0001854139false00018541392024-11-062024-11-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO

SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): November 6, 2024

ZEVIA PBC

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

Delaware |

001-40630 |

86-2862492 |

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

|

15821 Ventura Blvd., Suite 135, Encino, CA |

|

91436 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

(424) 343-2654

(Registrant’s Telephone Number, Including Area Code)

Former Name or Former Address, if Changed Since Last Report: N/A

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Class A common stock, par value $0.001 per share |

|

ZVIA |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

Zevia PBC ("the Company") issued an earnings release on November 6, 2024, announcing its financial results for the third quarter ended September 30, 2024.

A copy of the earnings release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information furnished in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, and shall not be deemed incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

ZEVIA PBC |

|

|

|

Date: November 6, 2024 |

|

/s/ LORNA R. SIMMS |

|

|

Name: |

Lorna R. Simms |

|

|

Title: |

SVP, General Counsel and Corporate Secretary |

Exhibit 99.1

Zevia Announces Third Quarter 2024 Results

Net loss improved to $2.8 million and Adjusted EBITDA loss improved to $1.5 million year over year

Expands Distribution into 4,300 Walmart Stores

LOS ANGELES – November 6, 2024 (BUSINESS WIRE) – Zevia PBC (“Zevia” or the “Company”) (NYSE: ZVIA), the Company bringing naturally delicious, zero sugar, clean-label beverages across usage occasions today reported results for the third quarter ended September 30, 2024.

Third Quarter 2024 Highlights

•Net sales of $36.4 million, a decline of $6.7 million year over year

•Gross profit margin was 49.1%, an improvement of 3.7 percentage points year over year

•Net loss was $2.8 million, including $1.0 million of non-cash equity-based compensation expense, an improvement of $8.4 million year over year

•Adjusted EBITDA loss was $1.5 million(1), an improvement of $7.6 million year over year

•Loss per share was $0.04 to Zevia’s Class A Common stockholders, an improvement of $0.12 year over year

•Subsequent to the third quarter, Zevia expanded distribution to more than 4,300 U.S. Walmart stores from the 800 it previously served

“We are very pleased to have delivered vast improvements in net loss and adjusted EBITDA, despite coming in slightly below our net sales expectations,” said Amy Taylor, President and Chief Executive Officer. “Through the strong execution of our Productivity Initiative, we now expect to achieve $15 million in annual cost savings, the majority of which we plan to reinvest in growth initiatives”.

“Looking ahead, we expect to resume net sales growth in the fourth quarter, in large part due to expanded nationwide distribution at Walmart. This partnership not only bolsters volume, but also fosters awareness and trial across regions where we are underpenetrated and growing fastest. Overall, we remain laser focused on executing a powerful brand marketing strategy, building sustainable distribution expansion and delivering product innovation that is unmatched in the natural soda category, all of which we believe will help pave the way to strong profitable growth long term.”

Third Quarter 2024 Results

Net sales decreased 15.6% to $36.4 million in the third quarter of 2024 compared to $43.1 million in the third quarter of 2023, largely due to the expected lost distribution in our club channel and one customer in our mass channel, resulting in reduced volumes of 12.2%, and to a lesser degree due to increased promotional activity at retailers.

Gross profit margin was 49.1% in the third quarter of 2024 compared to 45.4% in the third quarter of 2023, an improvement of 3.7 percentage points. The improvement was primarily due to lower inventory write-downs and favorable unit costs, partially offset by higher promotional levels.

(1) Adjusted EBITDA is a non-GAAP financial measure. See the supplementary schedules in this press release for a discussion of how we define and calculate this measure and a reconciliation thereof to the most directly comparable GAAP measure.

Selling and marketing expenses were $12.0 million, or 32.9% of net sales, in the third quarter of 2024 compared to $20.5 million, or 47.5%, of net sales in the third quarter of 2023. The improvement was primarily due to a decrease in freight transfers and warehousing costs as a result of the impact of supply chain logistics challenges in the prior year as well as the Productivity Initiative, and a decrease in repackaging and freight out costs. These decreases were partially offset by investments made in marketing to drive brand awareness.

General and administrative expenses were $7.4 million, or 20.3% of net sales, in the third quarter of 2024 compared to $8.3 million, or 19.1%, of net sales in the third quarter of 2023. The decrease of $0.9 million was primarily driven by a decrease in costs as a result of our Productivity Initiative.

Restructuring expenses were $0.1 million in the third quarter of 2024 and primarily includes costs to exit two of our third-party warehouse and distribution facilities.

Equity-based compensation, a non-cash expense, was $1.0 million in the third quarter of 2024, compared to $1.9 million in the third quarter of 2023. The decrease of $0.8 million was largely due to the accelerated method of expense recognition on certain equity awards issued in connection with the Company’s IPO in 2021, partially offset by equity-based compensation expense related to new equity awards granted.

Net loss for the third quarter of 2024 was $2.8 million, compared to net loss of $11.3 million in the third quarter of 2023.

Loss per share for the third quarter of 2024 was $0.04 to Zevia’s Class A Common stockholders, compared to loss per share of $0.16 in the third quarter of 2023.

Adjusted EBITDA loss was $1.5 million in the third quarter of 2024, compared to an Adjusted EBITDA loss of $9.1 million in the third quarter of 2023. Adjusted EBITDA is a non-GAAP financial measure. See the supplementary schedules in this press release for a discussion of how we define and calculate this measure and a reconciliation thereof to the most directly comparable GAAP measure.

Balance Sheet and Cash Flows

As of September 30, 2024, the Company had $32.7 million in cash and cash equivalents and no outstanding debt, as well as an unused credit line of $20 million.

Guidance

The Company is updating its guidance for the full year of 2024 to reflect recent results. Net sales for the full year of 2024 are now expected to be in the range of $154 million to $156 million. For the fourth quarter of 2024, net sales are expected to be in the range of $38 million to $40 million. Adjusted EBITDA losses for the fourth quarter of 2024 are expected to be in the range of $1.8 million to $2.2 million.

We have not provided the forward-looking GAAP equivalent to our Adjusted EBITDA outlook or a GAAP reconciliation as a result of the uncertainty regarding, and the potential variability of, reconciling items such as stock-based compensation, income tax, and charges associated with restructuring and cost saving initiatives, including but not limited to severance costs, warehouse/distribution facility exit costs, and asset impairments. Accordingly, a reconciliation of this non-GAAP guidance metric to its corresponding GAAP equivalent is not available without unreasonable effort. These items are inherently variable and uncertain and depend on various factors, some of which are outside of the Company’s control or ability to predict. However, it is important to note that the reconciling items could have a significant effect on future GAAP results. We have provided historical reconciliations of GAAP to non-GAAP metrics in tables at the end of this release. For more information regarding the non-GAAP financial measures discussed in this earnings release, please see "Reconciliation of GAAP to non-GAAP Financial Results" below.

Webcast

The Company will host a conference call today at 8:30 a.m. Eastern Time to discuss this earnings release. Investors and other interested parties may listen to the webcast of the conference call by logging on via the Investor Relations section of Zevia’s website at https://investors.zevia.com/ or directly here. A replay of the webcast will be available for approximately thirty (30) days following the call.

Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate or imply future results, performance or achievements, and may contain words such as “anticipate,” “believe,” “consider,” “contemplate,” “continue,” “could,’” “estimate,” “expect,” “forecast,” “guidance,” “intend,” “may,” “on track,” “outlook,” “plan,” “potential,” “predict,” “project,” “pursue,” “seek,” “should,” “target,” “will,” “would,” or the negative of these words or other similar words, terms or expressions with similar meanings. Forward-looking statements should not be read as a guarantee of future performance or results and will not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved. Forward-looking statements contained in this press release relate to, among other things, statements regarding Guidance, expected benefits of and annualized cost savings from the Productivity Initiative, long-term growth opportunities, future results of operations or financial condition, strategic direction, and plans and objectives of management for future operations, including marketing, distribution expansion and product innovation. Forward-looking statements are based on current expectations, forecasts and assumptions that involve risks and uncertainties, including, but not limited to, the ability to develop and maintain our brand, our ability to successfully execute on our rebranding strategy, cost reduction initiatives, and to compete effectively, our ability to maintain supply chain service levels and any disruption of our supply chain, product demand, changes in the retail landscape or in sales to any key customer, change in consumer preferences, pricing factors, our ability to manage changes in our workforce, future cyber incidents and other disruptions to our information systems, failure to comply with personal data protection and privacy laws, the impact of inflation on our sales growth and cost structure such as increased commodity, packaging, transportation and freight, warehouse, labor and other input costs and other economic conditions, our reliance on contract manufacturers and service providers, competitive and governmental factors outside of our control, such as pandemics or epidemics, adverse global macroeconomic conditions, including relatively high interest rates, instability in financial institutions and a recessionary environment, any potential shutdown of the U.S. government, and geopolitical events or conflicts, including the military conflicts in Ukraine and the Middle East and trade tensions between the U.S. and China, our ability to maintain our listing on the New York Stock Exchange, failure to adequately protect our intellectual property rights or infringement on intellectual property rights of others, potential liabilities and costs from litigation, claims, legal or regulatory proceedings, inquiries or investigations, that may cause our business, strategy or actual results to differ materially from the forward-looking statements. We do not intend and undertake no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by applicable law. Investors are referred to our filings with the U.S. Securities and Exchange Commission for additional information regarding the risks and uncertainties that may cause actual results to differ materially from those expressed in any forward-looking statement.

About Zevia

Zevia PBC, a Delaware public benefit corporation designated as a “Certified B Corporation,” is focused on addressing the global health challenges resulting from excess sugar consumption by offering a broad portfolio of zero sugar, zero calorie, naturally sweetened beverages. All Zevia® beverages are made with a handful of simple, plant-based ingredients, contain no artificial sweeteners, and are Non-GMO Project verified, gluten-free, Kosher, and vegan. Zevia is distributed in more than 34,000 retail locations in the U.S. and Canada through a diverse network of major retailers in the grocery, drug, warehouse club, mass, natural, convenience and ecommerce channels.

(ZEVIA-F)

Contacts

Investors

Greg Davis

Zevia PBC

424-343-2654

Gregory@zevia.com

Reed Anderson

ICR

646-277-1260

Reed.Anderson@icrinc.com

ZEVIA PBC

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS (UNAUDITED)

(in thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net sales |

|

$ |

36,366 |

|

|

$ |

43,089 |

|

|

$ |

115,591 |

|

|

$ |

128,630 |

|

Cost of goods sold |

|

|

18,516 |

|

|

|

23,517 |

|

|

|

63,080 |

|

|

|

69,261 |

|

Gross profit |

|

|

17,850 |

|

|

|

19,572 |

|

|

|

52,511 |

|

|

|

59,369 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Selling and marketing |

|

|

11,981 |

|

|

|

20,455 |

|

|

|

40,673 |

|

|

|

48,467 |

|

General and administrative |

|

|

7,377 |

|

|

|

8,250 |

|

|

|

23,186 |

|

|

|

23,102 |

|

Equity-based compensation |

|

|

1,034 |

|

|

|

1,876 |

|

|

|

3,950 |

|

|

|

6,614 |

|

Depreciation and amortization |

|

|

310 |

|

|

|

411 |

|

|

|

1,041 |

|

|

|

1,234 |

|

Restructuring |

|

|

112 |

|

|

|

— |

|

|

|

977 |

|

|

|

— |

|

Total operating expenses |

|

|

20,814 |

|

|

|

30,992 |

|

|

|

69,827 |

|

|

|

79,417 |

|

Loss from operations |

|

|

(2,964 |

) |

|

|

(11,420 |

) |

|

|

(17,316 |

) |

|

|

(20,048 |

) |

Other income, net |

|

|

118 |

|

|

|

165 |

|

|

|

357 |

|

|

|

908 |

|

Loss before income taxes |

|

|

(2,846 |

) |

|

|

(11,255 |

) |

|

|

(16,959 |

) |

|

|

(19,140 |

) |

(Benefit) provision for income taxes |

|

|

(4 |

) |

|

|

(5 |

) |

|

|

43 |

|

|

|

31 |

|

Net loss and comprehensive loss |

|

|

(2,842 |

) |

|

|

(11,250 |

) |

|

|

(17,002 |

) |

|

|

(19,171 |

) |

Loss attributable to noncontrolling interest |

|

|

315 |

|

|

|

3,033 |

|

|

|

2,760 |

|

|

|

4,932 |

|

Net loss attributable to Zevia PBC |

|

$ |

(2,527 |

) |

|

$ |

(8,217 |

) |

|

$ |

(14,242 |

) |

|

$ |

(14,239 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share attributable to common stockholders |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.04 |

) |

|

$ |

(0.16 |

) |

|

$ |

(0.25 |

) |

|

$ |

(0.27 |

) |

Diluted |

|

$ |

(0.04 |

) |

|

$ |

(0.16 |

) |

|

$ |

(0.25 |

) |

|

$ |

(0.27 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

59,490,258 |

|

|

|

50,754,470 |

|

|

|

58,037,780 |

|

|

|

50,074,992 |

|

Diluted |

|

|

59,490,258 |

|

|

|

50,754,470 |

|

|

|

58,037,780 |

|

|

|

50,074,992 |

|

ZEVIA PBC

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED)

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

September 30, 2024 |

|

|

December 31, 2023 |

|

ASSETS |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

32,688 |

|

|

$ |

31,955 |

|

Accounts receivable, net |

|

|

10,008 |

|

|

|

11,119 |

|

Inventories |

|

|

20,690 |

|

|

|

34,550 |

|

Prepaid expenses and other current assets |

|

|

2,676 |

|

|

|

5,063 |

|

Total current assets |

|

|

66,062 |

|

|

|

82,687 |

|

Property and equipment, net |

|

|

1,490 |

|

|

|

2,109 |

|

Right-of-use assets under operating leases, net |

|

|

1,509 |

|

|

|

1,959 |

|

Intangible assets, net |

|

|

3,276 |

|

|

|

3,523 |

|

Other non-current assets |

|

|

522 |

|

|

|

579 |

|

Total assets |

|

$ |

72,859 |

|

|

$ |

90,857 |

|

LIABILITIES AND EQUITY |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

|

14,865 |

|

|

$ |

21,169 |

|

Accrued expenses and other current liabilities |

|

|

7,700 |

|

|

|

5,973 |

|

Current portion of operating lease liabilities |

|

|

629 |

|

|

|

575 |

|

Total current liabilities |

|

|

23,194 |

|

|

|

27,717 |

|

Operating lease liabilities, net of current portion |

|

|

892 |

|

|

|

1,373 |

|

Other non-current liabilities |

|

|

58 |

|

|

|

— |

|

Total liabilities |

|

|

24,144 |

|

|

|

29,090 |

|

|

|

|

|

|

|

|

Stockholders’ equity |

|

|

|

|

|

|

Class A common stock |

|

|

60 |

|

|

|

54 |

|

Class B common stock |

|

|

13 |

|

|

|

17 |

|

Additional paid-in capital |

|

|

188,014 |

|

|

|

191,144 |

|

Accumulated deficit |

|

|

(115,579 |

) |

|

|

(101,337 |

) |

Total Zevia PBC stockholders’ equity |

|

|

72,508 |

|

|

|

89,878 |

|

Noncontrolling interests |

|

|

(23,793 |

) |

|

|

(28,111 |

) |

Total equity |

|

|

48,715 |

|

|

|

61,767 |

|

Total liabilities and equity |

|

$ |

72,859 |

|

|

$ |

90,857 |

|

ZEVIA PBC

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS (UNAUDITED)

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

Operating activities: |

|

|

|

|

|

|

Net loss |

|

$ |

(17,002 |

) |

|

$ |

(19,171 |

) |

Adjustments to reconcile net loss to net cash provided by (used in) operating activities: |

|

|

|

|

|

|

Non-cash lease expense |

|

|

450 |

|

|

|

423 |

|

Depreciation and amortization |

|

|

1,041 |

|

|

|

1,234 |

|

Loss on disposal of property, equipment and software, net |

|

|

55 |

|

|

|

101 |

|

Amortization of debt issuance cost |

|

|

57 |

|

|

|

57 |

|

Equity-based compensation |

|

|

3,950 |

|

|

|

6,614 |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Accounts receivable, net |

|

|

1,111 |

|

|

|

(5,295 |

) |

Inventories |

|

|

13,860 |

|

|

|

(21,822 |

) |

Prepaid expenses and other assets |

|

|

2,387 |

|

|

|

(451 |

) |

Accounts payable |

|

|

(6,296 |

) |

|

|

30,312 |

|

Accrued expenses and other current liabilities |

|

|

1,727 |

|

|

|

(1,234 |

) |

Operating lease liabilities |

|

|

(427 |

) |

|

|

(436 |

) |

Other non-current liabilities |

|

|

58 |

|

|

|

— |

|

Net cash provided by (used in) operating activities |

|

|

971 |

|

|

|

(9,668 |

) |

Investing activities: |

|

|

|

|

|

|

Purchases of property, equipment and software |

|

|

(238 |

) |

|

|

(1,557 |

) |

Proceeds from sales of property, equipment and software |

|

|

— |

|

|

|

2,343 |

|

Net cash (used in) provided by investing activities |

|

|

(238 |

) |

|

|

786 |

|

Financing activities: |

|

|

|

|

|

|

Proceeds from revolving line of credit |

|

|

8,000 |

|

|

|

— |

|

Repayment of revolving line of credit |

|

|

(8,000 |

) |

|

|

— |

|

Proceeds from exercise of stock options |

|

|

— |

|

|

|

25 |

|

Net cash provided by financing activities |

|

|

— |

|

|

|

25 |

|

Net change from operating, investing, and financing activities |

|

|

733 |

|

|

|

(8,857 |

) |

Cash and cash equivalents at beginning of period |

|

|

31,955 |

|

|

|

47,399 |

|

Cash and cash equivalents at end of period |

|

$ |

32,688 |

|

|

$ |

38,542 |

|

|

|

|

|

|

|

|

Use of Non-GAAP Financial Information

We use Adjusted EBITDA, a financial measure that is not calculated in accordance with U.S. generally accepted accounting principles (“GAAP”). The Company’s management believes that Adjusted EBITDA, when taken together with our financial results presented in accordance with GAAP, provides meaningful supplemental information regarding our operating performance and facilitates internal comparisons of our historical operating performance on a more consistent basis by excluding certain items that may not be indicative of our business, results of operations or outlook. In particular, we believe that the use of Adjusted EBITDA is helpful to our investors as it is a measure used by management in assessing the health of our business, determining incentive compensation and evaluating our operating performance, as well as for internal planning and forecasting purposes.

We calculate Adjusted EBITDA as net income (loss) adjusted to exclude: (1) other income (expense), net, which includes interest (income) expense, foreign currency (gains) losses, (2) provision (benefit) for income taxes, (3) depreciation and amortization, (4) equity-based compensation, and (5) restructuring expenses (for 2024, in light of our Productivity Initiative). Adjusted EBITDA may in the future also be adjusted for amounts impacting net income related to the Tax Receivable Agreement liability and other infrequent and unusual transactions.

Adjusted EBITDA is presented for supplemental informational purposes only, has limitations as an analytical tool and should not be considered in isolation or as a substitute for financial information presented in accordance with GAAP. Some of the limitations of Adjusted EBITDA include that (1) it does not properly reflect capital commitments to be paid in the future, (2) although depreciation and amortization are non-cash charges, the underlying assets may need to be replaced and Adjusted EBITDA does not reflect these capital expenditures, (3) it does not consider the impact of equity-based compensation expense, including the potential dilutive impact thereof, and (4) it does not reflect other non-operating expenses, including interest (income) expense, foreign currency (gains) losses, and restructuring. In addition, our use of Adjusted EBITDA may not be comparable to similarly titled measures of other companies because they may not calculate Adjusted EBITDA in the same manner, limiting its usefulness as a comparative measure. Because of these limitations, when evaluating our performance, you should consider Adjusted EBITDA alongside other financial measures, including our net loss or income and other results stated in accordance with GAAP.

ZEVIA PBC

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL RESULTS

(in thousands)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net loss and comprehensive loss |

|

$ |

(2,842 |

) |

|

$ |

(11,250 |

) |

|

$ |

(17,002 |

) |

|

$ |

(19,171 |

) |

Other income, net* |

|

|

(118 |

) |

|

|

(165 |

) |

|

|

(357 |

) |

|

|

(908 |

) |

(Benefit) provision for income taxes |

|

|

(4 |

) |

|

|

(5 |

) |

|

|

43 |

|

|

|

31 |

|

Depreciation and amortization |

|

|

310 |

|

|

|

411 |

|

|

|

1,041 |

|

|

|

1,234 |

|

Equity-based compensation |

|

|

1,034 |

|

|

|

1,876 |

|

|

|

3,950 |

|

|

|

6,614 |

|

Restructuring |

|

|

112 |

|

|

|

— |

|

|

|

977 |

|

|

|

— |

|

Adjusted EBITDA |

|

$ |

(1,508 |

) |

|

$ |

(9,133 |

) |

|

$ |

(11,348 |

) |

|

$ |

(12,200 |

) |

* Includes interest (income) expense, and foreign currency (gains) losses.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

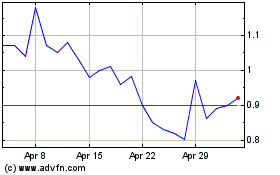

Zevia PBC (NYSE:ZVIA)

Historical Stock Chart

From Nov 2024 to Dec 2024

Zevia PBC (NYSE:ZVIA)

Historical Stock Chart

From Dec 2023 to Dec 2024