SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of

Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of April, 2022

Commission File Number: 001-12102

YPF Sociedad Anónima

(Exact name of registrant as specified in its charter)

Macacha

Güemes 515

C1106BKK Buenos Aires, Argentina

(Address of principal executive office)

Indicate by

check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form

40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation

S-T Rule 101(b)(7):

Yes ☐ No ☒

ORDINARY SHAREHOLDER’S MEETING APRIL

2022

DISCLAIMER This document contains

statements that YPF believes constitute forward-looking statements within the meaning of the US Private Securities Litigation Reform Act of 1995. These forward-looking statements may include statements regarding the intent, belief, plans, current

expectations or objectives as of the date hereof of YPF and its management, including statements with respect to trends affecting YPF’s future financial condition, financial, operating, reserve replacement and other ratios, results of

operations, business strategy, geographic concentration, business concentration, production and marketed volumes and reserves, as well as YPF’s plans, expectations or objectives with respect to future capital expenditures, investments,

expansion and other projects, exploration activities, ownership interests, divestments, cost savings and dividend payout policies. These forward-looking statements may also include assumptions regarding future economic and other conditions, such as

the future price of petroleum and petroleum products, refining and marketing margins and exchange rates. These statements are not guarantees of future performance, prices, margins, exchange rates or other events and are subject to material risks,

uncertainties, changes in circumstances and other factors that may be beyond YPF’s control or may be difficult to predict. YPF’s actual future financial condition, financial, operating, reserve replacement and other ratios, results of

operations, business strategy, geographic concentration, business concentration, production and marketed volumes, reserves, capital expenditures, investments, expansion and other projects, exploration activities, ownership interests, divestments,

cost savings and dividend payout policies, as well as actual future economic and other conditions, such as the future price of petroleum and petroleum products, refining margins and exchange rates, could differ materially from those expressed or

implied in any such forward-looking statements. Important factors that could cause such differences include, but are not limited to fluctuations in the price of petroleum and petroleum products, supply and demand levels, currency fluctuations,

exploration, drilling and production results, changes in reserves estimates, success in partnering with third parties, loss of market share, industry competition, environmental risks, physical risks, the risks of doing business in developing

countries, legislative, tax, legal and regulatory developments, economic and financial market conditions in various countries and regions, political risks, wars and acts of terrorism, natural disasters, project delays or advancements and lack of

approvals, economic conditions in Argentina and their effects on the regional economy, the effects of diseases or pandemics, such as COVID-19, as well as those factors described in the filings made by YPF and its affiliates before the Comisión

Nacional de Valores in Argentina and with the U.S. Securities and Exchange Commission, in particular, those described in “Item 3. Key Information—Risk Factors” and “Item 5. Operating and Financial Review and Prospects”

in YPF’s Annual Report on Form 20-F for the fiscal year ended December 31, 2021 filed with the Securities and Exchange Commission. In light of the foregoing, the forward-looking statements included in this document may not occur. Unless

otherwise indicated, the calculation of the main financial aggregates in U.S. dollars is derived from the calculation of the consolidated financial results expressed in Argentine pesos using the average exchange rate of each period. From 1Q 2019

onwards, the calculation of the main financial aggregates in U.S. dollars is derived from the sum of: (1) the individual financial results of YPF S.A. expressed in Argentine pesos divided by the average exchange rate of the period and (2) the

financial results of YPF S.A.’s subsidiaries expressed in Argentine pesos divided by the exchange rate at the end of the period. Except as required by law, YPF does not undertake to publicly update or revise these forward-looking statements

even if experience or future changes make it clear that the projected performance, conditions, or events expressed or implied therein will not be realized. These materials do not constitute an offer for sale of YPF S.A. bonds, shares or ADRs in the

United States or elsewhere.

AGENDA CONTEXT 2021 01. RESULTS 2021 02.

OUTLOOK 2022 03.

AGENDA CONTEXT 2021 01. RESULTS 2021 02.

OUTLOOK 2022 03.

GLOBAL AND LOCAL CONTEXT 2021 GLOBAL

CONTEXT New Coronavirus variants with limited impact due to vaccination. Recovery of the world economy at higher-than-expected rates. Inflation rates in developed economies at 4 decades record high. Underinvestment in the energy industry accelerates

a tight supply scenario. Increase in international prices of energy commodities to record levels and with high volatility. ARGENTINA CONTEXT Decreased COVID impact after Q2 mobility restrictions, as vaccination plan progressed. Recovery of economic

activity with rising inflation. Negotiations with the IMF and legislative elections set the economic agenda. Strong recovery in fuel demand and oil and gas production. Implementation of the Plan Gas.AR to encourage new investments in gas

production.

AGENDA OUTLOOK 2022 03. CONTEXT 2021 01.

RESULTS 2021 02.

CONTINUE FOCUSING ON THE SECURITY OF OUR

PERSONNEL WHILE MOVING TOWARDS ENERGY TRANSITION INJURY FRECUENCY RATE (IFR) With no impact on relevant operations Per million hours worked INTENSITY OF DIRECT GHG EMISSIONS UPSTREAM (1) KgCO2e/ BOE Target IFR 2017-2022: 12% reduction / year

Equivalent to 50% of the company's total Scope 1 Emissions – Total Emissions 2021E: 15.5 MTn/CO2e Invested during 2021 in Integrity & Environment (CAPEX + OPEX) Hours invested for direct personnel and contractors in security matters US$

450 M +500 thou. Due to absenteeism derived from COVID-19 Total GHG Intensity direct emissions reduction (2017-2021) Target 2022: - 6.5% y/y 14.5% Electric power purchases coming from renowable sources (4Q 2021) 37% (13.2%)

FREE CASH FLOW ADJUSTED EBITDA &

MARGIN (2) CAPEX Million US$ Milllion US$ / % Million US$ 13,749 9,736 13,238 +41% 3,607 1,454 3,839 +2.6x 3,521 1,554 2,671 (2)EBITDA = Operating income + Depreciation of PP&E + Depreciation of the right of use assets + Amortization of

intangible assets + Unproductive exploratory drillings + (Reversal) / Deterioration of PP&E. Adjusted EBITDA = EBITDA that excludes IFRS 16 and IAS 29 effects +/- one-off items. . +164% TOTAL REVENUES Milllon US$ OUTSTANDING RECOVERY OF

PROFITABILITY DURING 2021 THAT ALLOWED US TO ACHIEVE OUR CAPEX PLAN -80

144 424 53 75 2022 = 696 857 298 284 559

1,091 801 1,419 1,207 STRONG DELEVERAGING DURING 2021, WITH HISTORICAL LOW SHORT-TERM MATURITIES NET DEBT AND LEVERAGE RATIO (1) US$ Bn. / x times CONSOLIDATED PRINCIPAL DEBT AMORTIZATION SCHEDULE (2) Global Debt Exchange allowed to generate cash

flow savings of U$S577 million for 2021-22 Excess liquidity applied to pre-pay foreign trade financing facilities due in 2022 U$S300 million cross-border A/B loan, led by CAF, fully disbursed during first quarter of 2022 Net debt calculated as total

debt less cash & equivalents. Net leverage = Net debt over 12M Adjusted EBITDA 01 02 03 As of December 31, 2021, converted to US$ using the exchange rate of AR$102.62 to US$1.00. Excludes IFRS 16 effects. Net Debt

O&G PRODUCTION EXPANDED ALONG THE

YEAR ON REMARKABLE GROWTH IN OUR SHALE OPERATIONS TOTAL PRODUCTION NET SHALE PRODUCTION YPF O&G AVERAGE REALIZATION PRICES 506 423 KBOE/D 461 496 484 KBBL/D y KBOE/D 437 2021: 470 (stable y/y) TOTAL PRODUCTION BREAKDOWN % +62% +2x +14% Natural

Gas Crude Oil Shale Gas Shale Oil Conventional Crude Oil (US$/BBL) Natural Gas (US$/MMBTU) NGL

WE WERE THE HIGHEST BIDDER OF THE NEW

PLAN GAS.AR, ACHIEVING THE HIGHEST PRICE OF THE MARKET PLAN GAS.AR TENDER Contractualization of the Neuquén and Austral basins for the period 2021-2024 15 participating companies - YPF, PAE, Tecpetrol and Total as the largest bidders (70% of

the total volume) 97% of the summer base volume awarded + 3.6 Mm3 /d of winter volume, ensuring that local base demand needs are covered. 3.57 US$/Mbtu average price for Neuquén basin and 3.43 US$/Mbtu average price for Austral basin.

ASSIGNMENT OF YPF It was possible to place 100% of the volume offered – 20.9 Mm3/d – 40% of the total of the Neuquén basin. We obtained an average price of US$3.66/Mbtu. +32% 25 25 25 25 28 30 32 33 33 32 32 31 NET YPF NATURAL GAS

PRODUCTION – NEUQUINA BASIN Mm3/d +80%

INCREASED SHALE ACTIVITY WHILE

MAINTAINING FOCUS ON OPERATING EFFICIENCIES OPERATED COMPLETED HORIZONTAL WELLS # Pozos CORE HUB – DEVELOPMENT COST U$S/bbl CORE HUB – LIFTING COST U$S/bbl 138 34 77 91 75 +79% UNCONVENTIONAL -50% -56%

RECORD HIGH RESERVE REPLACEMENT RATIO

DRIVEN BY SHALE ADDITIONS EVOLUTION OF HYDROCARBON PROVED RESERVES Miillones BOE 2021 P1 RESERVES BREAKDOWN % +24% Shale P1 reserves increased by 56.7% (+202 Mboe), with a RRR of 4.3x, representing 49% of total reserves Total P1 reserves registered

the highest level in last 5 years (+24.0% y/y), with a RRR of 2.3x – highest in company’s last 20 years. P1 reserves evolution was driven by the progressive development of our shale operations coupled with the effect of prices and costs

variation 01 02 03 49% 31% 39% 19% Crude Oil NGL Natural Gas

STRONG RECOVERY IN FUELS’ DEMAND

AND PRICE ADJUSTMENTS TO PRE-PANDEMIC LEVELS REFINING PRODUCT SALES KM3 REFINERIES’ UTILIZATION During 2H21 fuels’ demand fully recovered, even exceeding pre-pandemic levels. The higher demand in 4Q21 led to an increase in imported

volumes of fuels. 01 % / KBBLD F.O.B REFINERY / TERMINAL PRICE (1) US$/BBL 2021: 270 / 82% (16%) + 18% Processing levels continued recovering during the last months of the year, averaging a refining utilization rate of 85% in 4Q21 02 Managed to keep

local fuels´ prices in dollars stable during the 2H21 through wholesale pricing dynamics. Recently resumed pump prices adjustments to catch up with currency devaluation and reduce the gap with international prices. 03

MANAGEMENT MODEL FOCUSED ON PEOPLE,

AGILITY, INNOVATION AND DIVERSITY DEVELOPMENT OF CRITICAL SKILLS Expansion of the Expertise, PACTO and FTO programs LEADERSHIP, TALENT AND NEW WAYS OF WORKING 930 leaders in development and leadership programs New hybrid work modality Update of the

talent map and successors Federal Young Professionals Programs for AESA and DW, and Internships DIVERSITY AND GENDER EQUITY 16.6% participation of women in leadership positions (+1% vs 2020). Gender perspective in all transversal processes

Communication campaign "25N" on gender violence. Tripling technical disciplines +2,500 employees vs. 500 in 2020 +60 learning projects with innovative technologies 4 academies for transversal skills

TRANSFORMING CUSTOMER EXPERIENCE AND

OUR OPERATIONS THROUGH TECHNOLOGY DIGITALIZATION OF OPERATIONS YPF APP 4.2 Million (1) As of December 2021. New APP: YPF Ruta YPF RUTA +5,000 Since its release in June-21 TRANSACTIONS PER MONTH(1) 2.3X VS. DEC-20 18% payment penetration Integrated

Serviclub experience Launching Money in Account CONNECTED VEHICLES We launched a new app that digitizes the experience for drivers and fleet managers 40 automated processes and +45,000 hours released through RPA software Launching Aconcagua Proyect

Continue connecting our assets with the Iluminar Project Wifi y WirelessHart in refineries First company in the region with 100% wireless connected industrial complexes New Data Analytics models Optimization of fleet contracting Fracking

Interference Detection NOC petrophysical profile prediction models In order to achieve a simple and efficient process of Procure to Pay

CONTINUE WITH THE ENERGY TRANSITION

THROUGH YPF LUZ AND NEW ENERGIES EBITDA 2021 US$ 321 million +42% vs 2020 includes a 30% share of GWh sold by Central Dock Sud S.A. ENERGY SOLD 11,572 GW/h(1) +32% vs 2020 INSTALLED CAPACITY 2.483MW +10% vs 2020 RENEWABLE CAPACITY 397MW +79% vs 2020

MAIN HIGHLIGHTS 2021 THE MOST EFFICIENT WIND FARMS IN THE COUNTRY 233 MW COD 2021 Wind Farm Cañadón León 123 MW Wind Farm Los Teros II 52 MW Engines Manantiales Behr 58 MW Average capacity factor of 54.4% (+16% country average)

PROYECTS 100 MW UNDER CONSTRUCTION PV Solar Zonda proyect 100 MW – financed with 1st green bond from YPF Luz (US$64 million at 10 years at 5% rate) NEW TRANSITION ENERGIES H2ar - YPF and affiliates as part of the consortium for the development

of hydrogen and CCUS in Argentina Lithium exploration and cell plant launching

DEEPENING A CULTURE OF ETHICS AND

TRANSPARENCY #COMPLIANCEMODE Improvements in Complaints and Investigation processes Compliance training program New GRIP tool for third-party risk management Integrity Program for affiliates AESA, YTEC, OPESSA, YPF GAS, YPF CHILE, YPF BRASIL,

FOUDATION #HacemosYPFHaciendoLoCorrecto

YPF FOUNDATION - HIGHLIGHTS 2021

Teaching materials for 380 primary and secondary schools 4,212 laptops to technical schools' students of 18 O&G communities To contribute to equal access to quality education and technology, we deliver: 37,000 people were trained in our

educational activities NEW ACTIVITY Professionalizing internships for technical schools in the facilities of the main companies in the industry in Vaca Muerta and in the Golfo San Jorge basin. Sustainable Rio Grande Action Plan delivered 224

scholarships to students of careers related to energy 75 new admissions of students from universities based in Neuquén, Río Negro, Chubut, Santa Cruz, Tierra del Fuego, Mendoza and Buenos Aires; and 149 renewals.

RESULTS 2021 02. CONTEXT 2021 01.

OUTLOOK 2022 03. AGENDA

Maintaining focus on profitability in a

challenging macroeconomic environment – pump prices to be adjusted in a sustainable way 2022 OUTLOOK Working to deliver sound production growth through efficient capex deployment Focus on midstream initiatives (gas and oil) to assure

debottlenecking of VM evacuation capacity Continuing with fuel’s sulphur reduction multiyear project – estimated CAPEX of US$150-200 million in 2022 Expecting neutral to slightly negative FCF - max leverage ratio at 2x TOTAL US$3,700

UPSTREAM US$2,800 DOWNSTREAM US$700 OTHERS US$200 (IN MILLIONS) Uncon. US$1,600 Conven. US$1,200 CAPEX PRODUCTION +45% SHALE OIL CRUDE OIL ~224 KBBL/D NATURAL GAS ~37 MM3/D +40% SHALE GAS Vs 2021 Vs 2021 +6% +5% BOE +8% 2022 GUIDANCE(1) (1) The

ability to execute the investment plan for 2022 depends on numerous factors that are beyond YPF's control or influence. Such investment plan includes estimates subject to the financial and operational viability of the different projects that

comprise it. The projected increase in oil and gas production also depends on the ability to implement the investment plan

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

YPF Sociedad Anónima |

|

|

|

|

| Date: April 29, 2022 |

|

|

|

By: |

|

/s/ Pablo Calderone |

|

|

|

|

Name: |

|

Pablo Calderone |

|

|

|

|

Title: |

|

Market Relations Officer |

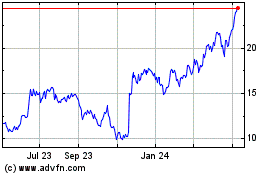

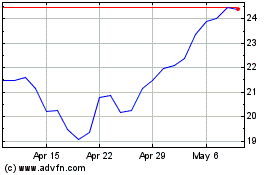

YPF Sociedad Anonima (NYSE:YPF)

Historical Stock Chart

From Aug 2024 to Sep 2024

YPF Sociedad Anonima (NYSE:YPF)

Historical Stock Chart

From Sep 2023 to Sep 2024