Yirendai Announces Business Realignment with CreditEase

March 25 2019 - 6:24AM

Yirendai Ltd. (NYSE: YRD) (“Yirendai” or the “Company”), a leading

fintech company in China, announced today that it has entered

into definitive agreements relating to a business realignment with

CreditEase Holdings (Cayman) Limited, or CreditEase, the

controlling shareholder of the Company, to better serve its

investors and borrowers. Pursuant to the definitive agreements,

Yirendai will assume certain business operations, including online

wealth management targeting the mass affluent, unsecured and

secured consumer lending, financial leasing, SME lending, and other

related services or businesses (the “Target Businesses”) from

CreditEase and its affiliates, for a total consideration of

106,917,947 newly issued ordinary shares of Yirendai and RMB889

million cash, as may be adjusted in accordance with the pre-agreed

mechanism, at the transaction closing. Ning Tang, the executive

chairman of Yirendai, who is also the founder, chairman and CEO of

CreditEase, will assume the Chief Executive Officer role of

Yirendai upon the closing of the transactions. CreditEase has also

agreed not to compete with the Company and to provide business

consulting and other support and license certain intellectual

properties to the Company.

The transactions contemplated under the definitive agreements

are subject to certain closing conditions. It is expected that the

Target Businesses will be consolidated into Yirendai’s consolidated

financial statements prior to the closing of the transactions once

controls are transferred to Yirendai.

The Company’s Board of Directors, acting upon the unanimous

recommendation of its Audit Committee consisting of independent and

disinterested directors, approved the definitive agreements and the

transactions contemplated thereunder. The Audit Committee reviewed

and considered the terms of the definitive agreements and the

transactions with the assistance of its financial and legal

advisors.

It is estimated that the unaudited total net revenues of the

Target Businesses under U.S. GAAP were RMB6.6 billion (US$962.3

million) in 2018. The online wealth management business had RMB8.6

billion of total assets under management (“AUM”) as of December 31,

2018 and an active investor base of approximately 230 thousand in

2018. As of December 31, 2018, the lending businesses had

facilitated more than RMB200 billion of loans to approximately 2.2

million borrowers since inception. In 2018, the lending businesses

referred RMB15.9 billion of loans to Yirendai and facilitated

RMB23.2 billion of loans on its own platform.

Safe Harbor Statement

This press release contains forward-looking statements. These

statements constitute “forward-looking” statements within the

meaning of Section 21E of the Securities Exchange Act of 1934, as

amended, and as defined in the U.S. Private Securities Litigation

Reform Act of 1995. These forward-looking statements can be

identified by terminology such as “will,” “expects,” “anticipates,”

“future,” “intends,” “plans,” “believes,” “estimates,” “target,”

“confident” and similar statements. Such statements are based upon

management’s current expectations and current market and operating

conditions, and relate to events that involve known or unknown

risks, uncertainties and other factors, all of which are difficult

to predict and many of which are beyond Yirendai’s control.

Forward-looking statements involve risks, uncertainties and other

factors that could cause actual results to differ materially from

those contained in any such statements. Potential risks and

uncertainties include, but are not limited to, uncertainties as to

Yirendai’s ability to attract and retain borrowers and investors on

its marketplace, its ability to introduce new loan products and

platform enhancements, its ability to compete effectively, PRC

regulations and policies relating to the peer-to-peer lending

service industry in China, general economic conditions in China,

and Yirendai’s ability to meet the standards necessary to maintain

listing of its ADSs on the NYSE or other stock exchange, including

its ability to cure any non-compliance with the NYSE’s continued

listing criteria. Further information regarding these and other

risks, uncertainties or factors is included in Yirendai’s filings

with the U.S. Securities and Exchange Commission. All information

provided in this press release is as of the date of this press

release, and Yirendai does not undertake any obligation to update

any forward-looking statement as a result of new information,

future events or otherwise, except as required under applicable

law.

About Yirendai

Yirendai Ltd. (NYSE: YRD) is a leading fintech company in China

connecting investors and individual borrowers. The Company provides

an effective solution to address largely underserved investor and

individual borrower demand in China through an online platform that

automates key aspects of its operations to efficiently match

borrowers with investors and execute loan transactions. Yirendai

deploys a proprietary risk management system, which enables the

Company to effectively assess the creditworthiness of borrowers,

appropriately price the risks associated with borrowers, and offer

quality loan investment opportunities to investors. Yirendai’s

online marketplace provides borrowers with quick and convenient

access to consumer credit at competitive prices and investors with

easy and quick access to an alternative asset class with attractive

returns. For more information, please visit ir.yirendai.com.

For investor and media inquiries, please

contact: Yirendai Hui (Matthew)

Li/Lydia Yu Investor Relations Email: ir@yirendai.com

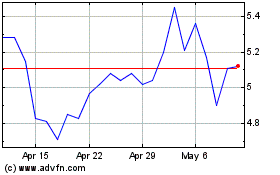

Yiren Digital (NYSE:YRD)

Historical Stock Chart

From Mar 2024 to Apr 2024

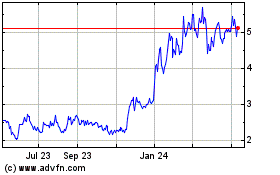

Yiren Digital (NYSE:YRD)

Historical Stock Chart

From Apr 2023 to Apr 2024