured as a spin-off by SIX Swiss Exchange AG of the Swiss

derivatives business regarding Eurex Zürich AG to a newly formed

Swiss company (which is referred to herein as “Swiss NewCo”). The

spin-off will include the shares in Eurex Zürich AG held by SIX

Swiss Exchange AG, the rights to the Eurex system and the brand

“Eurex” and other assets and contracts required for the current

operation of the Swiss derivatives business and relating to Eurex

Zürich AG. Assets and agreements held by SIX Swiss Exchange AG

regarding the CHF Repo Market and the OTC Spot Market will not form

a part of the spin-off. However, Eurex Zürich AG will continue to

operate the CHF Repo Market and the OTC Spot Market following

closing (with economic effect as from January 1, 2012 for its own

account) based on continued business management agreements

(Geschäftsbesorgungsverträge) and license agreements. Following the

spin-off, all shares in Swiss NewCo will be acquired by Deutsche

B�rse. Through the acquisition of these shares in Swiss NewCo,

Deutsche B�rse will become sole indirect shareholder of Eurex

Zürich AG and will carry on the business activities of Eurex in

Germany and Switzerland.

Following the closing of the Eurex transaction, the

shareholders’ agreement dated August 31, 1998 between Deutsche

B�rse and SIX Swiss Exchange AG, the Investment Protection

Agreements relating to International Securities Exchange (ISE) and

European Energy Exchange (EEX), the operating agreement

(Betriebsführungsvertrag) between SIX Swiss Exchange and Eurex

Zürich AG and the letters of comfort issued by SIX Swiss Exchange

AG in favor of Eurex Clearing AG, as well as a number of other

agreements that have been entered into by the parties in relation

to the Eurex joint venture, will be terminated or transferred to

Swiss NewCo.

SIX Group AG and SIX Swiss Exchange AG have agreed in the share

purchase agreement that neither they nor their affiliated companies

will engage directly or indirectly in competition with Eurex

regarding the derivatives business, as it is presently operated by

Eurex, for a term of two years after the closing of the Eurex

transaction. In turn, Deutsche B�rse has agreed to continue the

business of Eurex Zürich AG, largely as it currently stands

(including the CHF Repo Market and the OTC Spot Market) and with a

competitive operating platform, for at least three years from

closing of the Eurex transaction.

Other areas of cooperation between Deutsche B�rse and SIX Group,

such as STOXX and Scoach, will not be affected by the share

purchase agreement. However, the parties agreed to commence

non-binding discussions for the purpose of evaluating other

co-operations after the closing.

The closing of the Eurex transaction is subject to, among other

approvals, antitrust approvals, other regulatory approvals, if

required, and either the completion of the combination of Deutsche

B�rse and NYSE Euronext or the occurrence of March 31, 2012. If, at

March 31, 2012, the settlement of Holdco’s exchange offer for

Deutsche B�rse shares (i.e. , the delivery of HoldCo shares for

tendered Deutsche B�rse shares) has not been completed, but all

conditions to completing the combination between Deutsche B�rse and

NYSE Euronext have been satisfied, then Deutsche B�rse’s obligation

to pay the share portion of the consideration in Holdco shares will

be extended until April 15, 2012. After such time, assuming

completion of all other conditions under the share purchase

agreement, the share portion of the transaction consideration will

be made in Deutsche B�rse shares. If the closing conditions to the

share purchase agreement are not satisfied by June 30, 2012, either

party may withdraw from the share purchase agreement.

Amsterdam, 16 June 2011

Alpha Beta Netherlands Holding N.V.

Disclaimer

Safe Harbour Statement

In connection with the proposed business combination transaction

between NYSE Euronext and Deutsche Boerse AG, Alpha Beta

Netherlands Holding N.V. (“Holding”), a newly formed holding

company, has filed, and the SEC has declared effective on May 3,

2011, a Registration Statement on Form F-4 with the U.S. Securities

and Exchange Commission (“SEC”) that includes (1) a proxy statement

of NYSE Euronext that will also constitute a prospectus for Holding

and (2) an offering prospectus of Holding to be used in connection

with Holding’s offer to acquire Deutsche Boerse AG shares held by

U.S. holders. Holding has also filed an offer document with the

German Federal Financial Supervisory Authority (Bundesanstalt fuer

Finanzdienstleistungsaufsicht) (“BaFin”), which was approved by the

BaFin for publication pursuant to the German Takeover Act

(Wertpapiererwerbs-und Übernahmegesetz), and was published on May

4, 2011.

Investors and security holders are urged to read the definitive

proxy statement/prospectus, the offering prospectus, the offer

document and published additional accompanying information in

connection with the exchange offer regarding the proposed business

combination transaction because they contain important information.

You may obtain a free copy of the definitive proxy

statement/prospectus, the offering prospectus and other related

documents filed by NYSE Euronext and Holding with the SEC on the

SEC’s website at www.sec.gov. The definitive proxy

statement/prospectus and other documents relating thereto may also

be obtained for free by accessing NYSE Euronext’s website at

www.nyse.com. The offer document and published additional

accompanying information in connection with the exchange offer are

available at Holding’s website at www.global-exchange-operator.com.

Holders of Deutsche B�rse shares who have accepted the exchange

offer have certain withdrawal rights which are set forth in the

offer document.

This document is neither an offer to purchase nor a solicitation

of an offer to sell shares of Holding, Deutsche Boerse AG or NYSE

Euronext. The final terms and further provisions regarding the

public offer are disclosed in the offer document that has been

approved by the BaFin and in documents that have been filed with

the SEC.

No offering of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the U.S.

Securities Act of 1933, as amended, and applicable European

regulations. The exchange offer and the exchange offer document

shall not constitute an issuance, publication or public advertising

of an offer pursuant to laws and regulations of jurisdictions other

than those of Germany, United Kingdom of Great Britain and Northern

Ireland and the United States of America. The relevant final terms

of the proposed business combination transaction will be disclosed

in the information documents reviewed by the competent European

market authorities.

Subject to certain exceptions, in particular with respect to

qualified institutional investors (tekikaku kikan toshika) as

defined in Article 2 para. 3 (i) of the Financial Instruments and

Exchange Act of Japan (Law No. 25 of 1948, as amended), the

exchange offer will not be made directly or indirectly in or into

Japan, or by use of the mails or by any means or instrumentality

(including without limitation, facsimile transmission, telephone

and the internet) of interstate or foreign commerce or any facility

of a national securities exchange of Japan. Accordingly, copies of

this announcement or any accompanying documents may not be,

directly or indirectly, mailed or otherwise distributed, forwarded

or transmitted in, into or from Japan.

The shares of Holding have not been, and will not be, registered

under the applicable securities laws of Japan. Accordingly, subject

to certain exceptions, in particular with respect to qualified

institutional investors (tekikaku kikan toshika) as defined in

Article 2 para. 3 (i) of the Financial Instruments and Exchange Act

of Japan (Law No. 25 of 1948, as amended), the shares of Holding

may not be offered or sold within Japan, or to or for the account

or benefit of any person in Japan.

Participants in the Solicitation

NYSE Euronext, Deutsche Boerse AG, Holding and their respective

directors and executive officers and other members of management

and employees may be deemed to be participants in the solicitation

of proxies from NYSE Euronext stockholders in respect of the

proposed business combination transaction. Additional information

regarding the interests of such potential participants will be

included in the definitive proxy statement/prospectus and the other

relevant documents filed with the SEC.

Forward-Looking Statements

This document includes forward-looking statements about NYSE

Euronext, Deutsche Boerse AG, Holding, the enlarged group and other

persons, which may include statements about the proposed business

combination, the likelihood that such transaction could be

consummated, the effects of any transaction on the businesses of

NYSE Euronext or Deutsche Boerse AG, and other statements that are

not historical facts. By their nature, forward-looking statements

involve risks and uncertainties because they relate to events and

depend on circumstances that may or may not occur in the future.

Forward-looking statements are not guarantees of future performance

and actual results of operations, financial condition and

liquidity, and the development of the industries in which NYSE

Euronext and Deutsche Boerse AG operate may differ materially from

those made in or suggested by the forward-looking statements

contained in this document. Any forwardlooking statements speak

only as at the date of this document. Except as required by

applicable law, none of NYSE Euronext, Deutsche Boerse AG or

Holding undertakes any obligation to update or revise publicly any

forward-looking statement, whether as a result of new information,

future events or otherwise.

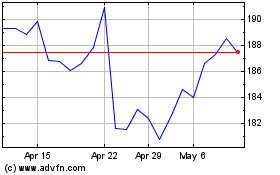

Deutsche Boerse (TG:DB1)

Historical Stock Chart

From Oct 2024 to Nov 2024

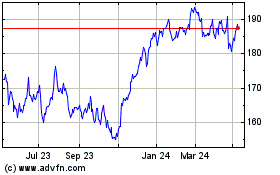

Deutsche Boerse (TG:DB1)

Historical Stock Chart

From Nov 2023 to Nov 2024