Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

April 05 2022 - 12:04PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 6-K

____________________

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the Month of April 2022

Commission File Number: 001-38303

______________________

WPP plc

(Translation of registrant's name into English)

________________________

Sea Containers, 18 Upper Ground

London, United Kingdom SE1 9GL

(Address of principal executive offices)

_________________________

Indicate

by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

Form

20-F X Form 40-F

___

Indicate

by check mark if the registrant is submitting the Form 6-K in paper

as permitted by Regulation S-T Rule 101(b)(1): ___

Note: Regulation S-T Rule 101(b)(1) only permits the

submission in paper of a Form 6-K if submitted solely to provide an

attached annual report to security holders.

Indicate

by check mark if the registrant is submitting the Form 6-K in paper

as permitted by Regulation S-T Rule 101(b)(7): ___

Note: Regulation S-T Rule 101(b)(7) only permits the

submission in paper of a Form 6-K if submitted to furnish a report

or other document that the registrant foreign private issuer must

furnish and make public under the laws of the jurisdiction in which

the registrant is incorporated, domiciled or legally organized (the

registrant’s “home country”), or under the rules

of the home country exchange on which the registrant’s

securities are traded, as long as the report or other document is

not a press release, is not required to be and has not been

distributed to the registrant’s security holders, and, if

discussing a material event, has already been the subject of a Form

6-K submission or other Commission filing on EDGAR.

Forward-Looking Statements

In

connection with the provisions of the Private Securities Litigation

Reform Act of 1995 (the “Reform Act”), WPP plc and its

subsidiaries (the “Company”) may include

forward-looking statements (as defined in the Reform Act) in oral

or written public statements issued by or on behalf of the Company.

These forward-looking statements may include, among other things,

plans, objectives, projections and anticipated future economic

performance based on assumptions and the like that are subject to

risks and uncertainties. As such, actual results or outcomes may

differ materially from those discussed in the forward-looking

statements. Important factors that may cause actual results to

differ include but are not limited to: the unanticipated loss of a

material client or key personnel, delays or reductions in client

advertising budgets, shifts in industry rates of compensation,

regulatory compliance costs or litigation, natural disasters or

acts of terrorism, the Company’s exposure to changes in the

values of major currencies other than the UK pound sterling

(because a substantial portion of its revenues are derived and

costs incurred outside of the United Kingdom) and the overall level

of economic activity in the Company’s major markets (which

varies depending on, among other things, regional, national and

international political and economic conditions and government

regulations in the world’s advertising markets). In addition,

you should consider the risks described in Item 3D, captioned

“Risk Factors” in the Company’s Form 20-F for the

year ended 31 December 2019, which could also cause actual results

to differ from forward-looking information. In light of these and

other uncertainties, the forward-looking statements included in the

oral or written public statements should not be regarded as a

representation by the Company that the Company’s plans and

objectives will be achieved.

The

Company undertakes no obligation to update or revise any such

forward-looking statements, whether as a result of new information,

future events or otherwise.

EXHIBIT INDEX

|

Exhibit No.

|

Description

|

|

1

|

Notification of Major Holdings dated 05 April 2022, prepared by WPP

plc.

|

TR-1: Standard form for notification of major holdings

1. Issuer Details

ISIN

Issuer

Name

UK

or Non-UK Issuer

2. Reason for Notification

|

An acquisition or disposal of voting rights

|

3. Details of person subject to the notification

obligation

Name

|

Wellington Management Company LLP

|

City

of registered office (if applicable)

Country

of registered office (if applicable)

4. Details of the shareholder

|

Name

|

City

of registered office

|

Country

of registered office

|

|

JP

Morgan Chase Nominees Limited

|

|

|

|

BBH ISL

Nominees Ltd

|

|

|

|

Euroclear Nominees

Limited

|

|

|

|

HSBC

Global Custody Nominee (UK) Limited

|

|

|

|

Mellon

Nominees (UK) Ltd.

|

|

|

|

Nortrust Nominees

Limited

|

|

|

|

ROY

Nominees Limited

|

|

|

|

State

Street Nominees Limited

|

|

|

|

Vidacos

Nominees Limited

|

|

|

5. Date on which the threshold was crossed or reached

6. Date on which Issuer notified

7. Total positions of person(s) subject to the notification

obligation

|

|

% of voting rights attached to shares (total of 8.A)

|

% of voting rights through financial instruments (total of 8.B 1 +

8.B 2)

|

Total of both in % (8.A + 8.B)

|

Total number of voting rights held in issuer

|

|

Resulting

situation on the date on which threshold was crossed or

reached

|

4.990000

|

0.090000

|

5.080000

|

56677124

|

|

Position

of previous notification (if applicable)

|

5.010000

|

0.100000

|

5.110000

|

|

8. Notified details of the resulting situation on the date on which

the threshold was crossed or reached

8A. Voting rights attached to shares

|

Class/Type of shares ISIN code(if possible)

|

Number of direct voting rights (DTR5.1)

|

Number of indirect voting rights (DTR5.2.1)

|

% of direct voting rights (DTR5.1)

|

% of indirect voting rights (DTR5.2.1)

|

|

JE00B8KF9B49

|

|

55633307

|

|

4.990000

|

|

Sub

Total 8.A

|

55633307

|

4.990000%

|

8B1. Financial Instruments according to (DTR5.3.1R.(1)

(a))

|

Type of financial instrument

|

Expiration date

|

Exercise/conversion period

|

Number of voting rights that may be acquired if the instrument is

exercised/converted

|

% of voting rights

|

|

Depository

Receipt

|

|

|

105

|

0.000000

|

|

Sub

Total 8.B1

|

|

105

|

0.000000%

|

8B2. Financial Instruments with similar economic effect according

to (DTR5.3.1R.(1) (b))

|

Type of financial instrument

|

Expiration date

|

Exercise/conversion period

|

Physical or cash settlement

|

Number of voting rights

|

% of voting rights

|

|

Equity

Swap

|

22/05/2023

|

25/01/2022 to

22/05/2023

|

Cash

|

1031204

|

0.090000

|

|

Equity

Swap

|

15/05/2023

|

25/01/2022 to

15/05/2023

|

Cash

|

12508

|

0.000000

|

|

Sub

Total 8.B2

|

|

1043712

|

0.090000%

|

9. Information in relation to the person subject to the

notification obligation

|

2. Full chain of controlled undertakings through which the voting

rights and/or the financial instruments are effectively held

starting with the ultimate controlling natural person or legal

entities (please add additional rows as necessary)

|

|

Ultimate controlling person

|

Name of controlled undertaking

|

% of voting rights if it equals or is higher than the notifiable

threshold

|

% of voting rights through financial instruments if it equals or is

higher than the notifiable threshold

|

Total of both if it equals or is higher than the notifiable

threshold

|

|

Wellington

Management Group LLP

|

Wellington Group

Holdings LLP

|

5.490000

|

|

5.580000%

|

|

Wellington Group

Holdings LLP

|

Wellington

Investment Advisors Holdings LLP

|

5.490000

|

|

5.580000%

|

|

Wellington

Investment Advisors Holdings LLP

|

Wellington

Management Company LLP

|

4.990000

|

|

5.080000%

|

|

Wellington

Investment Advisors Holdings LLP

|

Wellington

Management Global Holdings, Ltd.

|

|

|

|

|

Wellington

Management Global Holdings, Ltd.

|

Wellington

Management International Ltd

|

|

|

|

10. In case of proxy voting

Name

of the proxy holder

The

number and % of voting rights held

The

date until which the voting rights will be held

11. Additional Information

|

Wellington Management Company LLP has crossed below the 5%

notification threshold for voting rights attached to shares in its

own right. Wellington Management Company LLP is an investment

management entity that manages the assets of certain funds and/or

managed accounts.Wellington Management Company LLP is a direct

controlled undertaking of Wellington Investment Advisors Holdings

LLP, which, in turn, is a direct controlled undertaking of

Wellington Group Holdings LLP, which, in turn, is a direct

controlled undertaking of Wellington Management Group

LLP.

|

12. Date of Completion

13. Place Of Completion

SIGNATURES

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant

has duly caused this report to be signed on its behalf by the

undersigned, thereunto duly authorized.

|

|

WPP

PLC

|

|

|

(Registrant)

|

|

Date:

05 April 2022

|

By:

______________________

|

|

|

Balbir

Kelly-Bisla

|

|

|

Company

Secretary

|

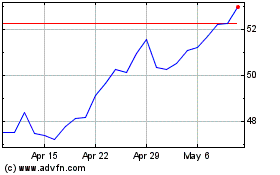

WPP (NYSE:WPP)

Historical Stock Chart

From Mar 2024 to Apr 2024

WPP (NYSE:WPP)

Historical Stock Chart

From Apr 2023 to Apr 2024