W.W. Grainger, Inc. and Subsidiaries

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

|

|

|

September 30,

|

|

|

|

|

2019

|

|

2018

|

|

%

|

|

SG&A reported

|

$

|

761

|

|

|

$

|

890

|

|

|

(14

|

)%

|

|

Restructuring, net of branch gains (U.S.)

|

—

|

|

|

3

|

|

|

|

|

Restructuring (Canada)

|

1

|

|

|

—

|

|

|

|

|

Restructuring (Other businesses)

|

—

|

|

|

1

|

|

|

|

|

Impairment charges (Other businesses)

|

—

|

|

|

139

|

|

|

|

|

Total restructuring, net and impairment charges

|

1

|

|

|

143

|

|

|

|

|

SG&A adjusted

|

$

|

760

|

|

|

$

|

747

|

|

|

2

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2019

|

|

2018

|

|

%

|

|

Operating earnings reported

|

$

|

338

|

|

|

$

|

189

|

|

|

78

|

%

|

|

Total restructuring, net and impairment charges

|

1

|

|

|

143

|

|

|

|

|

Operating earnings adjusted

|

$

|

339

|

|

|

$

|

332

|

|

|

2

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2019

|

|

2018

|

|

%

|

|

Net earnings attributable to W.W. Grainger, Inc. reported

|

$

|

233

|

|

|

$

|

104

|

|

|

123

|

%

|

|

Total restructuring, net and impairment charges

|

1

|

|

|

143

|

|

|

|

|

Tax effect of impairment (1)

|

—

|

|

|

(6

|

)

|

|

|

|

Tax effect (1)

|

(1

|

)

|

|

(1

|

)

|

|

|

|

Total restructuring, net, impairment charges and tax

|

—

|

|

|

136

|

|

|

|

|

Net earnings attributable to W.W. Grainger, Inc. adjusted

|

$

|

233

|

|

|

$

|

240

|

|

|

(3

|

)%

|

(1) The tax impact of adjustments is calculated based on the income tax rate in each applicable jurisdiction, subject to deductibility limitations and the Company's ability to realize the associated tax benefits.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30,

|

|

|

2019

|

|

2018

|

|

Bps impact

|

|

Effective tax rate reported

|

24.2

|

%

|

|

32.7

|

%

|

|

(850

|

)

|

|

Restructuring, net and impairment charges

|

—

|

|

|

(12.7

|

)

|

|

|

|

Effective tax rate adjusted

|

24.2

|

%

|

|

20.0

|

%

|

|

420

|

|

SG&A of $761 million for the third quarter of 2019 decreased $129 million, or 14% compared to the third quarter of 2018. Excluding restructuring, net and impairment charges in both periods as noted in the table above, SG&A increased $13 million, or 2%.

Operating earnings of $338 million for the third quarter of 2019 increased $149 million, or 78% compared to the third quarter of 2018. Excluding restructuring, net and impairment charges in both periods as noted in the table above, operating earnings increased $7 million or 2%, driven primarily by higher gross profit dollars.

Other expense, net was $16 million for the third quarter of 2019, a decrease of $2 million, or 16% compared to the third quarter of 2018. The decrease was primarily due to lower losses from the Company's clean energy investments which were concluded in the second half of 2018.

Income taxes of $78 million for the third quarter of 2019 increased $22 million, or 39% compared to the third quarter of 2018. Grainger's effective tax rates were 24.2% and 32.7% for the three months ended September 30, 2019 and 2018, respectively. The higher tax rate in the prior year quarter was driven primarily by Cromwell impairment charges which lowered reported operating earnings and were not tax deductible. Excluding restructuring, net and impairment charges in both periods as noted in the table above, the effective tax rates were 24.2% and 20.0% for the three months

W.W. Grainger, Inc. and Subsidiaries

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS

ended September 30, 2019 and 2018, respectively. The increase in effective tax rate was primarily driven by lower tax benefit from stock-based compensation and the absence of the Company's clean energy tax benefits in 2019 as the Company concluded its investment in 2018.

Net earnings attributable to W.W. Grainger, Inc. of $233 million for the third quarter of 2019 increased $129 million or 123% compared to the third quarter of 2018. Excluding restructuring, net and impairment charges from both periods in the table above, net earnings decreased $7 million or 3%.

Diluted earnings per share of $4.25 in the third quarter of 2019 was up 134% versus the $1.82 for the third quarter of 2018, primarily due to higher net earnings and lower average shares outstanding, partially offset by higher taxes due to lower tax benefits from stock-based compensation. Excluding restructuring, net and impairment charges from both periods in the table above, diluted earnings per share of $4.26 in the third quarter of 2019 increased 2% from $4.19 for the third quarter of 2018.

Segment Analysis

The following results at the U.S. and Canada segments and Other businesses level include external and intersegment net sales and operating earnings. See Note 10 to the Financial Statements.

United States

Net sales were $2,277 million for the third quarter of 2019, an increase of $89 million, or 4% compared to the same period in 2018. On a daily basis, net sales increased 2.5% and consisted of the following:

|

|

|

|

|

|

|

Percent Increase/(Decrease)

|

|

Volume

|

2.5%

|

|

Intercompany sales to Zoro (included in other businesses)

|

0.5

|

|

Other

|

(0.5)

|

|

Total

|

2.5%

|

Overall, revenue increases were primarily driven by market share gains. Price inflation was flat. See Note 3 to the Financial Statements for information related to disaggregated revenue.

The gross profit margin for the third quarter of 2019 decreased 0.8 percentage point compared to the same period in 2018, driven by the timing of pricing adjustments during the year which resulted in negative price cost spread.

SG&A in the third quarter of 2019 was flat when compared to the third quarter of 2018.

Operating earnings of $343 million for the third quarter of 2019 increased $17 million, or 5% from $326 million for the third quarter of 2018. This increase was driven primarily by SG&A leverage.

Canada

Net sales were $129 million for the third quarter of 2019, a decrease of $20 million, or 14% compared to the same period in 2018. On a daily basis, net sales decreased 15.5%, or 14.5% in local currency and consisted of the following:

|

|

|

|

|

|

|

Percent (Decrease)/Increase

|

|

Volume

|

(15.5)%

|

|

Foreign exchange

|

(1.0)

|

|

Price

|

1.0

|

|

Total

|

(15.5)%

|

For the third quarter of 2019, volume was down 15.5 percentage points compared to the same period in 2018 primarily due to market share declines.

W.W. Grainger, Inc. and Subsidiaries

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS

The gross profit margin increased 0.5 percentage points in the third quarter of 2019 versus the third quarter of 2018, driven by inventory management efficiencies, partially offset by negative price cost spread.

SG&A decreased 19% in the third quarter of 2019 compared to the third quarter of 2018. Excluding restructuring costs in both periods as noted in the table above, SG&A would have decreased 22%, primarily due to the 2018 cost take out actions.

Operating earnings was break even for the third quarter of 2019 compared to operating losses of $4 million in the third quarter of 2018. Excluding restructuring, net in both periods as noted in the table above, operating earnings would have been $1 million compared to operating losses of $4 million in the prior period primarily due higher gross profit and lower SG&A.

Other businesses

Net sales were $673 million for the third quarter of 2019, an increase of $63 million, or 11% when compared to the same period in 2018. On a daily basis, net sales increased 9.0%. The increase in net sales was due to strong growth in the endless assortment businesses.

The gross profit margin decreased 1.3 percentage points in the third quarter of 2019 versus the third quarter 2018, driven by higher promotional activities, freight headwinds and mix in the endless assortment businesses.

Operating earnings of $30 million for the third quarter of 2019 were up $129 million compared to operating losses of $99 million for the third quarter of 2018. Other businesses' 2018 results included impairment charges relating to the Cromwell business in the U.K. Excluding restructuring, net and impairment charges in both periods as noted in the table above, operating earnings would have decreased $11 million or 26%. This decrease is primarily due to the endless assortment businesses' investments to drive long-term growth and under performance in the international high-touch solutions businesses.

Matters Affecting Comparability

There were 191 sales days in the nine months ended September 30, 2019 and 2018.

Results of Operations – Nine Months Ended September 30, 2019

The following table is included as an aid to understanding the changes in Grainger’s Condensed Consolidated Statements of Earnings (in millions of dollars):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30,

|

|

|

|

|

|

Percent Increase/(Decrease)

|

|

As a Percent of Net Sales

|

|

|

2019

|

|

2018

|

|

2019

|

|

2018

|

|

Net sales

|

$

|

8,639

|

|

|

$

|

8,458

|

|

2

|

%

|

|

100.0

|

%

|

|

100.0

|

%

|

|

Cost of goods sold

|

5,324

|

|

|

5,176

|

|

3

|

|

|

61.6

|

|

|

61.2

|

|

|

Gross profit

|

3,315

|

|

|

3,282

|

|

1

|

|

|

38.4

|

|

|

38.8

|

|

|

Selling, general and administrative expenses

|

2,234

|

|

|

2,414

|

|

(7

|

)

|

|

25.9

|

|

|

28.5

|

|

|

Operating earnings

|

1,081

|

|

|

868

|

|

24

|

|

|

12.5

|

|

|

10.3

|

|

|

Other expense, net

|

42

|

|

|

66

|

|

(38

|

)

|

|

0.5

|

|

|

0.8

|

|

|

Income taxes

|

261

|

|

|

198

|

|

32

|

|

|

3.0

|

|

|

2.3

|

|

|

Net earnings

|

778

|

|

|

604

|

|

|

|

|

|

|

|

Noncontrolling interest

|

32

|

|

|

31

|

|

6

|

|

|

0.4

|

|

|

0.4

|

|

|

Net earnings attributable to W.W. Grainger, Inc.

|

$

|

746

|

|

|

$

|

573

|

|

30

|

%

|

|

8.6

|

%

|

|

6.8

|

%

|

W.W. Grainger, Inc. and Subsidiaries

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS

Grainger’s net sales of $8,639 million for the nine months ended September 30, 2019 increased $181 million, or 2% compared to the same period in 2018 and consisted of the following:

|

|

|

|

|

|

|

Percent Increase/(Decrease)

|

|

Volume

|

2.5%

|

|

Price

|

0.5

|

|

Foreign exchange

|

(0.5)

|

|

Other

|

(0.5)

|

|

Total

|

2.0%

|

The increase in net sales was primarily driven by volume increases in the U.S. business due to market share gain and continued double digit growth in the endless assortments businesses, offset by lower sales in the Canada business and other businesses. See the Segment Analysis below for further details related to segment revenue.

Gross profit of $3,315 million for the nine months ended September 30, 2019 increased $33 million, or 1% compared to the same period in 2018. The gross profit margin of 38.4% decreased 0.4 percentage point when compared to the same period in 2018, primarily driven by the endless assortment businesses.

The table below reconciles reported SG&A, operating earnings and net earnings attributable to W.W. Grainger, Inc. determined in accordance with U.S. GAAP to adjusted SG&A, operating earnings and net earnings attributable to W.W. Grainger, Inc., which are all considered non-GAAP measures. The Company believes that these non-GAAP measures provide meaningful information to assist shareholders in understanding financial results and assessing prospects for future performance as they provide a better baseline for analyzing the ongoing performance of its businesses by excluding items that may not be indicative of core operating results. Because non-GAAP financial measures are not standardized, it may not be possible to compare these measures with other companies' non-GAAP measures having the same or similar names. All tables below are in millions of dollars:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended

|

|

|

|

|

September 30,

|

|

|

|

|

2019

|

|

2018

|

|

%

|

|

SG&A reported

|

$

|

2,234

|

|

|

$

|

2,414

|

|

|

(7

|

)%

|

|

Restructuring, net of branch gains (U.S.)

|

—

|

|

|

5

|

|

|

|

|

Restructuring (Canada)

|

(1

|

)

|

|

23

|

|

|

|

|

Restructuring (Other businesses)

|

—

|

|

|

3

|

|

|

|

|

Impairment charges (Other businesses)

|

—

|

|

|

139

|

|

|

|

|

Restructuring (Unallocated expense)

|

—

|

|

|

(5

|

)

|

|

|

|

Total restructuring, net and impairment charges

|

(1

|

)

|

|

165

|

|

|

|

|

SG&A adjusted

|

$

|

2,235

|

|

|

$

|

2,249

|

|

|

(1

|

)%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2019

|

|

2018

|

|

%

|

|

Operating earnings reported

|

$

|

1,081

|

|

|

$

|

868

|

|

|

24

|

%

|

|

Total restructuring, net and impairment charges

|

—

|

|

|

166

|

|

|

|

|

Operating earnings adjusted

|

$

|

1,081

|

|

|

$

|

1,034

|

|

|

5

|

%

|

W.W. Grainger, Inc. and Subsidiaries

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2019

|

|

2018

|

|

%

|

|

Net earnings attributable to W.W. Grainger, Inc. reported

|

$

|

746

|

|

|

$

|

573

|

|

|

30

|

%

|

|

Total restructuring, net

|

(1

|

)

|

|

166

|

|

|

|

|

Tax effect of impairment (1)

|

—

|

|

|

(6

|

)

|

|

|

|

Tax effect (1)

|

1

|

|

|

(6

|

)

|

|

|

|

Total restructuring, net and impairment charges and tax

|

—

|

|

|

154

|

|

|

|

|

Net earnings attributable to W.W. Grainger, Inc. adjusted

|

$

|

746

|

|

|

$

|

727

|

|

|

3

|

%

|

(1) The tax impact of adjustments is calculated based on the income tax rate in each applicable jurisdiction, subject to deductibility limitations and the Company's ability to realize the associated tax benefits.

SG&A of $2,234 million for the nine months ended September 30, 2019 decreased $180 million, or 7% from $2,414 million for the nine months ended September 30, 2018. Excluding restructuring, net in both periods as noted in the table above, SG&A decreased $14 million, or 1% primarily due to 2018 cost take-out actions in Canada.

Operating earnings for the nine months ended September 30, 2019 were $1,081 million, an increase of $213 million, or 24% compared to the same period in 2018. Excluding restructuring, net in both periods as noted in the table above, operating earnings increased $47 million or 5%, driven primarily by cost take-out actions in the Canadian business and SG&A leverage in the U.S. business.

Other expense, net was $42 million for the nine months ended September 30, 2019, a decrease of $24 million, or 38% compared to the nine months ended September 30, 2018. The decrease was primarily due to lower losses from the Company's clean energy investments which were concluded in the second half of 2018.

Income taxes of $261 million for the nine months ended September 30, 2019 increased $63 million, or 32% compared with $198 million for the comparable 2018 period. Grainger's effective tax rates were 25.1% and 24.7% for the nine months ended September 30, 2019 and 2018, respectively. The increase was primarily driven by lower tax benefit from stock-based compensation and the absence of the Company's clean energy tax benefits in 2019 as the Company concluded its investments in 2018.

Net earnings attributable to W.W. Grainger, Inc. for the nine months ended September 30, 2019 increased $173 million or 30% to $746 million from $573 million for the nine months ended September 30, 2018. Excluding restructuring, net from both periods in the table above, net earnings increased $19 million, or 3%. The increase in net earnings primarily resulted from lower SG&A and lower other expense, net.

Diluted earnings per share of $13.40 in the nine months ended September 30, 2019 was up 33% versus the $10.04 for the same period in 2018, due to higher earnings and lower average shares outstanding. Excluding restructuring, net from both periods in the table above, diluted earnings per share would have been $13.40 compared to $12.74 in 2018, an increase of 5%.

Segment Analysis

The following comments at the segment and other businesses level include external and intersegment net sales and operating earnings. See Note 10 to the Financial Statements.

W.W. Grainger, Inc. and Subsidiaries

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS

United States

Net sales were $6,648 million for the nine months ended September 30, 2019, an increase of $177 million, or 3%, compared to the same period in 2018 and consisted of the following:

|

|

|

|

|

|

|

Percent Increase/(Decrease)

|

|

Volume

|

2.0%

|

|

Price

|

0.5

|

|

Intercompany sales to Zoro (included in other businesses)

|

0.5

|

|

Other

|

(0.5)

|

|

Total

|

2.5%

|

Overall, revenue increases were primarily driven by market share gains and pricing. See Note 3 to the Financial Statements for information related to disaggregated revenue.

The gross profit margin decreased 0.1 percentage point compared to the same period in 2018.

SG&A for the nine months ended September 30, 2019 increased $5 million compared to the same period in 2018. The increase was primarily driven by digital marketing and advertising.

Operating earnings of $1,088 million for the nine months ended September 30, 2019 increased $56 million, or 5% from $1,032 million for the nine months ended September 30, 2018. This increase was driven primarily by higher sales, higher gross profit dollars and improved SG&A leverage.

Canada

Net sales were $400 million for the nine months ended September 30, 2019, a decrease of $108 million, or 21% compared to the same period in 2018 and consisted of the following:

|

|

|

|

|

|

|

Percent (Decrease)/Increase

|

|

Volume

|

(21.5)%

|

|

Foreign exchange

|

(2.5)

|

|

Price

|

2.5

|

|

Total

|

(21.5)%

|

For the nine months ended September 30, 2019, volume was down 21.5 percentage points compared to the same period in 2018 due to customer disruption as a result of actions taken to reduce the branch footprint and sales coverage optimization activities.

The gross profit margin decreased 1.1 percentage points in the nine months ended September 30, 2019 compared to the nine months ended September 30, 2018, primarily due to negative price cost spread.

SG&A decreased $73 million, or 36% in the nine months ended September 30, 2019 compared to the nine months ended September 30, 2018. Excluding restructuring, net in both periods as noted in the table above, SG&A would have decreased $48 million, or 27% compared to the prior period. This decrease was primarily due to cost reduction actions and lower variable expense as the result of lower sales volume.

Operating losses were $4 million for the nine months ended September 30, 2019 compared to losses of $38 million in the nine months ended September 30, 2018. Excluding restructuring, net in both periods as noted in the table above, operating losses would have been $5 million compared to $15 million in the prior period primarily due to lower gross profit, partially offset by lower SG&A.

W.W. Grainger, Inc. and Subsidiaries

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS

Other businesses

Net sales for other businesses were $1,969 million for the nine months ended September 30, 2019 an increase of $149 million, or 8% compared to the same period in 2018 and consisted of the following:

|

|

|

|

|

|

|

Percent Increase/(Decrease)

|

|

Price/volume

|

10.0%

|

|

Foreign exchange

|

(2.0)

|

|

Total

|

8.0%

|

The net sales increase was primarily due to customer acquisition growth from the endless assortment businesses, partially offset by foreign exchange headwinds from the euro and pound sterling.

Operating earnings of $87 million for the nine months ended September 30, 2019 increased $109 million from operating losses of $22 million in the comparable period from the prior year. Other businesses' 2018 results included impairment charges relating to the Cromwell business in the U.K. Excluding restructuring, net and impairment charges in both periods as noted in the table above, operating earnings would have decreased $34 million or 28%.This decrease is primarily due to the endless assortment businesses' investments to drive long-term growth and performance in the high-touch solutions businesses.

Financial Condition

Cash Flow

Net cash provided by operating activities was $770 million and $743 million for the nine months ended September 30, 2019 and 2018, respectively. The increase in cash provided by operating activities is primarily the result of higher net earnings and favorable changes in working capital, partially offset by higher income tax payments and higher net payments related to employee variable compensation and benefits paid under annual incentive plans.

Net cash used in investing activities was $145 million and $105 million for the nine months ended September 30, 2019 and 2018, respectively. This increase in net cash used in investing activities was primarily driven by lower proceeds from the sales of assets when compared to the prior year.

Net cash used in financing activities was $875 million and $437 million in the nine months ended September 30, 2019 and 2018, respectively. The increase in net cash used in financing activities was primarily driven by higher treasury stock repurchases in 2019 compared to 2018.

Working Capital

Internally generated funds are the primary source of working capital and funds used for growth initiatives and capital expenditures. Grainger's working capital is not impacted by significant seasonality trends throughout the year.

Working capital consists of current assets (less non-operating cash) and current liabilities (less short-term debt, current maturities of long-term debt and lease liabilities). Working capital at September 30, 2019, was $2,059 million, an increase of $161 million when compared to $1,898 million at December 31, 2018. The increase was primarily driven by an increase in accounts receivable and a decrease in accrued contributions to employees profit-sharing plans due to the annual cash contribution. At these dates, the ratio of current assets to current liabilities was 2.6 and 2.4, respectively.

Debt

Grainger maintains a debt ratio and liquidity position that provides flexibility in funding working capital needs and long-term cash requirements. In addition to internally generated funds, Grainger has various sources of financing available, including bank borrowings under lines of credit. Total debt, which is defined as total interest-bearing debt (short-term, current maturities and long-term) and lease liabilities as a percent of total capitalization was 53.7% at September 30, 2019, and 51.5% at December 31, 2018.

W.W. Grainger, Inc. and Subsidiaries

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS

Critical Accounting Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make judgments, estimates and assumptions about future events that affect the amounts reported in the financial statements and accompanying notes.

Accounting estimates are considered critical when they require management to make subjective and complex judgments, estimates and assumptions about matters that have a material impact on the presentation of Grainger’s financial statements and accompanying notes. For a description of Grainger’s critical accounting estimates, see Grainger's Annual Report on Form 10-K for the fiscal year ended December 31, 2018.

Management has discussed the development and selection of these critical accounting estimates with the Audit Committee of the Board of Directors and with the Company's independent registered public accounting firm.

Forward-Looking Statements

From time to time, in this Quarterly Report on Form 10-Q, as well as in other written reports, communications and verbal statements, Grainger makes forward-looking statements that are not historical in nature but concern forecasts of future results, business plans, analyses, prospects, strategies, objectives and other matters that may be deemed to be “forward-looking statements” under the federal securities laws. Forward-looking statements can generally be identified by their use of terms such as “anticipate,” “estimate,” “believe,” “expect,” “could,” “forecast,” “may,” “intend,” “plan,” “predict,” “project” “will” or “would” and similar terms and phrases, including references to assumptions.

Grainger cannot guarantee that any forward-looking statement will be realized and achievement of future results is subject to risks and uncertainties, many of which are beyond the Company’s control, which could cause Grainger’s results to differ materially from those that are presented.

Important factors that could cause actual results to differ materially from those presented or implied in the forward-looking statements include, without limitation: higher product costs or other expenses; a major loss of customers; loss or disruption of sources of supply; increased competitive pricing pressures; failure to develop or implement new technology initiatives or business strategies; failure to adequately protect intellectual property or successfully defend against infringement claims; the implementation, timing and results of the Company’s strategic pricing initiatives and other responses to market pressures; the outcome of pending and future litigation or governmental or regulatory proceedings, including with respect to wage and hour, anti-bribery and corruption, environmental, advertising, privacy and cybersecurity matters; investigations, inquiries, audits and changes in laws and regulations; disruption of information technology or data security systems; general industry, economic, market or political conditions; general global economic conditions; currency exchange rate fluctuations; market volatility, including volatility or price declines of the Company’s common stock; commodity price volatility; labor shortages; facilities disruptions or shutdowns; higher fuel costs or disruptions in transportation services; natural and other catastrophes; unanticipated and/or extreme weather conditions; loss of key members of management; the Company’s ability to operate, integrate and leverage acquired businesses; changes in effective tax rates and other factors identified under Item 1A: Risk Factors in the Company’s Annual Report on Form 10-K for the year ended December 31, 2018, as updated in the Company’s Quarterly Reports on Form 10-Q.

Caution should be taken not to place undue reliance on Grainger’s forward-looking statements and Grainger undertakes no obligation to update or revise any of its forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

W.W. Grainger, Inc. and Subsidiaries

|

|

|

|

Item 3.

|

Quantitative and Qualitative Disclosures About Market Risk

|

For quantitative and qualitative disclosures about market risk, see “Item 7A: Quantitative and Qualitative Disclosures About Market Risk” in Grainger's Annual Report on Form 10-K for the fiscal year ended December 31, 2018.

|

|

|

|

Item 4.

|

Controls and Procedures

|

Disclosure Controls and Procedures

Grainger carried out an evaluation, under the supervision and with the participation of its management, including the Chief Executive Officer and the Chief Financial Officer, of the effectiveness of Grainger's disclosure controls and procedures (as defined in Rule 13a-15(e) under the Securities Exchange Act of 1934, as amended (the Exchange Act)) as of the end of the period covered by this report. Based upon that evaluation, the Chief Executive Officer and the Chief Financial Officer concluded that Grainger’s disclosure controls and procedures were effective as of the end of the period covered by this report in (i) ensuring that information required to be disclosed by Grainger in the reports that it files or submits under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the SEC's rules and forms and (ii) ensuring that information required to be disclosed by the Company in the reports that it files or submits under the Exchange Act is accumulated and communicated to the Company's management, including the Company's Chief Executive Officer and Chief Financial Officer, as appropriate to allow timely decisions regarding required disclosure.

Changes in Internal Control Over Financial Reporting

There have been no changes in Grainger's internal control over financial reporting for the quarter ended September 30, 2019, that have materially affected, or are reasonably likely to materially affect, Grainger’s internal control over financial reporting.

PART II – OTHER INFORMATION

|

|

|

|

Item 1.

|

Legal Proceedings

|

For a description of the Company’s legal proceedings, see Note 11 - Contingencies and Legal Matters - to the Condensed Consolidated Financial Statements included under Item 1 - Financial Statements, of Part I of this report.

|

|

|

|

Item 2.

|

Unregistered Sales of Equity Securities and Use of Proceeds

|

Issuer Purchases of Equity Securities – Third Quarter

|

|

|

|

|

|

|

|

|

|

Period

|

Total Number of Shares Purchased (A)

|

Average Price Paid per Share (B)

|

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs (C)

|

Maximum Number of

Shares That May Yet be Purchased Under the

Plans or Programs

|

|

July 1 – July 31

|

440,612

|

$273.08

|

440,612

|

3,682,923

|

|

Aug. 1 – Aug. 31

|

128,913

|

$270.42

|

128,913

|

3,554,010

|

|

Sept. 1 – Sept. 30

|

156,390

|

$286.52

|

156,390

|

3,397,620

|

|

Total

|

725,915

|

|

725,915

|

|

|

|

|

|

(A)

|

There were no shares withheld to satisfy tax withholding obligations.

|

|

|

|

|

(B)

|

Average price paid per share includes any commissions paid and includes only those amounts related to purchases as part of publicly announced plans or programs.

|

|

|

|

|

(C)

|

Purchases were made pursuant to a share repurchase program approved by Grainger’s Board of Directors and announced by the Company on April 24, 2019, which authorizes the repurchase of up to 5 million shares with no expiration date.

|

W.W. Grainger, Inc. and Subsidiaries

Item 6. Exhibits

A list of exhibits filed with this report on Form 10-Q is provided in the Exhibit Index on page 31 of this report.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

W.W. GRAINGER, INC.

|

|

Date:

|

October 23, 2019

|

By:

|

/s/ Thomas B. Okray

|

|

|

|

|

Thomas B. Okray, Senior Vice President

and Chief Financial Officer

|

|

|

|

|

(Principal Financial Officer)

|

|

Date:

|

October 23, 2019

|

By:

|

/s/ Eric R. Tapia

|

|

|

|

|

Eric R. Tapia, Vice President

and Controller

|

|

|

|

|

(Principal Accounting Officer)

|

EXHIBIT INDEX

|

|

|

|

|

|

|

EXHIBIT NO.

|

|

DESCRIPTION

|

|

|

|

Certification of Principal Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002.

|

|

|

|

Certification of Principal Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002.

|

|

|

|

Certification of Principal Executive Officer and Principal Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002.

|

|

101.INS

|

|

XBRL Instance Document - the instance document does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document.

|

|

101.SCH

|

|

XBRL Taxonomy Extension Schema Document.

|

|

101.CAL

|

|

XBRL Taxonomy Extension Calculation Linkbase Document.

|

|

101.DEF

|

|

XBRL Taxonomy Extension Definition Linkbase Document.

|

|

101.LAB

|

|

XBRL Taxonomy Extension Label Linkbase Document.

|

|

101.PRE

|

|

XBRL Taxonomy Extension Presentation Linkbase Document.

|

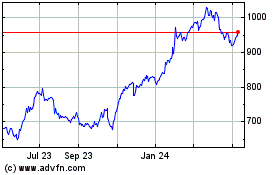

WW Grainger (NYSE:GWW)

Historical Stock Chart

From Mar 2024 to Apr 2024

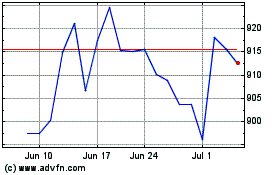

WW Grainger (NYSE:GWW)

Historical Stock Chart

From Apr 2023 to Apr 2024