United States Securities and Exchange Commission

Washington, D.C. 20549

Form 11-K

Annual Report

Pursuant to Section 15(d) of the Securities Exchange Act of 1934

(Mark One)

| | | | | | | | |

| þ | | Annual Report Pursuant to Section 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended December 31, 2021

| | | | | | | | |

| o | | Transition Report Pursuant to Section 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to

Commission file number 001-15202

| | | | | |

| A. | Full title of the plan and the address of the plan, if different from that of the issuer named below: |

W. R. Berkley Corporation Profit Sharing Plan

| | | | | |

| B. | Name of issuer of the securities held pursuant to the plan and the address of its principal executive office: |

W. R. Berkley Corporation

475 Steamboat Road

Greenwich, CT 06830

W. R. BERKLEY CORPORATION PROFIT SHARING PLAN

December 31, 2021 and 2020

Index to Financial Statements and Supplemental Schedule

Page(s)

Report of Independent Registered Public Accounting Firm 1

Financial Statements:

Statements of Net Assets Available for Plan Benefits as of December 31, 2021 and 2020 2

Statement of Changes in Net Assets Available for Plan Benefits for the year ended December 31, 2021 3

Notes to Financial Statements 4 - 10

Supplemental Schedules*:

Supplemental Schedule H, line 4i — Schedule of Assets (Held at End of Year) as of December 31, 2021 11 - 12

Schedule H, Line 4a - Schedule of Delinquent Participant Contributions for the Year Ended December 31, 2021 13

Exhibit 23 - Consent of Independent Registered Public Accounting Firm EX-23

Report of Independent Registered Public Accounting Firm

To the Plan Participants and Plan Administrator

W. R. Berkley Corporation Profit Sharing Plan:

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for plan benefits of W. R. Berkley Corporation Profit Sharing Plan (the Plan) as of December 31, 2021 and 2020, the related statement of changes in net assets available for plan benefits for the year ended December 31, 2021, and the related notes (collectively, the financial statements). In our opinion, the financial statements present fairly, in all material respects, the net assets available for plan benefits of the Plan as of December 31, 2021 and 2020, and the changes in net assets available for plan benefits for the year ended December 31, 2021, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Accompanying Supplemental Information

The supplemental information in the accompanying Schedule H, line 4i - Schedule of Assets (Held at End of Year) as of December 31, 2021, has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental information is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ KPMG LLP

We have not been able to determine the specific year that we began serving as the Plan’s auditor, however we are aware that we have served as the Plan’s auditor since at least 1993.

Stamford, Connecticut

June 29, 2022

W. R. BERKLEY CORPORATION PROFIT SHARING PLAN

Statements of Net Assets Available for Plan Benefits

December 31, 2021 and 2020

| | | | | | | | | | | |

| | | |

| 2021 | | 2020 |

Assets: | | | |

| Cash | $ | 3,904 | | | $ | 1,794,577 | |

| | | |

Investments, at fair value (note 6): | | | |

W. R. Berkley Corporation Common Stock Fund | 161,293,502 | | | 140,669,988 | |

Mutual Funds | 388,078,817 | | | 344,249,257 | |

Common Collective Trusts | 1,249,129,943 | | | 979,371,287 | |

Money Market Funds | 916,584 | | | 92,489,287 | |

Other Investments | 2,140,581 | | | 156,256 | |

Total Investments at fair value | 1,801,559,427 | | | 1,556,936,075 | |

| | | |

| | | |

| | | |

| | | |

Participant loans receivable | 15,112,271 | | | 14,957,470 | |

| | | |

Contributions receivable employer | 53,412,716 | | | 46,440,307 | |

| | | |

| | | |

| | | |

Total Assets | 1,870,088,318 | | | 1,620,128,429 | |

| | | |

| Liabilities: | | | |

Payable for securities purchased | 65,428 | | | 105,303 | |

Payable for trustee, administrative fees and other | 2 | | | 9 | |

Total Liabilities | 65,430 | | | 105,312 | |

| | | |

| | | |

| Net assets available for plan benefits | $ | 1,870,022,888 | | | $ | 1,620,023,117 | |

See accompanying notes to financial statements.

W. R. BERKLEY CORPORATION PROFIT SHARING PLAN

Statement of Changes in Net Assets Available for Plan Benefits

Year ended December 31, 2021

| | | | | |

| |

| |

Additions to net assets attributed to: | |

Investment income: | |

Net appreciation in fair value of investments | $ | 227,055,772 | |

Interest and dividends | 36,738,712 | |

Net investment income | 263,794,484 | |

| |

| |

Interest on participant loans | 583,437 | |

| |

Contributions: | |

Employer | 53,412,716 | |

Participants | 49,059,314 | |

Rollovers | 21,781,022 | |

Total contributions | 124,253,052 | |

| |

Total additions | 388,630,973 | |

| |

| |

Deductions from net assets attributed to: | |

Benefits paid to participants | 138,360,212 | |

Other expense, net | 270,990 | |

Total deductions | 138,631,202 | |

| |

Net increase in net assets available for plan benefits | 249,999,771 | |

| |

| |

Net assets available for plan benefits at: | |

Beginning of year | 1,620,023,117 | |

| |

End of year | $ | 1,870,022,888 | |

See accompanying notes to financial statements.

W. R. BERKLEY CORPORATION PROFIT SHARING PLAN

Notes to Financial Statements

December 31, 2021 and 2020

(1) Plan Description

The following brief description of the W. R. Berkley Corporation (the “Company”) Profit Sharing Plan (the “Plan”) is provided for general information purposes only. This brief description is qualified in its entirety by the text of the Plan, and Participants should refer to the Plan for a more complete description of the Plan. Capitalized terms used herein shall have the respective meanings as set forth in the Plan.

(a) General

The Plan is a defined contribution plan and was established for the benefit of eligible Employees of the Company and its participating subsidiaries. Employees of the Company and its participating subsidiaries become eligible to participate in the Plan for purposes of making Tax-Deferred Contributions, Roth Contributions, Catch-Up Contributions and Rollover Contribution/Transfer Amounts on the date they were first credited with an Hour-of-Service. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”). The Plan allows for mandatory distributions to terminated Participants whose vested Account balance is less than $1,000.

Fidelity Management Trust Company (“Fidelity”) is the Trustee and Fidelity or its affiliates act as the custodian and record keeper for the Plan. The Company has a Profit Sharing Plan Finance Committee (“Finance Committee”) to select the investment alternatives provided by the Plan. The Company has a Profit Sharing Plan Administrative Committee (“Administrative Committee”) to act as the administrator of the Plan (“Plan Administrator”).

(b) Contributions

Employer Contributions

Each Plan Year, the Company makes an Employer Profit Sharing Contribution to the Plan. The Company’s current minimum Employer Profit Sharing Contribution for each Plan Year is 5% of a Participant’s Earnings for the period of the calendar year that the Employee was a Participant, up to the maximum amount permitted for one year by the U.S. Internal Revenue Code of 1986, as amended (“IRC”). The Company’s Employer Profit Sharing Contribution is allocated as follows: 60% to the Participant’s Company Profit Sharing Account, subject to the Plan’s vesting schedule; and 40% to the Participant’s Tax-Deferred Contribution Account, which is 100% vested.

Employer Profit Sharing Contributions are determined separately for each Participating Employer and are allocated as of the last day of the calendar year based on the Participant’s Earnings. Eligible Earnings accrue on the earlier of the first day of the Calendar Quarter following the first full Calendar Quarter in which the Participant completes 250 Hours-of-Service, or on the first day of the Calendar Quarter following the first employment year (the 12 consecutive month period measured from the date of the first Hour-of-Service) in which the Participant completes at least 1,000 Hours-of-Service provided they are an employee on the first day of such Calendar Quarter. Prior to January 1, 2021, Hours-of-Service were determined by tracking an employee’s actual completed hours. For Plan years commencing on and after January 1, 2021, Hours-of-Service will be determined using the U.S. Department of Labor’s equivalency rules. Under these rules, for Plan purposes, an employee will automatically be deemed to complete 190 Hours-of-Service for each calendar month in which he or she is credited with at least one Hour-of-Service, regardless of the actual number of hours that the employee completes in a calendar month. If the Participant’s employment during a single Plan Year was divided between two or more Participating Employers, and the Participant is eligible for an Employer Profit Sharing Contribution for the Plan Year, each Participating Employer for which the Participant worked will make the appropriate contribution to the Participant’s Account based on their period of service with, and Earnings from, the Participating Employer.

Participant Contributions

Tax-Deferred Contributions

A Participant in the Plan may elect to have voluntary Tax-Deferred Contributions deducted from their pay, for each pay period, in any amount from 1% to 50% of their eligible Earnings. A Participant may also elect to have an amount in excess of 50% of their eligible Earnings for a pay period deducted provided that their aggregate Tax-Deferred Contributions for the calendar year do not exceed 50% of the Participant’s eligible Earnings to date up to a statutory limit ($19,500 for 2021). A Participant may change or suspend their Tax-Deferred Contributions election. Any Employee who fails to make an election with respect to the Tax-Deferred Contributions and/or Roth Contributions shall be deemed to have elected to make Tax-Deferred Contributions to the Plan at an initial rate equal to 1% of Earnings commencing the first payday on or after the 90th day following the Employee’s employment commencement date. The Employee is also automatically enrolled in the Plan's Annual Increase Program, that increases the contribution rate 1% annually as determined by the Employee’s date of hire or adjusted date of hire, whichever is the latest, until capped at 3%.

W. R. BERKLEY CORPORATION PROFIT SHARING PLAN

Notes to Financial Statements

December 31, 2021 and 2020

After-Tax Roth Contributions

A Participant may designate part or all of their Plan contributions as either Tax-Deferred Contributions or as after-tax Roth Contributions provided that their aggregate combined Tax-Deferred Contributions and after-tax Roth Contributions for the calendar year do not exceed 50% of the Participant’s Earnings for the Plan year up to a statutory limit ($19,500 for 2021). A Participant may change or suspend their after-tax Roth Contribution election. An in-plan Roth conversion feature is available subject to terms and conditions established by the Plan’s Administrative Committee. Participants may be eligible to convert certain accounts that are eligible for in-service withdrawal (other than hardship withdrawal) to a designated Roth account within the Plan.

Rollover Contributions/Transfer Amounts

A Participant who receives a qualifying rollover distribution from an eligible retirement plan may make a Rollover Contribution into the Plan even though the Participant has not otherwise become eligible to participate in the Plan. Amounts that are attributable to after-tax Roth Contributions may be rolled into the Plan only from another employer’s eligible retirement plan; they may not be rolled into the Plan from a Roth IRA, even if the only monies held in the Roth IRA were previously distributed from an eligible retirement plan.

In addition, amounts attributable to after-tax Roth Contributions must be rolled over to the Plan by means of a Rollover Contribution.

Catch-Up Contributions

In addition to the Tax-Deferred Contributions and/or after-tax Roth Contributions described above, Plan Participants who will be at least 50 years old by the end of the calendar year and who have contributed the maximum amount of Tax-Deferred Contributions and/or after-tax Roth Contributions for the year may make additional Catch-up Contributions to the Plan. For 2021, Tax-Deferred and after-tax Roth Catch-up Contributions had a combined limit of $6,500.

(c) Participants’ Accounts

Each Participant’s Account is credited with the Participant’s contributions, the appropriate amount of the Company’s Employer Profit Sharing Contributions and an allocation of investment fund earnings or losses in which the Participant has directed his or her contribution. The benefit to which a Participant is entitled is the benefit that can be provided from the Participant’s vested Account. The Account of each Participant is valued on a daily basis.

(d) Vesting

Participants are fully vested in their Tax-Deferred and after-tax Roth Contributions, Roll-Over Contributions, Catch-up Contributions, the Employer Profit Sharing Contribution to their Tax-Deferred Contribution Account, and earnings thereon. Effective January 1, 2007, the vesting percent in the portion of the Employer Profit Sharing Contribution allocated to the Participant’s Company Profit Sharing Account occurs at the rate of 20% per year beginning after two years of continuous employment.

(e) Payments of Benefits

On Termination of Employment, Retirement or death, a Participant or Participant’s beneficiary may elect to receive the payment of benefits in a lump sum or in annual installments not to exceed 15 years. Distributions to terminated Participants are based upon the closing price of the funds on the date the Participant requests the distribution from Fidelity. Withdrawals to active Participants are based on the date the withdrawals have been approved by the Plan Administrator and are processed by Fidelity.

Hardship withdrawals are allowed under certain circumstances as defined in the Plan. Participants are suspended from making contributions for six months after taking a hardship withdrawal from the Plan.

On March 27, 2020, Congress passed the Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”), which included several relief provisions available to tax qualified retirement plans and their participants. The provisions of the CARES Act may be effective and operationalized immediately, prior to amending the Plan document. The Plan has adopted the provision that allows eligible plan participants to request penalty-free distributions of up to $100,000 before December 31, 2020 for qualifying reasons associated with the COVID-19 pandemic.

(f) Forfeitures

Amounts forfeited by non-vested Participants who terminated employment during the year were $1,788,647 and $1,702,528 for the years ended December 31, 2021 and 2020, respectively. Prior to January 1, 2021, any amounts that were forfeited by participants during the Plan year (for example, due to termination of employment without sufficient vesting service) were allocated at the end of the Plan year to the accounts of individuals who were participants on the last day of the Plan year and completed at least 1,000 Hours-of-Service during the Plan year. For Plan years commencing on and after January 1, 2021, forfeitures are no longer to be allocated to participant accounts and, instead, are applied toward the costs of operating and funding the Plan. The forfeiture balance totaled $1,846,798 and $1,823,697 as of December 31, 2021 and 2020, respectively.

W. R. BERKLEY CORPORATION PROFIT SHARING PLAN

Notes to Financial Statements

December 31, 2021 and 2020

(g) Participant Loans

The Plan allows Participants to borrow from their Account. Participants may borrow up to 50% of their vested Account balance; the minimum amount of any loan from the Plan is $1,000, and the maximum amount is the lesser of $50,000 or 50% of the value of the Participant’s vested Account. A Participant may request a loan for any reason and the loan may be repaid over 60 months. For the purchase of a primary residence, however, the loan may be repaid over 25 years. At December 31, 2021 and 2020, there were 1,547 and 1,634 individual loans outstanding, respectively, bearing interest at rates ranging from 3.25% to 9.5% per annum with maturities ranging from 1 to 25 years for both years.

The interest rate charged on the loan and repaid to the Participant’s Account is set to the prime rate as of the first day of the quarter in which the loan originated and is fixed for the duration of the loan. A Participant may have up to two loans outstanding at a time. Repayment of the loan to the Participant’s Account is made through payroll deductions or the loan may be paid in full by a lump-sum payment. A partial repayment is not permitted other than pursuant to the aforementioned payroll deductions or as set forth in the following sentence. A Participant with an outstanding loan balance who separates from service with the Company has the option of repaying the loan in a lump sum or continuing to pay the monthly loan payment amount directly to Fidelity.

(h) Hardship Withdrawals

The following changes have been made to the Plan provisions governing hardship withdrawals effective January 1, 2019:

•The investment earnings on Elective Deferral Contributions may be included in a hardship withdrawal.

•The following hardship withdrawal criteria are expanded to include a Participant’s designated primary beneficiary.

◦Payment of certain deductible medical expenses;

◦Payment of certain tuition and related educational expenses;

◦Payments for burial or funeral expenses;

•The criteria for a hardship withdrawal includes expenses and losses (including loss of income) incurred on account of a disaster declared by the Federal Emergency Management Agency (“FEMA”), provided that the Participant’s principal residence or principal place of employment at the time of the disaster was located in an area designated by FEMA for individual assistance with respect to the disaster and the Participant satisfies any other conditions imposed by the Internal Revenue Service.

•A six-month suspension will no longer be imposed on a Participant’s Elective Deferral Contributions and/or Roth Contributions upon taking a hardship withdrawal; and a Participant will no longer be required to take out all available Plan loans before taking a hardship withdrawal.

•A Participant will not be required to take any distribution, withdrawal and/or nontaxable loan that is currently available under any employer plan prior to receiving a hardship distribution, if doing so would be counterproductive to relief of the Participant’s immediate and heavy financial need.

•A Participant will be required to self-certify that he or she meets the criteria for a hardship withdrawal and has insufficient other liquid assets to meet the immediate and heavy financial need.

(i) Claims Provisions

Effective January 1, 2021, in the event a claim for Plan benefits is denied, no person may bring a civil action under Section 501 of the Employee Retirement Income Security Act of 1974 later than three years after the initial claim for benefits was filed with the Plan.

(j) Investments

Participants are responsible for directing the investment of their respective Accounts. Contributions for which the Participant does not provide investment direction are invested in the Plan’s designated default option (“Plan Designated Fund”). The Fidelity Institutional Asset Management (“FIAM”) Target Date Commingled Pool Class R Fund with a target Retirement Date closest to the year the Participant may retire based on their present age and a retirement age of 65, is the Plan Designated Fund. Investment changes requested by Participants are implemented as soon as administratively practical in accordance with the Plan document.

(k) Plan Expenses

Participants are charged an annual recordkeeping maintenance fee in quarterly installments which is deducted from each Participant’s Account after the end of each quarter. These charges are included in the “Other expense, net” account.

W. R. BERKLEY CORPORATION PROFIT SHARING PLAN

Notes to Financial Statements

December 31, 2021 and 2020

(l) Revenue Credits

Revenue credits are allocated into eligible Participant Accounts pro rata into the specific fund that was used to determine the basis, and is allocated pro rata across all sources with that fund balance. These credits are included in the “Other expense, net” account.

(2) Summary of Significant Accounting Policies

The following are the more significant accounting policies followed by the Plan:

(a) Basis of Accounting and Use of Estimates

The financial statements of the Plan are prepared under the accrual method of accounting. The preparation of financial statements in conformity with U.S. generally accepted accounting principles (“GAAP”) requires the Plan to make estimates and assumptions that affect the reported amounts of assets and liabilities and changes therein, as well as disclosure of contingent assets and liabilities at the date of the financial statements. Actual results could differ from those estimates and assumptions.

(b) Investment Valuation and Income Recognition

The Plan’s investments are stated at fair value. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. For additional information, refer to Note 6, Fair Value Measurement of Investments.

Purchases and sales of investments are recorded on a trade date basis. Investment purchases that have not been settled as of year-end are recorded as a liability. Realized gains and losses are based on an average cost basis and are included in net appreciation (depreciation) in fair value of investments. Interest income is recorded on the accrual basis. Dividends are recorded on the ex-dividend date.

Investment management fees, including brokerage fees and commissions on the purchase and sale of securities and other related portfolio management expenses, are paid from assets of, and applied against the investment performance of, the respective investment funds.

Each Participant is entitled to exercise voting rights attributable to the shares of the W. R. Berkley Corporation Common Stock Fund (“Company Common Stock Fund”) allocated to his or her Account and is notified by the Trustee prior to the time that such rights are to be exercised. The Trustee is permitted to vote any allocated shares for which instructions have not been given by a Participant in the same proportion as those allocated shares for which instructions were given by Participants.

(c) Cash and Cash Equivalents

The Company considers all highly liquid investments with a maturity of three months or less to be cash equivalents. Cash and cash equivalents include $3,904 and $1,794,577 of money market mutual funds with an initial term of less than three months at December 31, 2021 and 2020.

(d) Payment of Benefits

Benefit payments are recorded when paid.

(3) Risks and Uncertainties

The Plan offers a number of investment options including the Company Common Stock Fund and a variety of pooled investment funds, which consist of registered investment companies and common collective trusts. The investment funds are comprised of U.S. equities, international equities, and fixed income securities. Investment securities, in general, are exposed to various risks, such as interest rate, credit, and overall market volatility risk. Due to the level of risk associated with certain investment securities, it is reasonable to expect that changes in the values of investment securities will occur in the near term and that such changes could materially affect Participant Account balances and the Statement of Changes in Net Assets Available for Plan Benefits.

The Plan’s exposure to a concentration of credit risk is limited by the diversification of investments across all Participant-directed fund elections. Additionally, the investments within each Participant-directed fund election are further diversified into varied financial instruments, with the exception of the Company Common Stock Fund, which principally invests in a security of a single issuer. Approximately 9% of the Plan’s net assets were invested in the Company Common Stock Fund as of December 31, 2021 and 2020, respectively.

W. R. BERKLEY CORPORATION PROFIT SHARING PLAN

Notes to Financial Statements

December 31, 2021 and 2020

The Plan investments include mutual funds and common collective trusts that may directly or indirectly invest in securities with contractual cash flows, such as asset backed securities, collateralized mortgage obligations and commercial mortgage backed securities, including securities backed by subprime mortgage loans. The value, liquidity and related income of these securities are sensitive to changes in economic conditions, including real estate value, delinquencies or defaults, or both, and may be adversely affected by shifts in the market’s perception of the issuers and changes in interest rates.

(4) Plan Termination

Although it has not expressed any intent to do so, the Company has the right under the Plan to discontinue its contributions at any time and to terminate the Plan subject to the provisions of ERISA.

In the event of termination of the Plan, all amounts credited to the Participants will become fully vested, and all assets remaining after payments of any expenses properly chargeable against the Plan will be distributed to the Participants pro rata in accordance with the value of each Participant’s Account on the date of such termination.

(5) Tax Status

The Internal Revenue Service (“IRS”) has determined and informed the Company by a letter dated October 31, 2017 that the Plan and related trust are designed in accordance with applicable sections of the IRC. Although the Plan has been amended since receiving the determination letter, the Plan Administrator believes that the Plan is currently designed, and being operated, in compliance with the applicable requirements of the IRC.

GAAP requires the Plan’s management to evaluate tax positions taken by the Plan and recognize a tax liability (or asset) if the Plan has taken an uncertain position that more likely than not would not be sustained upon examination by the IRS.

The Plan Administrator has analyzed the tax positions taken by the Plan, and has concluded that as of December 31, 2021, there are no uncertain positions taken or expected to be taken that would require recognition of a liability (or asset) or disclosure in the financial statements.

The Plan is subject to routine audits by various taxing jurisdictions. There are currently no audits for any periods in progress.

(6) Fair Value Measurement of Investments

Fair value is defined as “the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date”. The Plan utilizes a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value into three broad levels, as follows:

Level 1 — Quoted prices (unadjusted) in active markets for identical assets or liabilities.

Level 2 — Quoted prices for similar assets or valuations based on inputs that are observable.

Level 3 — Estimates of fair value based on internal pricing methodologies using unobservable inputs. Unobservable inputs are only used to measure fair value to the extent that observable inputs are not available.

The asset’s or liability’s fair value measurement level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement.

Fair value estimates are made at a specific point in time, based on available market information and other observable inputs. In some cases, the fair value estimates cannot be substantiated by comparison to independent markets. In addition, the disclosed fair value may not be realized in the ultimate settlement of the financial asset as these values do not represent any premium or discount that could result from selling an entire holding of a particular financial asset at one time. Other expenses that would be incurred in an actual sale or settlement are not included in the amounts disclosed.

The following is a description of the valuation methodologies used for assets measured at fair value.

Money Market Funds and Mutual Funds - Valued at the closing price reported on the active market on which the individual securities are traded.

W. R. Berkley Corporation Common Stock Fund - Consists of W. R. Berkley Corporation common stock. The stock is valued at the closing price reported on the active market on which the individual securities are traded.

W. R. BERKLEY CORPORATION PROFIT SHARING PLAN

Notes to Financial Statements

December 31, 2021 and 2020

Common Collective Trusts - Excluding the Fidelity Managed Income Portfolio II Class 4 Stable Value Fund (“Stable Value Fund”) the common collective trusts are valued at the Net Asset Value (“NAV”) based on the collective trust’s underlying investments as determined by the fund’s issuer. Redemptions from these collective trust funds generally can be made daily and are determined to have a readily determinable fair value. The Stable Value Fund is an indirect investment in a fully benefit-responsive investment, and are valued using Net Asset Value as a practical expedient, and are recorded at the Plan’s proportionate share of the contract value as determined by the fund manager. This is considered the fair value. For additional information, refer to Note 7, Investments in Stable Value Fund.

Other Investments - Consists of short term investments and varies with the amount of cash awaiting investment and with participant activity in the W. R. Berkley Corporation Common Stock Fund (contributions, redemptions, exchanges, withdrawals, etc.)

The methods described above may produce a fair value calculation that may not be indicative of net realizable value or reflective of future fair values. Furthermore, while the Plan believes its valuation methods are appropriate and consistent with those of other market participants, the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different fair value measurement at the reporting date. There were no changes to the valuation methodologies in 2021 or 2020.

The following tables set forth by level, within the fair value hierarchy, the Plan’s assets at fair value as of December 31, 2021 and 2020:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fair Value Measurements at December 31, 2021 |

| | | Quoted or | | Significant | | |

| | | published | | other | | Significant |

| Total assets | | prices in | | observable | | unobservable |

| measured at | | active markets | | market data | | market data |

| fair value | | (Level 1) | | (Level 2) | | (Level 3) |

| W. R. Berkley Corporation Common Stock Fund | $ | 161,293,502 | | | $ | 161,293,502 | | | — | | | — | |

| Mutual Funds | 388,078,817 | | | 388,078,817 | | | — | | | — | |

| Common Collective Trusts | 1,164,935,331 | | | 1,164,935,331 | | | — | | | — | |

| Money Market funds | 916,584 | | | 916,584 | | | — | | | — | |

| Other Investments | 2,140,581 | | | 2,140,581 | | | — | | | — | |

| Investments measured at net asset value as a practical expedient | 84,194,612 | | | — | | | — | | | — | |

| Total Investments | $ | 1,801,559,427 | | | $ | 1,717,364,815 | | | — | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fair Value Measurements at December 31, 2020 |

| | | Quoted or | | Significant | | |

| | | published | | other | | Significant |

| Total assets | | prices in | | observable | | unobservable |

| measured at | | active markets | | market data | | market data |

| fair value | | (Level 1) | | (Level 2) | | (Level 3) |

| W. R. Berkley Corporation Common Stock Fund | $ | 140,669,988 | | | $ | 140,669,988 | | | — | | | — | |

| Mutual Funds | 344,249,257 | | | 344,249,257 | | | — | | | — | |

| Common Collective Trusts | 979,371,287 | | | 979,371,287 | | | — | | | — | |

| Money Market funds | 92,489,287 | | | 92,489,287 | | | — | | | — | |

| Other Investments | 156,256 | | | 156,256 | | | — | | | — | |

| Total Investments | $ | 1,556,936,075 | | | $ | 1,556,936,075 | | | — | | | — | |

W. R. BERKLEY CORPORATION PROFIT SHARING PLAN

Notes to Financial Statements

December 31, 2021 and 2020

(7)Investment in Stable Value Funds

The Plan's investment in the Stable Value Fund, holds investment contracts that are deemed to be fully benefit responsive investment contracts ("FBRIC"), however, this is considered to be an indirect FBRIC investment and it is reflected at NAV as a practical expedient which is considered fair value. The NAV is equal to contract value of the underlying investments and is equal to the accumulated cash contributions and interest credited to the Plan's contracts, less any withdrawals or transfers. The Stable Value Fund is not available for sale or transfer on any securities exchange. The contract value is a relevant measurement attribute because contract value is the amount participants would receive if they were to initiate permitted transactions under the terms of the Plan.

(8)Related Party Transactions

Certain Plan investments are managed or sponsored by Fidelity Investments, an affiliate of Fidelity who is the Trustee as defined by the Plan and accordingly, these transactions with Fidelity Investments qualify as party-in-interest transactions. Investments in the Company Common Stock Fund also qualify as party-in-interest transactions.

(9)Subsequent Events

Events that have occurred subsequent to December 31, 2021 have been evaluated through the date these financial statements were issued. There were no events that occurred during such period that would require recognition or disclosure in the financial statements as of, or for, the year ended December 31, 2021.

W. R. BERKLEY CORPORATION PROFIT SHARING PLAN

Schedule H, line 4i – Schedule of Assets (Held at End of Year)

December 31, 2021

| | | | | | | | | | | | | | |

| | | | Current value at |

| | | | December 31,

2021 |

| Identity of issuer | | Description and number of shares | |

* W. R. Berkley Corporation Common Stock Fund | | Common Stock Fund: 1,957,683 shares | | $ | 161,293,502 | |

| Total Common Stock Fund | | | | 161,293,502 | |

| | | | |

| | | | |

| | | | |

| | | | |

* Fidelity® Government Income Fund | | Mutual Funds: 1,676,907 shares | | 17,808,755 | |

| | | | |

* Fidelity® Puritan® Fund - Class K | | Mutual Funds: 2,276,050 shares | | 61,840,292 | |

| | | | |

Invesco Small Cap Growth Fund Class R6 | | Mutual Funds: 851,323 shares | | 39,961,088 | |

| | | | |

JPMorgan Mid Cap Value Fund Class L | | Mutual Funds: 513,960 shares | | 21,385,892 | |

Metropolitan West Total Return Bond Fund Plan Class | | Mutual Funds: 4,603,626 shares | | 47,095,095 | |

MFS International Diversification Fund Class R6 | | Mutual Funds: 1,818,415 shares | | 45,587,672 | |

Neuberger Berman Mid Cap Growth Fund Class R6 | | Mutual Funds: 927,069 shares | | 17,827,530 | |

| T. Rowe Price Small-Cap Value Fund I Class | | Mutual Funds: 704,446 Shares | | 43,478,417 | |

Vanguard Inflation-Protected Securities Fund Institutional Shares | | Mutual Funds: 2,345,741 shares | | 27,187,142 | |

| | | | |

| | | | |

| | | | |

Vanguard Equity-Income Fund Admiral Shares | | Mutual Funds: 714,671 shares | | 65,906,934 | |

| Total Mutual Funds | | | | 388,078,817 | |

W. R. BERKLEY CORPORATION PROFIT SHARING PLAN

Schedule H, Line 4i – Schedule of Assets (Held at End of Year)

December 31, 2021

| | | | | | | | | | | | | | |

| | | | Current value at |

| | | | December 31, |

| Identity of issuer | | Description and number of shares | | 2021 |

| * FIAM Target Date 2010 Commingled Pool Class R | | Collective Trusts: 182,264 shares | | 3,818,422 | |

| * FIAM Target Date 2015 Commingled Pool Class R | | Collective Trusts: 483,174 shares | | 10,697,479 | |

| * FIAM Target Date 2020 Commingled Pool Class R | | Collective Trusts: 1,936,070 shares | | 43,793,894 | |

| * FIAM Target Date 2025 Commingled Pool Class R | | Collective Trusts: 3,855,694 shares | | 93,423,468 | |

| * FIAM Target Date 2030 Commingled Pool Class R | | Collective Trusts: 4,277,509 shares | | 106,467,197 | |

| * FIAM Target Date 2035 Commingled Pool Class R | | Collective Trusts: 2,797,945 shares | | 76,048,153 | |

| * FIAM Target Date 2040 Commingled Pool Class R | | Collective Trusts: 2,235,483 shares | | 61,855,827 | |

| * FIAM Target Date 2045 Commingled Pool Class R | | Collective Trusts: 1,866,746 shares | | 51,932,861 | |

| * FIAM Target Date 2050 Commingled Pool Class R | | Collective Trusts: 1,526,226 shares | | 41,818,581 | |

| * FIAM Target Date 2055 Commingled Pool Class R | | Collective Trusts: 789,836 shares | | 23,213,293 | |

| * FIAM Target Date 2060 Commingled Pool Class R | | Collective Trusts: 440,004 shares | | 8,668,071 | |

| * FIAM Target Date 2065 Commingled Pool Class R | | Collective Trusts: 23,859 shares | | 355,260 | |

| * FIAM Target Date Income Commingled Pool Class R | | Collective Trusts: 51,196 shares | | 862,657 | |

| * Fidelity® Contrafund® Commingled Pool | | Collective Trusts: 6,723,315 shares | | 225,970,619 | |

| * Fidelity® Growth Company Commingled Pool | | Collective Trusts: 4,138,787 shares | | 217,617,409 | |

| * Managed Income Portfolio II Class 4 | | Collective Trusts: 84,194,612 shares | | 84,194,612 | |

| State Street Global All Cap Equity Ex-U.S. Index Securities Lending Series Fund Class II | | Collective Trusts: 1,350,290 shares | | 18,515,172 | |

| State Street Russell Small/Mid Cap® Index Securities Lending Series Fund Class II | | Collective Trusts: 1,545,692 shares | | 26,034,087 | |

| State Street S&P 500® Index Securities Lending Series Fund Class II | | CoIlective Trusts: 6,709,297 shares | | 134,333,537 | |

| State Street U.S. Bond Index Securities Lending Series Fund Class XIV | | ColIective Trusts: 1,685,909 shares | | 19,509,344 | |

| Total Common Collective Trusts | | | | 1,249,129,943 | |

| | | | |

| | | | |

| Vanguard Federal Money Market Fund Investor Shares | | Mutual Funds: 916,584 shares | | 916,584 | |

| Total Money Market Funds | | | | 916,584 | |

| | | | |

| | | | |

| | | | |

| | | | |

| * Participant loans | | 1,547 Participant loans (interest rates range from 3.25% to 9.50% per annum with maturities ranging from 1 to 25 years) | | 15,112,271 | |

| | | | |

| Other Investments | | Consists of short term investments | | 2,140,581 | |

| | | | |

| Total investments and participant loans | | | | $ | 1,816,671,698 | |

* Party-in-interest as defined by ERISA |

| | |

See accompanying report of independent registered public accounting firm.

W. R. BERKLEY CORPORATION PROFIT SHARING PLAN

Schedule H, Line 4a - Schedule of Delinquent Participant Contributions

Year ended December 31, 2021

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Total That Constitute Nonexempt Prohibited Transactions | | |

| Participant Contributions |

| Transferred Late to Plan | | Not Corrected | | Corrected Outside VFCP | | Pending Correction in VFCP | | Total Fully Corrected Under VFCP and PTE |

| | | | | | | | |

| $ | 119 | | | — | | | $ | 119 | | | — | | | — | |

It was noted that there was an unintentional delay by the Plan Sponsor in submitting employee contributions to the Plan. The 21 day delay on the submission of the withholding amount of $119 resulted in lost interest of $0.21 that was paid in 2021. The Participants’ contributions have been credited and the lost interest has been reimbursed to the Plan.

See accompanying report of independent registered public accounting firm.

W. R. BERKLEY CORPORATION PROFIT SHARING PLAN

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the Finance Committee of W. R. Berkley Corporation Profit Sharing Plan has duly caused this annual report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | |

| | | |

| |

| W. R. BERKLEY CORPORATION |

| PROFIT SHARING PLAN |

| | | /s/ Richard M. Baio |

| By | | Richard M. Baio |

| | | Member, Profit Sharing Plan |

| | | Administrative Committee |

| | | |

June 29, 2022

Exhibit Index

Exhibit 23 Consent of Independent Registered Public Accounting Firm

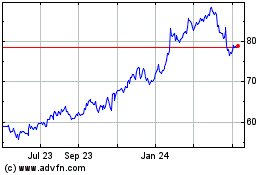

WR Berkley (NYSE:WRB)

Historical Stock Chart

From Mar 2024 to Apr 2024

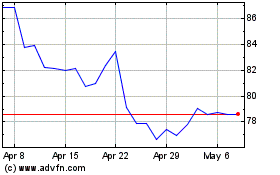

WR Berkley (NYSE:WRB)

Historical Stock Chart

From Apr 2023 to Apr 2024