Record Quarterly Underwriting Income of $274

Million, Net Income Increased 157% to $591 Million and

Return on Equity of 35.5%

W. R. Berkley Corporation (NYSE: WRB) today reported its

first quarter 2022 results.

Summary Financial Data

(Amounts in thousands, except per

share data)

First Quarter

2022

2021

Gross premiums written

$ 2,859,837

$ 2,484,712

Net premiums written

2,413,254

2,050,038

Net income to common stockholders

590,638

229,525

Net income per diluted share (1)

2.12

0.82

Operating income (2)

306,921

201,780

Operating income per diluted share (1)

1.10

0.72

Return on equity (3)

35.5 %

14.5 %

(1) The 2021 per share amounts were restated for comparative

purposes to reflect the 3-for-2 common stock split effected on

March 23, 2022.

(2) Operating income is a non-GAAP financial measure defined by

the Company as net income excluding after-tax net investment gains

(losses) and related expenses.

(3) Return on equity represents net income expressed on an

annualized basis as a percentage of beginning of year common

stockholders’ equity.

First quarter highlights included:

- Return on equity of 35.5%.

- Record quarterly underwriting income and net income of $274.4

million and $590.6 million, respectively.

- Net premiums written increased nearly 18% to a quarterly record

of $2.4 billion.

- The current accident year combined ratio before catastrophe

losses of 1.3 loss ratio points was 86.5%.

- The reported combined ratio was 87.8%, including catastrophe

losses of $28.8 million.

- Record quarterly net investment gain of $366.3 million, mainly

due to real estate investment sales.

- Book value per share grew 3.5% before dividends, benefitting

from our decision to maintain a short investment duration.

The Company commented:

The Company reported exceptional results for the first quarter

of 2022, due to another quarter of record underwriting results and

continued strong investment income, including significant realized

gains from the sale of investments. We reported a 35.5% return on

beginning stockholders’ equity. Book value per share before

dividends grew 3.5%, benefitting from our decision to maintain a

short investment duration, notwithstanding the impact of rising

interest rates.

Net premiums written grew by nearly 18% as the majority of our

businesses expanded, particularly in the E&S and specialty

markets. Rate increases remained above expected loss cost trends

for the majority of our lines of business. Rate and exposure growth

improved our loss and expense ratios.

As we previously announced, the Company realized a pretax gain

on the sale of a real estate investment in London of more than $300

million before transaction expenses and the impact of foreign

currency. Net investment income grew more than 9% as investment

funds continued to outperform and fixed-maturity income benefited

from higher yields. We expect the latter trend to accelerate as

interest rates move higher.

We remain focused on our total risk-adjusted return strategy and

expect relative market stability in most parts of our business. Our

underwriting and investment portfolios remain well-positioned for

the inflationary environment. The Company is performing

exceptionally well and we continue to be optimistic about our

opportunities going forward.

Webcast Conference Call

The Company will hold its quarterly conference call with

analysts and investors to discuss its earnings and other

information on April 25, 2022, at 5:00 p.m. eastern time. The

conference call will be webcast live on the Company's website at

https://ir.berkley.com/news-and-events/events-andpresentations/default.aspx.

Please log on at least ten minutes early to register and download

and install any necessary software. A replay of the webcast will be

available on the Company's website approximately two hours after

the end of the conference call. Additional financial information

can be found on the Company's website at

https://ir.berkley.com/investor-relations/financial-information/quarterly-results/default.aspx.

About W. R. Berkley Corporation

Founded in 1967, W. R. Berkley Corporation is an insurance

holding company that is among the largest commercial lines writers

in the United States and operates worldwide in two segments of the

property casualty business: Insurance and Reinsurance &

Monoline Excess.

Forward Looking Information

This is a “Safe Harbor” Statement under the Private Securities

Litigation Reform Act of 1995. Any forward-looking statements

contained herein, including statements related to our outlook for

the industry and for our performance for the year 2022 and beyond,

are based upon the Company’s historical performance and on current

plans, estimates and expectations. The inclusion of this

forward-looking information should not be regarded as a

representation by us or any other person that the future plans,

estimates or expectations contemplated by us will be achieved. They

are subject to various risks and uncertainties, including but not

limited to: the cyclical nature of the property casualty industry;

the impact of significant competition, including new entrants to

the industry; the long-tail and potentially volatile nature of the

insurance and reinsurance business; product demand and pricing;

claims development and the process of estimating reserves;

investment risks, including those of our portfolio of fixed

maturity securities and investments in equity securities, including

investments in financial institutions, municipal bonds,

mortgage-backed securities, loans receivable, investment funds,

including real estate, merger arbitrage, energy related and private

equity investments; the effects of emerging claim and coverage

issues; the uncertain nature of damage theories and loss amounts,

including claims for cybersecurity-related risks; natural and

man-made catastrophic losses, including as a result of terrorist

activities; the ongoing COVID-19 pandemic; the impact of climate

change, which may alter the frequency and increase the severity of

catastrophe events; general economic and market activities,

including inflation, interest rates, and volatility in the credit

and capital markets; the impact of the conditions in the financial

markets and the global economy, and the potential effect of

legislative, regulatory, accounting or other initiatives taken in

response, on our results and financial condition; foreign currency

and political risks (including those associated with the United

Kingdom's withdrawal from the European Union, or "Brexit") relating

to our international operations; our ability to attract and retain

key personnel and qualified employees; continued availability of

capital and financing; the success of our new ventures or

acquisitions and the availability of other opportunities; the

availability of reinsurance; our retention under the Terrorism Risk

Insurance Program Reauthorization Act of 2019; the ability or

willingness of our reinsurers to pay reinsurance recoverables owed

to us; other legislative and regulatory developments, including

those related to business practices in the insurance industry;

credit risk related to our policyholders, independent agents and

brokers; changes in the ratings assigned to us or our insurance

company subsidiaries by rating agencies; the availability of

dividends from our insurance company subsidiaries; potential

difficulties with technology and/or cyber security issues; the

effectiveness of our controls to ensure compliance with guidelines,

policies and legal and regulatory standards; and other risks

detailed from time to time in the Company’s filings with the

Securities and Exchange Commission. These risks and uncertainties

could cause our actual results for the year 2022 and beyond to

differ materially from those expressed in any forward-looking

statement we make. Any projections of growth in our revenues would

not necessarily result in commensurate levels of earnings.

Forward-looking statements speak only as of the date on which they

are made, and the Company undertakes no obligation to update

publicly or revise any forward-looking statement, whether as a

result of new information, future developments or otherwise.

Consolidated Financial

Summary

(Amounts in thousands, except per

share data)

First Quarter

2022

2021

Revenues:

Net premiums written

$ 2,413,254

$ 2,050,038

Change in unearned premiums

(164,167)

(200,082)

Net premium earned

2,249,087

1,849,956

Net investment income

173,512

158,577

Net investment gains:

Net realized and unrealized gains on

investments

369,882

51,759

Change in allowance for credit losses on

investments

(3,617)

(16,920)

Net investment gains

366,265

34,839

Revenues from non-insurance businesses

97,776

87,430

Insurance service fees

27,951

25,808

Other Income

818

259

Total Revenues

2,915,409

2,156,869

Expenses:

Loss and loss expenses

1,339,252

1,121,592

Other operating costs and expenses

713,899

616,268

Expenses from non-insurance businesses

94,855

86,290

Interest expense

34,970

36,651

Total expenses

2,182,976

1,860,801

Income before income tax

732,433

296,068

Income tax expense

(139,403)

(64,352)

Net Income before noncontrolling

interests

593,030

231,716

Noncontrolling interest

(2,392)

(2,191)

Net income to common stockholders

$ 590,638

$ 229,525

Net income per share (1):

Basic

$ 2.13

$ 0.83

Diluted

$ 2.12

$ 0.82

Average shares outstanding (1) (2):

Basic

276,772

277,793

Diluted

279,157

280,245

(1) The 2021 per share amounts were restated for comparative

purposes to reflect the 3-for-2 common stock split effected on

March 23, 2022.

(2) Basic shares outstanding consist of the weighted average

number of common shares outstanding during the period (including

shares held in a grantor trust). Diluted shares outstanding consist

of the weighted average number of basic and common equivalent

shares outstanding during the period.

Business Segment Operating

Results

(Amounts in thousands, except

ratios) (1)

First Quarter

2022

2021

Insurance:

Gross premiums written

$ 2,484,799

$ 2,140,013

Net premiums written

2,073,291

1,739,824

Net premiums earned

1,962,835

1,604,979

Pre-tax income

382,412

257,109

Loss ratio

59.5 %

61.3 %

Expense ratio

28.1 %

29.3 %

GAAP Combined ratio

87.6 %

90.6 %

Reinsurance & Monoline

Excess:

Gross premiums written

$ 375,038

$ 344,699

Net premiums written

339,963

310,214

Net premiums earned

286,252

244,977

Pre-tax income

57,628

68,649

Loss ratio

59.9 %

56.5 %

Expense ratio

29.5 %

30.9 %

GAAP Combined ratio

89.4 %

87.4 %

Corporate and Eliminations:

Net investment gains

$ 366,265

$ 34,839

Interest expense

(34,970)

(36,651)

Other revenues and expenses

(38,902)

(27,878)

Pre-tax gain (loss)

292,393

(29,690)

Consolidated:

Gross premiums written

$ 2,859,837

$ 2,484,712

Net premiums written

2,413,254

2,050,038

Net premiums earned

2,249,087

1,849,956

Pre-tax income

732,433

296,068

Loss ratio

59.5 %

60.6 %

Expense ratio

28.3 %

29.5 %

GAAP Combined ratio

87.8 %

90.1 %

(1) Loss ratio is losses and loss expenses incurred expressed as

a percentage of premiums earned. Expense ratio is underwriting

expenses expressed as a percentage of premiums earned. GAAP

combined ratio is the sum of the loss ratio and the expense

ratio.

Supplemental

Information

(Amounts in thousands)

First Quarter

2022

2021

Net premiums written:

Other liability

$ 836,040

$ 676,796

Short-tail lines (1)

393,918

325,051

Workers' compensation

303,420

286,724

Commercial automobile

279,528

248,567

Professional liability

260,385

202,686

Total Insurance

2,073,291

1,739,824

Casualty reinsurance

198,155

174,864

Monoline excess

92,536

85,509

Property reinsurance

49,272

49,841

Total Reinsurance & Monoline

Excess

339,963

310,214

Total

$ 2,413,254

$ 2,050,038

Current accident year losses from

catastrophes (including COVID-19 related losses):

Insurance

$ 10,767

$ 32,829

Reinsurance & Monoline Excess

18,064

3,000

Total

$ 28,831

$ 35,829

Net Investment income:

Core portfolio (2)

$ 112,312

$ 100,568

Investment funds

52,013

38,935

Arbitrage trading account

9,187

19,074

Total

$ 173,512

$ 158,577

Net realized and unrealized gains on

investments:

Net realized gains on investments

$ 276,669

$ 76,094

Change in unrealized gains (losses) on

equity securities

93,213

(24,335)

Total

$ 369,882

$ 51,759

Other operating costs and

expenses:

Policy acquisition and insurance operating

expenses

$ 635,453

$ 545,750

Insurance service expenses

22,466

20,786

Net foreign currency gains

(4,168)

(5,594)

Debt extinguishment costs

—

3,617

Other costs and expenses

60,148

51,709

Total

$ 713,899

$ 616,268

Cash flow from operations

$ 477,682

$ 310,990

Reconciliation of net income to

operating income:

Net income

$ 590,638

$ 229,525

Pre-tax investment gains, net of related

expenses

(361,034)

(33,302)

Income tax expense

77,317

5,557

Operating income after-tax (3)

$ 306,921

$ 201,780

(1) Short-tail lines include commercial multi-peril

(non-liability), inland marine, accident and health, fidelity and

surety, boiler and machinery and other lines.

(2) Core portfolio includes fixed maturity securities, equity

securities, cash and cash equivalents, real estate and loans

receivable.

(3) Operating income is a non-GAAP financial measure defined by

the Company as net income excluding after-tax net investment gains

(losses). Net investment gains (losses) are computed net of related

expenses, including performance-based compensatory costs associated

with realized investment gains. Management believes this

measurement provides a useful indicator of trends in the Company’s

underlying operations.

Selected Balance Sheet

Information

(Amounts in thousands, except per

share data)

March 31, 2022

December 31, 2021

Net invested assets (1)

$ 23,658,053

$ 23,705,508

Total assets

32,250,954

32,047,876

Reserves for losses and loss expenses

15,722,889

15,390,888

Senior notes and other debt

1,834,155

2,259,416

Subordinated debentures

1,007,832

1,007,652

Common stockholders' equity (2)

6,864,503

6,653,011

Common stock outstanding (3) (4)

265,186

265,171

Book value per share (4) (5)

25.89

25.09

Tangible book value per share (4) (5)

24.92

24.27

(1) Net invested assets include investments, cash and cash

equivalents, trading accounts receivable from brokers and clearing

organizations, trading account securities sold but not yet

purchased and unsettled purchases, net of related liabilities.

(2) As of March 31, 2022, reflected in common stockholders'

equity are after-tax unrealized investment losses of $333 million

and unrealized currency translation losses of $316 million. As of

December 31, 2021, after-tax unrealized investment gains were $91

million and unrealized currency translation losses were $373

million.

(3) During the three months ended March 31, 2022, the Company

did not repurchase any shares of its common stock. The number of

shares of common stock outstanding excludes shares held in a

grantor trust.

(4) The 2021 per share amounts were restated for comparative

purposes to reflect the 3-for-2 common stock split effected on

March 23, 2022.

(5) Book value per share is total common stockholders’ equity

divided by the number of common shares outstanding. Tangible book

value per share is total common stockholders’ equity excluding the

after-tax value of goodwill and other intangible assets divided by

the number of common shares outstanding.

Investment Portfolio

March 31, 2022

(Amounts in thousands, except

percentages)

Carrying Value

Percent of Total

Fixed maturity securities:

United States government and government

agencies

$ 818,848

3.5 %

State and municipal:

Special revenue

1,935,528

8.2 %

State general obligation

424,590

1.8 %

Local general obligation

416,167

1.8 %

Pre-refunded

177,371

0.8 %

Corporate backed

172,005

0.7 %

Total state and municipal

3,125,661

13.3 %

Mortgage-backed securities:

Agency

874,067

3.7 %

Commercial

263,501

1.1 %

Residential - Prime

246,852

1.0 %

Residential - Alt A

4,771

0.0 %

Total mortgage-backed securities

1,389,191

5.8 %

Asset-backed securities

4,257,421

18.0 %

Corporate:

Industrial

3,270,804

13.8 %

Financial

1,706,732

7.2 %

Utilities

409,726

1.7 %

Other

201,245

0.9 %

Total corporate

5,588,507

23.6 %

Foreign government

1,246,568

5.3 %

Total fixed maturity securities (1)

16,426,196

69.5 %

Equity securities available for

sale:

Common stocks

883,317

3.7 %

Preferred stocks

243,174

1.0 %

Total equity securities available for

sale

1,126,491

4.7 %

Cash and cash equivalents (2)

1,980,346

8.4 %

Investment funds (3)

1,544,856

6.5 %

Real estate

1,276,157

5.4 %

Arbitrage trading account

1,188,910

5.0 %

Loans receivable

115,097

0.5 %

Net invested assets

$ 23,658,053

100.0 %

(1) Total fixed maturity securities had an average rating of AA-

and an average duration of 2.4 years, including cash and cash

equivalents.

(2) Cash and cash equivalents includes trading accounts

receivable from brokers and clearing organizations, trading account

securities sold but not yet purchased and unsettled purchases.

(3) Investment funds are net of related liabilities of $0.8

million.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220425005663/en/

Karen A. Horvath Vice President - External Financial

Communications (203) 629-3000

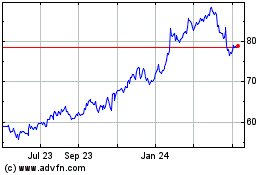

WR Berkley (NYSE:WRB)

Historical Stock Chart

From Mar 2024 to Apr 2024

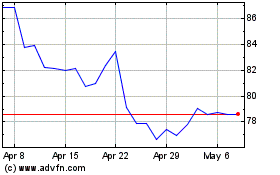

WR Berkley (NYSE:WRB)

Historical Stock Chart

From Apr 2023 to Apr 2024