|

|

UNITED STATES

|

|

|

|

SECURITIES AND EXCHANGE COMMISSION

|

|

|

|

Washington, D.C. 20549

|

|

|

|

|

|

|

|

SCHEDULE 13D/A

|

|

Under the Securities Exchange Act of 1934

(Amendment No. 3)

(Name of Issuer)

Ordinary Shares, par value $0.0001

(Title of Class of Securities)

(CUSIP Number)

Ning Tang

5/F, Tower A, Winterless Center

1 West Dawang Road

Chaoyang District, Beijing 100022

The People’s Republic of China

Telephone: +86 10

5395-3680

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

with a copy to:

Z. Julie Gao, Esq.

Skadden, Arps, Slate, Meagher & Flom LLP

c/o 42/F, Edinburgh Tower, The Landmark

15 Queen’s Road Central

Hong Kong

+852 3740-4700

(Date of Event Which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because § 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g) check the following box.

o

*

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934 ("Act") or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

|

1

|

Name of Reporting Persons

Ning Tang

|

|

|

2

|

Check the Appropriate Box if a Member of a Group (See Instructions)

|

|

|

|

(a)

|

o

|

|

|

|

(b)

|

o

|

|

|

3

|

SEC Use Only

|

|

|

4

|

Source of Funds (See Instructions)

OO

|

|

|

5

|

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

o

|

|

|

6

|

Citizenship or Place of Organization

The People’s Republic of China

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With

|

7

|

Sole Voting Power

70,299,932 Ordinary Shares

|

|

8

|

Shared Voting Power

0

|

|

9

|

Sole Dispositive Power

70,299,932 Ordinary Shares

|

|

10

|

Shared Dispositive Power

0

|

|

|

11

|

Aggregate Amount Beneficially Owned by Each Reporting Person

70,299,932 Ordinary Shares

|

|

|

12

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions)

o

|

|

|

13

|

Percent of Class Represented by Amount in Row (11)

37.3%

(1)

|

|

|

14

|

Type of Reporting Person (See Instructions)

IN

|

|

|

|

|

|

|

|

(1) The percentage is calculated based on 188,493,772 Ordinary Shares outstanding as of the Closing Date, which takes into account the issuance of Ordinary Shares contemplated in the Share Subscription Agreement, as amended.

2

|

|

1

|

Name of Reporting Persons

Great Service Holdings Limited

|

|

|

2

|

Check the Appropriate Box if a Member of a Group (See Instructions)

|

|

|

|

(a)

|

o

|

|

|

|

(b)

|

o

|

|

|

3

|

SEC Use Only

|

|

|

4

|

Source of Funds (See Instructions)

OO

|

|

|

5

|

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

o

|

|

|

6

|

Citizenship or Place of Organization

British Virgin Islands

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With

|

7

|

Sole Voting Power

70,299,932 Ordinary Shares

|

|

8

|

Shared Voting Power

0

|

|

9

|

Sole Dispositive Power

70,299,932 Ordinary Shares

|

|

10

|

Shared Dispositive Power

0

|

|

|

11

|

Aggregate Amount Beneficially Owned by Each Reporting Person

70,299,932 Ordinary Shares

|

|

|

12

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions)

o

|

|

|

13

|

Percent of Class Represented by Amount in Row (11)

37.3%

(1)

|

|

|

14

|

Type of Reporting Person (See Instructions)

CO

|

|

|

|

|

|

|

|

(1) The percentage is calculated based on 188,493,772 Ordinary Shares outstanding as of the Closing Date, which takes into account the issuance of Ordinary Shares contemplated in the Share Subscription Agreement, as amended.

3

Item 1.

Security and Issuer.

This Amendment No. 3 to Schedule 13D (this “

Amendment No. 3

”) amends the statement on Schedule 13D filed on December 31, 2015 (the “

Initial Schedule 13D

”), as amended by amendment No. 1 filed on September 12, 2016 and amendment No. 2 filed on September 23, 2016 (together with the Initial Schedule 13D, the “

Schedule 13D

”) in relation to the ordinary shares, par value $0.0001 per share (the “

Ordinary Shares

”), of Yirendai Ltd., a company organized under the laws of the Cayman Islands (the “

Company

”), whose principal executive offices are located at

10/F, Building 9, 91 Jianguo Road, Chaoyang District, Beijing 100022, the People’s Republic of China.

Except as provided herein, this Amendment No. 3 does not modify any of the information previously reported on the Schedule 13D.

Item 2.

Identity and Background.

Item

2 of the Schedule 13D is hereby amended and supplemented by the following:

(a) — (c), (f) This Amendment No. 3 is being filed jointly by Mr. Ning Tang and Great Service Holdings

Limited, a company organized under the laws of the British Virgin Islands (“

Great Service

,” together with Mr. Ning Tang, the “

Reporting Persons

”). Mr. Ning Tang is the executive chairman and the chief executive officer of the Company. Great Service is Mr. Ning Tang’s wholly owned holding vehicle. Mr. Ning Tang is the sole ultimate beneficial owner and the sole director of Great Service. The business address of the Reporting Persons is 5/F, Tower A, Winterless Center, 1 West Dawang Road, Chaoyang District, Beijing 100022, the People’s Republic of China.

(d), (e) During the last five years, the Reporting Persons

have not been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors) or a party to a civil proceeding of a judicial or administrative body of competent jurisdiction or as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

Item 3.

Source and Amount of Funds or Other Considerations.

Item 3 of the Schedule 13D is hereby amended

and supplemented by the following:

Mr. Ning Tang does not hold any Ordinary Share of the Company directly. Mr. Ning Tang, through Great Service, owns 43.4% of the total outstanding shares of

CeditEase Holdings (Cayman) Limited (“

CreditEase

”), the parent company and controlling shareholder of the Company on an as-converted basis.

CreditEase and the Company entered into a share subscription agreement on March 25, 2019

(the “

Share Subscription Agreement

”), a copy of which is attached hereto as

Exhibit 99.1

, and an amendment to the Share Subscription Agreement on July 10, 2019, a copy of which are attached hereto as

Exhibit 99.2

. The description of the Share Subscription Agreement and its amendment contained herein is qualified in its entirety by reference to

Exhibit 99.1

and

Exhibit 99.2

, which are incorporated herein by reference. Pursuant to the Share Subscription Agreement, as amended, CreditEase transferred certain of its businesses, including online wealth management targeting the mass affluent, unsecured and secured consumer lending, SME lending, and other related services or businesses, to the Company and the Company issued 61,981,412 Ordinary Shares to CreditEase and paid RMB262.3 million cash for such transfer at a closing that occurred on July 10, 2019 (the “

Closing Date

”) with the remaining cash consideration of RMB2,626.7 million to be paid by installments afterwards with each payment contingent upon the acquired business achieving certain pre-agreed performance targets.

From

September 22, 2016 to September 28, 2016, the Fund sold an aggregate of 170,000 ADSs, representing 340,000 Ordinary Shares, in the open market, and since then the Fund has ceased to own any Ordinary Shares in the Company.

Item 4.

Purpose of Transaction.

Item 4 of the Schedule 13D is hereby

amended and supplemented by the following:

4

The information set forth in Items 3 is hereby incorporated by reference in this Item 4.

The purpose of the transaction mentioned in the Item 3 above is to realign the businesses operated by CreditEase and the Company, and CreditEase’s subscription of the Ordinary Shares is for general investment purposes.

Although the Reporting Persons have no present intention to acquire additional securities of the Company, the Reporting Persons intend to review their investment on a regular basis and, as a result thereof and subject to applicable laws and regulations, may at any time or from time to time determine, either alone or as part of a group, (i) to acquire additional securities of the Company, through open market purchases, privately negotiated transactions or otherwise, (ii) to dispose of all or a portion of the securities of the Company owned by the Reporting Persons in the open market, in privately negotiated transactions or otherwise, or (iii) to take any other available course of action, which could involve one or more of the types of transactions or have one or more of the results described in the next paragraph of this Item 4. Any such acquisition or disposition or other transaction would be made in compliance with all applicable laws and regulations. Notwithstanding anything contained herein, the Reporting Persons specifically reserve the right to change their intention with respect to any or all of such matters. In reaching any decision as to its course of action (as well as to the specific elements thereof), the Reporting Persons currently expect that they would take into consideration a variety of factors, including, but not limited to, the following: the Company’s business and prospects; other developments concerning the Company and its businesses generally; other business opportunities available to the Reporting Persons; changes in law and government regulations; general economic conditions; and money and stock market conditions, including the market price of the securities of the Company.

Except as set forth in this Schedule 13D, the Reporting Persons have no present plans or proposals that relate to or would result in:

(i)

The acquisition by any person of additional securities of the Company, or the disposition of securities of the Company,

(ii)

An extraordinary corporate transaction, such as a merger, reorganization or liquidation, involving the Company,

(iii)

A sale or transfer of a material amount of assets of the Company,

(iv)

Any change in the present board or management of the Company, including any plans or proposals to change the number or term of directors or to fill any existing vacancies on the board,

(v)

Any material change in the present capitalization or dividend policy of the Company,

(vi)

Any other material change in the Company’s business or corporate structure,

(vii)

Changes in the Company’s charter, bylaws or instruments corresponding thereto or other actions that may impede the acquisition of control of the Company by any person,

(viii)

A class of securities of the Company being delisted from a national securities exchange or ceasing to be authorized to be quoted in an inter-dealer quotation system of a registered national securities association,

(ix)

A class of equity securities of the Company becoming eligible for termination of registration pursuant to Section 12(g)(4) of the Securities Act, or

(x)

Any action similar to any of those enumerated above.

Item 5.

Interest in Securities of the Issuer.

Item 5 of the Schedule 13D is hereby

amended and supplemented by the following:

The responses of the Reporting Persons to Rows (7) through (13) of the cover pages of this Amendment No. 3 are hereby incorporated by reference in this Item 5.

5

Great Service is Mr. Ning Tang’s wholly owned holding vehicle. As of the Closing Date, Mr. Ning Tang, through Great Service, beneficially owned 43.4% of the total outstanding shares of CreditEase on an as-converted basis, which in turn held 161,981,412 Ordinary Shares of the Company. As a result, the number of Ordinary Shares of the Company beneficially owned by Mr. Ning Tang through Great Service was 70,299,932, representing approximately 37.3% of the total issued and outstanding Ordinary Shares of the Company.

Mr. Ning Tang’s wife held 300,000 Ordinary Shares as of the Closing Date. Mr. Ning Tang expressly disclaims such beneficial ownership of the Ordinary Shares held by his wife.

The percentage of Ordinary Shares identified pursuant to Item 1 beneficially owned by the Reporting Persons is based on 188,493,772 issued and outstanding Ordinary Shares of the Company as of the Closing Date, which takes into account the issuance of Ordinary Shares contemplated in the Share Subscription Agreement, as amended.

Except as disclosed in this statement, the Reporting Persons do not beneficially own any Shares or have the right to acquire any Ordinary Shares.

Except as disclosed in this statement, the Reporting Persons do not presently have the power to vote or to direct the vote or to dispose or direct the disposition of any of the Ordinary Shares that they may be deemed to beneficially own.

Except as disclosed in this statement, the Reporting Persons have not effected any transaction in the Ordinary Shares during the past 60 days.

Except as disclosed in this statement, to the best knowledge of the Reporting Persons, no other person has the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, the Ordinary Shares beneficially owned by the Reporting Persons.

Item 6.

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

The information set forth in Items 3 and 4 is hereby incorporated by reference in this Item 6.

Except as described above or elsewhere in this Schedule 13D or incorporated by reference in this Schedule 13D, there are no contracts, arrangements, understandings or relationships (legal or otherwise) between each of the Reporting Person and any other person with respect to any securities of the Company, including, but not limited to, transfer or voting of any securities, finder’s fees, joint ventures, loan or option arrangements, puts or calls, guarantees of profits, division of profits or losses, or the giving or withholding of proxies.

Item 7.

Material to Be Filed as Exhibits.

Item 7 of the Schedule 13D is hereby amended

and supplemented by the following:

6

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: July

16, 2019

|

|

NING TANG

|

|

|

|

|

|

|

|

|

/s/ Ning Tang

|

|

|

|

|

|

|

|

|

Great Service Holdings Limited

|

|

|

|

|

|

|

|

|

By:

|

/s/ Ning Tang

|

|

|

|

Name:

|

Ning Tang

|

|

|

|

Title:

|

Sole Director

|

7

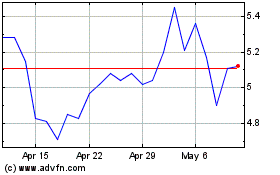

Yiren Digital (NYSE:YRD)

Historical Stock Chart

From Mar 2024 to Apr 2024

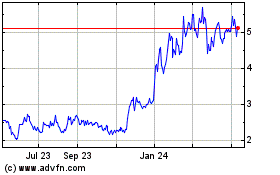

Yiren Digital (NYSE:YRD)

Historical Stock Chart

From Apr 2023 to Apr 2024